Are you or someone you know facing account suspension due to nonpayment? It's a frustrating experience, and understanding the reasons behind it is essential to navigate the situation effectively. In our upcoming article, we'll explore the common causes of account suspensions and provide you with a clear template for addressing the issue. Stay tuned to learn more and regain control of your account!

Company Branding and Information

Account suspension often occurs due to nonpayment issues, impacting customer access to various services provided by the company. Typically, a grace period of 30 days is allowed before suspension, notifying customers via email about outstanding balances. Some companies, such as telecommunications providers, require payments within specific billing cycles (e.g., monthly). If payment remains unpaid, access to services like internet and mobile will be restricted. In extreme cases, sustained nonpayment may result in the collection of debt through third-party agencies, impacting customers' credit scores. Providing clear branding and information regarding service agreements is crucial, detailing potential implications of account suspension to ensure customers remain informed.

Clear Subject Line

Account suspension may occur due to nonpayment for services rendered, such as subscription fees for digital platforms. Accounts typically remain active for a grace period of 30 days following the due date, allowing users time to settle outstanding balances. In cases where payment remains unresolved after this period, service providers enforce immediate suspension, restricting access to accounts. Notifications often highlight due amounts alongside payment methods, urging users to rectify financial discrepancies to reinstate services. Prompt communication addresses both the urgency and importance of timely payments in maintaining uninterrupted access to digital resources.

Specific Account Details

Account suspension due to nonpayment often leads to service termination, affecting users significantly. The account number (for example, 123456789) identifies the specific user profile within the service provider's database. Due date (such as March 15, 2023) marks the missed payment deadline, prompting actions to suspend privileges. Additional fees may arise due to late processing, impacting the total outstanding balance (for instance, an increase to $150 due to a $30 late fee). Suspension notifications typically occur via email (addressing the registered email, e.g., user@example.com), ensuring users are informed of their account status. Reactivating the account requires settling dues and may involve contacting customer service at a designated helpline (for example, 1-800-555-0199) for further assistance.

Amount Due and Payment History

Account suspension occurs when an account holder fails to make timely payments on outstanding balances. The specific amount due might vary significantly based on the service or product involved, often ranging from small fees to several hundred dollars. Payment history plays a crucial role in determining account status; frequent missed payments over a period of 30 to 90 days may result in immediate action. For instance, utility companies or subscription services often issue warnings before escalating to suspension. Effective communication regarding dues typically includes a detailed invoice showing required payments, previous amounts settled, and remaining balances, thus providing customers with a comprehensive overview of their financial obligations.

Consequences and Next Steps

Account suspension due to nonpayment can have significant consequences for users relying on services, such as cloud storage or subscription-based software. Affected individuals may lose access to crucial data stored on platforms like Google Drive or Dropbox, impacting business operations or personal projects. Notifications usually occur via email, detailing the amount overdue, typically ranging from $10 to $500. Users are often given a grace period, allowing for potential reactivation upon settling the outstanding balance. Next steps include reviewing billing statements, confirming payment processing options, and contacting customer support for reinstatement procedures. Understanding the implications of a suspended account is essential for users to prevent potential disruptions in service.

