Are you facing the challenge of notifying a client about a declined payment? It can be a delicate situation that requires clear communication while maintaining a professional tone. In this article, we'll explore an effective letter template that helps you convey the necessary information without sounding too harsh. Keep reading to discover how to craft a courteous yet firm declined payment notification for your clients!

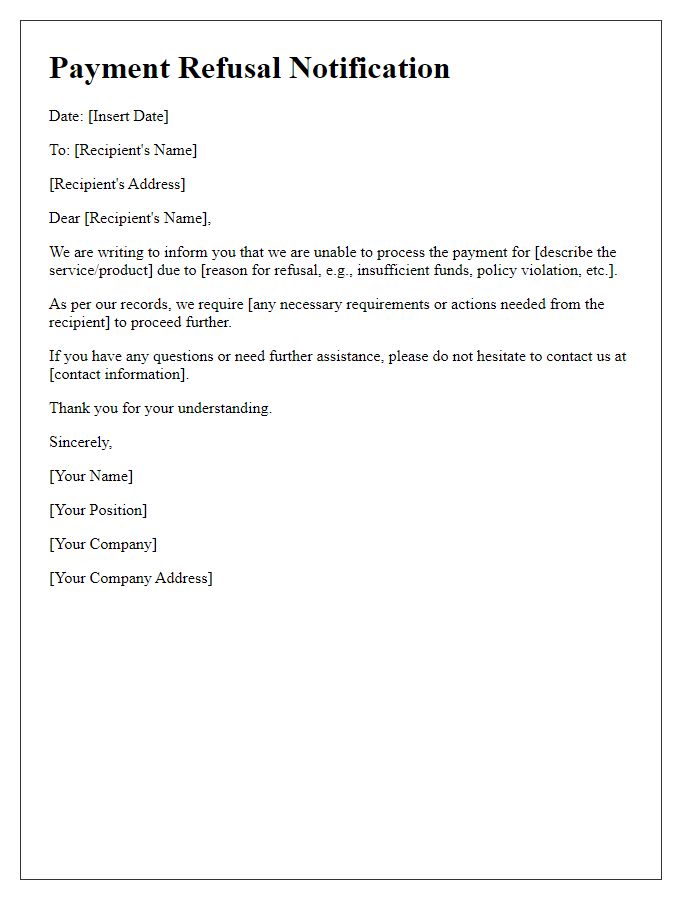

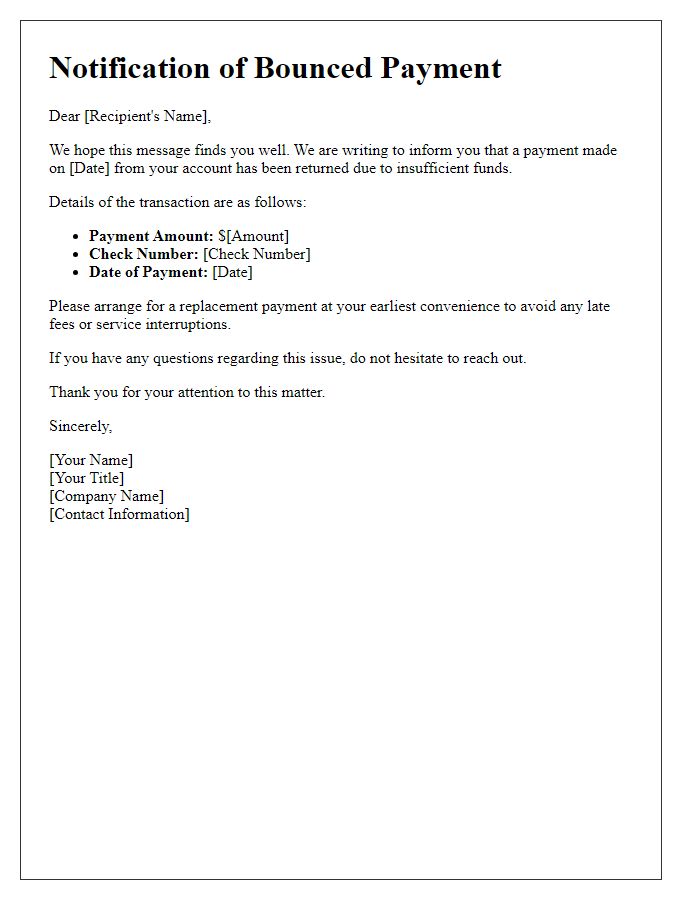

Professional tone

A declined payment notification is a formal communication that informs a customer about an unsuccessful transaction. This situation often arises when insufficient funds, expired payment methods, or other issues occur. The message should maintain a professional tone, addressing the customer respectfully while providing clear information about the decline and necessary next steps for resolution. It's important to include the original transaction details, amount, date, and any relevant contact information for customer service assistance, ensuring the customer feels supported throughout the process.

