Are you tired of those pesky annual fees piling up on your statements? You're not aloneâmany of us are always on the lookout for ways to save money. In this article, we'll explore how to effectively request a fee waiver and share tips on making your case stronger. So, if you're ready to lighten your financial load, keep reading to discover how you can score that annual fee waiver!

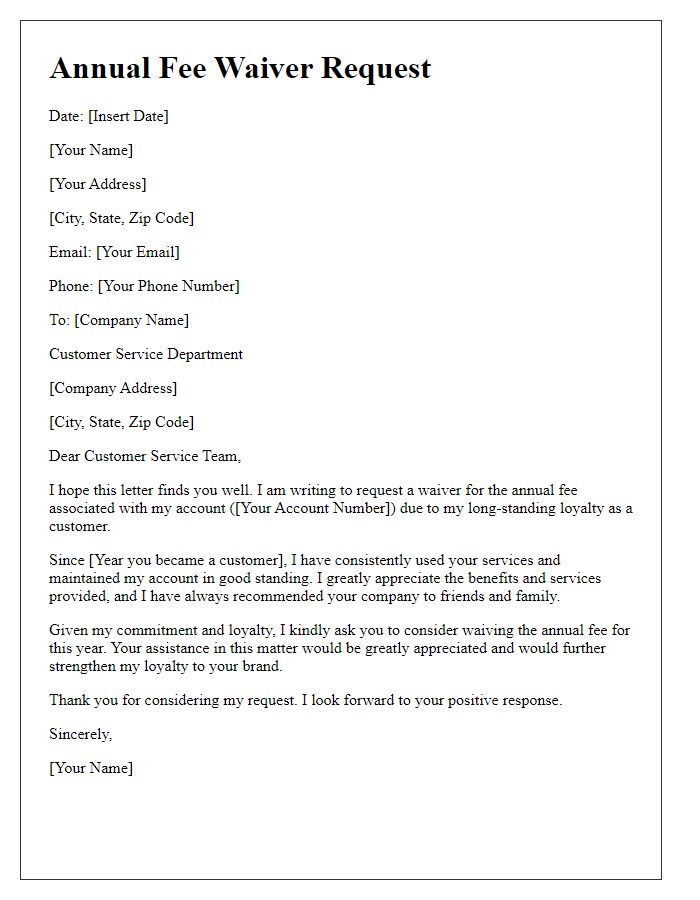

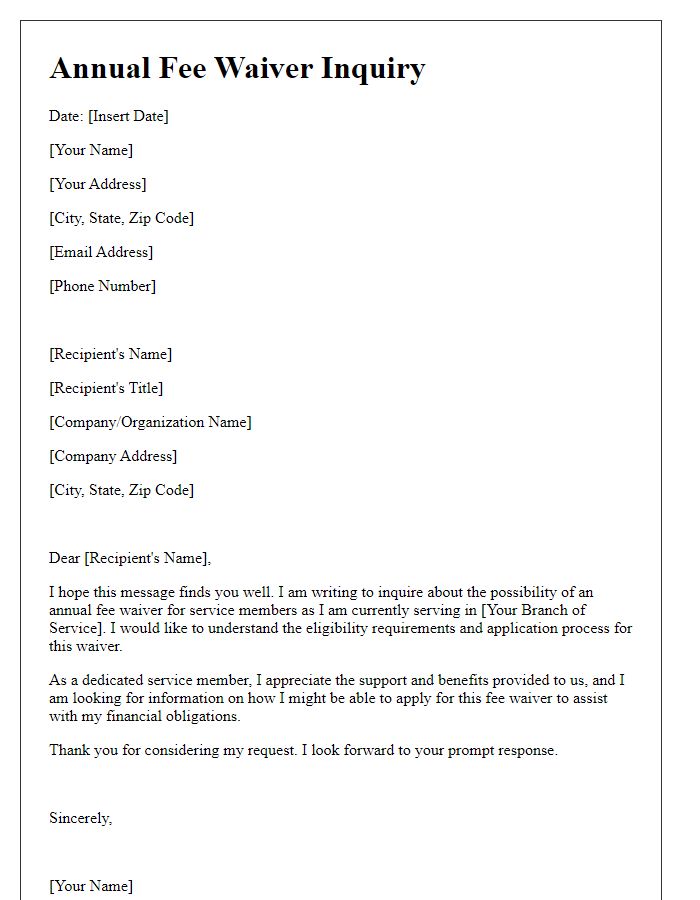

Recipient's personal information.