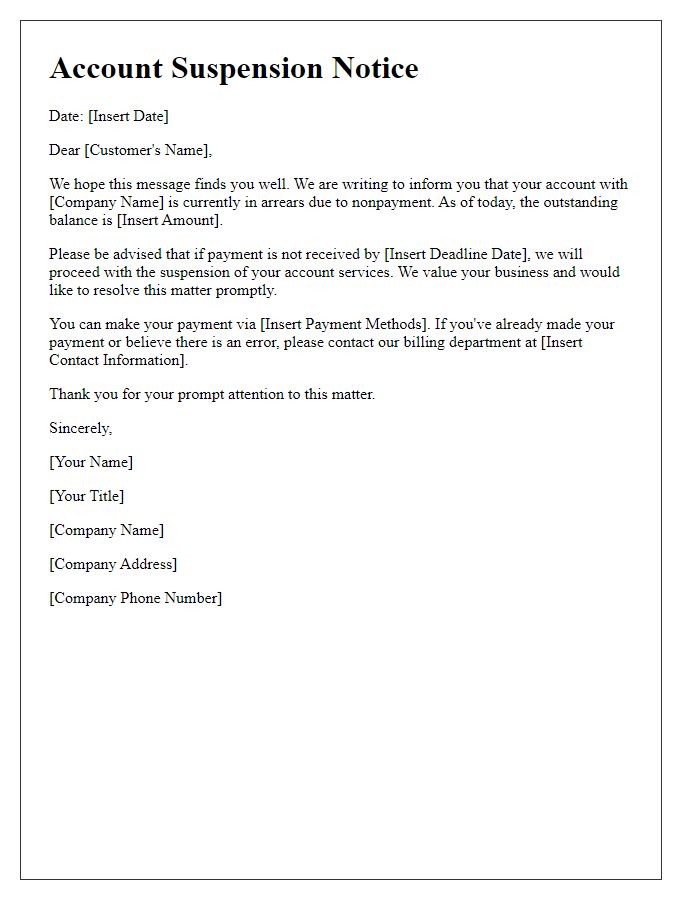

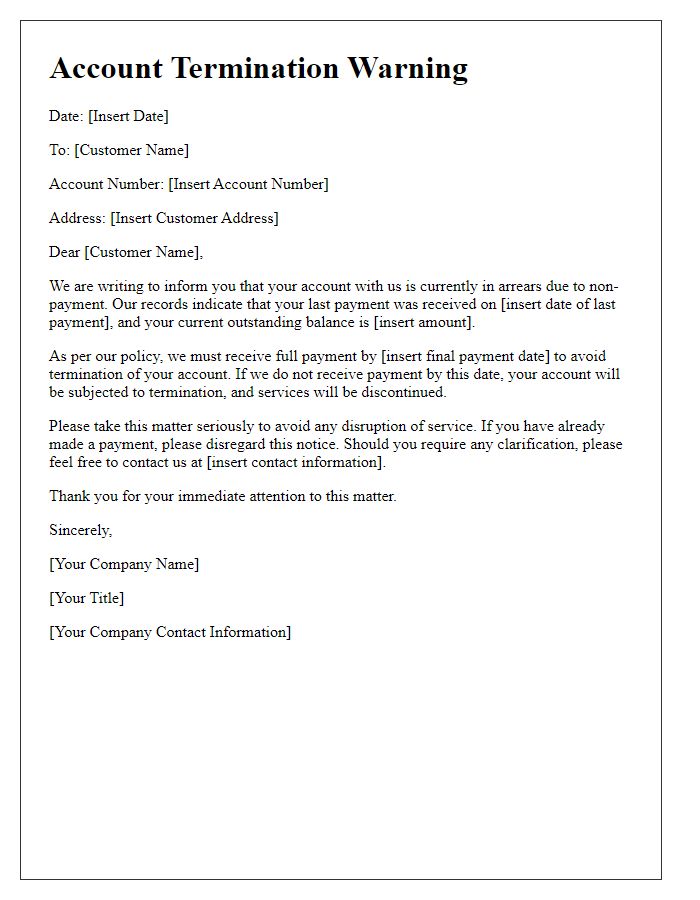

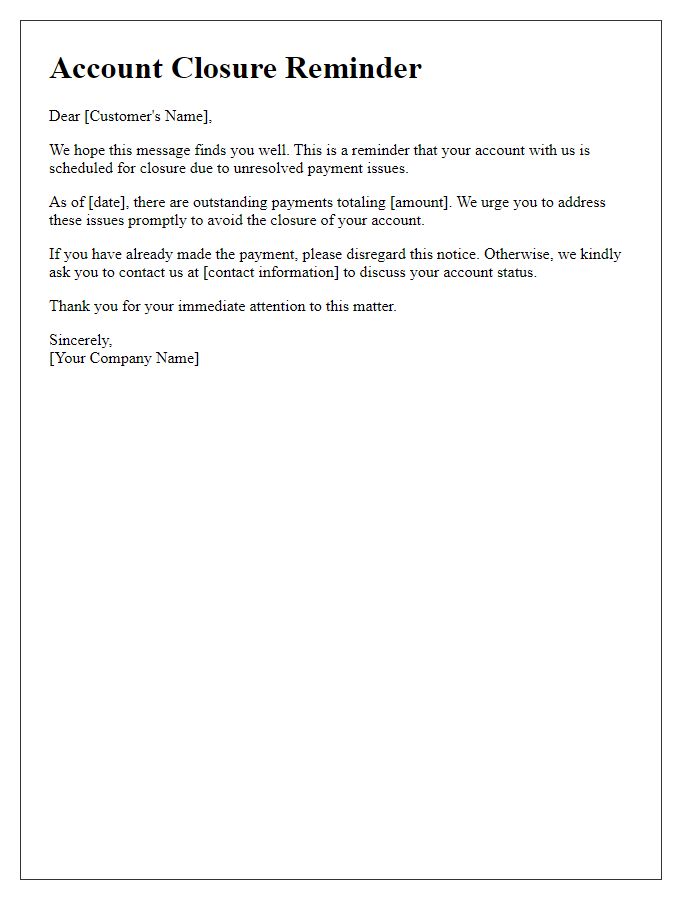

Letter Template For Account Suspension