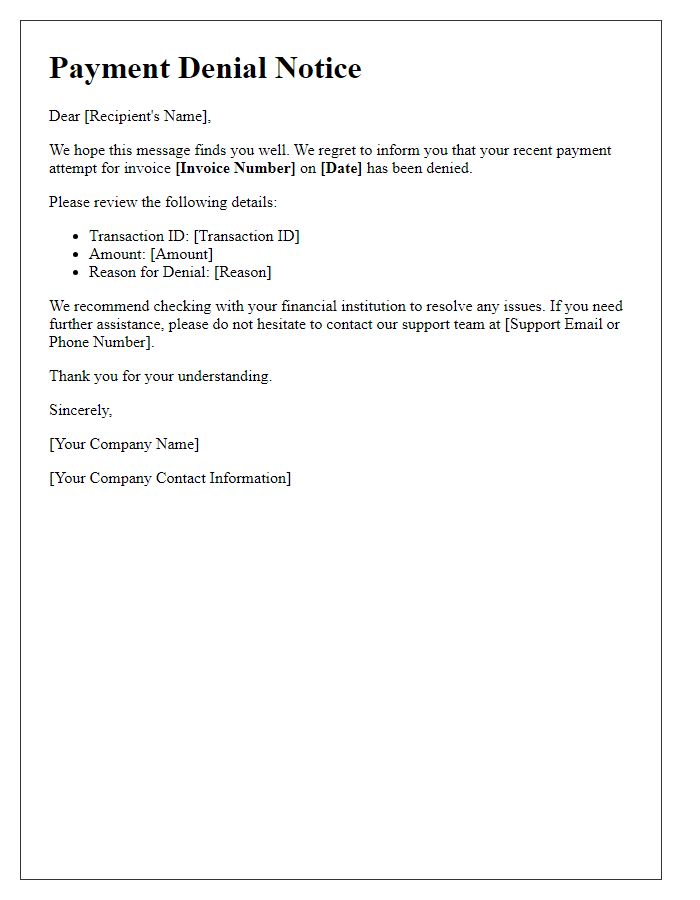

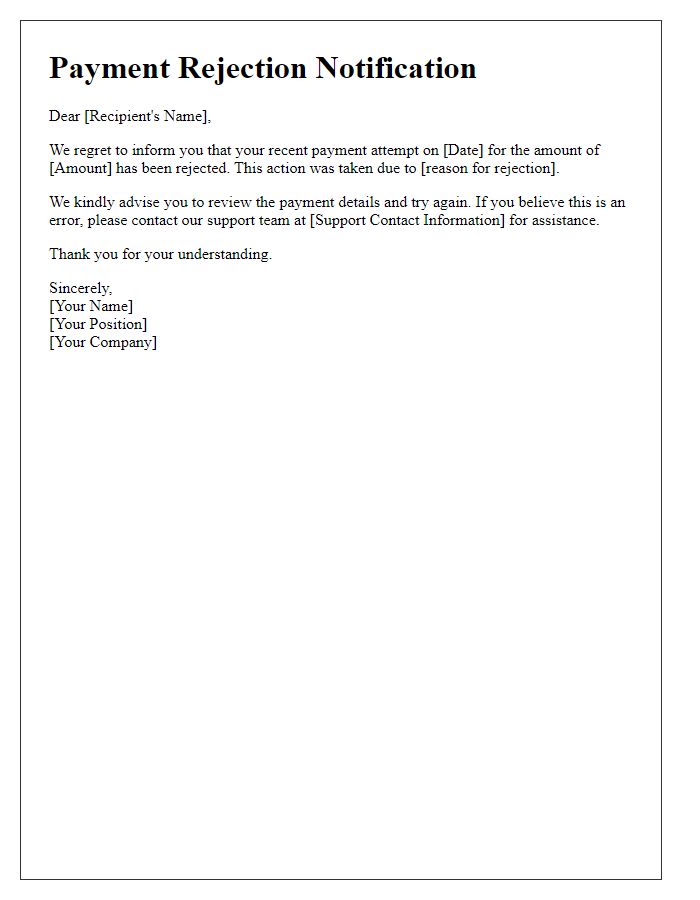

Clear explanation

Payment decline notifications occur when transactions cannot be processed, often due to insufficient funds or expired payment methods. Businesses must communicate this issue effectively to ensure understanding. Essential components include the transaction date, payment method used, and the specific amount that was declined. Additionally, it is crucial to mention potential consequences, such as service interruptions or late fees. Encouraging customers to verify their payment details provides a proactive approach, guiding them to resolve the situation promptly. Providing clear contact information for further assistance fosters positive customer relations, allowing individuals to seek help when necessary.

