Are you tired of managing accounts that seem to be stuck in limbo? Closing unresponsive accounts can streamline your financial life and help you focus on what truly matters. In this article, we'll walk you through a simple letter template to make the process easy and effective. Ready to take control and simplify your accounts? Then keep reading!

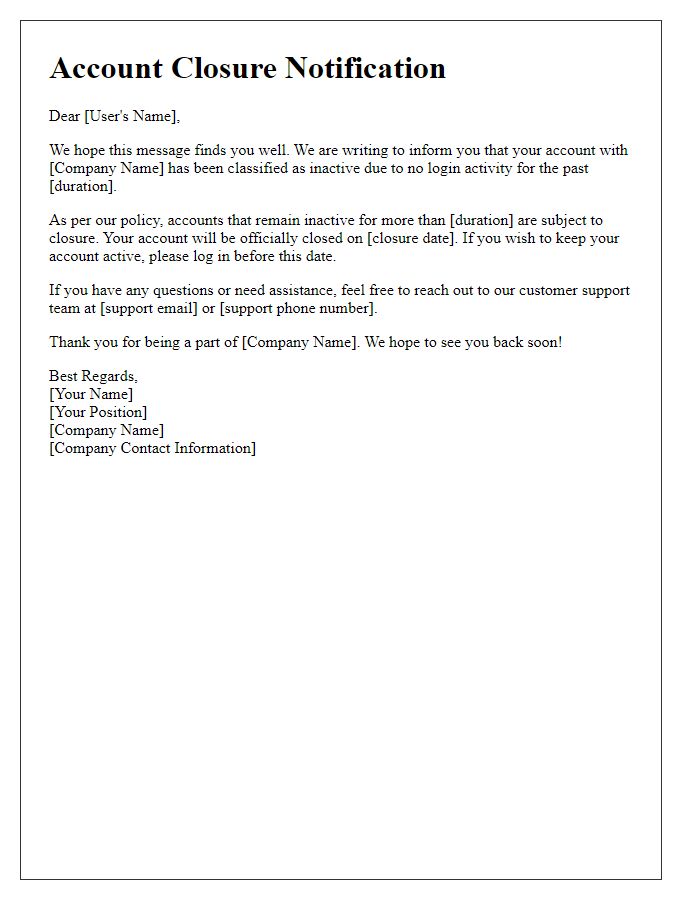

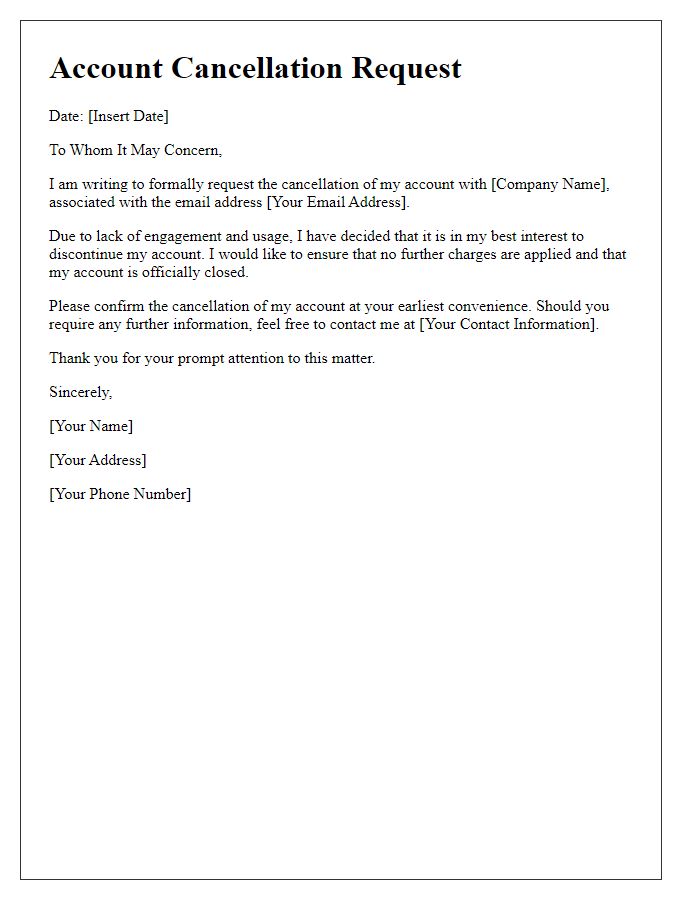

Formal Greeting and Identification

Inactive accounts may create security vulnerabilities and hinder management efficiency within a financial institution. Regular audits, particularly in institutions like banks or online platforms, often reveal that accounts inactive for over 12 months must be reviewed. Customers must be notified through formal communication, identifying account details and possible closure implications, ensuring compliance with local regulations. Account security measures, such as the deactivation of login access and retention of user data, must be communicated clearly to maintain transparency during the closure process.

