Are you finding your inbox cluttered with old accounts you never use? It's easy to forget about that online account you created ages ago, but if it remains inactive for too long, you might receive a warning notice. These friendly reminders aim to keep your digital life organized and secure. If you want to learn more about account management and what to do with those inactive accounts, keep reading!

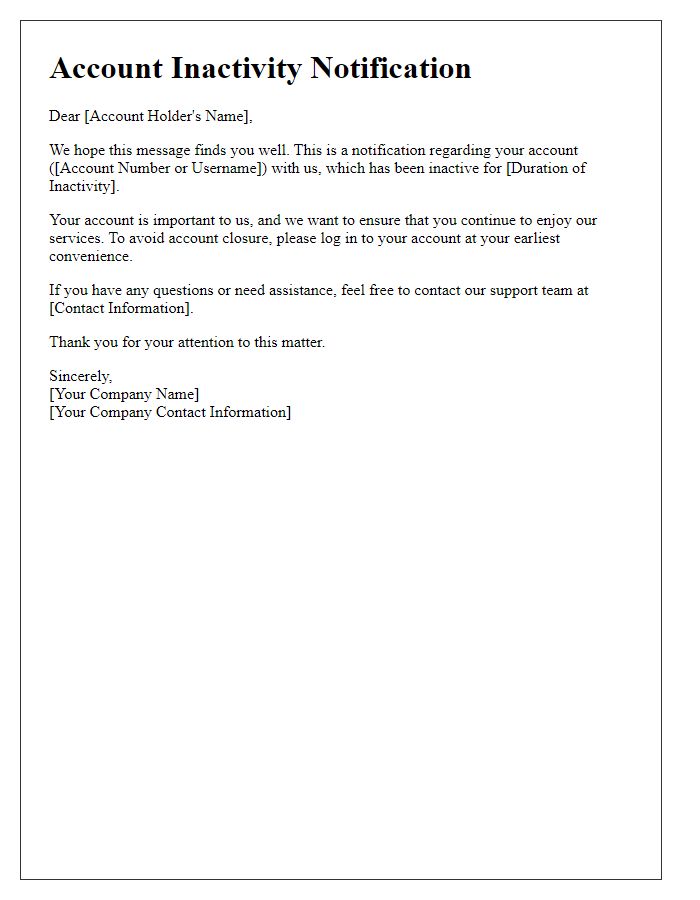

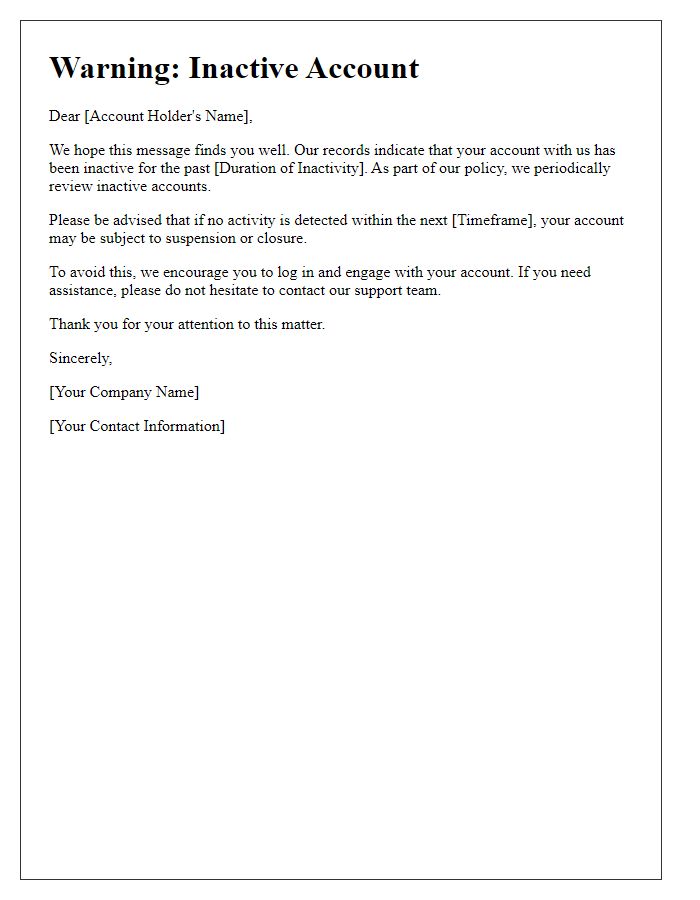

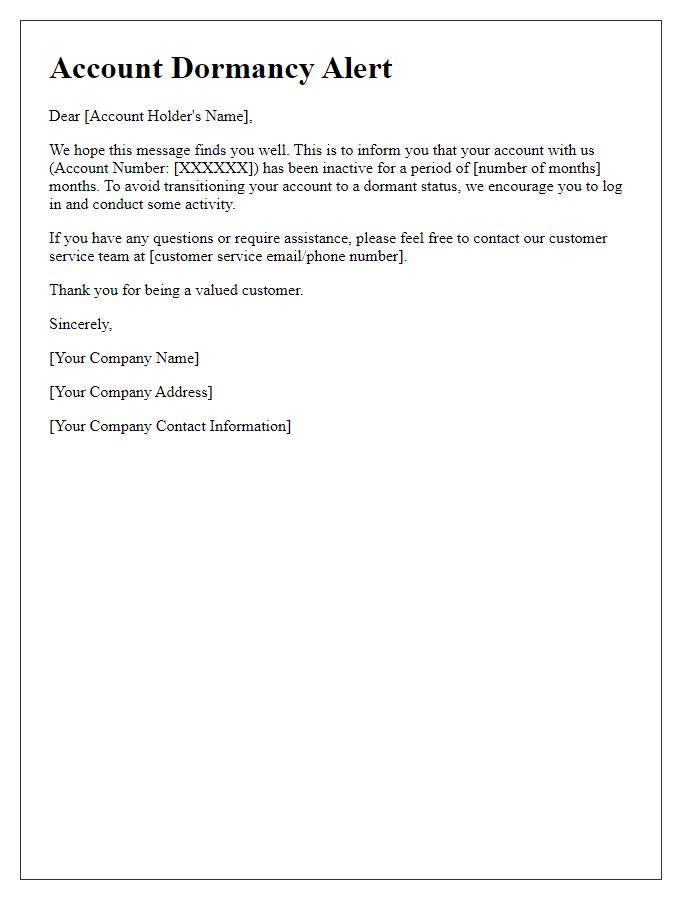

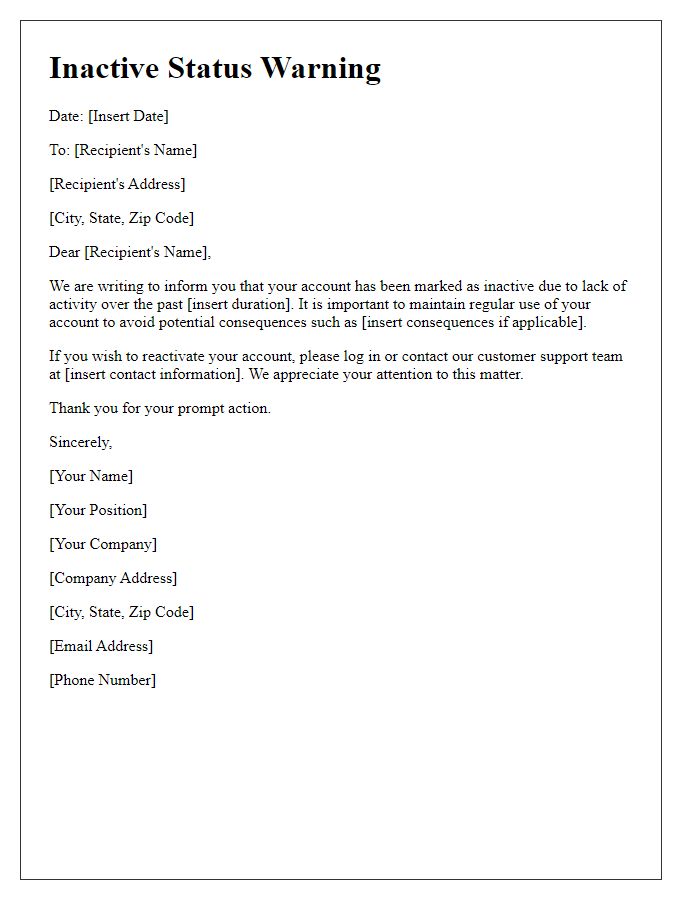

Clear subject line

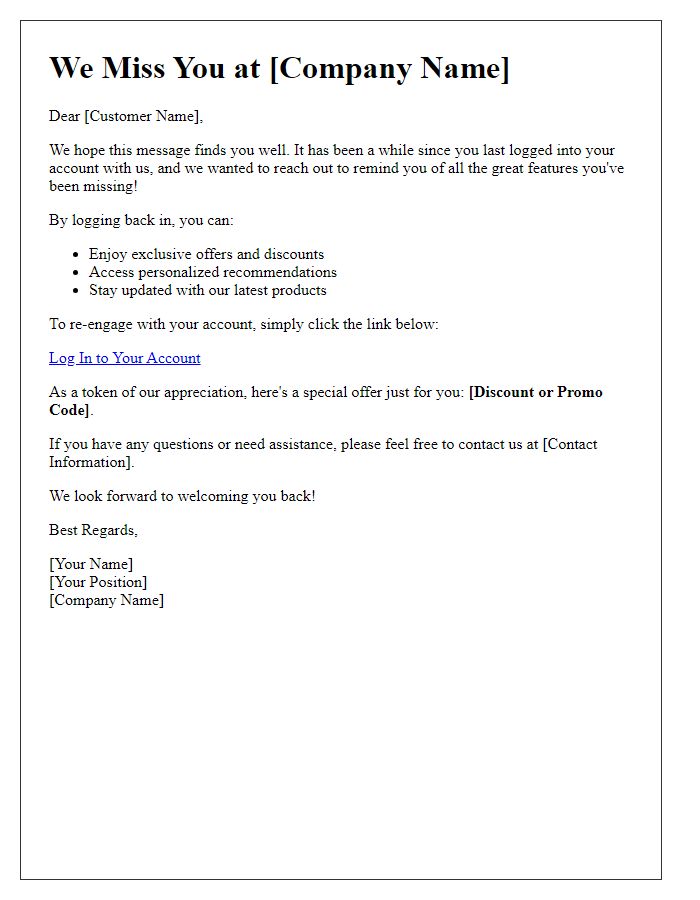

Inactivity in user accounts often triggers automated warning notices. These notifications typically highlight crucial information, including account status, last activity date, and potential consequences of prolonged inactivity. Users receive alerts typically via email, offering a clear subject line such as "Important: Account Inactivity Warning." The goal is to encourage user engagement before account deactivation occurs, usually after a specific period, often 90 days, of inactivity. Additionally, providing reinstatement options emphasizes the importance of account management and user participation in ongoing platforms or services.

Personalized salutation

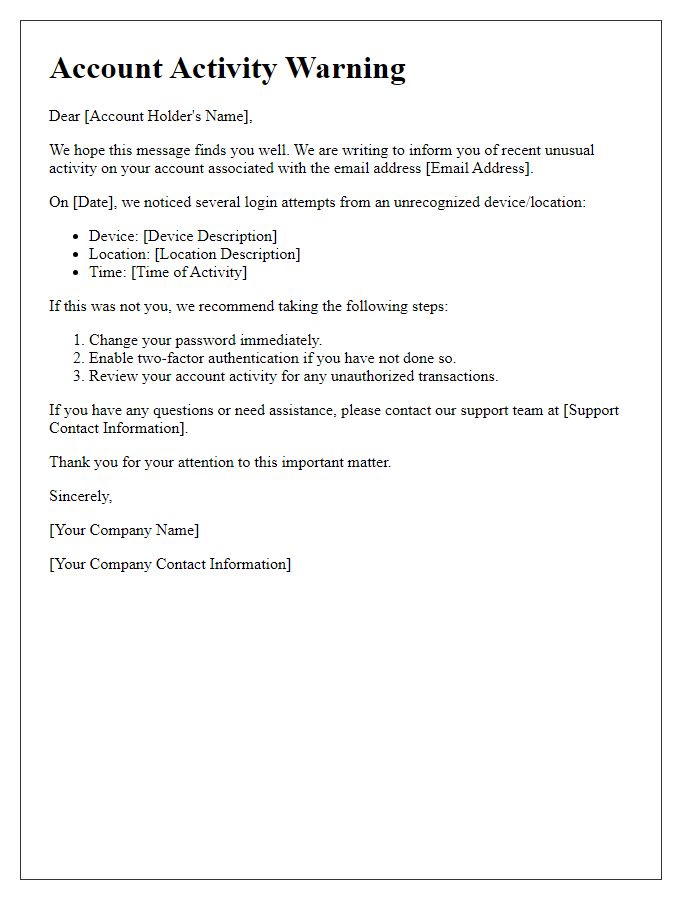

