Are you considering tapping into your pension fund? Whether it's for a major life change or a pressing financial need, navigating the withdrawal process can feel overwhelming. It's essential to understand the steps involved and the implications of your decision to ensure you're making the best choice for your future. Ready to learn more about how to effectively request your pension fund withdrawal?

Personal Information: Full Name, Address, Contact Details.

Individuals considering a pension fund withdrawal must provide detailed personal information to facilitate the process. Essential details include the full name, ensuring proper identification in financial records. The address should include the street number, city, state, and postal code to confirm residency status and facilitate correspondence. Contact details must consist of a valid telephone number, ideally a mobile number, for immediate communication, as well as an email address for timely updates regarding the withdrawal request. Clear and accurate information will expedite the pension fund release process, ensuring compliance with financial regulations.

Pension Fund Details: Account Number, Fund Name.

A pension fund withdrawal request typically includes precise information regarding the fund's details to facilitate a smooth process. Key elements to include are the Account Number, a unique identifier allocated to the individual's pension fund account, ensuring accurate tracking and processing of the request. The Fund Name, representing the specific pension scheme or fund managed by a financial institution, is also essential. This name often reflects the type of pension plan, such as Defined Contribution or Defined Benefit schemes, thereby providing clarity for the administrators managing the withdrawal. Including these details confirms the requestor's identity and aids in verifying eligibility for withdrawal according to the fund's regulations and legal requirements.

Request Details: Amount of Withdrawal, Purpose.

A pension fund withdrawal request typically involves specifying the amount intended for withdrawal and the purpose of the funds. For instance, if an individual is requesting a withdrawal of $15,000 from their retirement account, they might indicate that this amount is needed for a home purchase in Denver, Colorado. Providing such details helps the fund manager understand the urgency and reason for the withdrawal, ensuring the request is processed efficiently. Factors such as potential tax implications, penalties, and compliance with the fund's regulations should also be considered during this process. Clear articulation of these details ensures smooth communication between the account holder and the fund provider.

Authorization: Signature, Official ID Copies.

Pension fund withdrawal requests require specific authorization protocols to ensure security and compliance. Essential components include a valid signature from the account holder, which serves as a legal confirmation of the request and intent. Additionally, copies of official identification, such as government-issued photo IDs like driver's licenses or passports, are necessary to verify the identity of the individual making the request. These measures help prevent fraudulent activities and safeguard the assets within the pension fund, ensuring that withdrawals are processed accurately and in accordance with regulatory guidelines.

Contact Instructions: Preferred Communication Method, Follow-up Information.

Pension fund withdrawal procedures often require clarity in communication to ensure a smooth transaction. The preferred communication method can typically include options such as email, phone, or postal mail, depending on the retirement plan administrator's policies. When submitting a withdrawal request, it is advisable to provide your primary contact details, especially the most frequently checked email address or phone number, to facilitate timely responses. Follow-up information should encompass specific time frames for responses, such as requesting updates within a certain number of business days (usually 5 to 10), as well as any additional documentation or identification needed to process the request, ensuring compliance with regulatory standards set by financial authorities like the Internal Revenue Service (IRS) or local pension regulations.