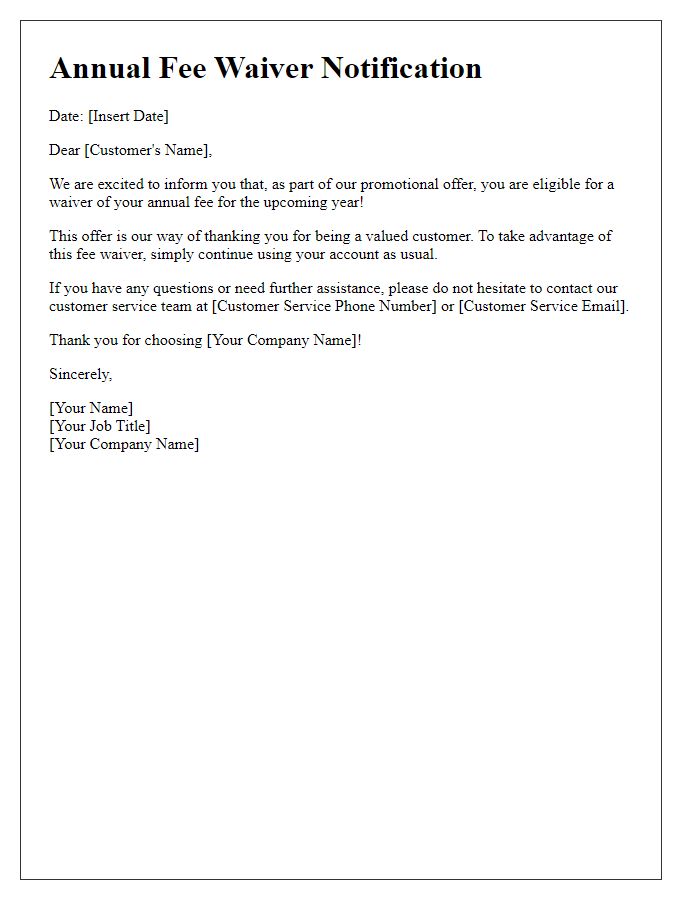

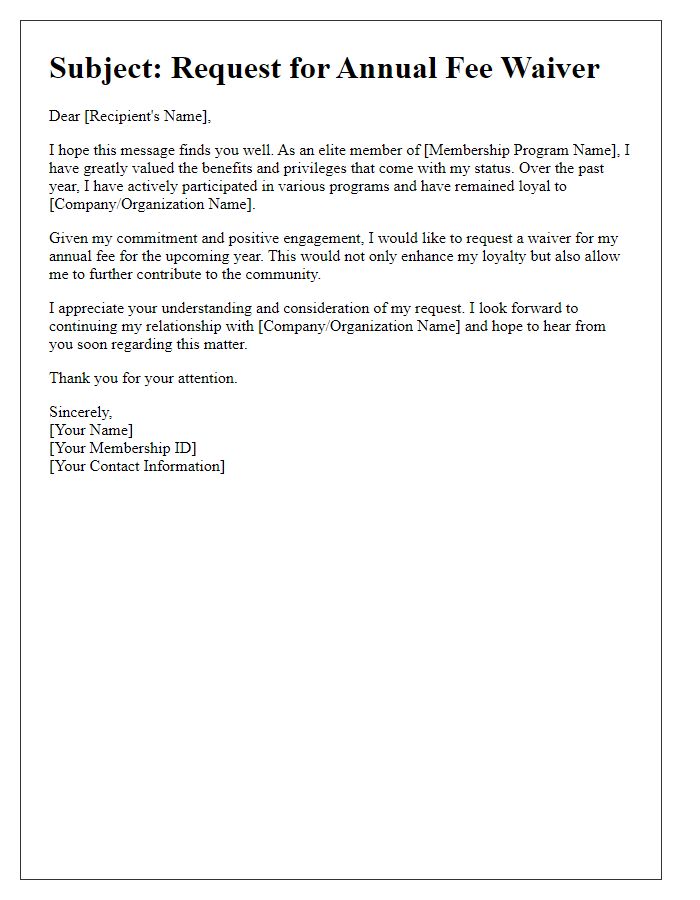

The annual fee waiver offer targets loyal customers, providing a significant financial relief of up to $120, applicable for credit cards issued by major banks like Chase and Bank of America. Eligibility typically requires meeting specific criteria, such as maintaining a minimum spending amount of $3,000 within the previous year or holding a premium