Have you ever received a zero-dollar bill and been left scratching your head? We get it; it can be confusing and might raise questions about what it means for you as a customer. In this article, we'll break down the purpose of zero-dollar billing and how it can actually benefit you, ensuring transparency in your billing process. So, if you're curious to learn more about zero-dollar bills and their implications, keep reading!

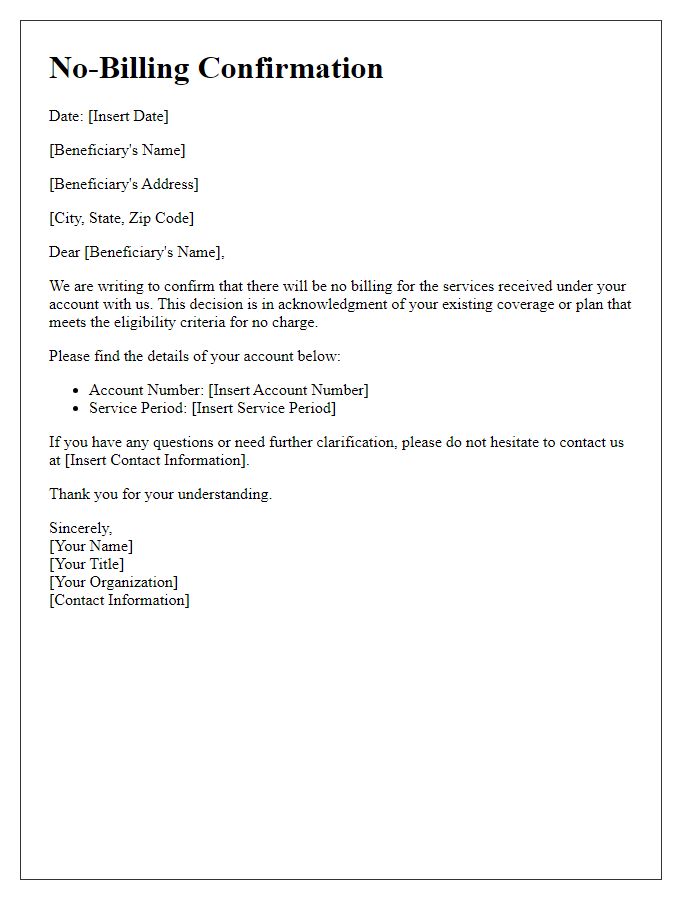

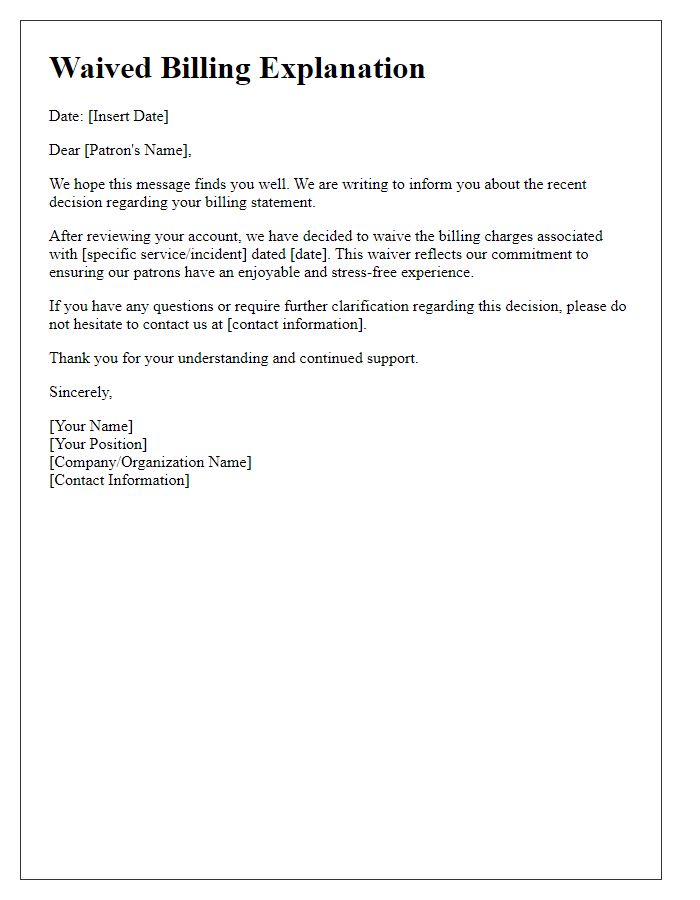

Clear subject line

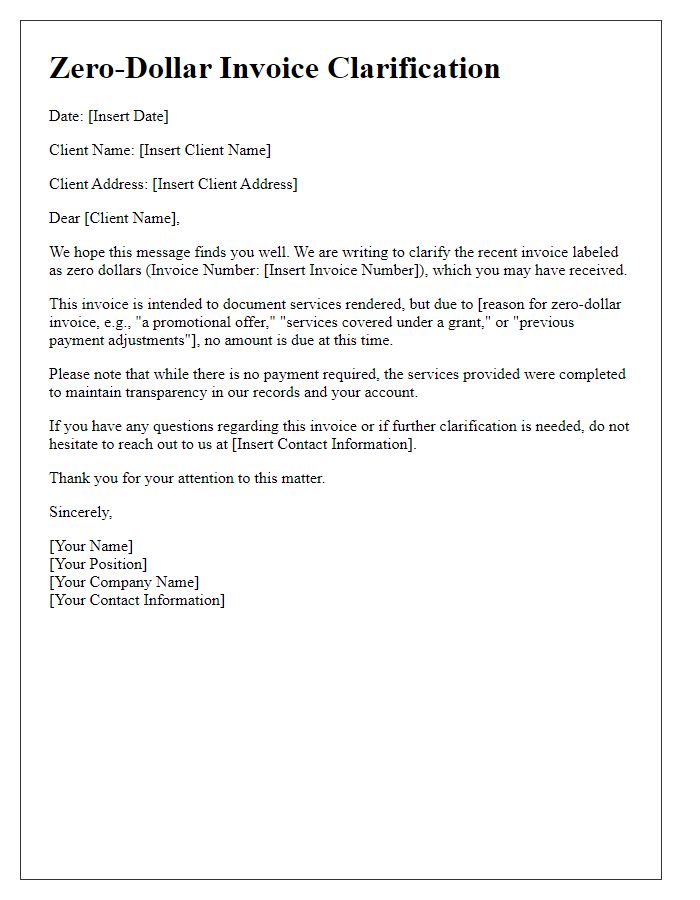

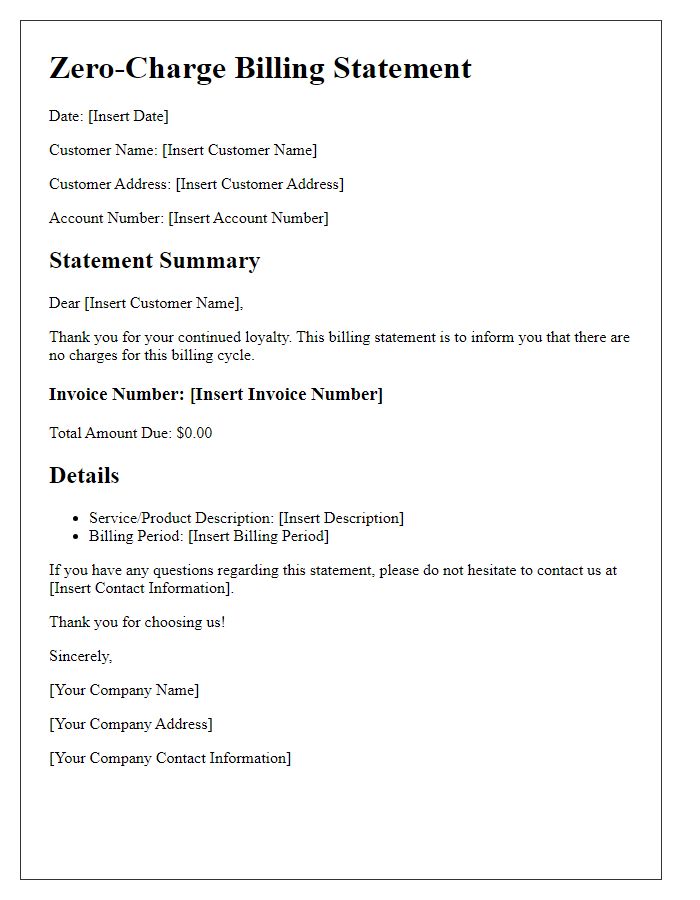

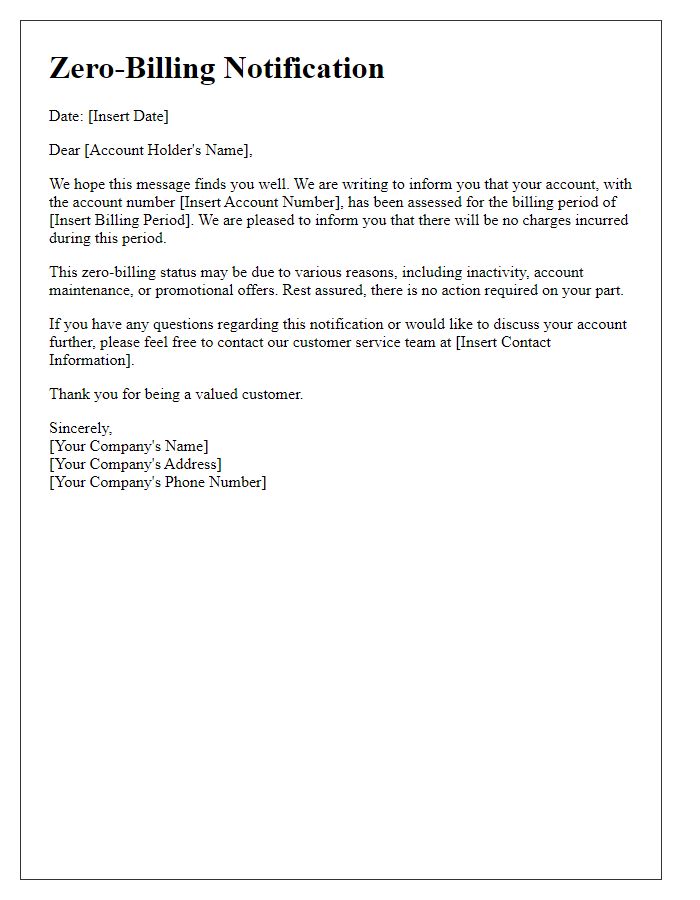

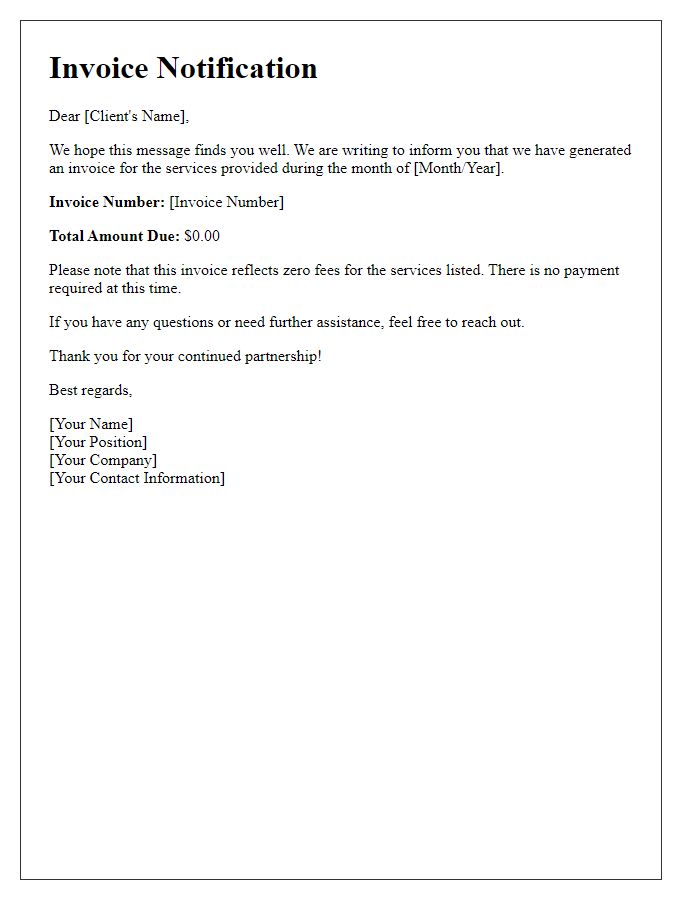

Zero-dollar billing occurs when a service provider issues an invoice indicating no balance due for the billing period, often seen in healthcare or telecommunications. This typically happens when charges are covered by insurance plans, government programs, or promotional offers. Customers receive these invoices to confirm ongoing service, maintain records, and ensure transparency. Important components include the billing period dates, service descriptions, and each charge detailed to justify the zero balance. Understanding the implications helps prevent confusion and fosters trust in the service provider's practices.