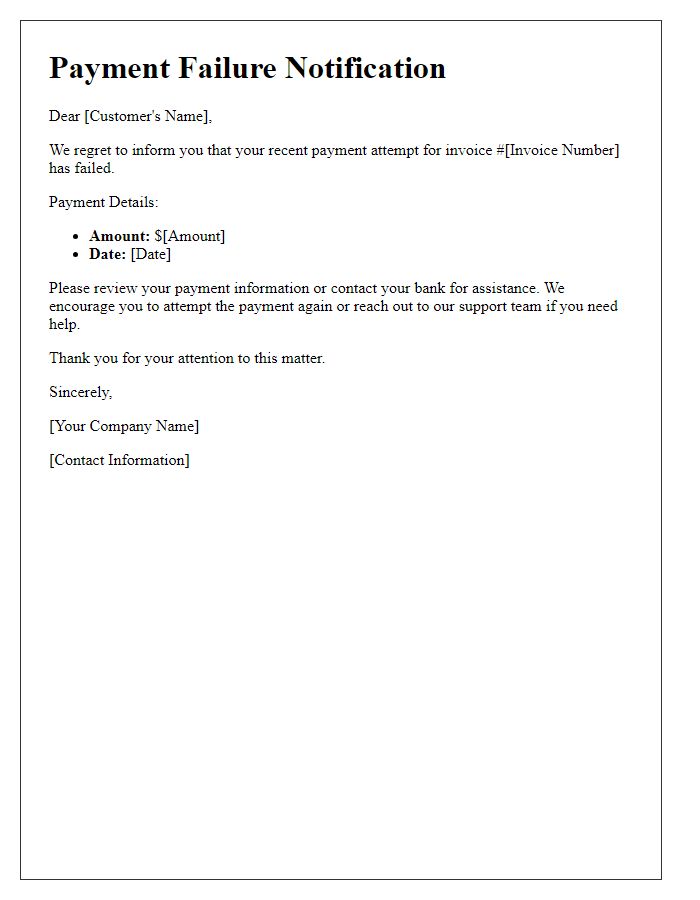

Payment details

The declined payment notification can occur for various payment methods including credit cards, debit cards, and online payment systems. A declined payment often results from insufficient funds, expired card information, or issues related to fraud protection mechanisms. For instance, Visa and MasterCard may decline transactions if they detect unusual spending patterns. Payment processors like PayPal may also halt transactions due to account verification failures. The notifications typically include crucial payment details such as transaction ID, date and time of attempted payment, and the specific reason for the decline, allowing users to rectify the issue promptly.