account status. Recipients can utilize savings from waived fees for other financial endeavors, such as investments or savings plans. The offer encourages retention of cardholders, enhancing customer loyalty while improving overall satisfaction levels in the competitive banking sector.

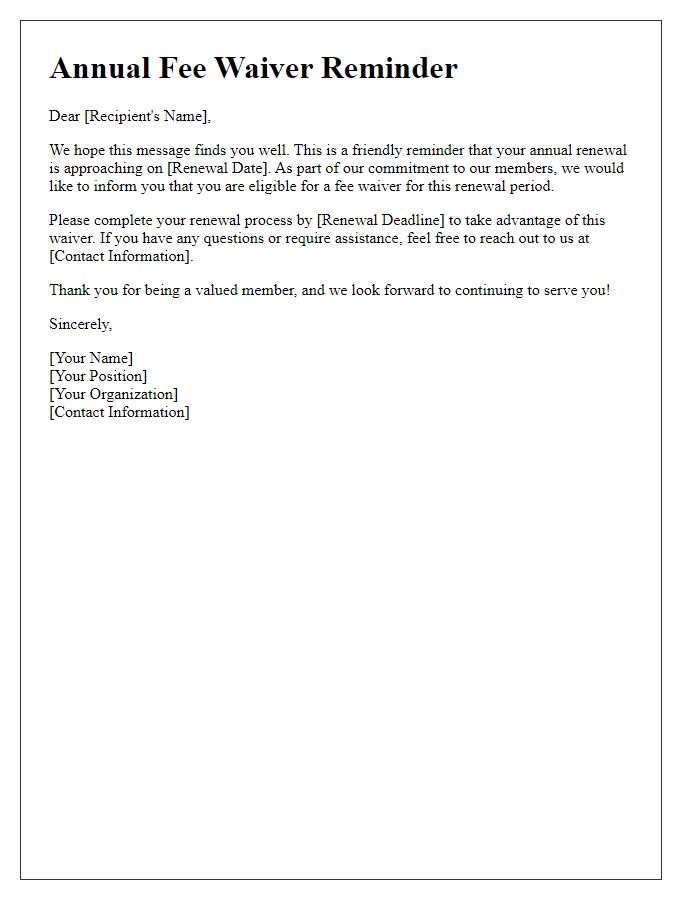

Clear subject line stating the offer.

Annual Fee Waiver Offer for Your Account

Personalized greeting.