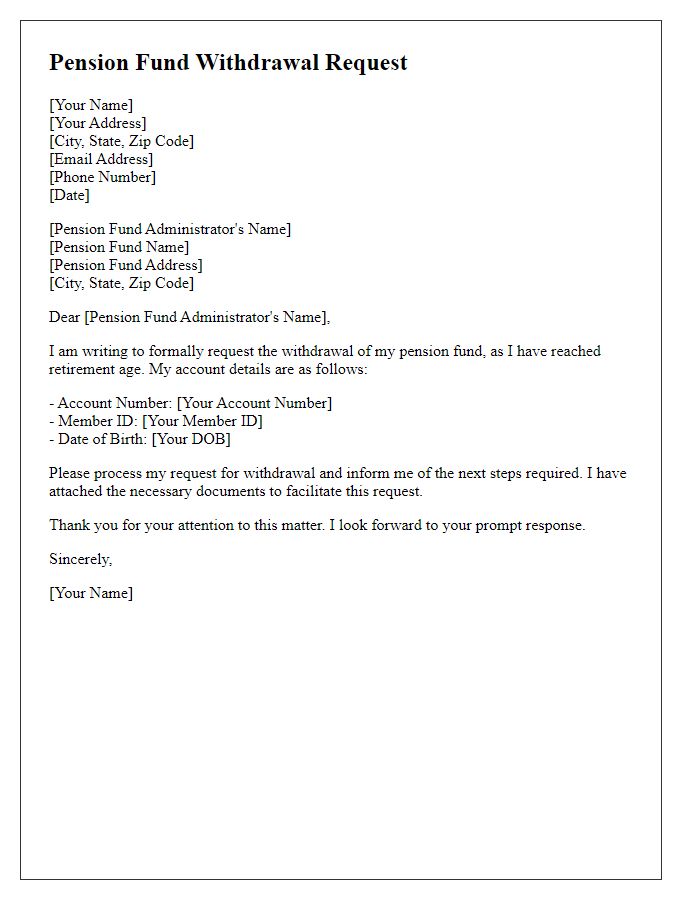

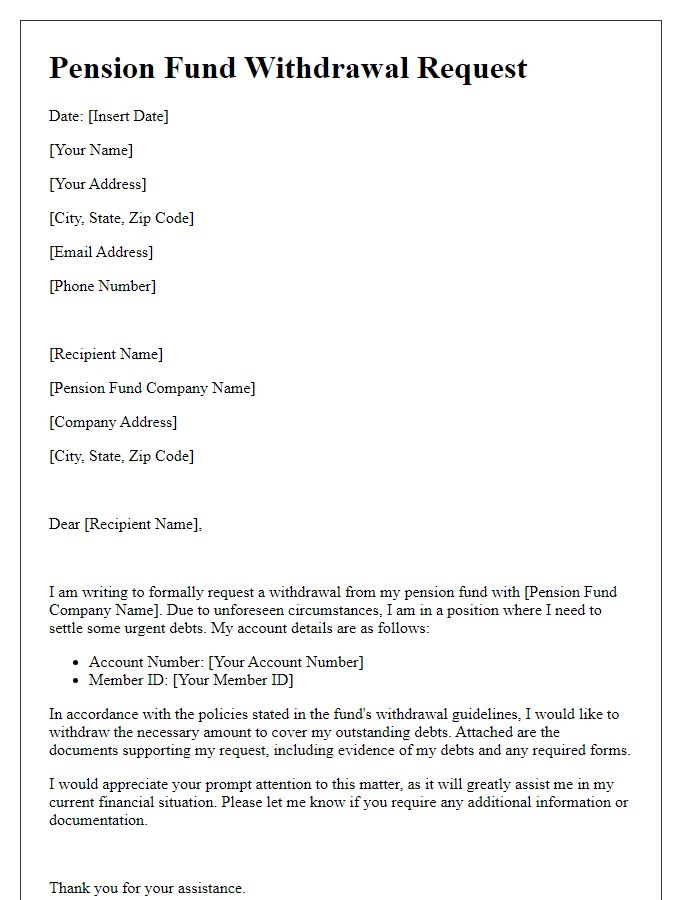

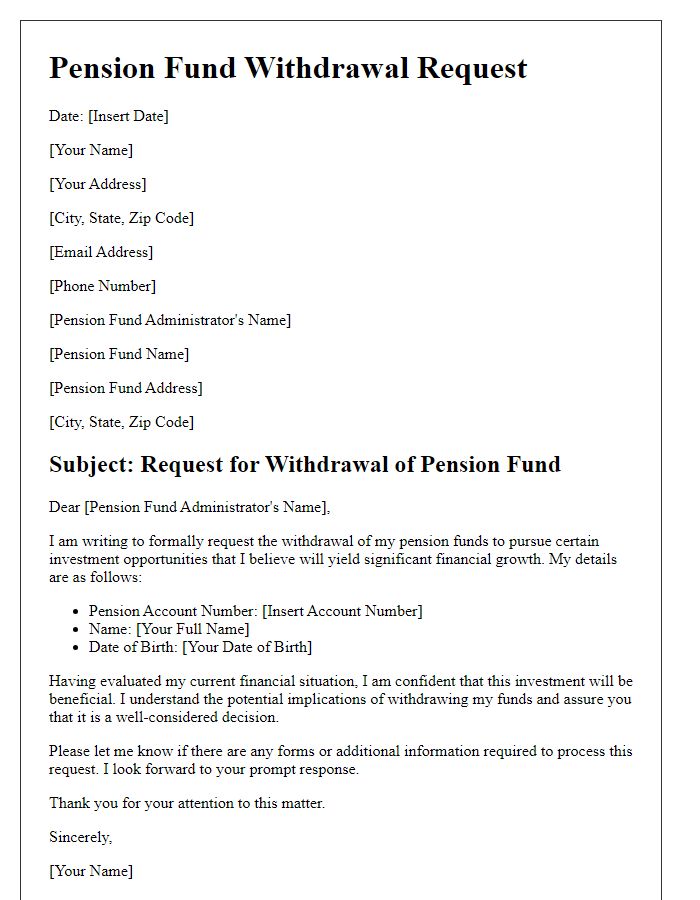

Letter Template For Pension