Hey there! If you're navigating the sometimes tricky waters of debt management, you might be interested in learning about debt transfer notifications. This important document is essential for clarifying changes in your financial commitments, and it can really simplify the process for everyone involved. Understanding when and why to notify about a debt transfer can save you from future headaches, so it's crucial to stay informed. Dive in to discover how to craft the perfect debt transfer notification letter!

Creditor and Debtor Information

A debt transfer notification involves the formal transfer of financial responsibility from one party to another, impacting both the creditor (the party owed money) and the debtor (the party who owes the money). This notification typically includes essential details such as the creditor's name (often a financial institution or individual lender) and their contact information, ensuring that the debtor can communicate with the correct party. The debtor's information includes their name, address, and account number, providing clarity on which debts are in question. Additionally, the notification may specify the original amount owed, the date of the debt transfer, and any relevant payment deadlines or terms. Organizations involved in debt transfers must maintain thorough records to facilitate transparency and uphold legal standards.

Debt Details and Amount

A formal debt transfer notification is crucial for maintaining transparency in financial transactions. The notification should detail the specific debt, including the original creditor's name, the amount owed which may be in the thousands, and the due date for payment, ensuring clarity about deadlines. It should also include the new creditor's contact information for any inquiries. Additionally, referencing the original agreement or loan number can help identify the exact terms of the debt, aiding in record-keeping and preventing disputes. Clear communication about changes in ownership of debt is essential for both parties involved.

Transfer Effective Date

The debt transfer notification process should clearly state the transfer effective date, a crucial detail denoting when the debt obligations are officially transferred from one party to another. Creditors must provide the new account information, including the account number and the name of the new creditor, usually compelling in cases of substantial debts, such as mortgages or student loans. Additionally, the notice should include details about the original loan, such as the principal amount, interest rate, and payment schedule, alongside the name and contact information of both the original and new creditor. Proper notification ensures compliance with relevant regulations and protects the rights of all involved parties, fostering transparency throughout the transition.

New Creditor Contact Information

Debtors facing a debt transfer should be aware of the new creditor's contact information. Accurate details enable effective communication, ensuring the debtor receives important updates related to their financial responsibilities. This includes the creditor's name, address, phone number, and email. For example, if a debt originally held by XYZ Financial is transferred to ABC Collections, the debtor must be informed of ABC's contact details promptly. This process typically follows the regulations under the Fair Debt Collection Practices Act, which mandates notification within a specific time frame, generally within 30 days of the transfer. Failure to provide this information can lead to confusion and potential disputes regarding debt repayment.

Authorization and Legal Compliance

A debt transfer notification is a critical document in financial transactions, particularly in situations where owed amounts (such as $10,000 or more) are reassigned from one party to another (like from an individual to a financial institution). Precise language ensures clarity and compliance with legal standards set by the Fair Debt Collection Practices Act (FDCPA) in the United States. Key elements include the original creditor's name, the amount of debt, and essential dates (like transfer date and notification date). Furthermore, the notification should identify the new creditor and provide contact information for inquiries. Adhering to state regulations, such as those in California or New York, is vital to maintain legitimacy and foster trust between parties involved in the transfer process. Properly executed, this document safeguards the rights of both the debtor and creditor, ensuring all parties are aware of their obligations and responsibilities within the terms of the agreement.