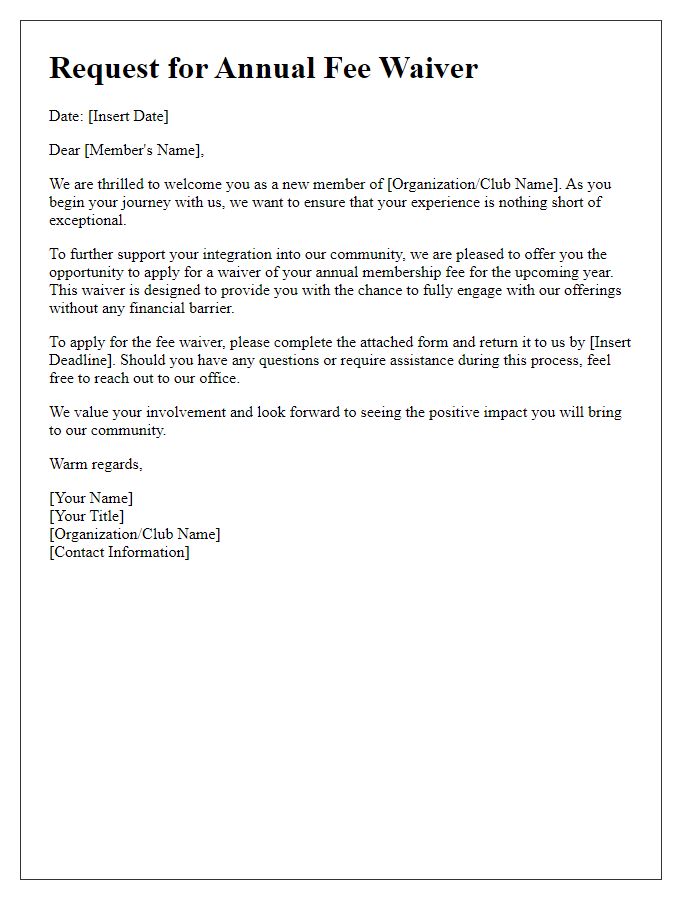

Annual fee waiver offers present a notable opportunity for cardholders to maintain their financial benefits without incurring additional costs. Prominent credit card companies often send tailored communications to invite loyalty among their client base. This strategy encourages long-term relationships, enhancing customer satisfaction. Engaging cardholders via personalized greetings can reinforce their connection to the brand while showcasing their individual value as customers. By emphasizing exclusivity and rewarding loyalty, companies can effectively utilize these offers to sustain high retention rates.

