Are you grappling with the stress of outdated debts lingering on your credit report? It's a common challenge, but navigating the negotiation process doesn't have to be daunting. With the right approach and a clear understanding of your rights, you can advocate for the removal of those old debts and improve your financial future. Ready to learn the steps involved in this negotiation? Keep reading!

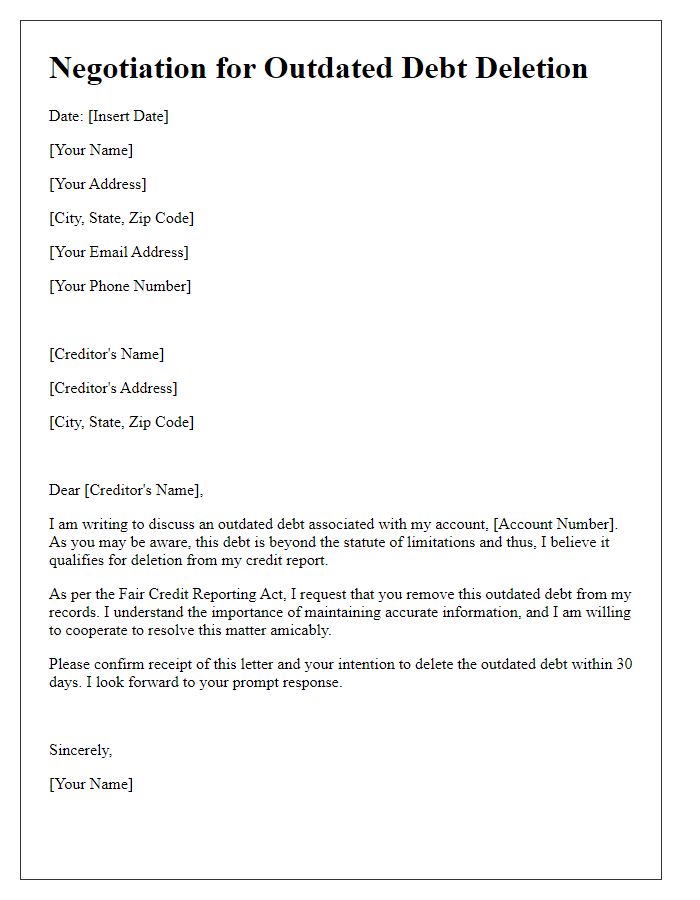

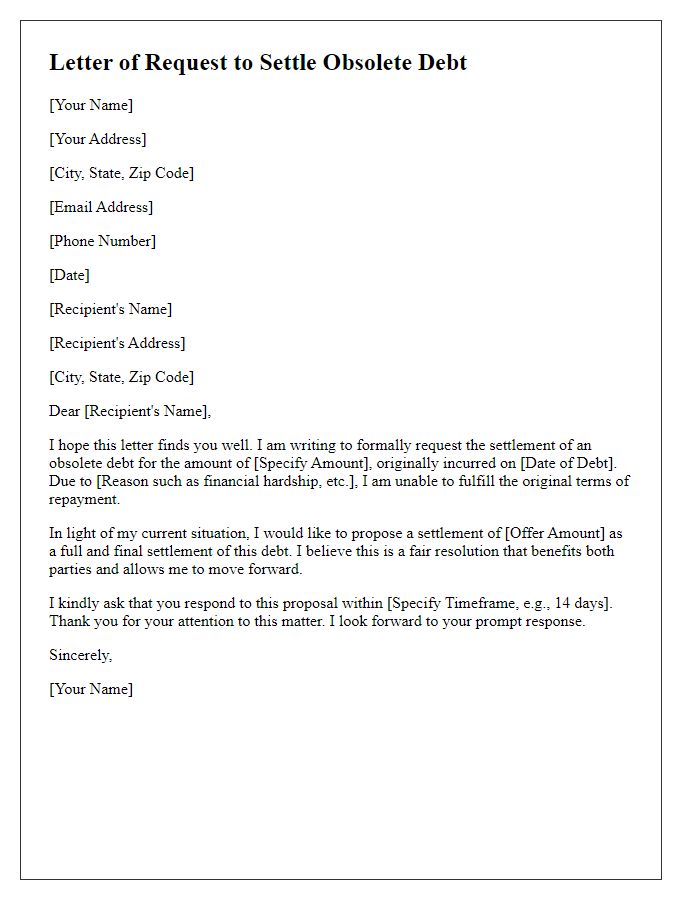

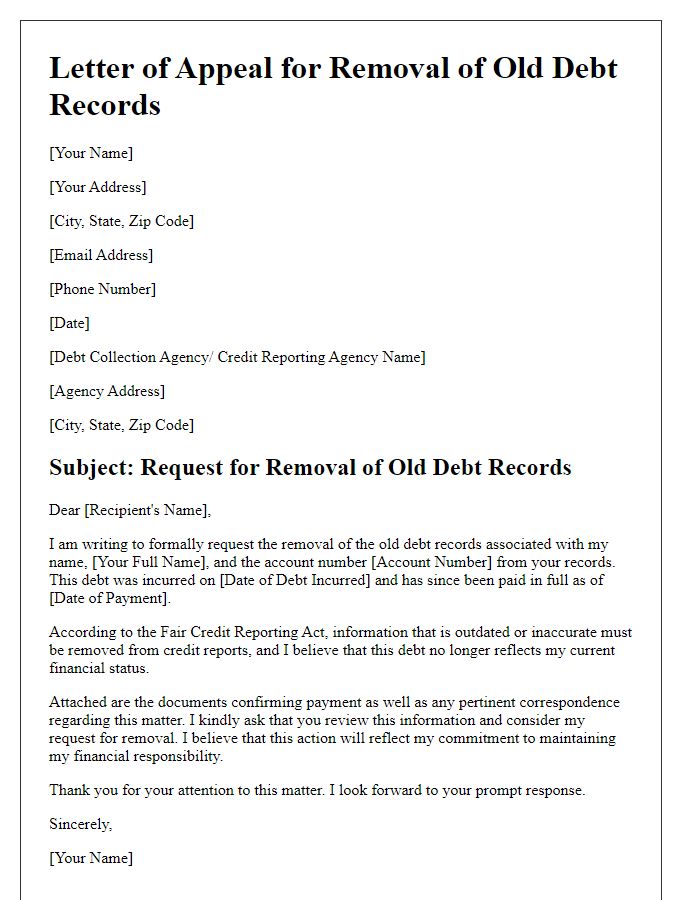

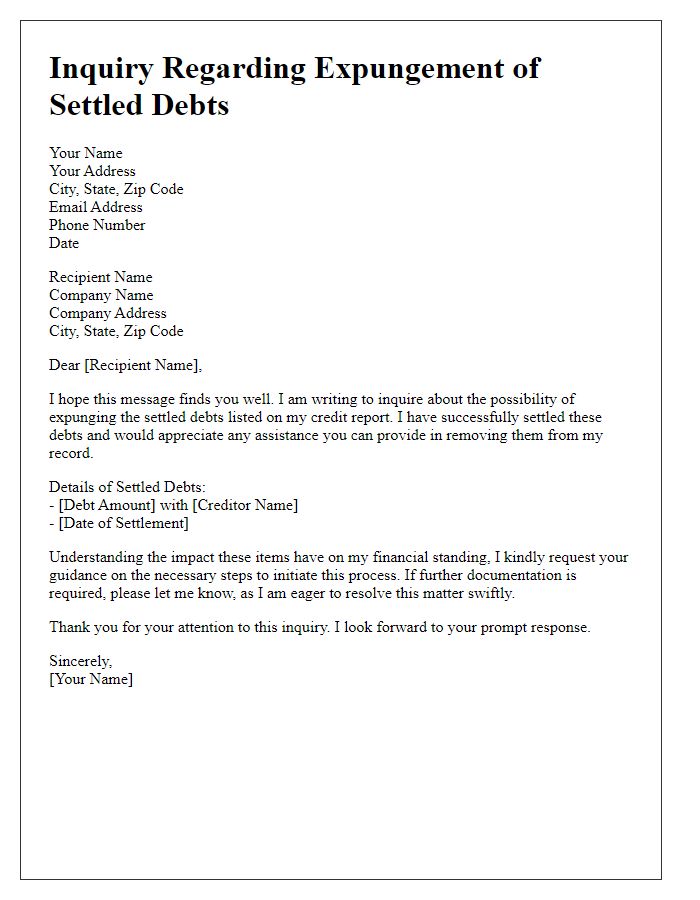

Creditor's Contact Information