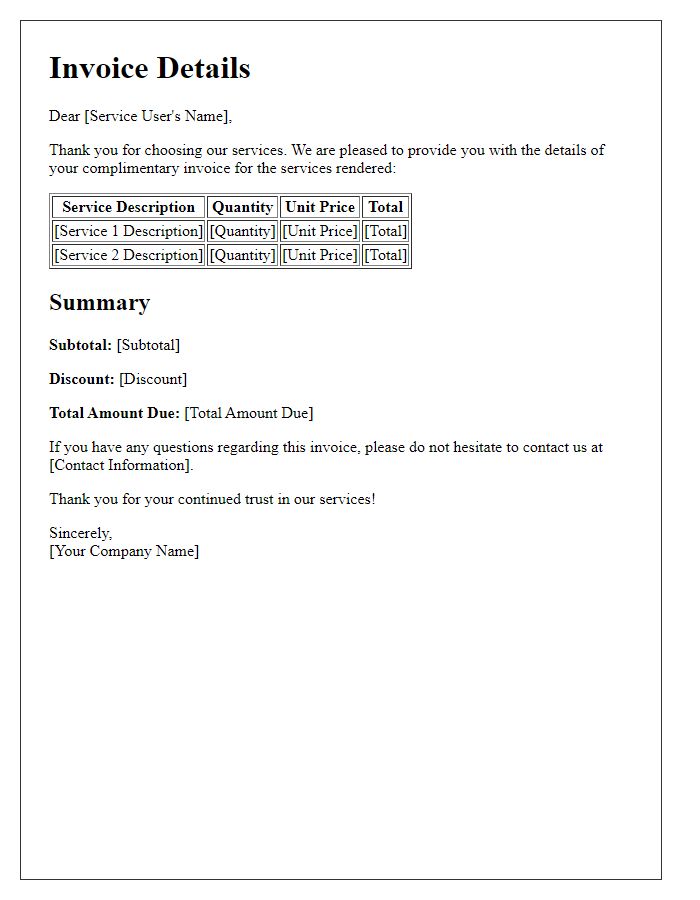

Concise summary of services rendered

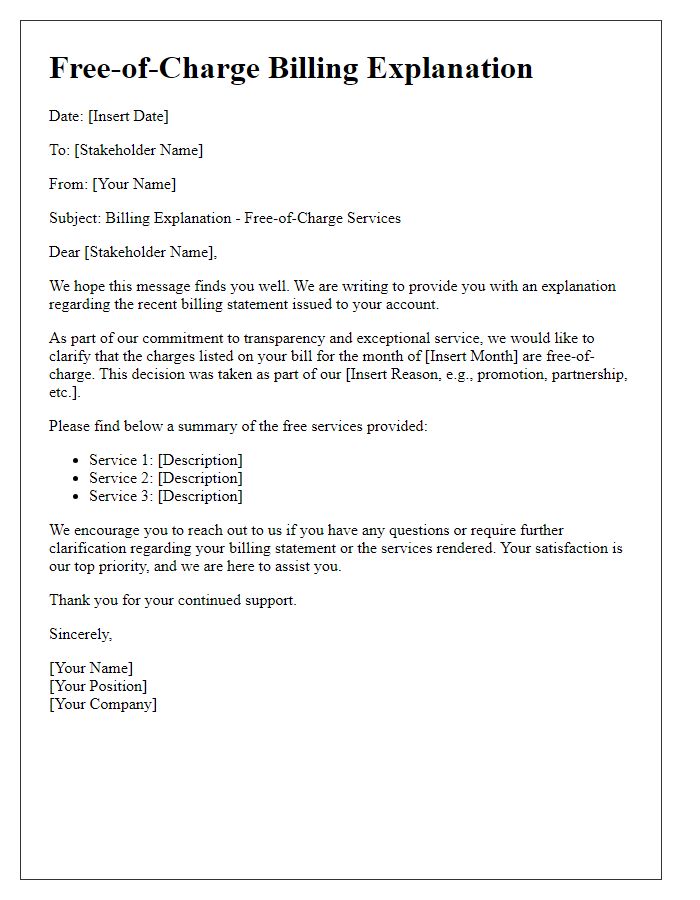

Zero-dollar billing occurs when a client receives an invoice for services that were rendered without any charge due. This situation often arises in specific circumstances, such as promotions, complimentary services, or contractual agreements that stipulate no fees for particular work. For example, a consulting firm might provide an initial consultation service valued at $500 as part of a promotional effort to attract new clients. The invoice would detail this service, highlighting the zero-dollar total to clearly communicate that no payment is required. Such billing practices help maintain transparency in financial transactions, fostering trust between service providers and clients.

