Hello there! We all know how frustrating unexpected charges can be, especially when they appear out of nowhere on our statements. That's why it's essential to formally acknowledge a charge reversal, ensuring that everything is clear and transparent for both parties involved. In this article, we'll guide you through a simple and effective letter template for charge reversal acknowledgment that you can easily customize. So, grab a cup of coffee and read on to find out how to draft the perfect letter!

Professional Tone

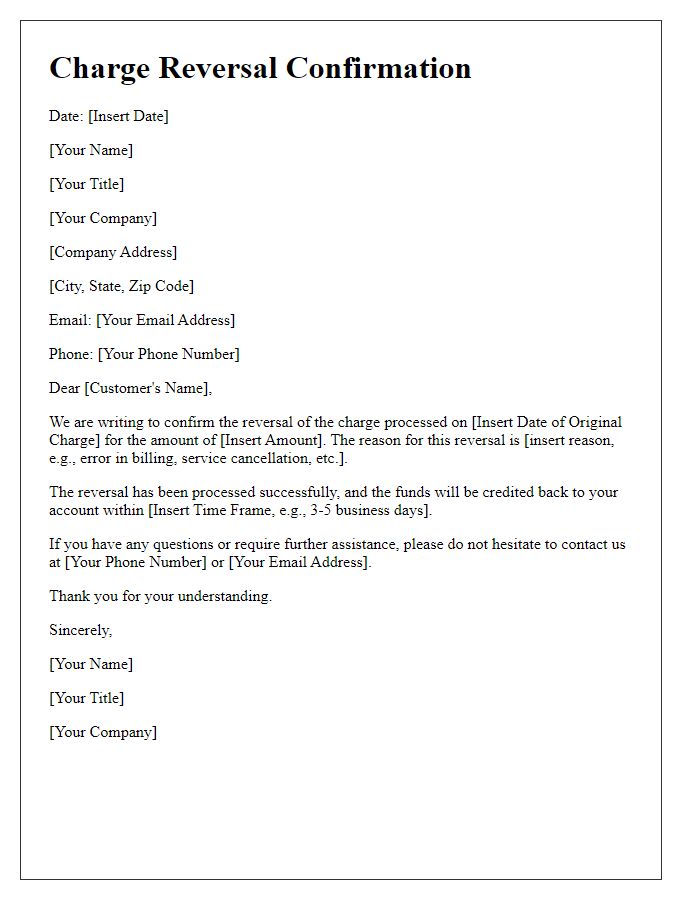

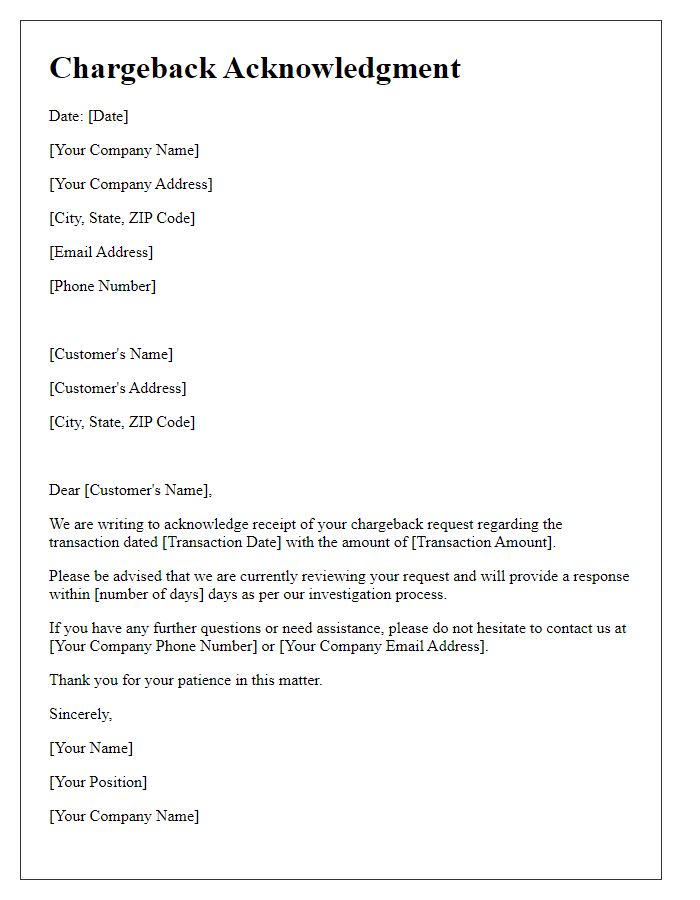

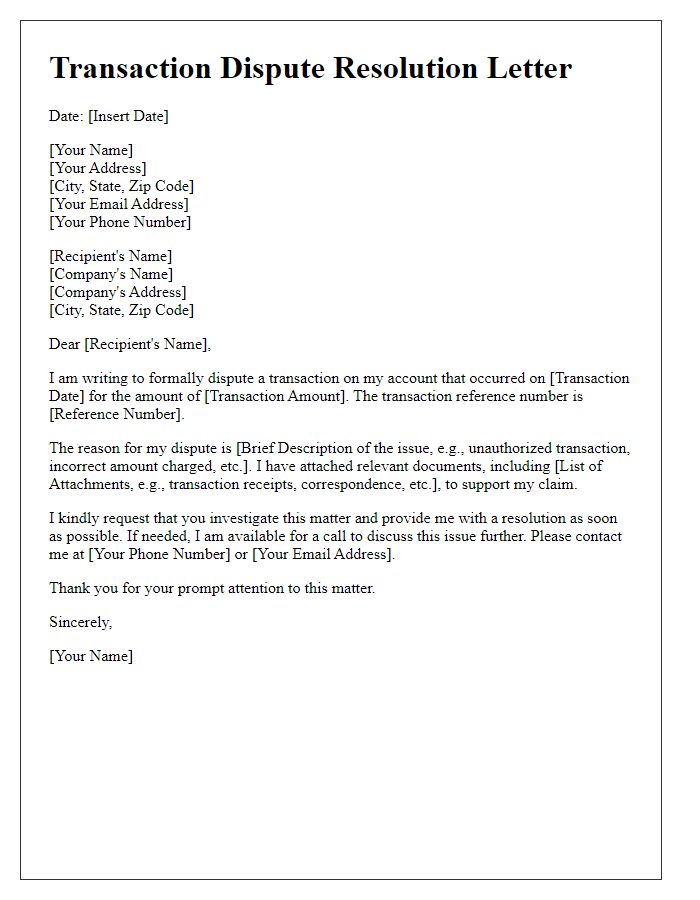

Charge reversal acknowledgments, often used in financial or banking contexts, involve recording instances where a customer disputes a transaction and the funds are reversed. A typical acknowledgment outlines important details such as transaction date, amount, reason for reversal, and relevant account information. Precise communication assures customers their concerns have been noted and actions will be taken as required. In the context of charge reversals, a clear, professional acknowledgment communicates respect for the customer's situation, providing them with confidence in the resolution process. Essential elements include the transaction's unique identifier, customer contact information, and the timeframe for any follow-up actions. Prompt acknowledgment prevents further misunderstandings, fostering a positive relationship between the institution and its clients.

Clear Reference to Original Transaction

Acknowledgment of charge reversal requests includes clear reference to the original transaction details, such as transaction date, amount of $120.00, and transaction ID 987654321. Documenting this information ensures accurate identification of the payment reversal process. Customers can verify the original transaction through their bank statement or merchant receipt while maintaining a record for financial auditing purposes. Issues may arise without this reference, complicating communication between financial institutions involved in the reversal process.

Specific Details of Charge Reversal