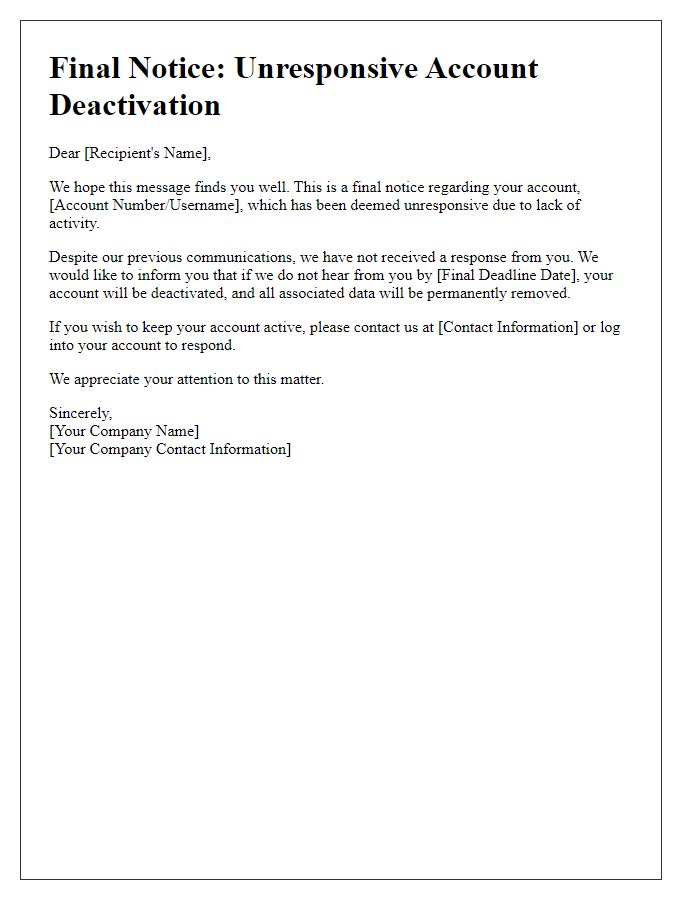

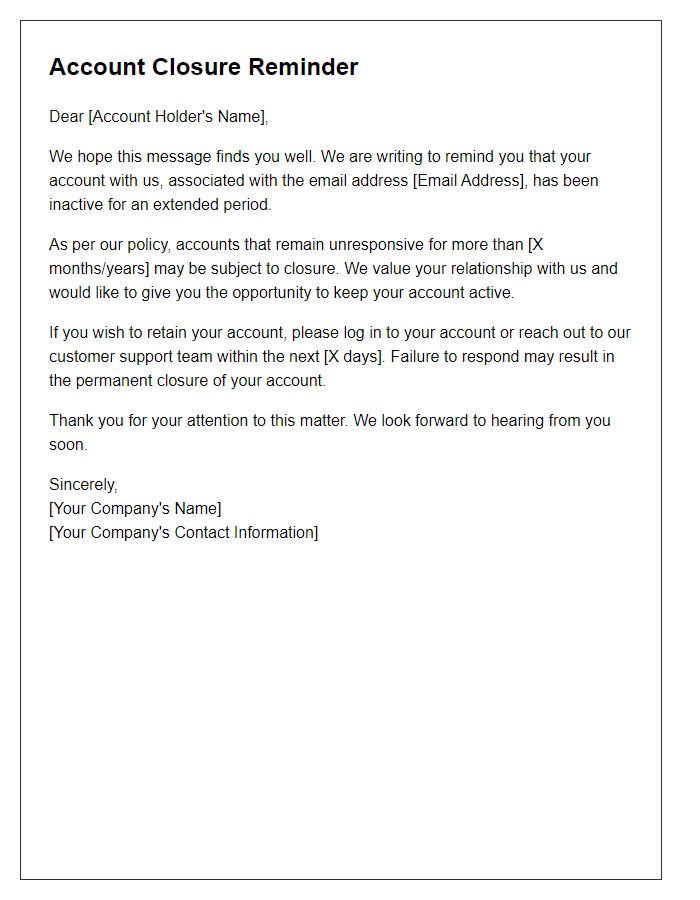

Account Status Explanation

Unresponsive accounts can lead to potential security risks and financial discrepancies within financial institutions. Account inactivity, typically defined as no transactions for a period exceeding 12 months, raises red flags for monitoring systems. In major cities like New York, where over 5% of bank accounts may remain dormant, unexplained inactivity can prompt institutions to contact account holders. This measure ensures compliance with regulatory requirements, which mandate rigorous tracking of account status to prevent fraud and identify abandoned assets. If customers do not respond within a specified timeframe, often 30 days, accounts may face closure to safeguard both the institution and its clients. Enabling customers to understand risks associated with dormant accounts can foster better financial practices and encourage timely communication with their banking institutions.

