Hey there! We all know that mistakes happen, and when it comes to billing, it's important to address any discrepancies promptly. If you've recently discovered incorrect charges on your account, don't worryâthere's a simple way to express your concerns and seek a resolution. In the following article, we'll provide you with a detailed template to craft an effective apology letter, so you can communicate your issue clearly and confidently. Ready to dive in?

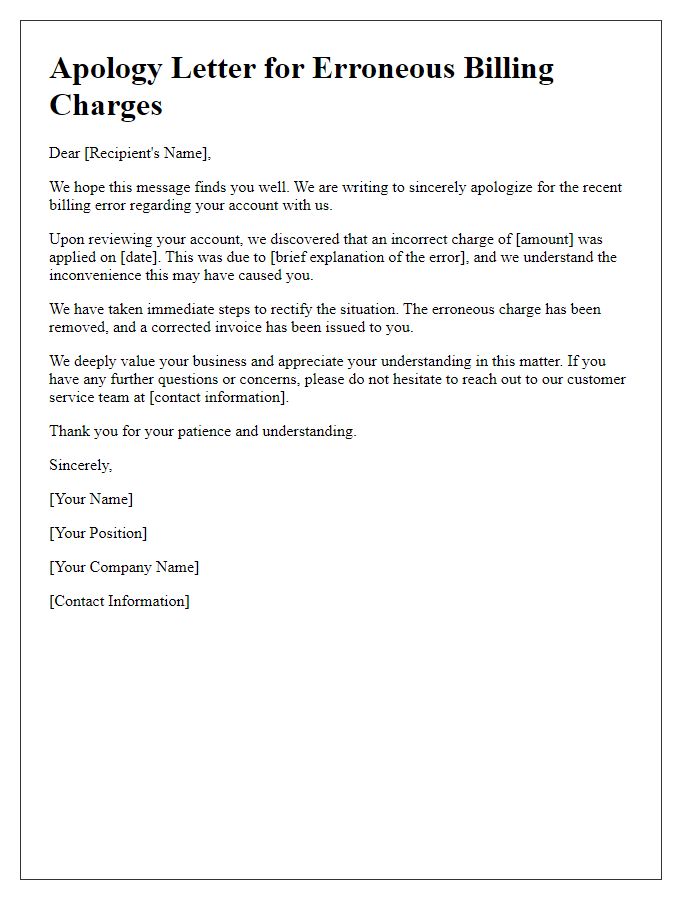

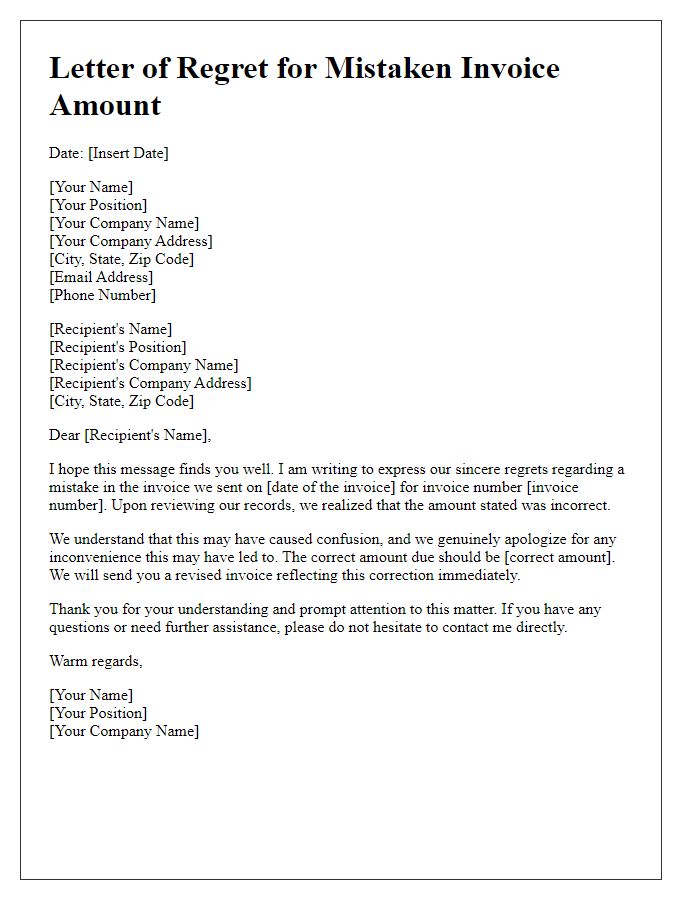

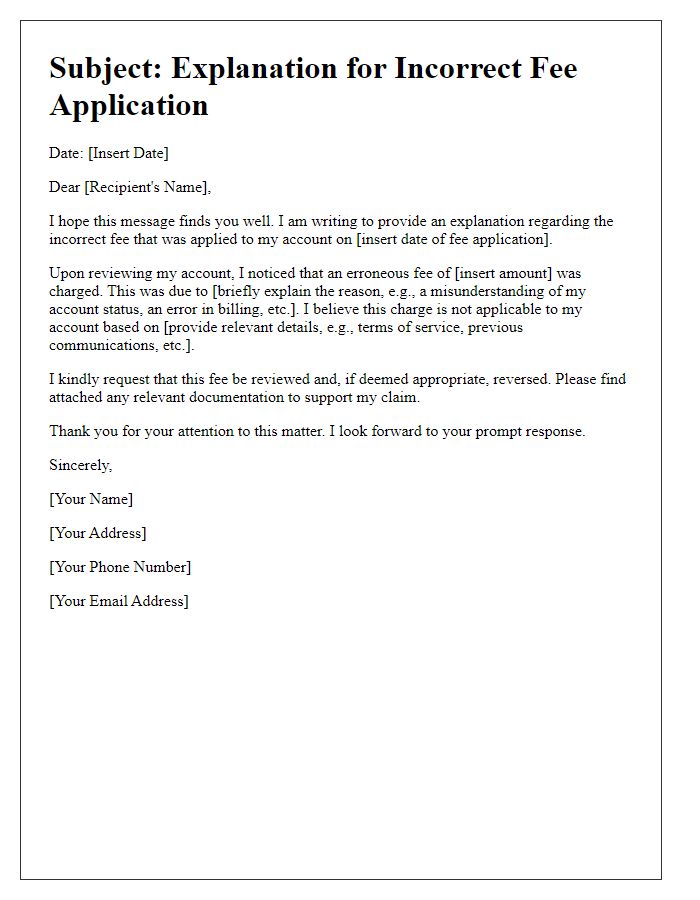

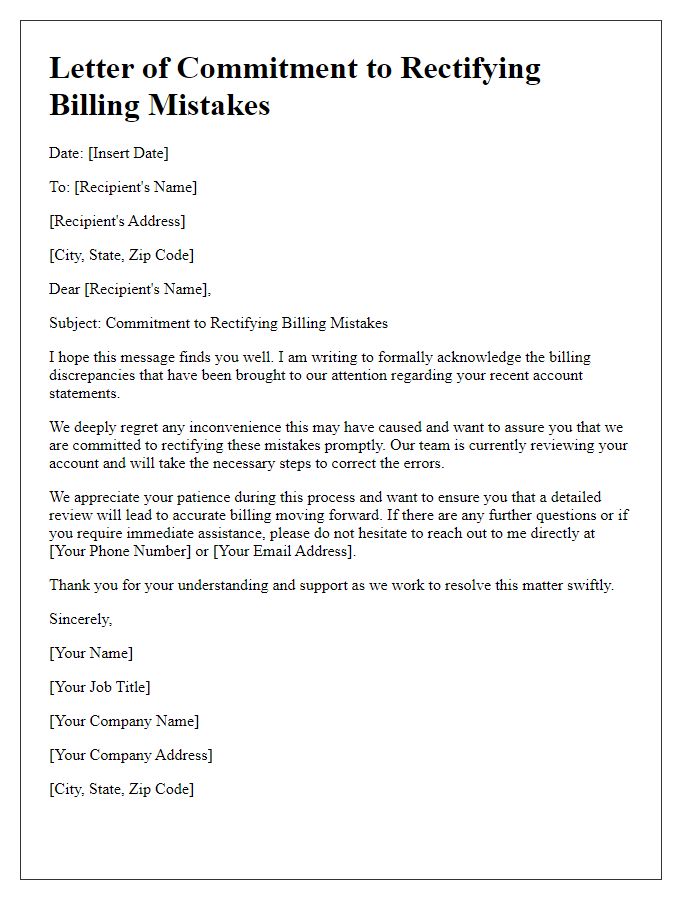

Professional tone

