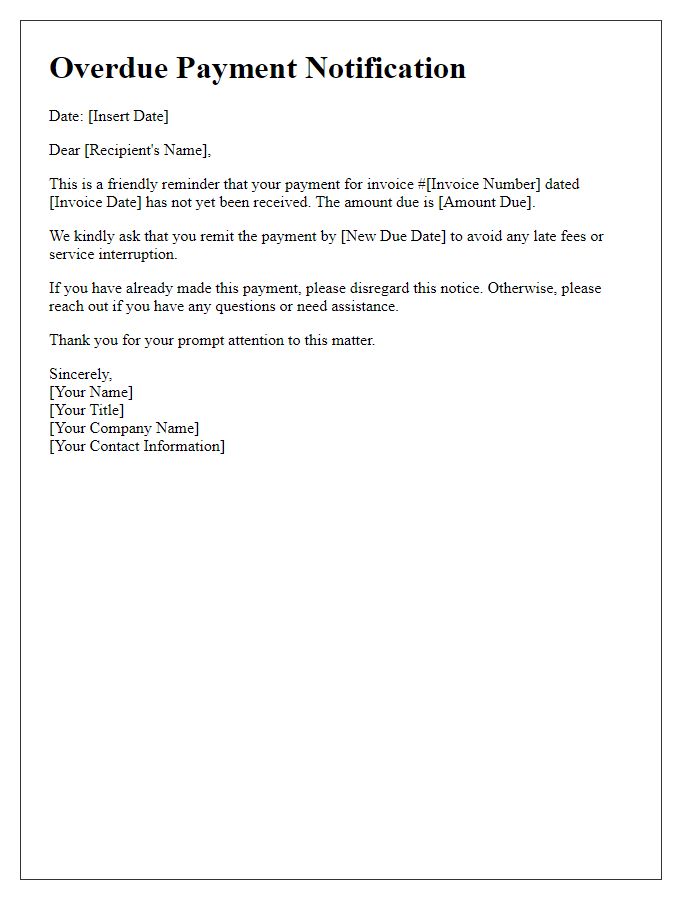

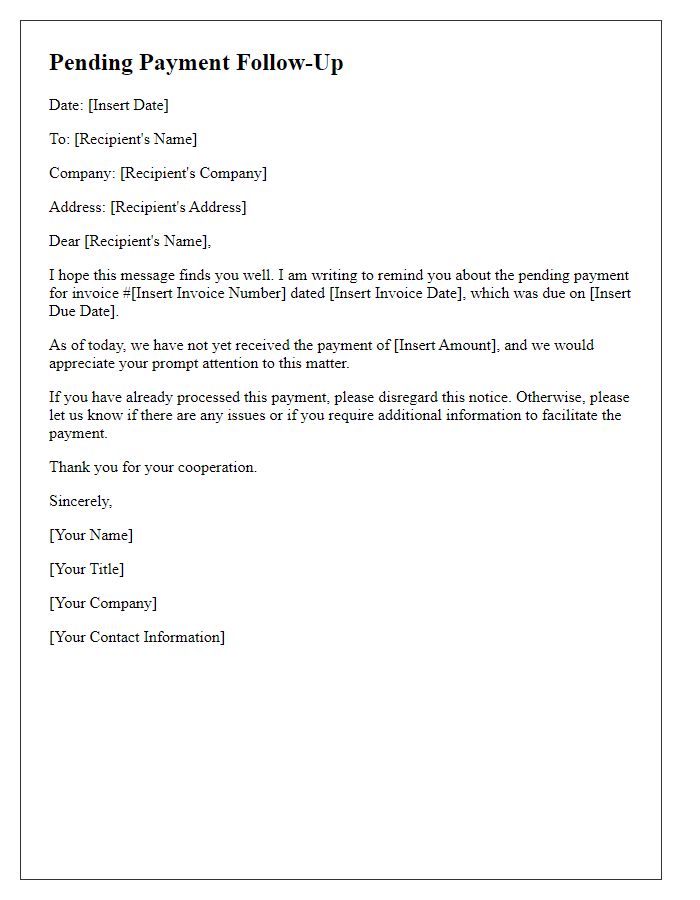

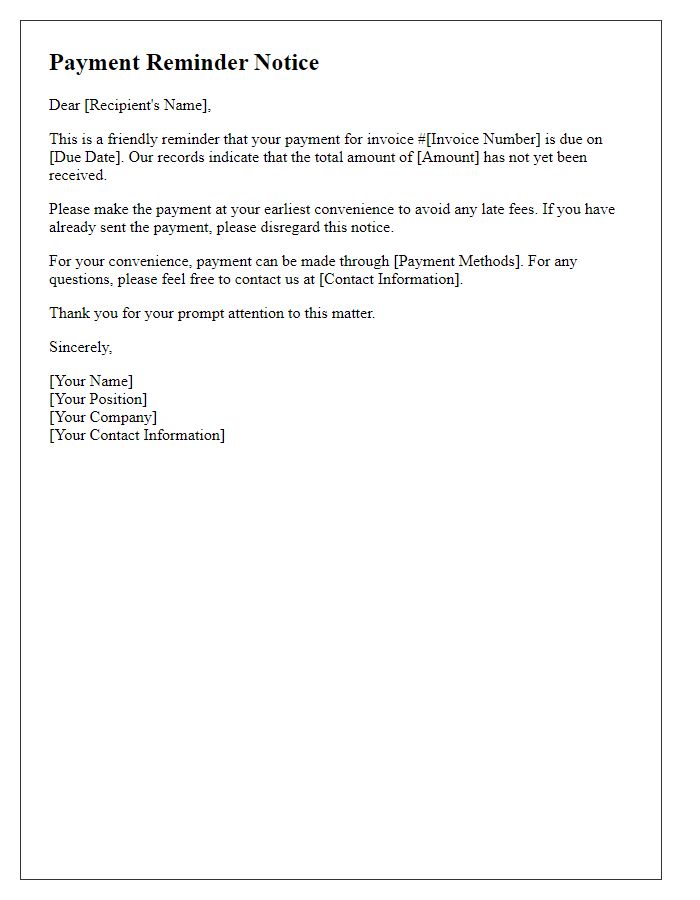

Hey there! We all know that life can get busy, and sometimes it's easy to overlook a payment here and there. However, staying on top of our financial commitments is essential for maintaining good relationships and avoiding any unnecessary penalties. In this article, we'll explore a friendly approach to crafting a missed payment reminder letter that encourages open communication and understanding. So, grab a cup of coffee and let's dive into how to effectively communicate these important reminders!