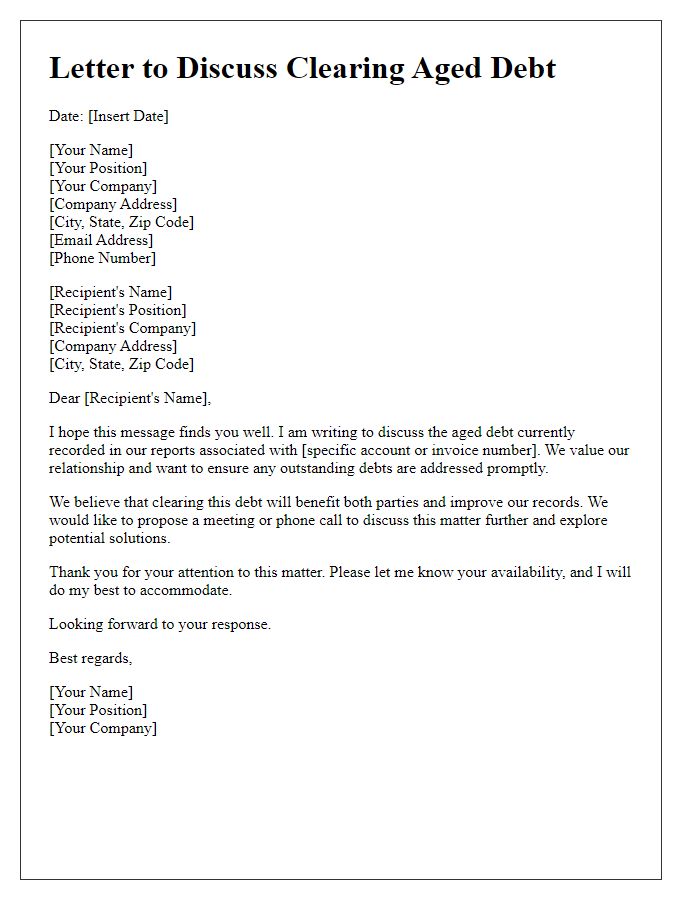

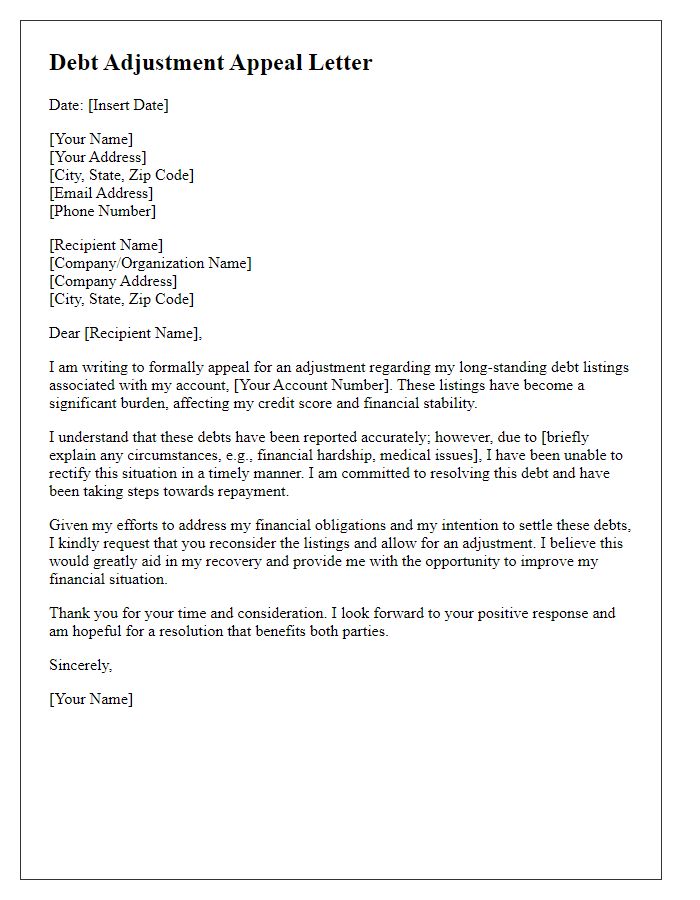

Negotiating outdated debt removal requires clear communication and relevant details about the creditor and the debt involved. Effective negotiation may include the creditor's name, contact number, mailing address, and email address. The creditor's name refers to the company or financial institution, such as XYZ Financial Services. Contact number represents the direct line where representatives can be reached, typically formatted as (123) 456-7890. Mailing address includes the physical location of the