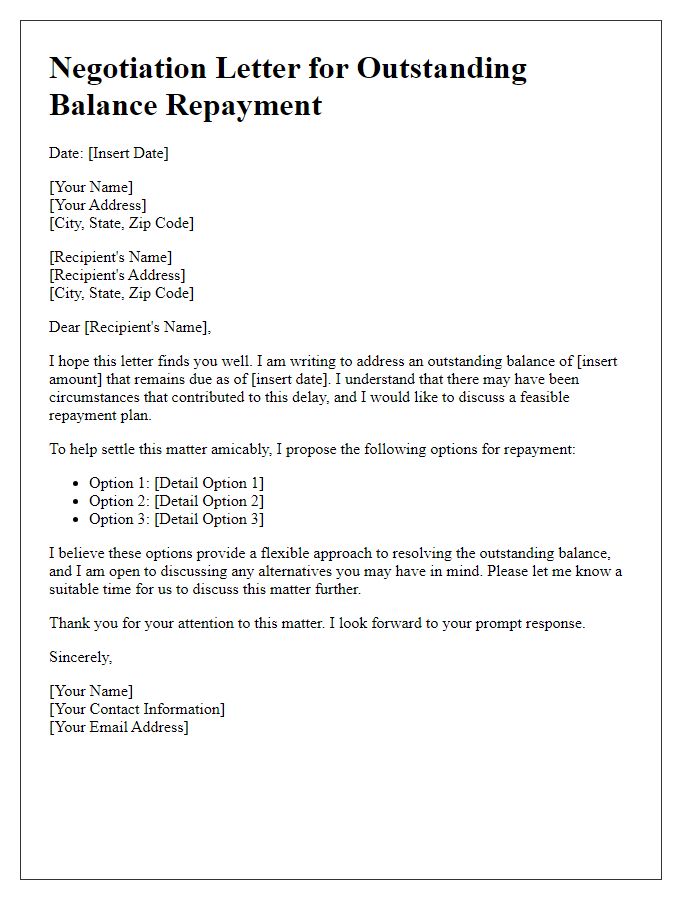

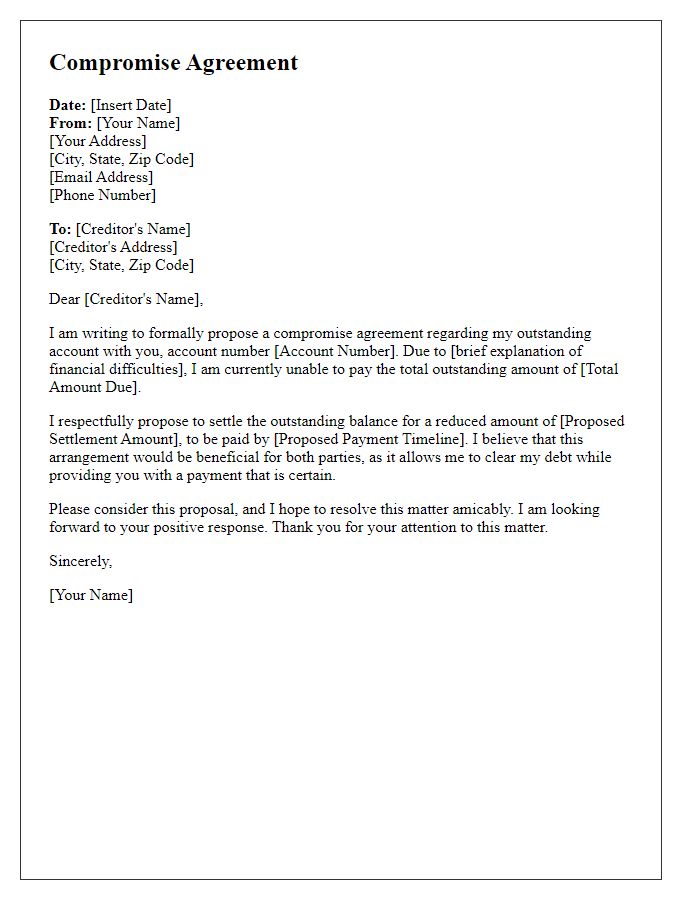

Are you struggling with an outstanding balance that feels overwhelming? It's important to tackle financial challenges head-on, and a well-crafted settlement proposal can pave the way toward a resolution. In this article, we'll guide you through the essential steps to create an effective letter template that not only conveys your intent but also encourages positive dialogue with creditors. So, grab a seat and let's explore how you can turn your financial situation around!