Incorrect charges can lead to significant customer dissatisfaction and confusion, often causing financial discrepancies. Affected customers may experience unexpected deductions from their accounts or inflated bills, leading to frustrations that can damage trust in the service provider. Prompt investigation into these discrepancies is crucial for addressing concerns. Providing clear explanations regarding the nature of the errors, the specific amounts involved, and reviewing relevant transaction dates fosters transparency. Additionally, a systematic approach to rectifying these charges, including issuing refunds or credits, demonstrates a commitment to customer satisfaction and helps restore confidence in the billing practices.

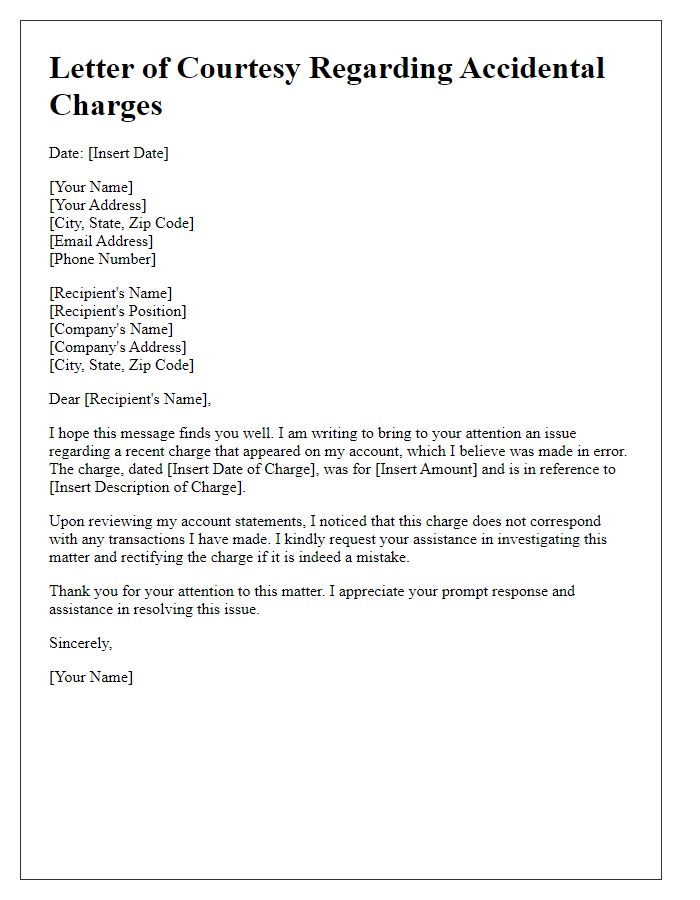

Clear explanation

Incorrect charges on customer accounts can create significant frustration. Detailed billing discrepancies may arise due to various errors such as misapplied payments or incorrect subscription fees. Customers at XYZ Company, for instance, experienced confusion regarding unexpected charges appearing on their monthly statements. Clear communication regarding these errors is essential to maintain customer trust and satisfaction. To resolve such issues effectively, a thorough review of the customer's account history, transaction dates, and applicable pricing tiers should occur. This ensures accurate adjustments, refunds, or credits where necessary, reinstating the customer's confidence in the billing process.

