When it comes to managing finances, we all know that sometimes things can slip through the cracks, especially when it involves debt payments. A gentle reminder can make a world of difference in helping someone stay on track with their payments. In this article, we'll explore effective letter templates that not only convey the message but also maintain a friendly tone. So, if you're ready to ensure your communication fosters understanding and responsibility, keep reading!

Clear Identification of Parties

When dealing with outstanding debt, clear identification of parties involved is crucial for ensuring accurate communication and resolution. The debtor, an individual or entity responsible for the payment, must be clearly identified with full name, address, and any account number associated with the debt. On the creditor's side, the organization or individual seeking payment should also be distinctly outlined, including their official name, address, and any relevant identification numbers such as tax identification or registration numbers. This precise identification helps prevent confusion, promotes accountability, and facilitates the necessary steps toward debt resolution, creating a structured context for future correspondence or legal proceedings if necessary.

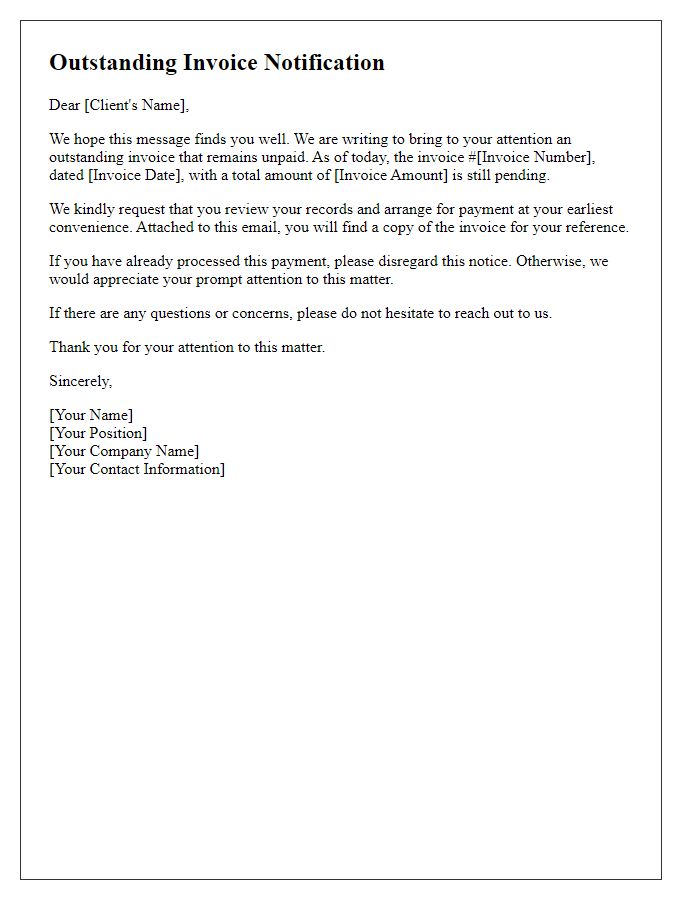

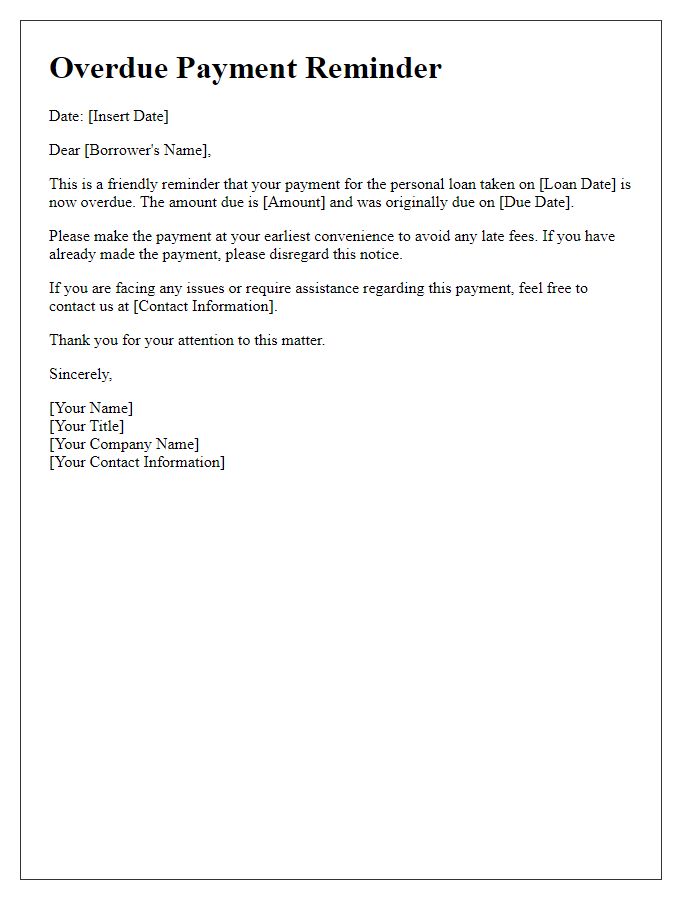

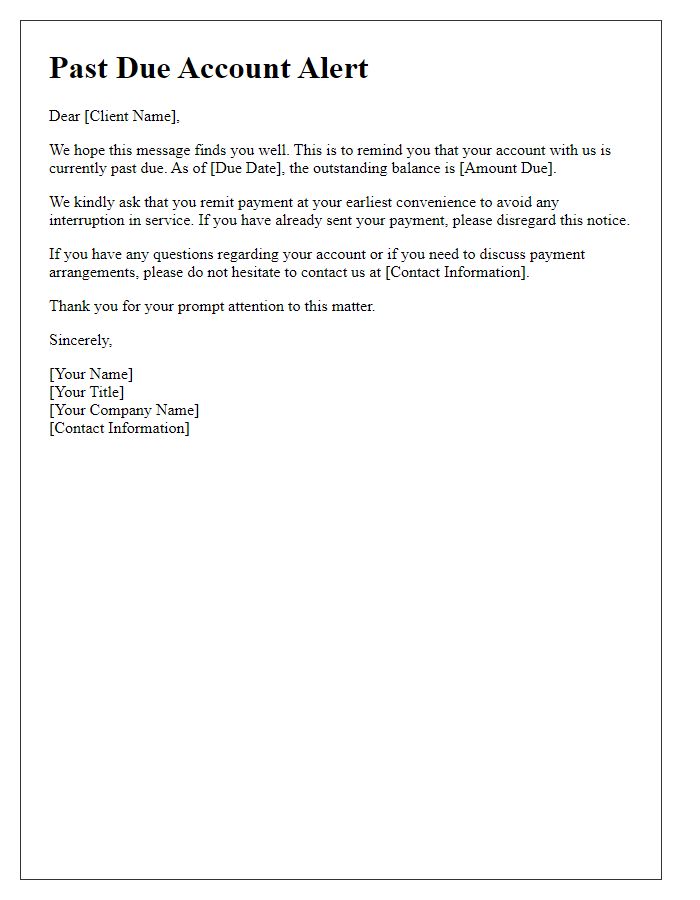

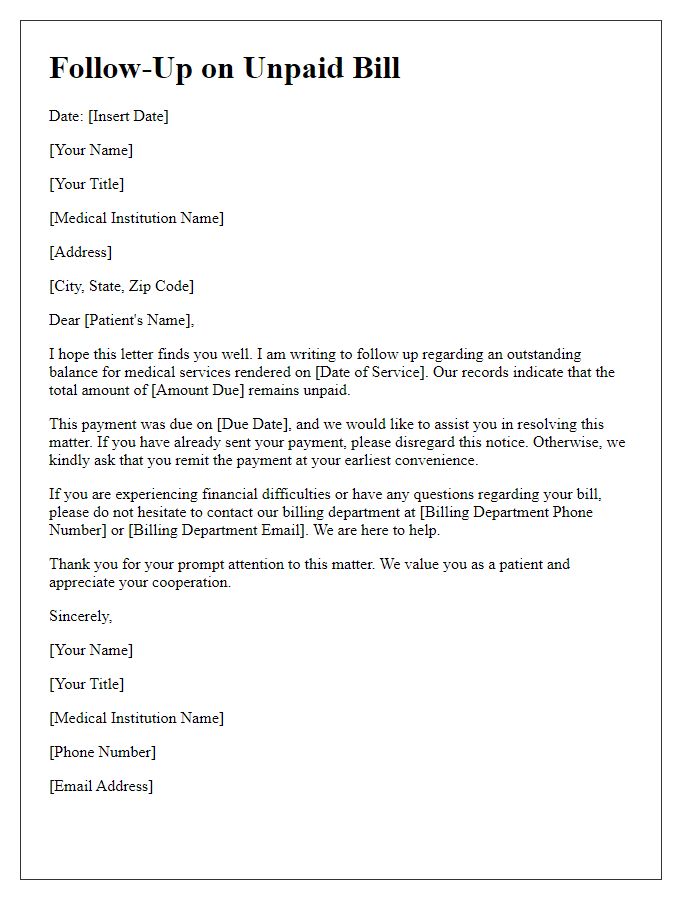

Polite and Professional Tone

A debt payment reminder is crucial for maintaining professionalism and ensuring timely payments. Clients should be gently reminded of outstanding balances, specifying the amount due (such as $1500) and due dates (e.g., October 15, 2023). Including details about the service or product related to the debt enhances context. For instance, referencing a recent project (such as "Consulting Services rendered in September 2023") provides clarity. Additionally, offering options for payment methods (like bank transfer or credit card) can facilitate faster transactions while maintaining a professional communication tone. Ending with an invitation for questions ensures transparency and encourages a positive response.