Charge reversals may occur in various financial transactions, often due to discrepancies or disputes. A charge reversal, which can also be referred to as a chargeback, typically involves a return of funds to a credit card or bank account after a transaction has been disputed. For instance, in the context of an online purchase, a customer might dispute a $100 charge for a defective electronic device from an e-commerce platform, leading the payment processor to investigate the claim. If resolved in the customer's favor, this reversal might take 5 to 10 business days to reflect in their account. The merchant's bank incurs a fee during this process, which can range from $20 to $100. Charge reversals can significantly impact a business's cash flow and reputation, especially if they arise from frequent disputes. Detailed documentation, such as receipts, communications, and transaction history, is crucial in addressing chargebacks effectively.

Contact Information for Further Assistance

Charge reversal acknowledgment provides important confirmation regarding financial transactions. Customers should retain records of charge reversals, including transaction IDs. These provide clarity for disputes. Clear communication of contact information is crucial for further assistance. Customers may require support from the issuing bank, credit card provider, or the merchant involved in the transaction. Having specific contact numbers, such as customer service hotlines, available hours of operation, and email addresses ensures prompt assistance. Maintaining thorough documentation of correspondence can facilitate any necessary follow-up regarding disputed transactions. Effective resolution often hinges on accurate information exchange between parties involved.

Gratitude and Appreciation

Acknowledgment of charge reversal includes details about the financial transaction involved. Customers often receive such notices following disputes or errors in billing. Financial institutions utilize these processes to reassure clients of transparent accounting practices. Charge reversals, especially in credit card statements, can reflect on users' account balances. Institutions often express gratitude for customer feedback, considering it essential for service improvement. Accurate records facilitate resolution efficiency, ensuring smooth communication between customers and financial entities. Timely acknowledgment of such reversals is vital in maintaining trust and satisfaction among service users.

Comments