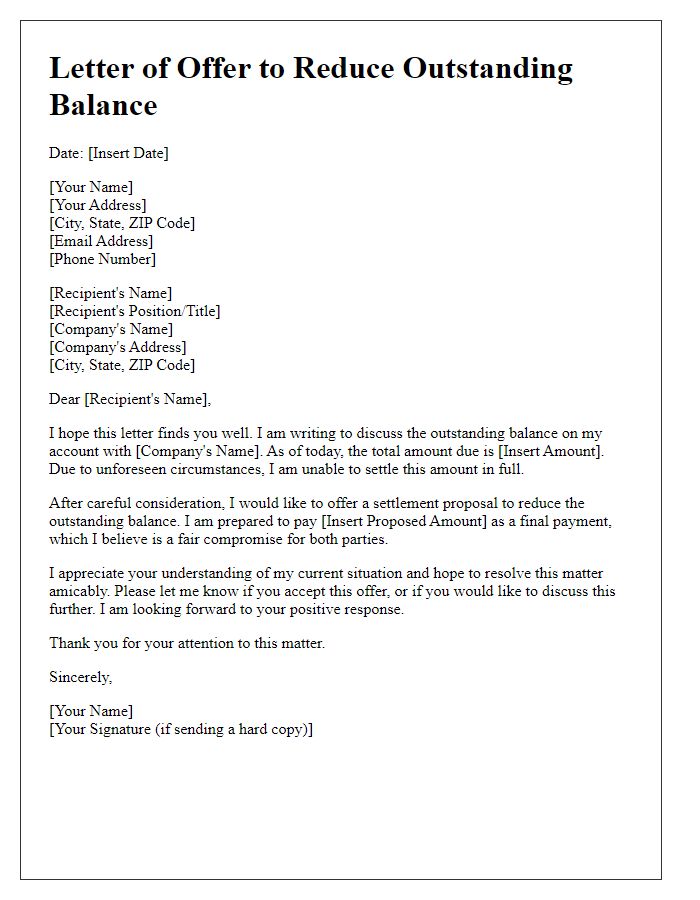

Concise statement of the outstanding balance amount

An outstanding balance of $15,750 is currently owed, reflecting unpaid invoices from July to September 2023, associated with services rendered by XYZ Corporation for project management and consulting. This total comprises principal charges and accrued late fees, leading to this current figure requiring resolution. Prompt attention to this matter is crucial to maintaining a positive financial relationship and avoiding further penalties.