company, essential for sending formal requests; for example, 123 Business Rd, Suite 100, Cityville, State, ZIP. Email address facilitates quick written correspondence; for instance, debtsettlement@xyzfinancial.com can be used for inquiries and dispute resolutions. Adding specific details about the debt, like original amount, date of last payment, and account number, enhances clarity during negotiations.

Debtor's Information

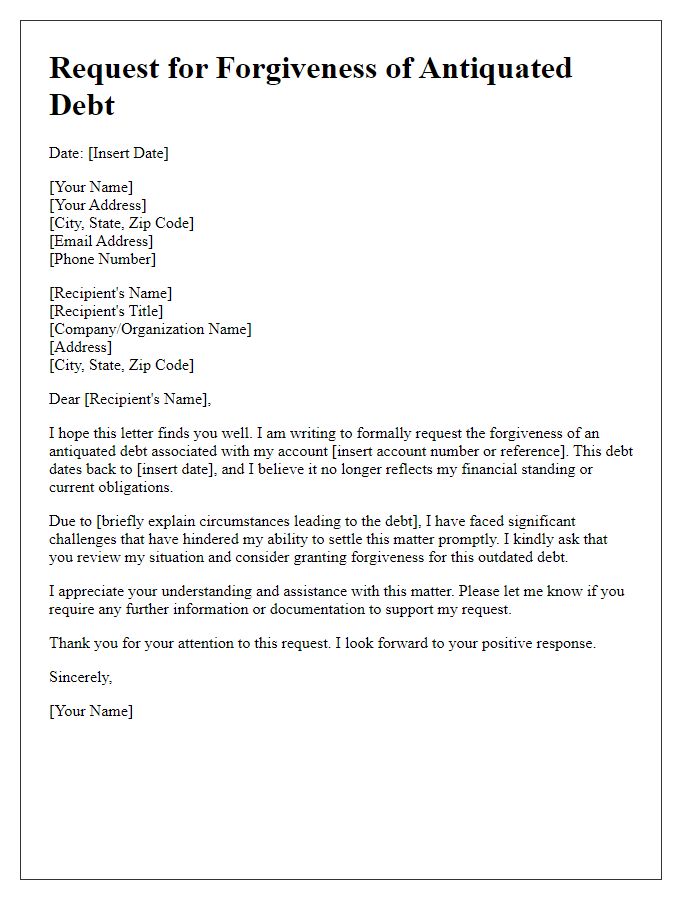

Previous debts often linger on credit reports, negatively impacting financial opportunities. Strategies for eliminating outdated debt can involve direct negotiations with creditors, often emphasizing legal statutes like the Fair Debt Collection Practices Act. Creditors may respond favorably to offers for partial payments or forgiveness requests, especially for debts over seven years old. Accurate documentation detailing debts, payment history, and current financial status is vital in negotiations. Understanding state-specific regulations, such as those in California or New York, can provide leverage in discussions. Ultimately, achieving successful debt removal can lead to improved credit scores and financial stability.