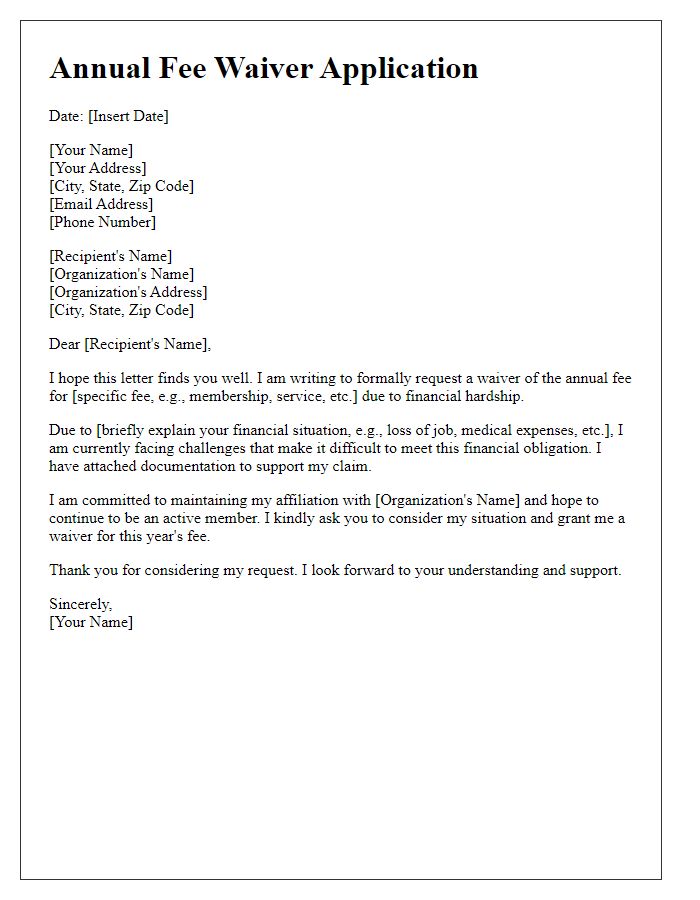

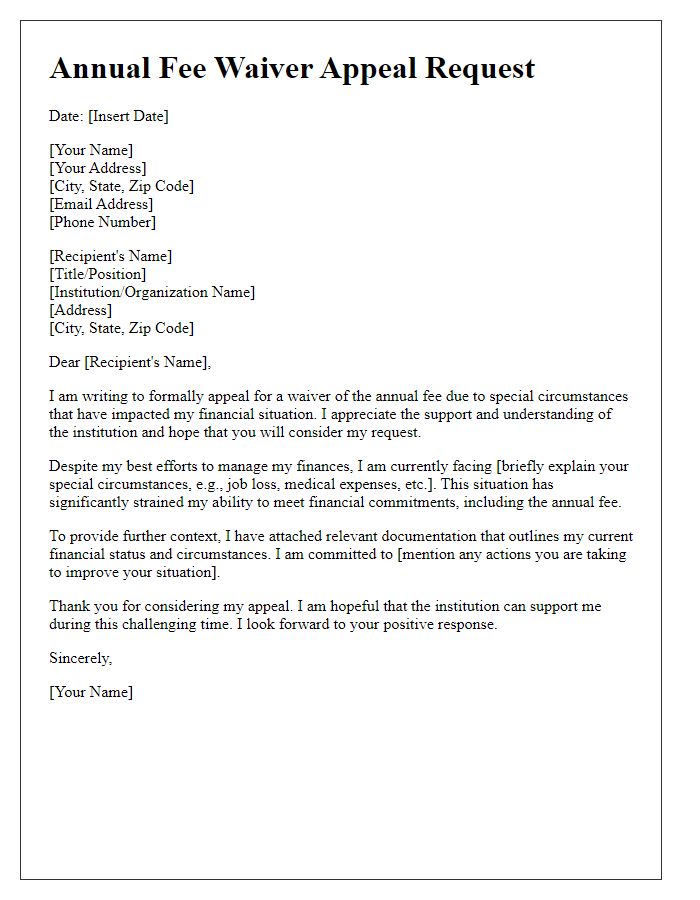

Explanation of fee waiver eligibility criteria.

Annual fee waivers can significantly benefit cardholders, particularly those holding premium credit cards such as Visa Infinite or Mastercard World Elite. Eligibility criteria for these waivers often include factors such as spending thresholds (typically around $15,000 to $25,000 annually), loyalty status with the financial institution (e.g., a minimum of three years as a customer), and account standing (in good standing with no late payments in the previous 12 months). Special promotions may also arise during events like customer appreciation months or the release of new card features, incentivizing customers to maintain or increase their spending. These elements contribute to a favorable assessment of waiver requests, thus enhancing overall customer satisfaction and retention.

Call to action with contact details.

An annual fee waiver offer can significantly enhance customer loyalty and satisfaction for financial institutions. Customers are often incentivized to continue their relationship with a company when they receive offers such as waived fees on credit cards and bank accounts. This particular offer highlights the financial benefits of maintaining an account without incurring unnecessary fees during the year. Clients can greatly benefit from this promotion, allowing for increased savings and improved cash flow management. To take advantage of this limited-time offer, customers are encouraged to call our customer service hotline at 1-800-123-4567 or visit our website at www.examplebank.com/wave-off-fees for more information and assistance.