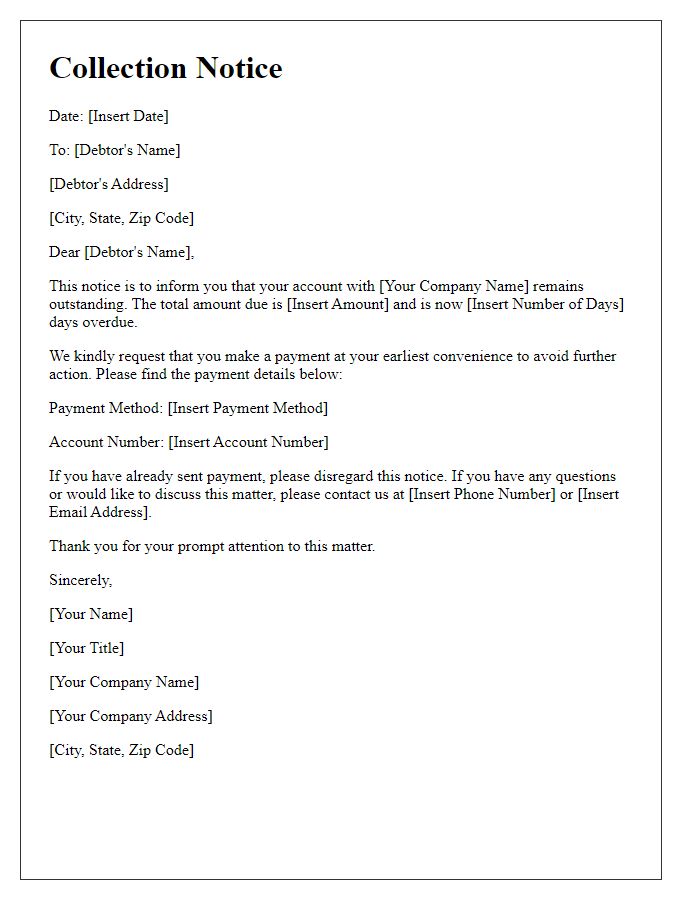

Statement of Outstanding Amount

Past due accounts can cause financial strain for both individuals and businesses. A Statement of Outstanding Amount serves to remind debtors of overdue payments. The statement often includes vital details such as the due date, which may range from 30 to 90 days past the original payment deadline. Debt amounts can vary significantly, from small invoices of $50 to substantial debts exceeding $10,000. Clear communication regarding outstanding balances can help prevent further complications. Additional charges, such as late fees which can accrue at rates of 1.5% per month, can increase the financial burden. The financial institution, which could be a bank, credit union, or private lender, typically emphasizes the importance of timely payments to maintain a positive credit score and avoid collections.