Subject Line: Debt Removal Request

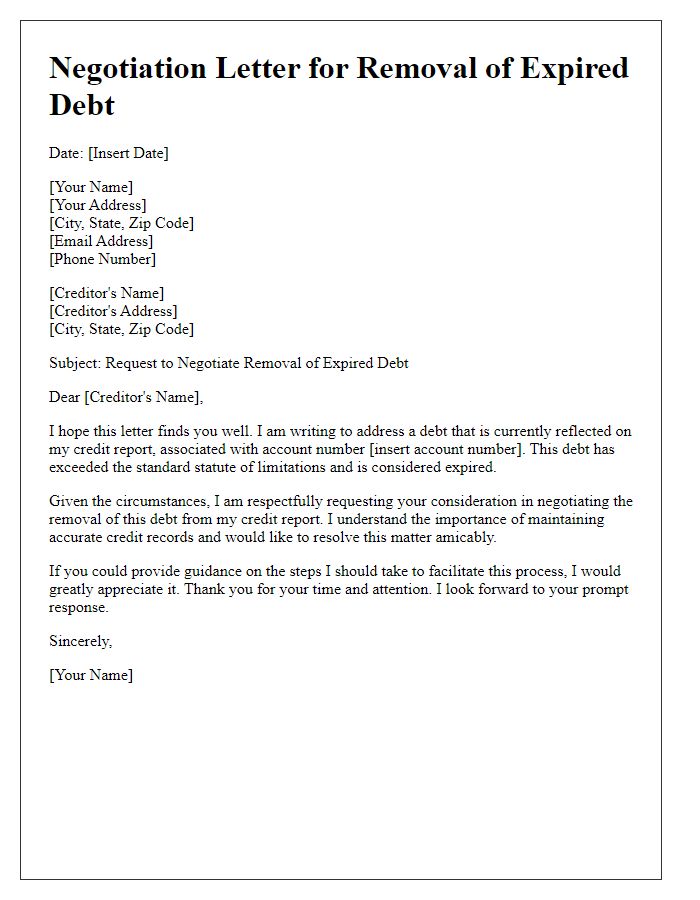

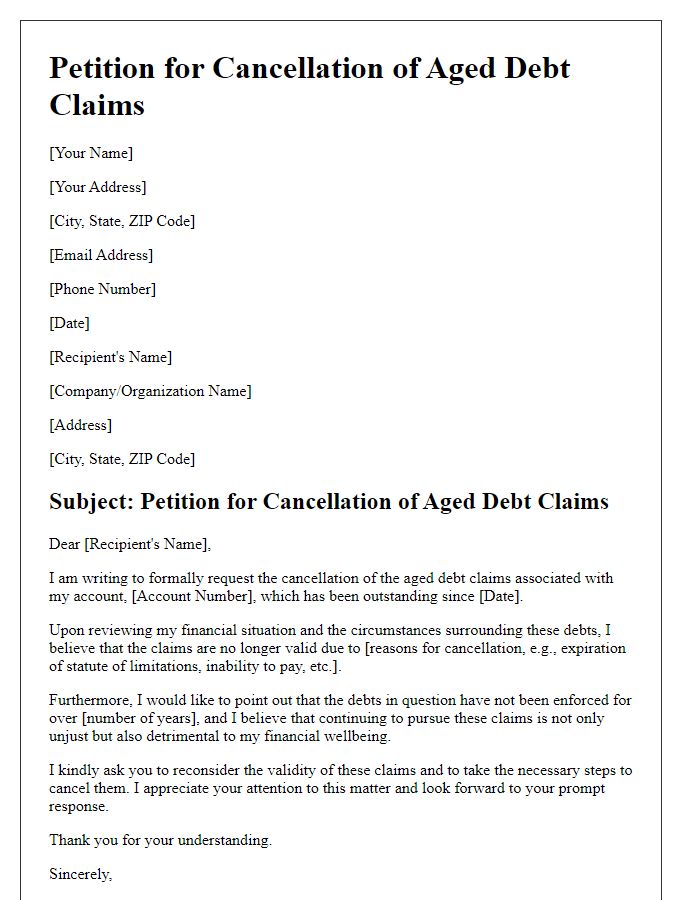

Outdated debt can significantly impact credit scores, often leading to higher interest rates on loans and difficulty obtaining mortgages. Individuals seeking debt removal often negotiate with collection agencies or credit bureaus to rectify their credit reports. Documentation such as proof of payment or statute of limitations laws (which vary by state) can support claims for debt removal. Engaging in this process can improve financial standing and restore creditworthiness. Filing a dispute with credit reporting agencies, including Equifax, Experian, or TransUnion, may lead to the successful removal of outdated debts.