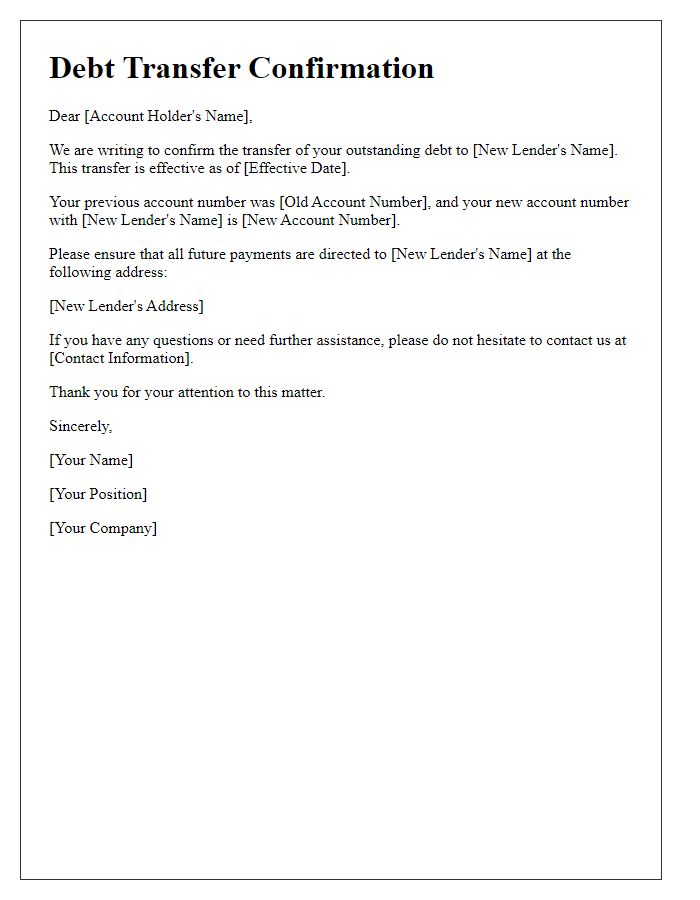

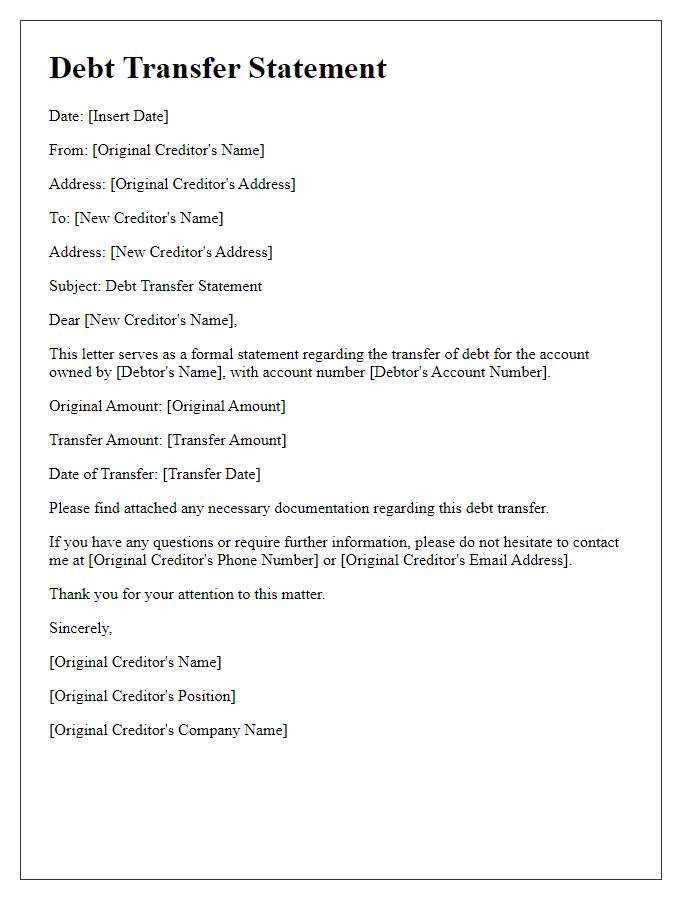

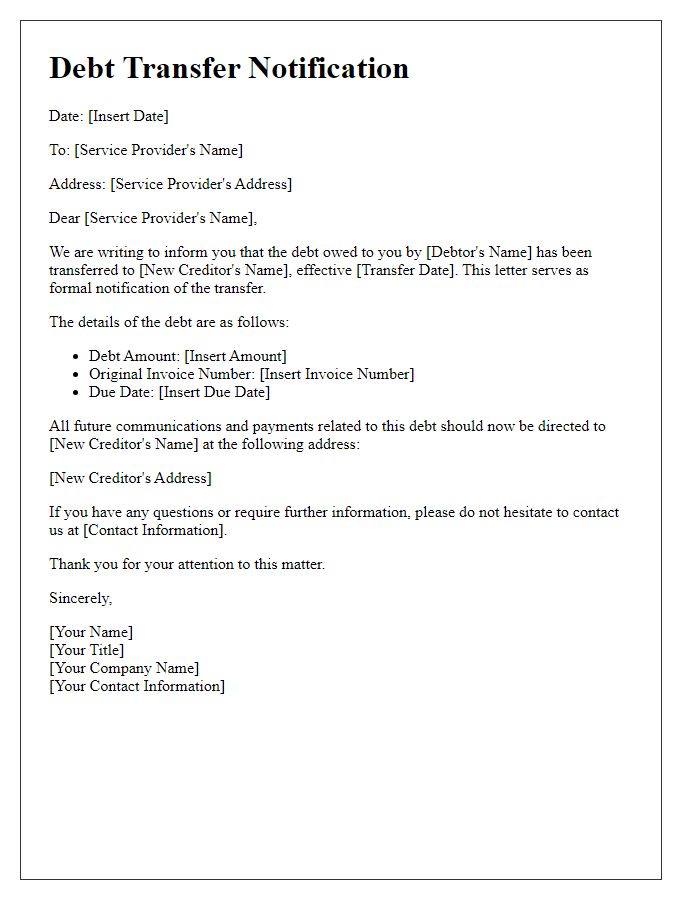

Letter Template For Debt Transfer Notification Samples

Letter template of debt transfer information for financial institutions.

Letter template of debt transfer disclosure for compliance requirements.

Comments