Fund Withdrawal Request Samples

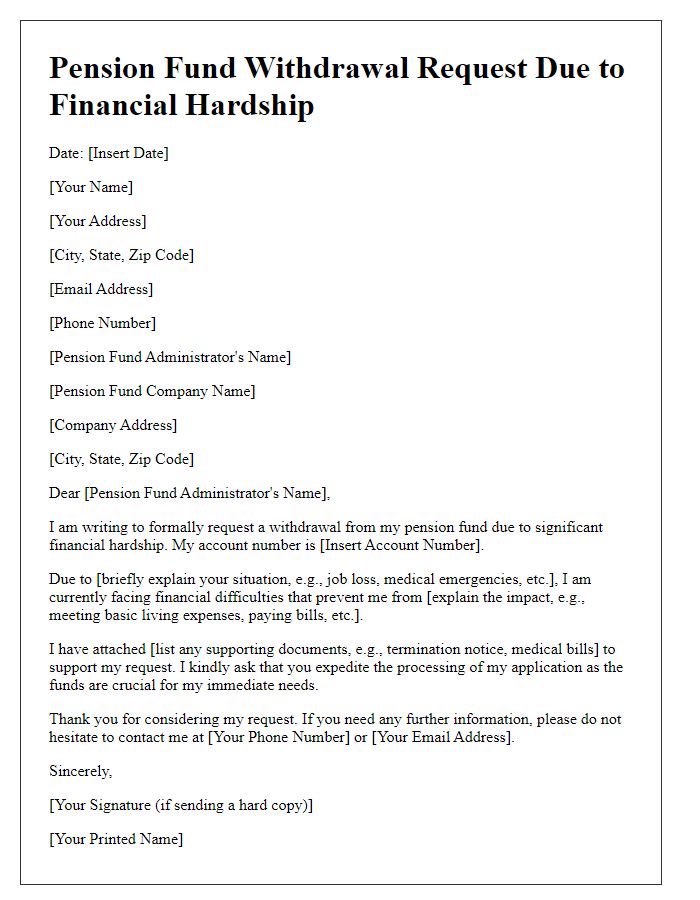

Letter template of pension fund withdrawal request due to financial hardship.