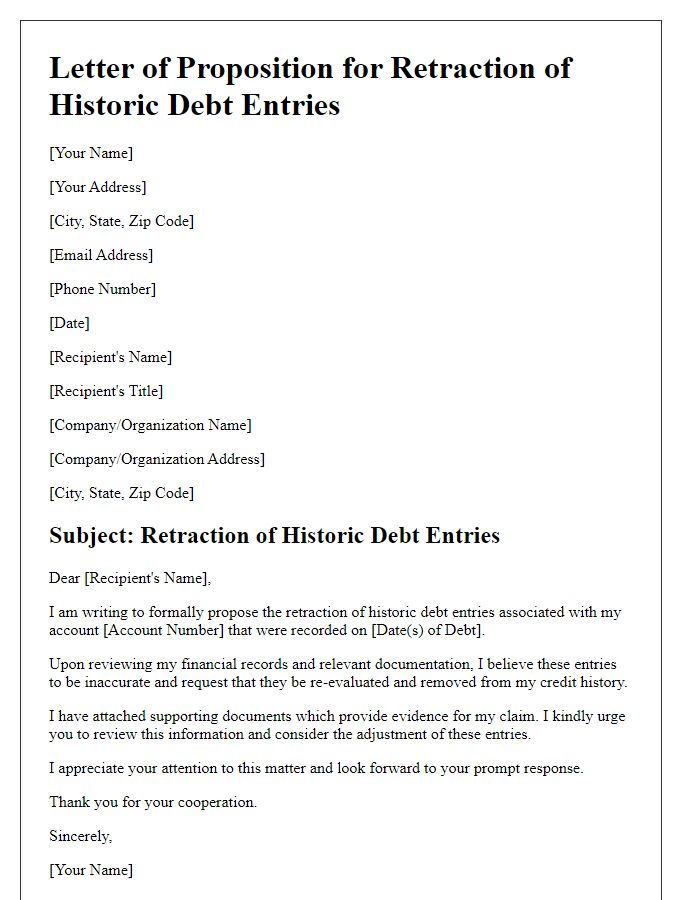

Debt Details and Reference Number

Negotiating the removal of outdated debt requires a clear understanding of relevant details. Outdated debt, such as accounts receivable over seven years old, can legally be removed from credit reports, affecting credit scores significantly. Reference numbers, like account identifiers provided by creditors, help track specific debts. Documentation includes associated dates, such as the original charge-off date, and amounts, which can range widely, impacting negotiations. Effective communication with creditors, especially collection agencies, often requires knowledge of federal regulations like the Fair Debt Collection Practices Act (FDCPA), which protects consumers from aggressive tactics. Trustworthiness can be established through clear records of past payments or disputes, influencing positive negotiation outcomes for debt removal.

Negotiated Terms and Conditions

Outdated debt removal negotiation can involve complex discussions regarding legal obligations, payment history, and creditor compliance. Documentation from both parties, including copies of original agreements and statute of limitations dates, plays a crucial role in these conversations. The Fair Debt Collection Practices Act (FDCPA) outlines specific regulations for collectors, ensuring they do not pursue debts that exceed legal time frames, often ranging from three to ten years, depending on the state. Additionally, terms such as "goodwill deletion" can be negotiated, where creditors agree to remove negative information from credit reports in exchange for payment. Understanding the implications of the Fair Credit Reporting Act (FCRA) is essential; it mandates that outdated debts be labeled correctly to avoid misinformation. Collectors and debtors should also review potential impacts on credit scores from outdated listings, which could influence approvals for future loans or credit. Proper negotiation strategies emphasize the importance of written agreements to document terms clearly, ensuring both parties honor their commitments well into the future.

Comments