Due To Nonpayment Samples

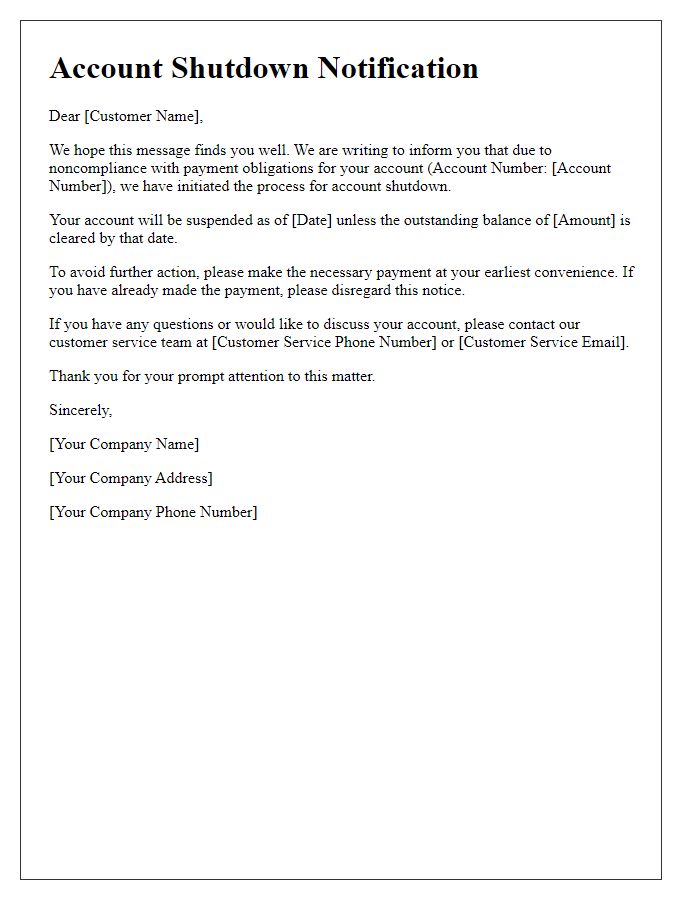

Letter template of account shutdown advisement for noncompliance with payment