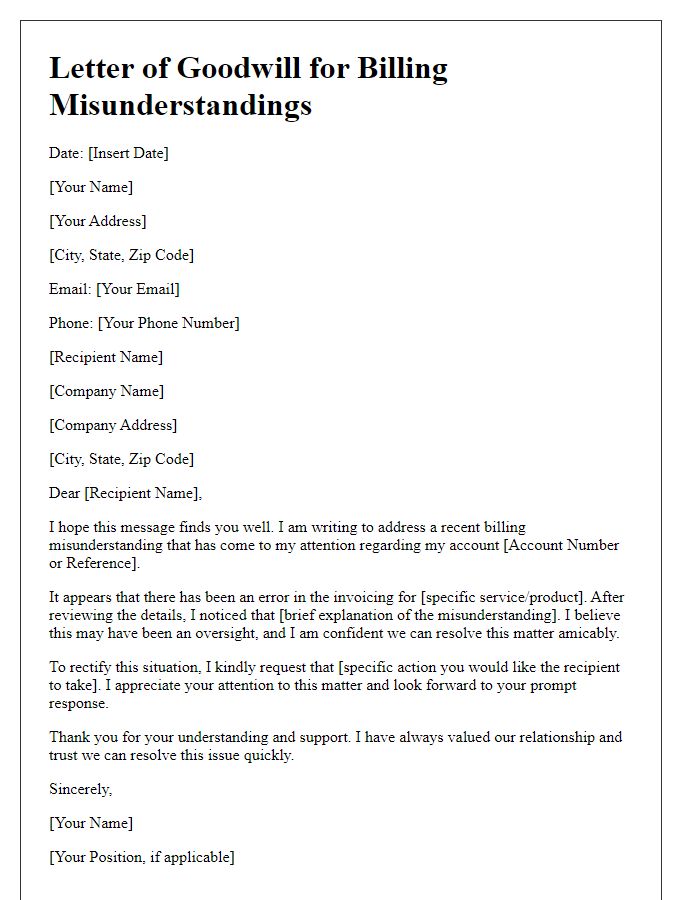

Empathy and apology

Customers often experience frustration when they encounter incorrect charges on their billing statements. These discrepancies can stem from various issues, such as data entry errors or miscommunication regarding pricing. Acknowledging the inconvenience caused by these mistakes is crucial for maintaining customer trust. Organizations, such as utility companies or retail businesses, typically handle these situations by issuing a formal apology. This approach includes expressing genuine empathy for the customer's frustration and a commitment to rectifying the error promptly. Addressing the issue can involve a refund process, providing detailed clarification on the charges, and ensuring adequate communication throughout the resolution. Such thoughtful actions can help restore customer confidence and foster long-term loyalty.

Corrective action

Inaccurate billing can lead to customer dissatisfaction and loss of trust. For instance, a retail company receiving numerous complaints regarding overcharges may need to review its invoicing systems. A detailed audit of transactions, especially within the last three months, can identify discrepancies. Implementing corrective measures, such as training staff on proper billing procedures and enhancing software audits, is essential. Furthermore, issuing refunds or account credits to affected customers can restore goodwill. Continuous monitoring of billing practices is crucial to prevent future errors and ensure that customers feel valued and understood.

Contact information

Customers frequently face incorrect charges on their billing statements, leading to confusion and frustration. Issues often arise from automated billing systems or clerical errors during transaction processing. It is vital to examine billing statements carefully, identifying discrepancies promptly. Common errors include duplicate charges, incorrect pricing, and unrecognized fees. To resolve such issues, contacting customer support through dedicated hotlines or email provides a direct line for clarification. Some companies offer online dispute forms, facilitating the process of reporting inaccuracies. Providing details such as invoice numbers, transaction dates, and account information aids in expediting resolution.

Comments