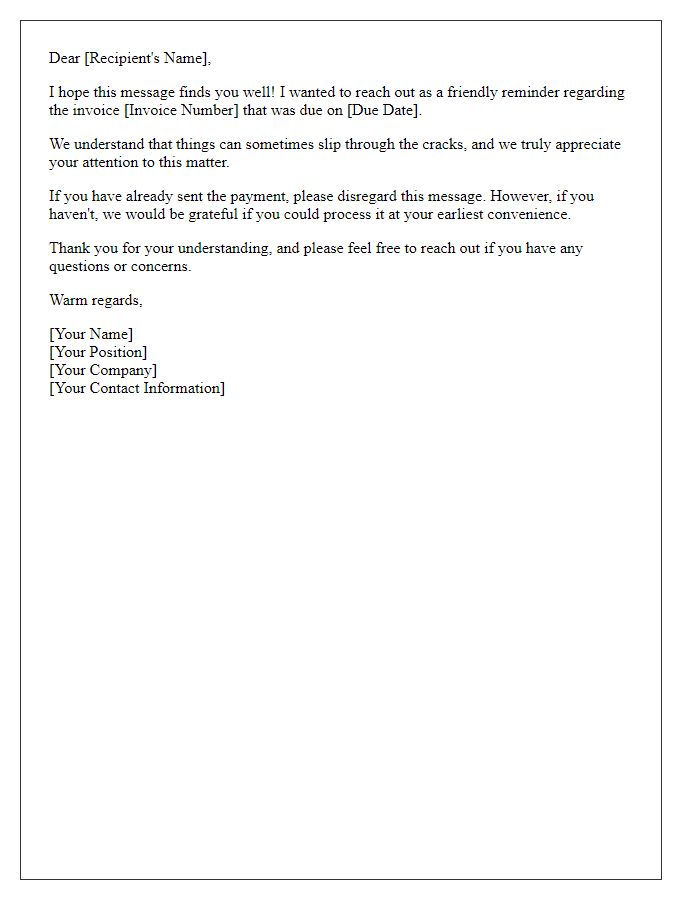

Professional Tone

A missed payment can negatively impact both personal finances and professional relationships. Late payments can accrue interest and penalties, which may increase the total amount owed. In many cases, reminders can encourage timely payments and maintain healthy business relationships. Clear communication detailing the missed due date and the amount owed is crucial. Adhering to guidelines set forth by professional associations (such as the American Institute of Professional Bookkeepers) can improve documentation and collection efforts, creating a more respectful approach to addressing the situation.

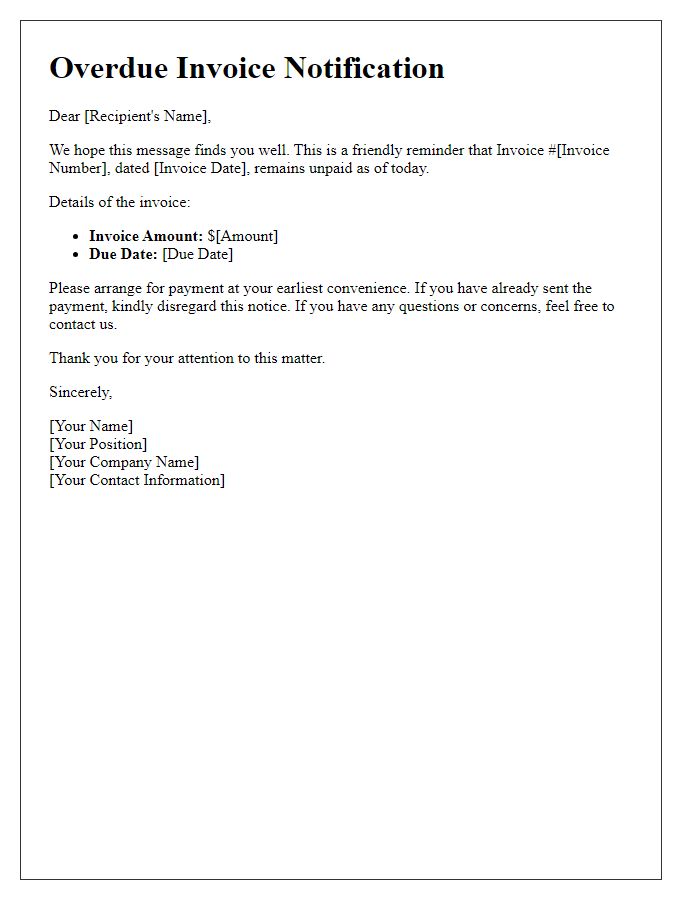

Clear Payment Details

Missed payments can lead to significant consequences for both individuals and businesses. An overdue payment, defined as a payment not received by the agreed-upon due date, can result in late fees, typically ranging from $20 to $50, depending on the organization's policy. For example, utility providers such as Pacific Gas and Electric (PG&E) or credit card companies often impose interest rates exceeding 20% on unpaid balances. Recurring missed payments can negatively impact credit scores, often affecting financing opportunities for major purchases like homes or vehicles. Additionally, consistent late payments may result in collections efforts, which could lead to legal actions and further financial strain. Swift resolution encourages accountability and maintains trust between parties involved.