Account inactivity can lead to potential security concerns for users, especially with online platforms such as social media or banking institutions. Inactivity periods exceeding six months often trigger warnings to users, prompting them to engage with the system again. In some cases, platforms may temporarily restrict account access or initiate account closure processes if no activity occurs for a specified duration, typically around 12 to 24 months. Notifications regarding inactivity are sent via email, often including personalized salutations to enhance user engagement and encourage account activity. Platforms may also highlight potential risks associated with inactive accounts, including unauthorized access or data breaches, emphasizing the importance of regular logins and account updates.

Brief account status summary

Account inactivity warnings highlight potential issues for users neglecting their accounts. These notifications generally remind users of account status, noting inactivity periods exceeding six months. Accounts at risk of suspension or deletion often belong to various services like email providers, social media platforms, or online banking. Users receiving such warnings may face restrictions on functionality until they log in or engage with the service. Regular reminders foster engagement, encouraging users to revisit accounts, retrieve information, or use features they may have forgotten. Such actions help maintain account security and data integrity.

Consequences of inactivity

Inactivity in bank accounts, such as savings or checking accounts, can lead to significant consequences. Accounts remaining dormant for over 12 months may incur monthly maintenance fees, typically ranging from $5 to $15, diminishing the total balance. If inactivity extends to 3 years, banks may classify such accounts as abandoned, leading to the potential transfer of funds to the state, as mandated by unclaimed property laws. Additionally, customers may lose access to online banking services and may require rigorous identity verification processes to reactivate their accounts. In some cases, account holders may also miss out on interest earnings, particularly in accounts with tiered interest rates based on balance and account activity, resulting in further financial loss.

Call to action with contact information

Account inactivity warnings can serve as crucial reminders for users to engage with their accounts, particularly for online services or platforms. Users with accounts that have remained inactive for over sixty days may receive notifications highlighting potential consequences, such as account suspension or deletion. This action aims to maintain platform security and ensure that user data remains current. To rectify this situation, users should log in to their accounts on the service's website, or they can contact customer support at the provided email address or phone number. Regular interaction with accounts is encouraged to avoid any interruptions in service.

Comments