Letter Template For Annual Fee Waiver Offer Samples

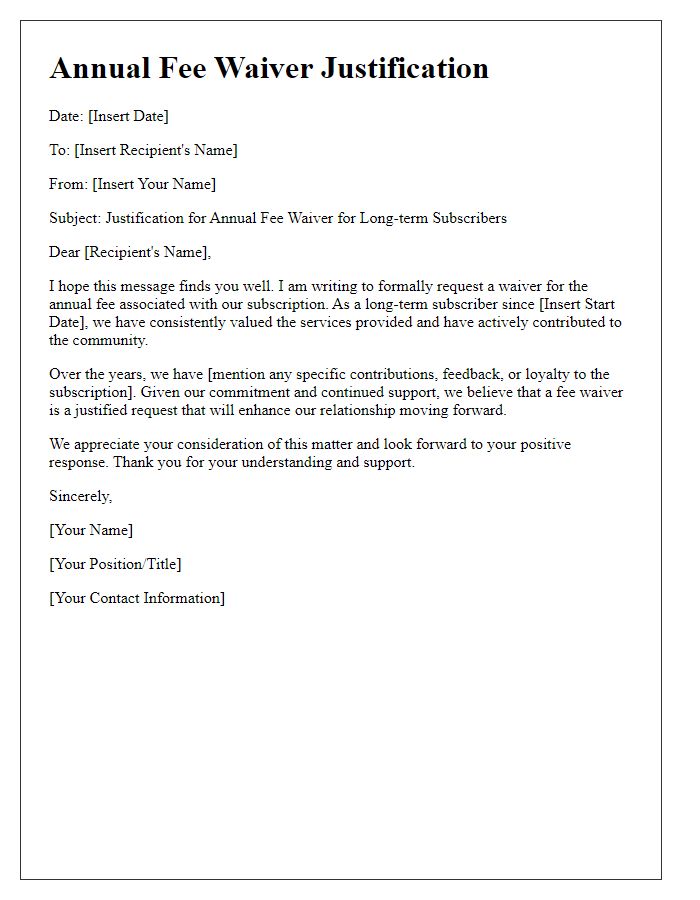

Letter template of annual fee waiver justification for long-term subscribers

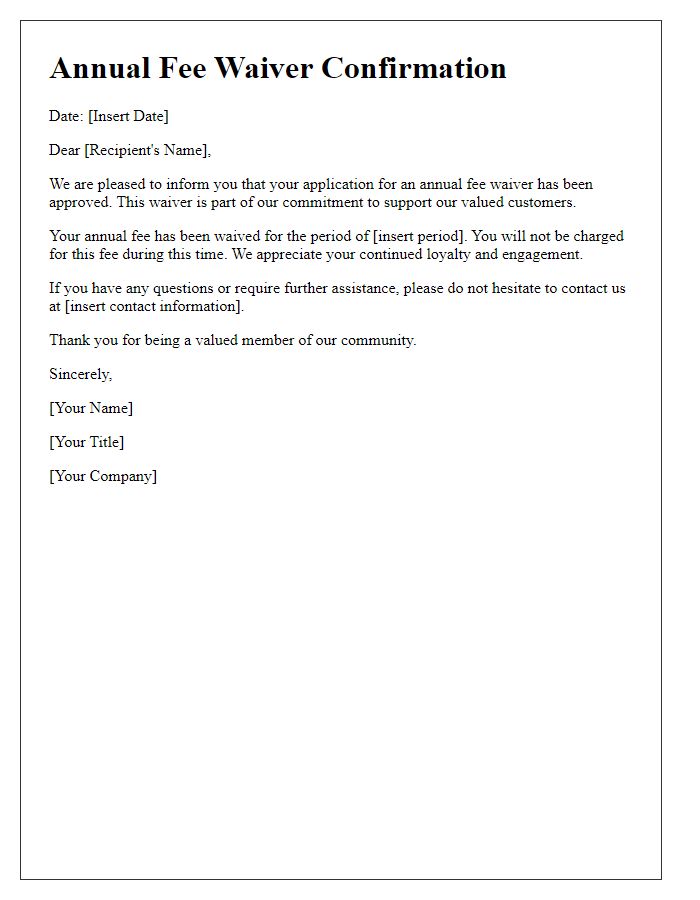

Letter template of annual fee waiver confirmation for targeted recipients

Comments