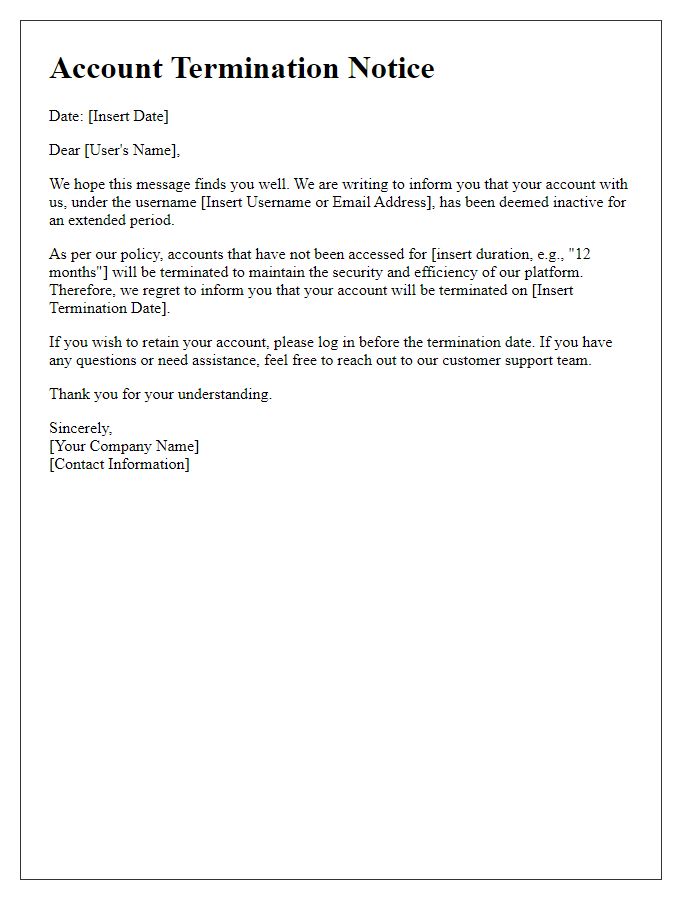

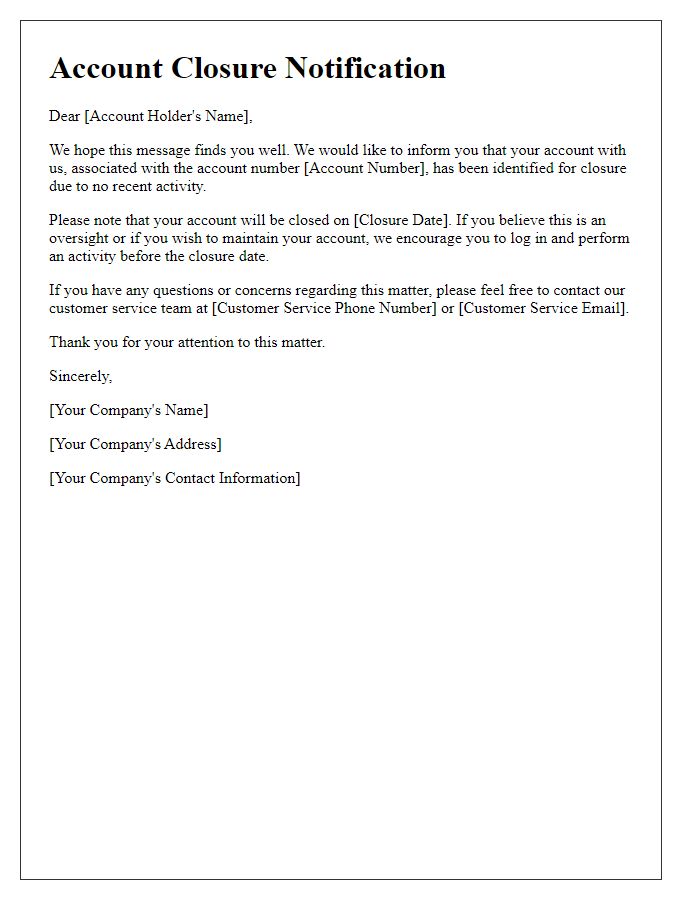

Clear Closure Date and Consequences

Closing unresponsive accounts, often seen in online services or banking, is a crucial process for maintaining security and account integrity. A definitive closure date, typically communicated at least 30 days in advance, ensures account holders have ample time to respond or retrieve information. Accounts remaining inactive for over 12 months, classified as unresponsive, face automatic closure to prevent unauthorized access. Consequences of non-response may include loss of data, funds, or access to service, emphasizing the importance of user engagement and communication. Organizations often provide notifications through emails or postal service to ensure the message reaches account holders effectively.

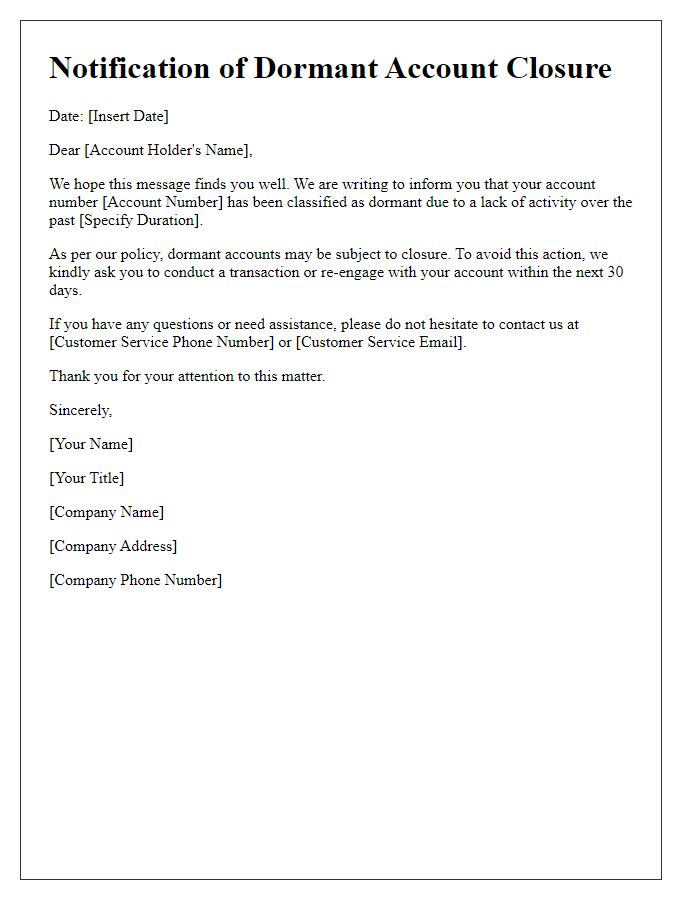

Instructions for Reactivation or Appeals

Unresponsive accounts can disrupt user engagement and business relationships. Accounts, such as those on social media platforms or online services, may become inactive after a period of 6 months. Steps for reactivation often vary by platform. Users need to check their registered email accounts for notifications concerning reactivation, which might involve clicking links or entering verification codes. In some cases, an appeals process may be necessary for accounts closed due to inactivity or policy violations. Users may contact customer support through dedicated phone lines, support tickets, or help center emails. Providing identification or proof of account ownership might be required to proceed with reactivation requests, ensuring secure access is restored to the user's profile.

Contact Information for Support

Closing unresponsive accounts can significantly enhance user experience and improve operational efficiency for companies. A systematic approach involves identifying accounts with no activity for an extended period, typically over six months. Clear communication is crucial when notifying users via email or official correspondence, providing them with essential details such as account status, last login date (often within the last year), and instructions on how to reactivate if desired. A deadline, such as 30 days from notification, ensures users have a limited time frame to respond. Including contact information for customer support, including phone numbers (e.g., 1-800-555-0199) and email addresses (like support@example.com), allows users to seek assistance or clarification. This proactive strategy helps maintain data integrity while respecting user privacy.

Comments