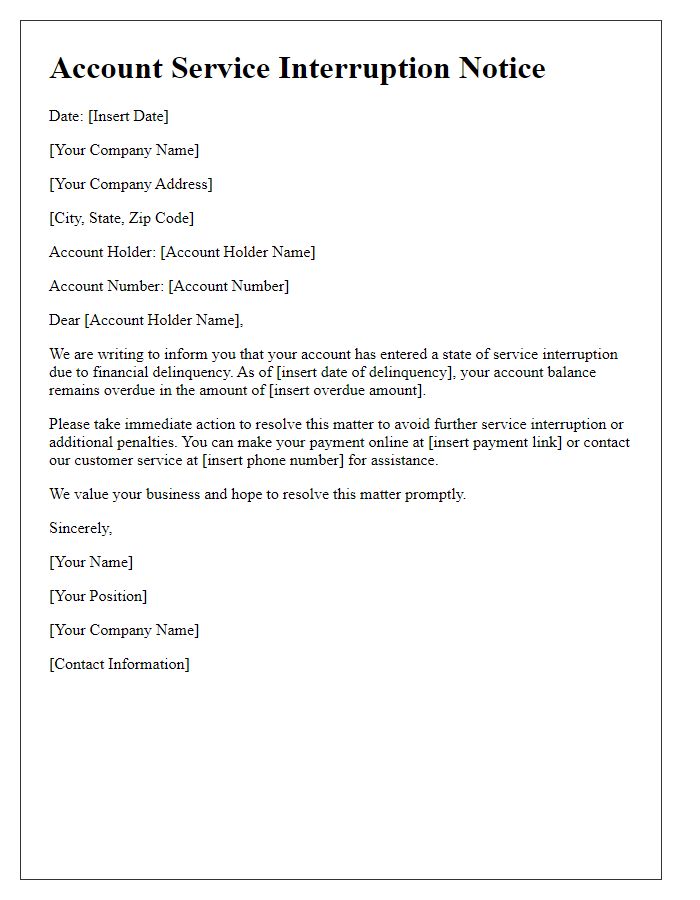

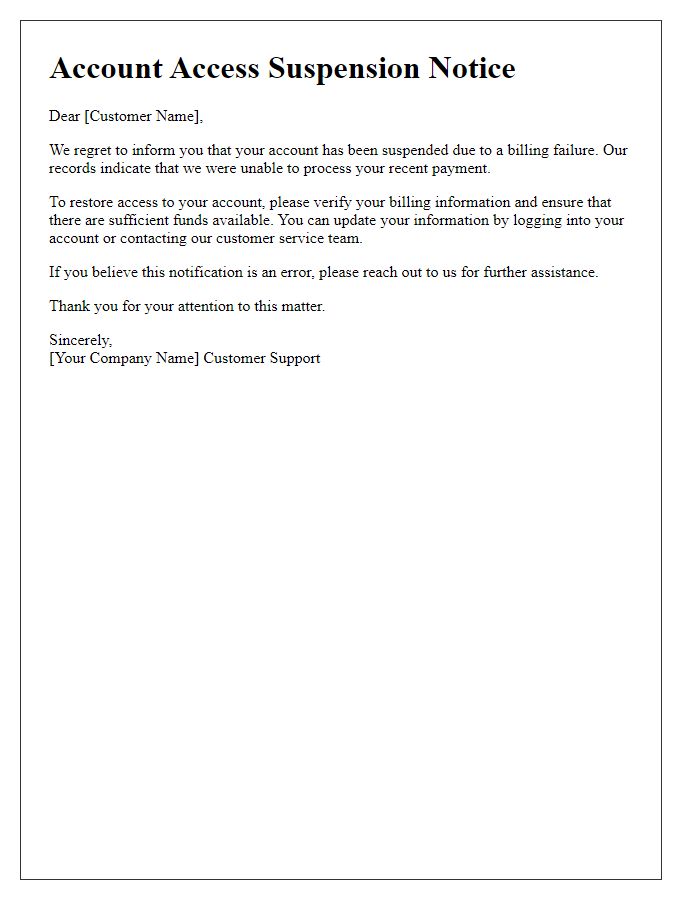

Letter template of account service interruption notice for financial delinquency

Comments