Explanation of billing terms

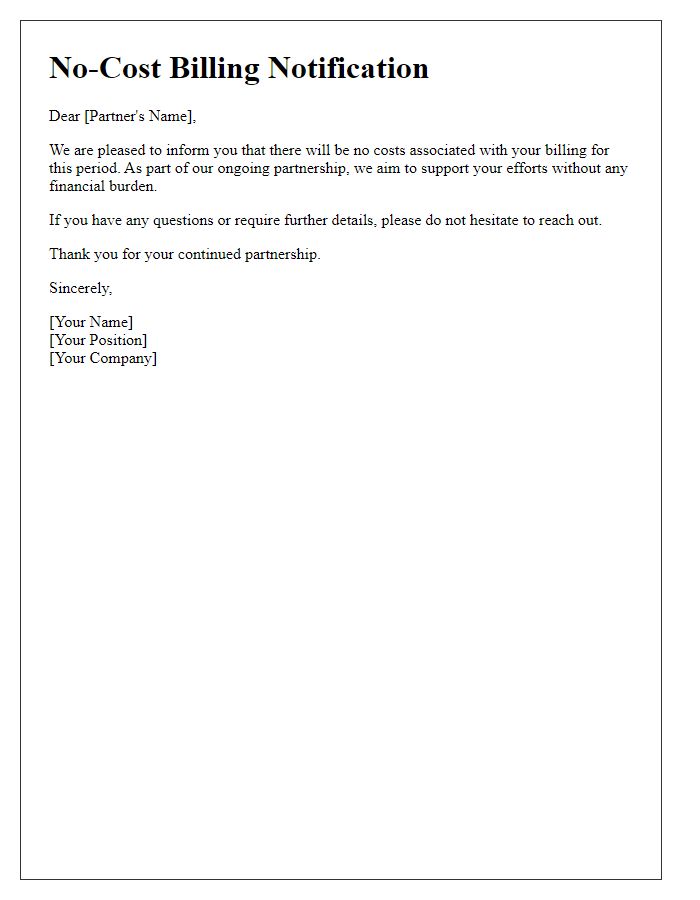

In the world of financial transactions, zero-dollar billing serves as a notification of activities related to accounts or services without any charges incurred. This type of statement is often issued after specific services rendered, such as routine maintenance or promotional offers, which may not attract any fees during a billing cycle. For example, in healthcare settings, a zero-dollar bill may indicate that an insurance claim (such as for routine check-ups) was processed without direct costs to the patient. Such billing periods are crucial for transparency, helping clients comprehend their financial situation and ensuring there are no discrepancies in accounts. Regular updates through zero-dollar bills maintain trust and communication between service providers and customers, fostering a better understanding of service usage and conditions.

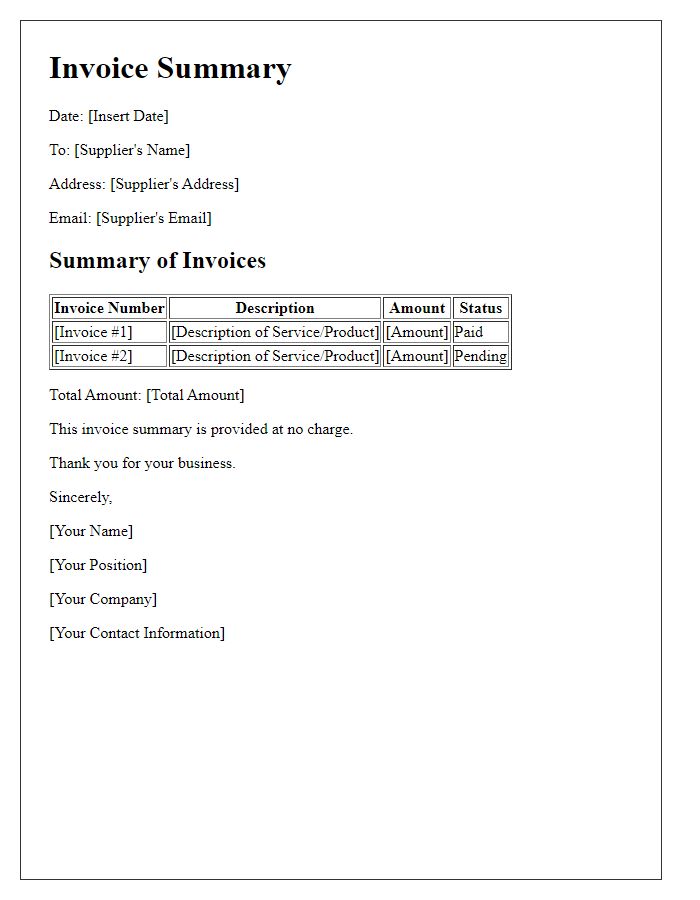

Contact information for inquiries

Zero-dollar billing occurs in various scenarios within healthcare, finance, and utility industries when the total amount due reaches zero after adjustments, credits, or payments. For patients at medical facilities, explanations may derive from insurance coverages or write-offs (like those from Medicare, Medicaid). In utilities, billing can reflect credits applied from previous overpayments or adjustments from services rendered. Precise contact information is crucial for inquiries, including customer service numbers, email addresses, and business hours for seamless communications regarding zero-dollar bills.

Polite closing statement

A zero-dollar billing statement reflects situations where no payment is required for services rendered, often due to insurance coverage or promotional offerings. This type of billing can frequently occur in healthcare settings, such as outpatient services or preventive care appointments, ensuring patients are not burdened by costs while receiving critical health assessments. Understanding the terms associated with zero-dollar bills can clarify any potential confusion regarding insurance policies or service benefits. Clear communication about the nature of these bills helps maintain positive relationships between service providers and clients.

Comments