Consequences of Non-Payment

Non-payment of bills can lead to serious consequences, such as late fees and interest charges, which can increase the total amount owed significantly. For example, credit card companies may impose late fees ranging from $25 to $40 after the due date, adding an extra financial burden. Additionally, payment delinquencies can negatively impact credit scores, potentially causing a reduction of up to 100 points depending on the severity and timing of the missed payment. This deterioration in creditworthiness may hinder future borrowing opportunities, as lenders may see a high-risk borrower profile. Furthermore, utility companies may disconnect services after a period of non-payment, leaving households without essential resources like electricity or water. Legal action could also be a consequence, with creditors pursuing collections through third-party agencies or through the court system, leading to additional legal fees and stress. Prompt action is crucial to avoid these escalating consequences of non-payment.

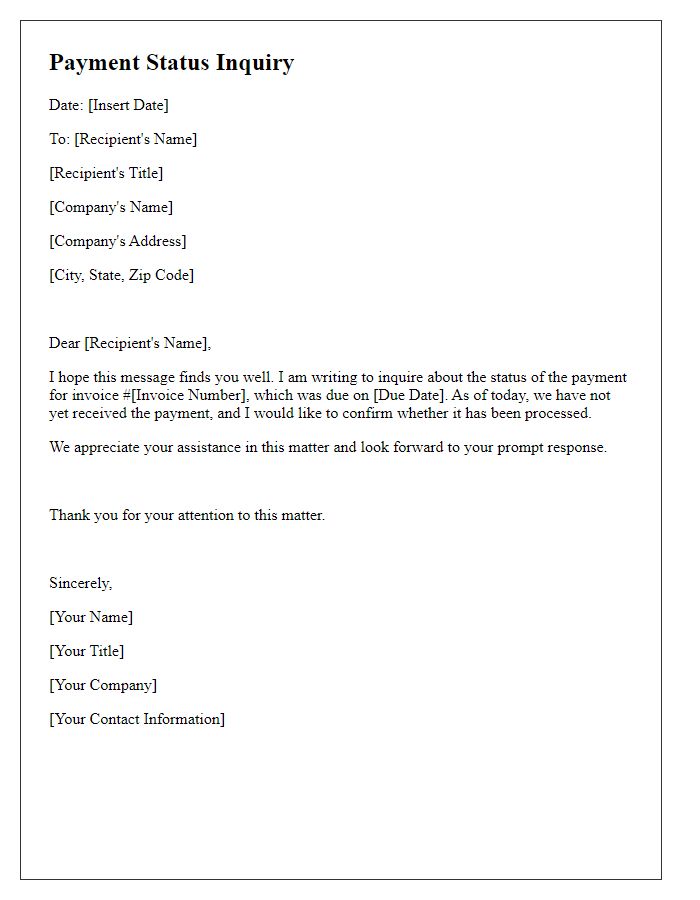

Contact Information

Missed payments can significantly impact credit scores and financial stability. Companies often send reminders to customers who have not fulfilled their payment obligations. Common contact information includes a company's name, address, phone number, email address, and account number. For instance, a client may receive a reminder detailing that a payment of $150, due on October 1, 2023, has not been received. This notice can include important instructions on how to rectify the situation, such as sending the payment through an online portal or contacting customer service at a specific number, ensuring that clients have clear avenues for resolution. Prompt action is advised to avoid late fees or service disruptions.

Call to Action

A missed payment reminder serves as an important communication tool for financial organizations and service providers. Timely reminders can streamline cash flow management and improve customer relations. A typical reminder might include details such as the due date that was originally set, the specific payment amount that remains outstanding, and the consequences of ongoing non-payment, including potential late fees or service interruptions. Additionally, contact information for customer service representatives can facilitate inquiries regarding payment options, promoting prompt action from the recipient. Clear instructions on how to make the payment, whether through an online portal, over the phone, or via postal service, can further encourage immediate resolution of the missed payment issue.

Comments