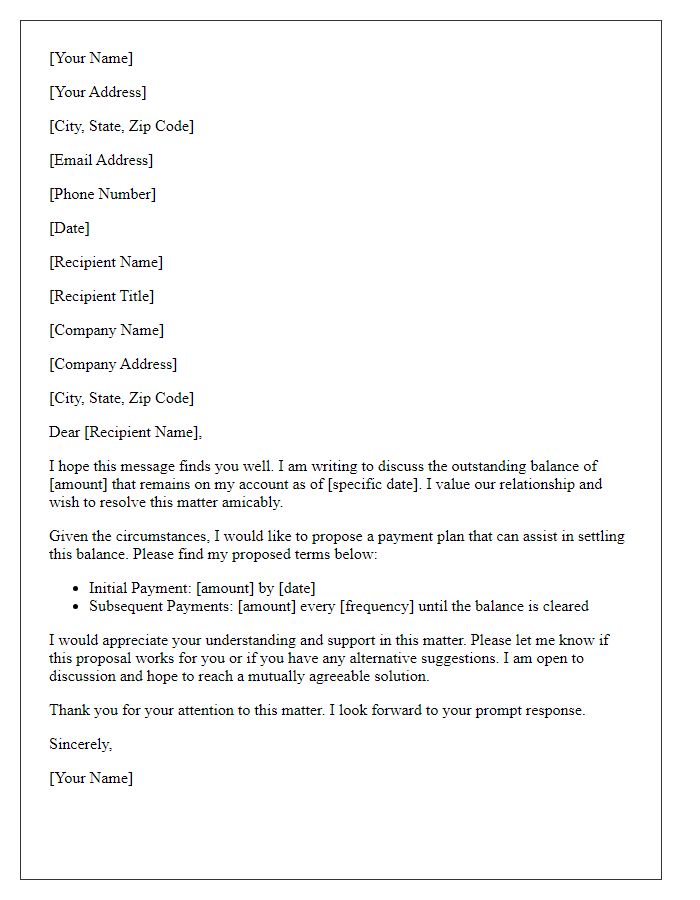

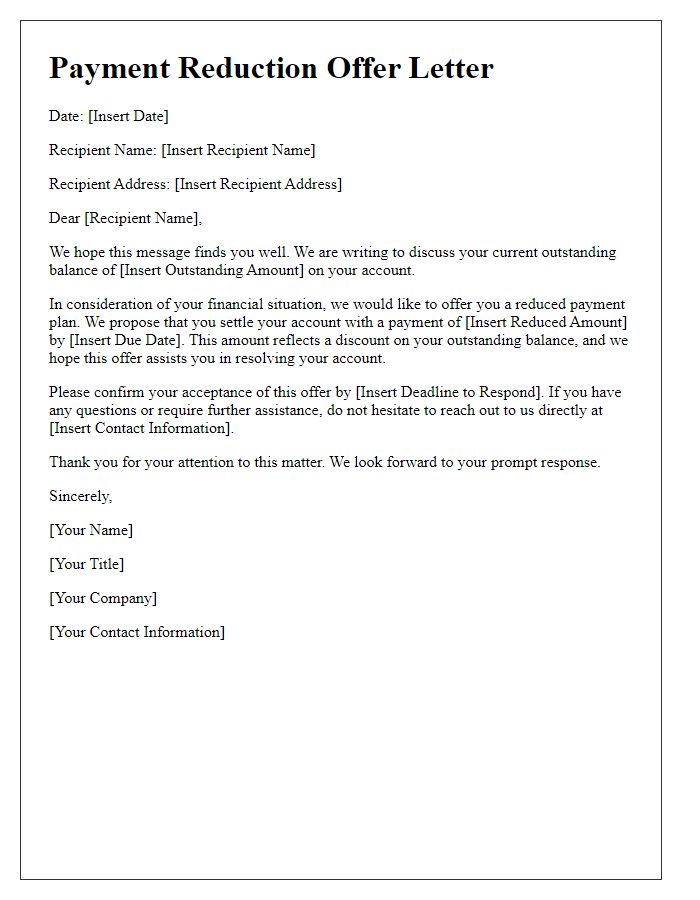

Clear payment terms and conditions

An outstanding balance settlement proposal outlines clear payment terms and conditions to resolve financial obligations. This proposal typically includes the total outstanding amount, such as $5,000 owed to a creditor or service provider. Payment terms specify a timeframe for settlement, for example, a 60-day period from the date of acceptance. The proposal may offer a reduced settlement amount, such as $4,000, if paid in full by a certain date, incentivizing prompt resolution. Payment methods could include bank transfers, checks, or online payment platforms, providing flexibility. Conditions may specify the removal of penalties and interest upon settlement to encourage compliance. Including a section for confirmation and acceptance ensures both parties acknowledge the agreement.