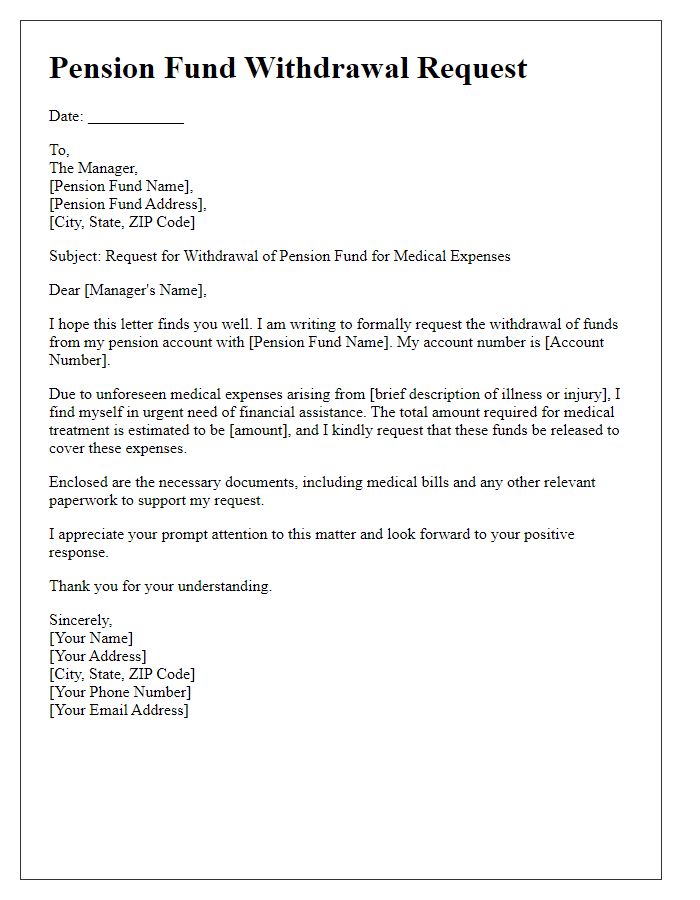

Letter template of pension fund withdrawal request for medical expenses.

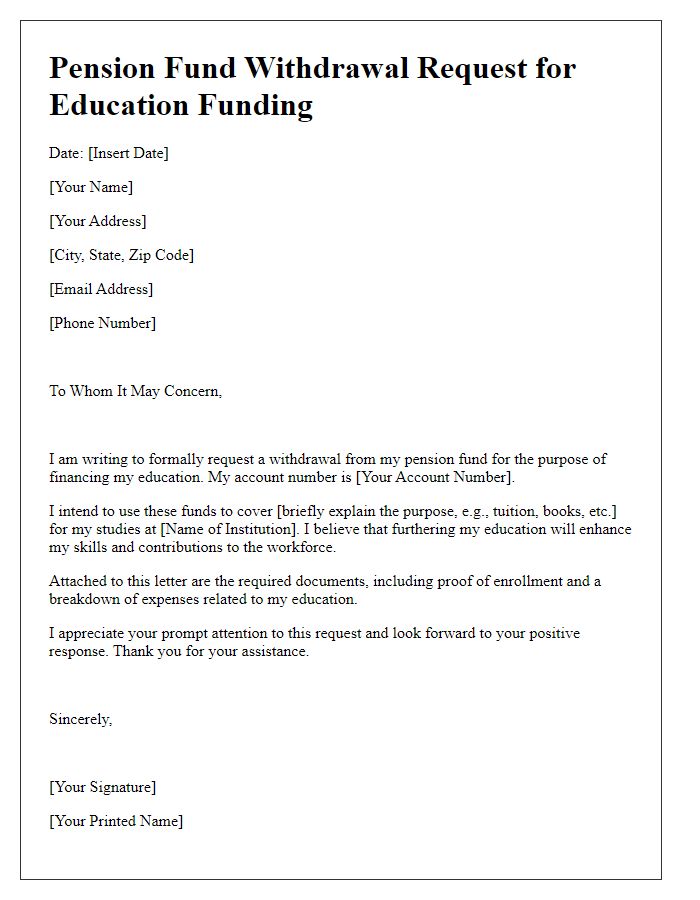

Letter template of pension fund withdrawal request for education funding.