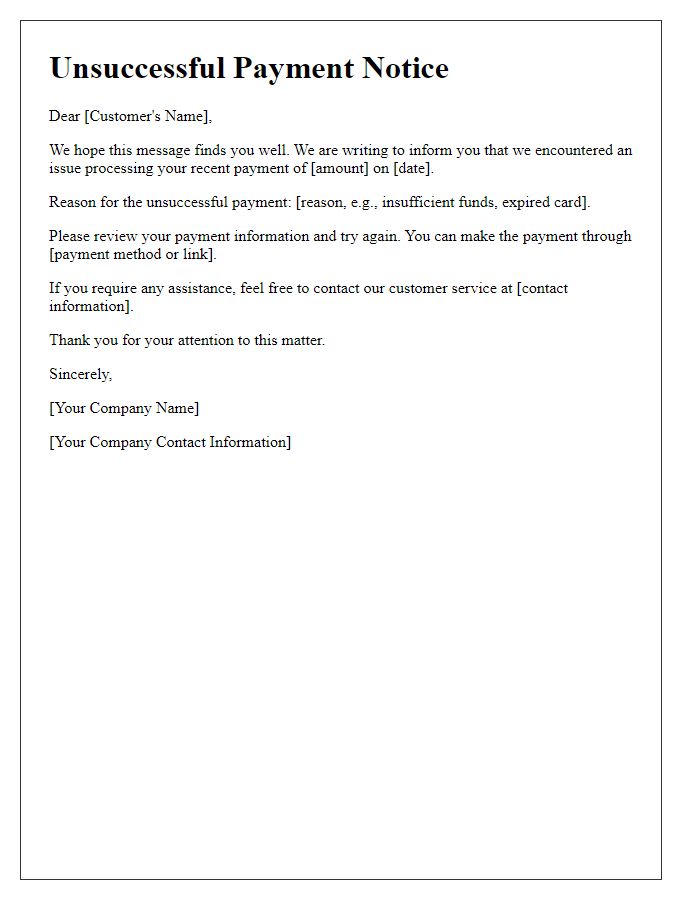

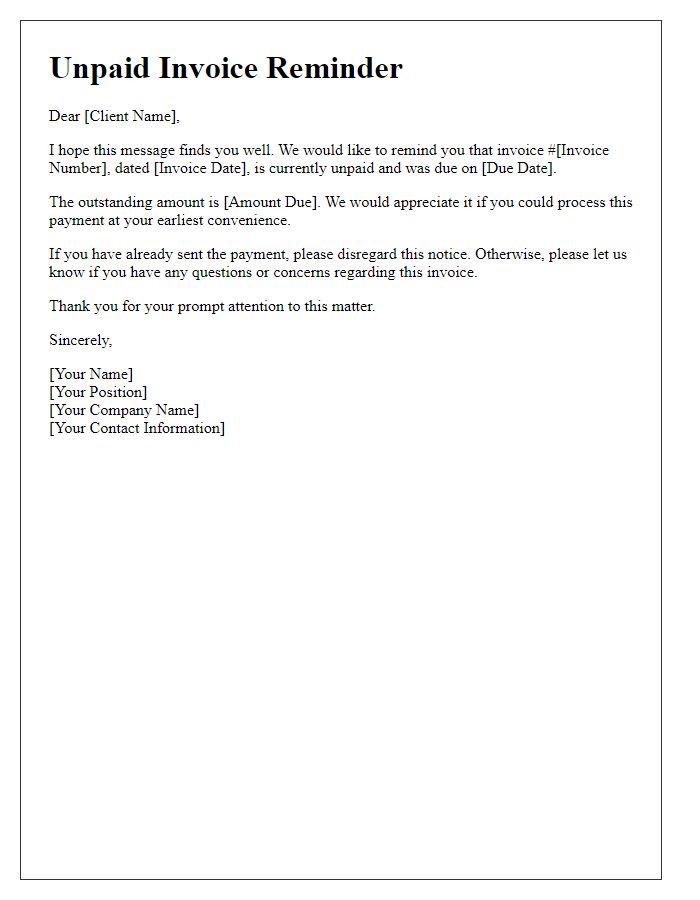

Next steps

A declined payment notification can cause significant inconvenience, leading to the need for timely actions to rectify the situation. Customers should first review their payment method details, such as credit card numbers or bank account information, to ensure accuracy. Checking for available funds or credit limits is essential, as many institutions may impose restrictions like overdraft limits (which can be below zero). Additionally, customers may want to contact their financial institution to identify issues, such as potential fraud alerts or freezes. If necessary, updating payment information through a secure online portal can facilitate successful transactions moving forward. Following these steps will help restore account standing and ensure uninterrupted access to services or products.

Contact information

Dear [Recipient's Name], We regret to inform you that your recent payment of [amount] for invoice [invoice number] has been declined. This may be due to various reasons such as insufficient funds, incorrect account details, or expiration of payment method. Please verify your payment information and attempt the transaction again. For further assistance, you may contact our billing department at [phone number] or email us at [email address]. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Position] [Your Company] [Contact Information] [Company Address] [Website]

Comments