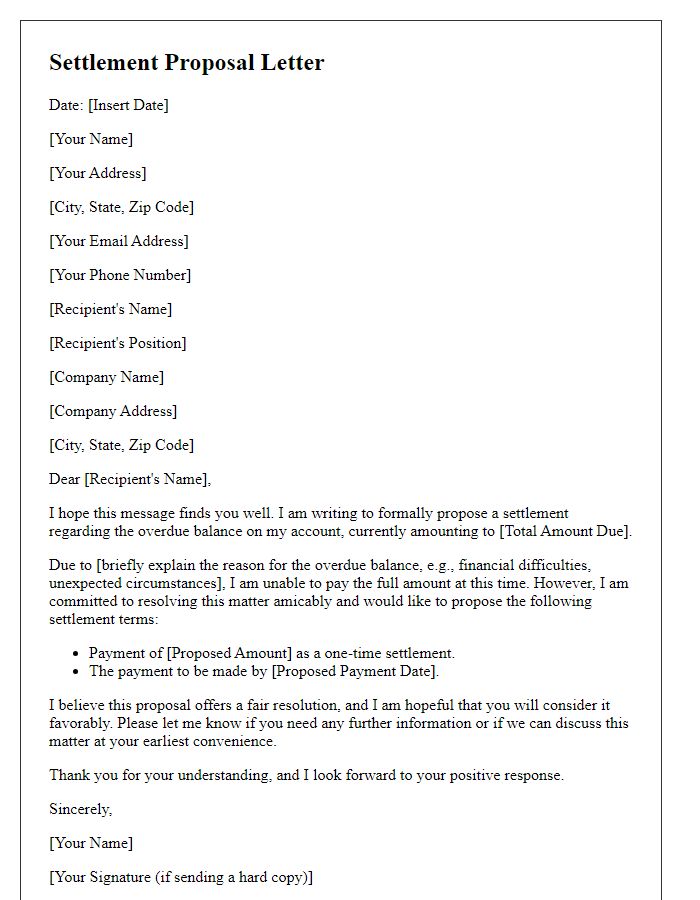

Proposed payment schedule or settlement plan

An outstanding balance settlement proposal outlines a structured payment schedule designed to clear debts effectively and efficiently. A proposed payment schedule includes monthly installments of $200, spanning over a period of six months, while aiming to clear a total outstanding balance of $1,200. Each payment date would be specified, such as the first of every month beginning January 1, 2024, ensuring timely contributions toward settling the debt. This plan reflects a commitment toward financial responsibility and aims to foster positive communication between the debtor and creditor, ultimately leading to a resolution of the outstanding financial obligation.

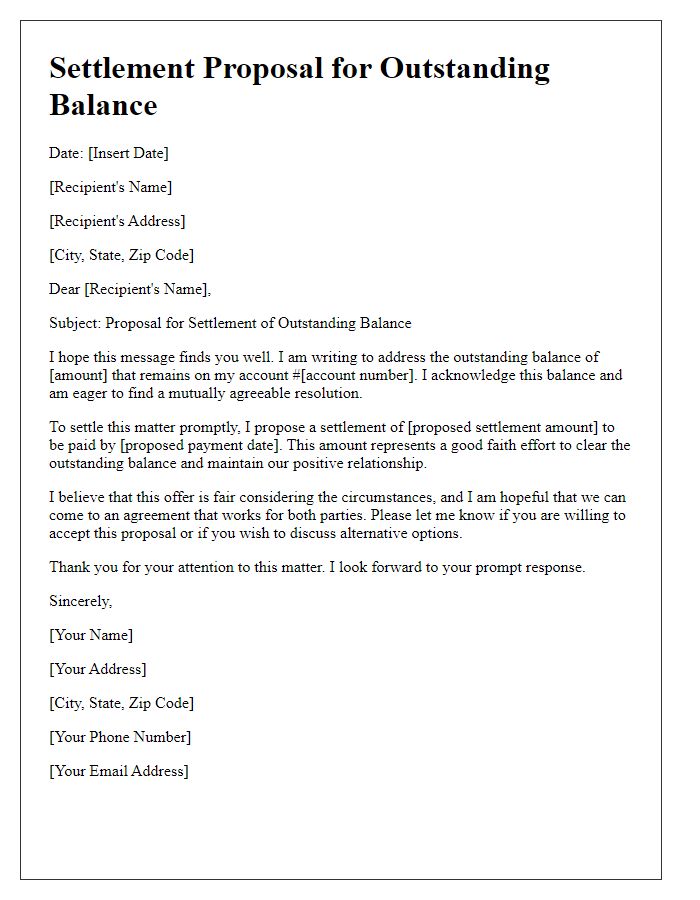

Contact information for further discussion

Outstanding balance settlements often require clear and direct communication to resolve financial discrepancies amicably. The proposal should include essential contact information, facilitating further discussion regarding the outstanding total, often assessed in monetary terms such as thousands of dollars, depending on the scenario. Include specific contacts such as a dedicated financial officer or customer service representative, along with their respective email addresses and phone numbers, ensuring a streamlined process for negotiations. This approach emphasizes transparency and accountability in financial matters, crucial in professional environments such as business partnerships or loan agreements.