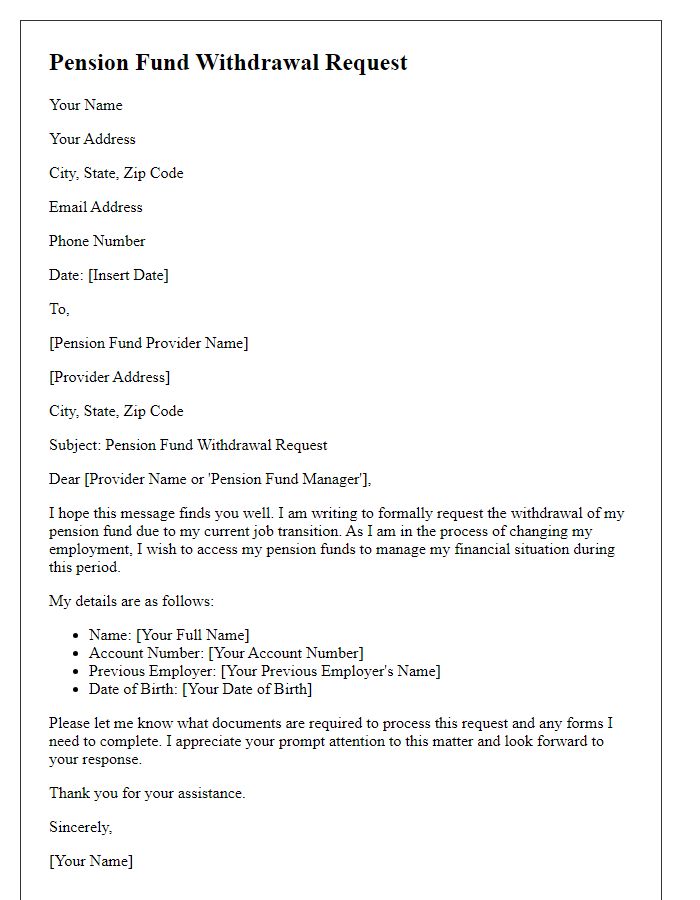

Letter template of pension fund withdrawal request during job transition.

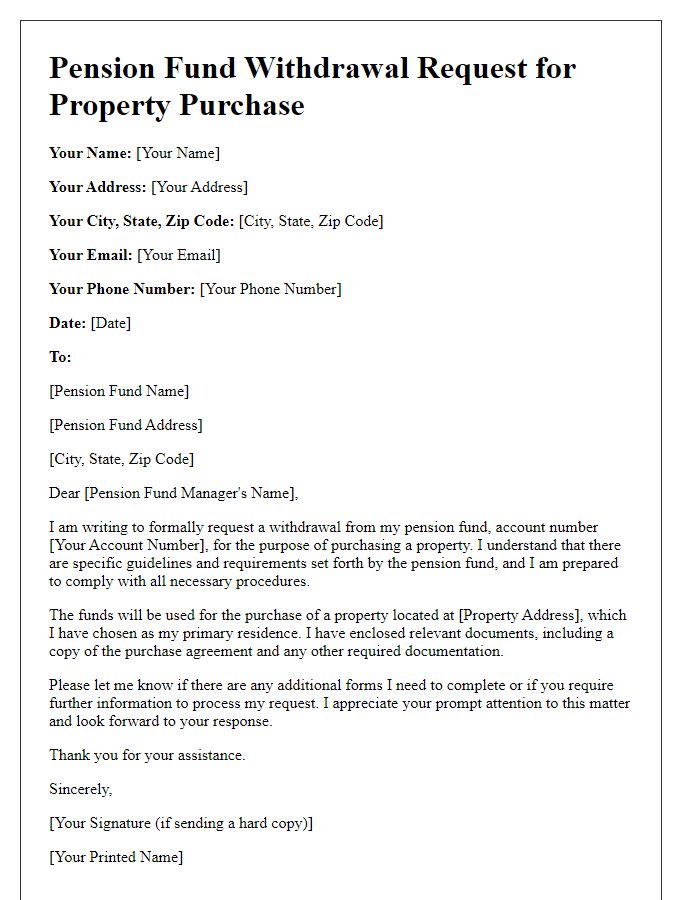

Letter template of pension fund withdrawal request for property purchase.