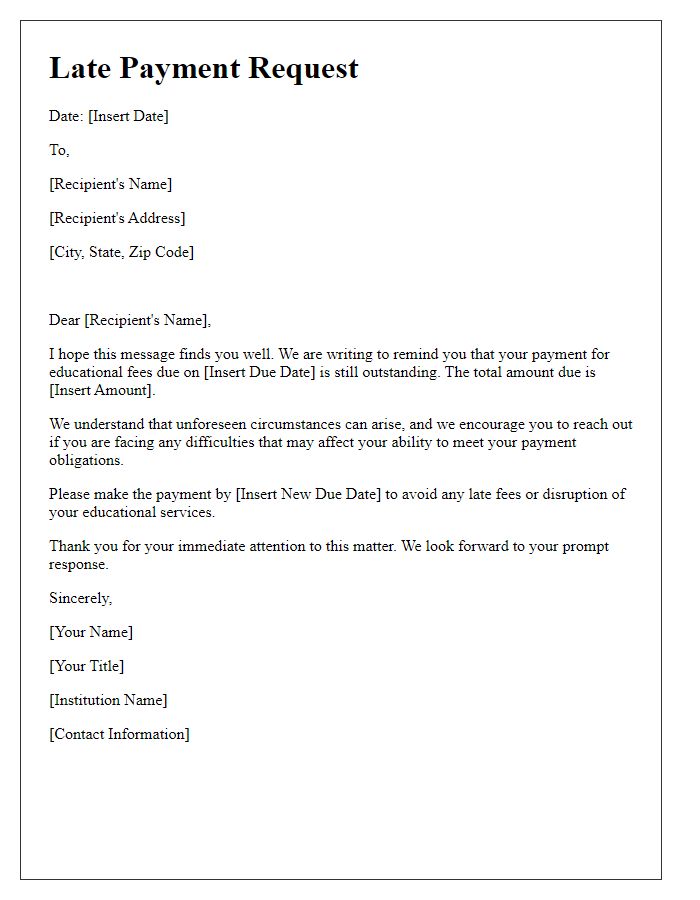

Deadline for Payment

Many individuals face challenges in meeting their financial obligations, often leading to missed debt payment deadlines, typically around the 30-day mark of billing cycles. Prompt reminders can help maintain financial health and avoid penalties. For example, a mortgage payment due on January 1st can cause significant stress if not addressed by the previous month. Timely communication, such as notices from creditors or lenders, can significantly improve adherence to payment schedules. Increasing awareness of responsibilities is crucial for managing debts effectively, especially for credit card payments, which often carry higher interest rates if overdue, sometimes exceeding 20%. Additionally, failure to pay on time may impact credit scores, which range from 300 to 850. Understanding these elements can enhance one's financial literacy.

Contact Information for Queries

When a debt payment reminder is issued, including contact information for queries is essential for facilitating communication. Prospective debtors may require clarification, making it necessary to provide a dedicated phone number (e.g., customer service line, regional office), email address (e.g., support@someservice.com), and any applicable office hours (e.g., Monday to Friday, 9 AM to 5 PM, EST). Incorporating physical address information (e.g., 123 Debt Management St., Suite 456, City, State, ZIP Code) can be helpful for mailing correspondence or documents. Lastly, outlining response expectations (e.g., within 48 hours) ensures timely communication, enhancing debtor engagement and promoting resolution.

Letter Template For Debt Payment Reminder Samples

Letter template of outstanding invoice notification for business clients

Comments