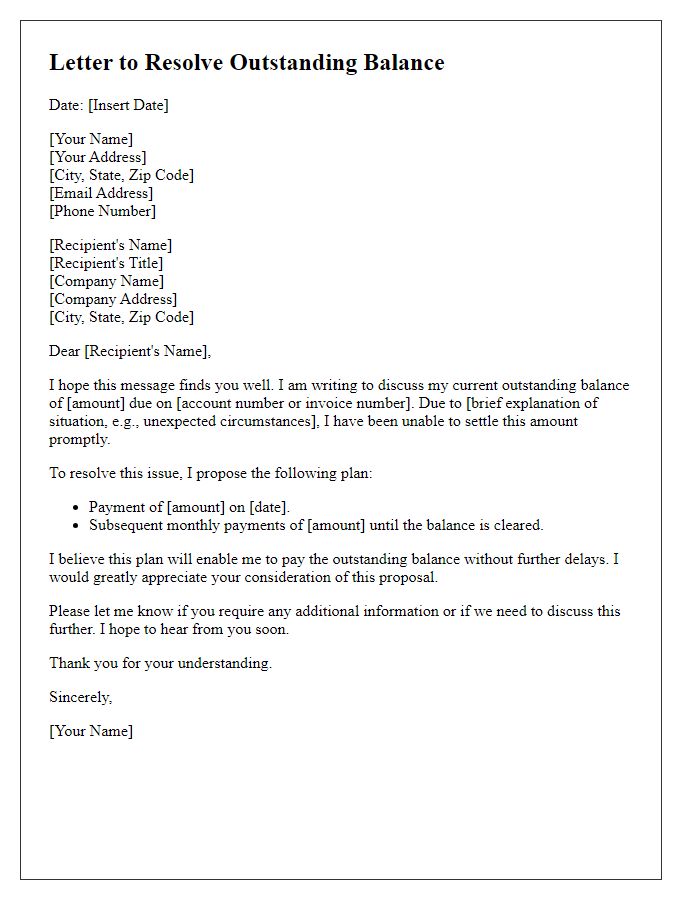

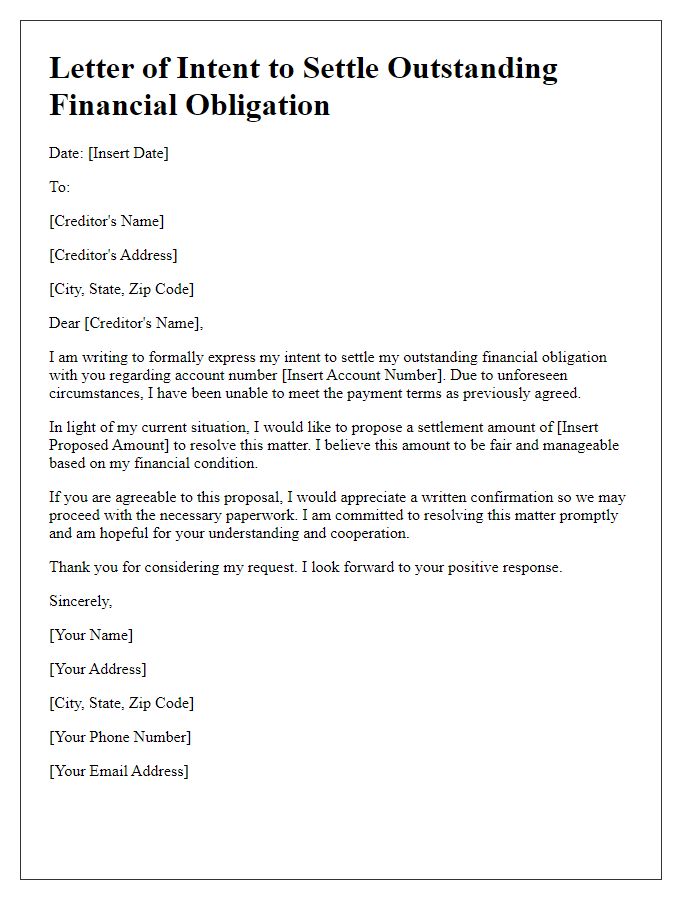

Expression of willingness to resolve the matter promptly

An outstanding balance settlement proposal expresses a genuine intention to resolve financial discrepancies. The proposal might include specific figures, such as the total amount owed, the timeframe for repayment, and any suggested lump-sum payments or installment plans. Acknowledgment of the debt is crucial, detailing its origins, such as a loan or an invoice from a service provider. Clear communication about willingness to settle, while emphasizing the desire to maintain a positive relationship moving forward, is vital. Potential benefits, like avoiding legal action or reducing future interest rates, can motivate acceptance.

Comments