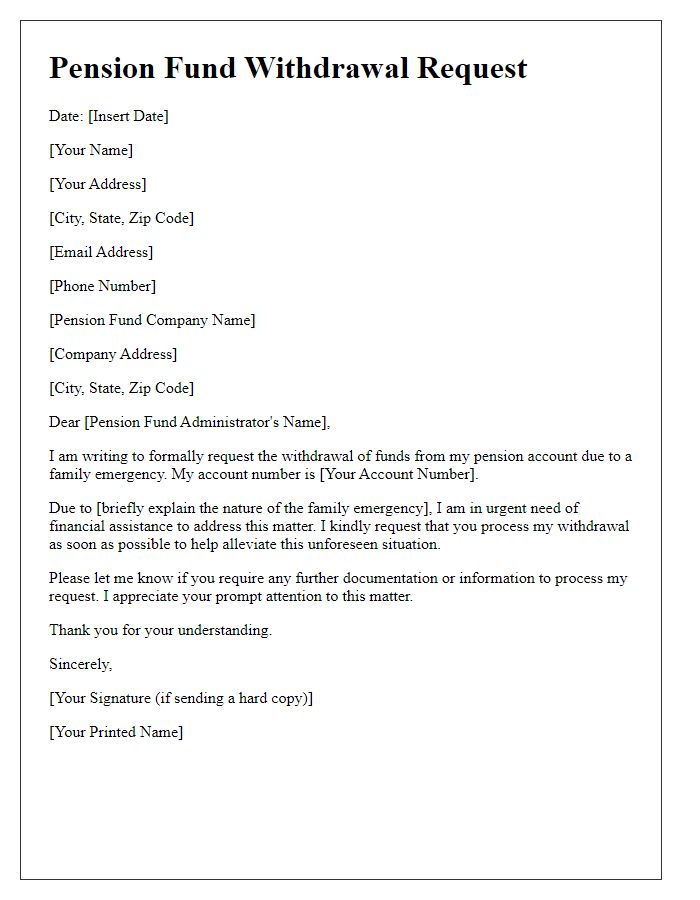

Letter template of pension fund withdrawal request for family emergencies.

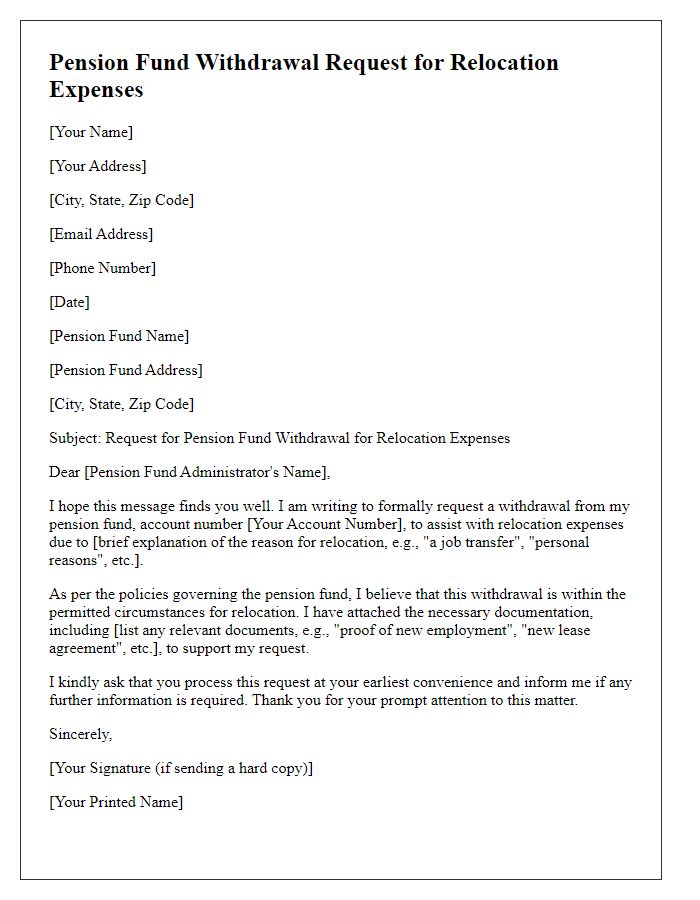

Letter template of pension fund withdrawal request for relocation expenses.

Comments