Are you feeling frustrated with a recent credit card charge that doesn't seem right? You're not aloneâmany people encounter unexpected charges or billing errors that can leave them feeling confused and powerless. In this article, we'll walk you through the process of crafting a compelling letter to resolve your credit card dispute effectively. So, if you're ready to take control of your financial situation, keep reading to discover the best practices for your complaint letter!

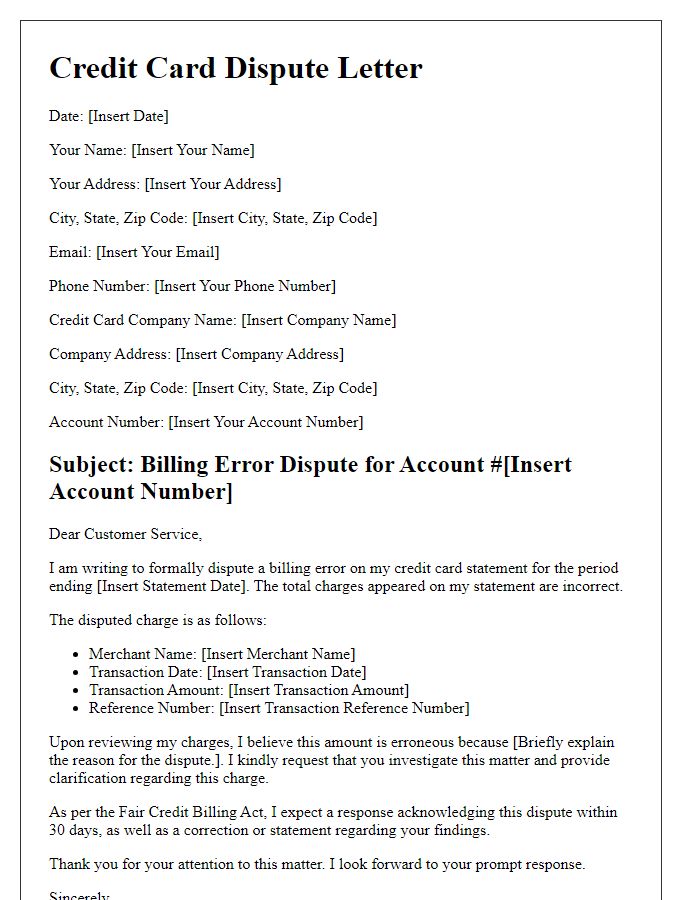

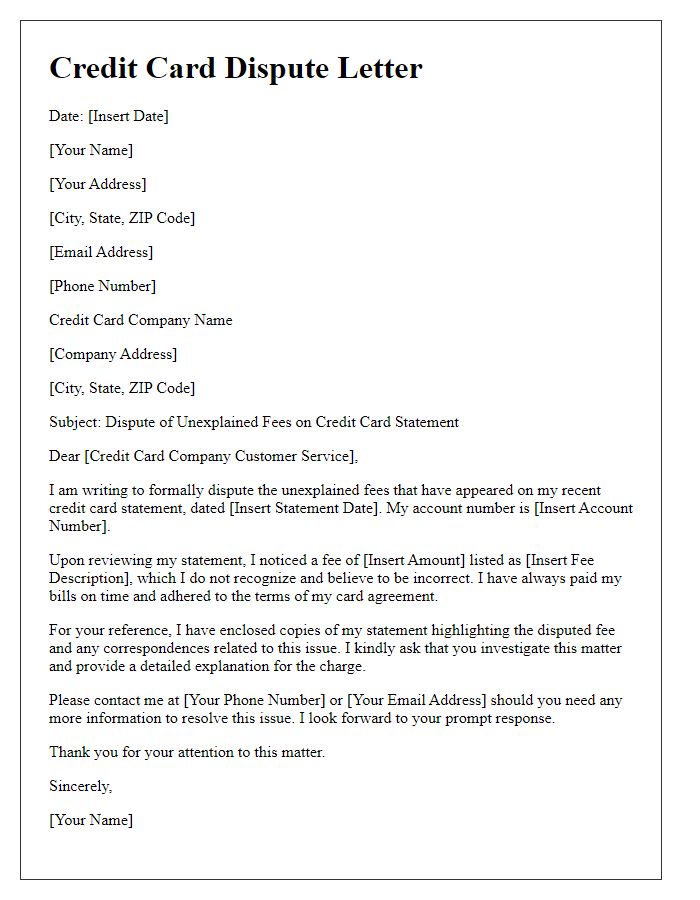

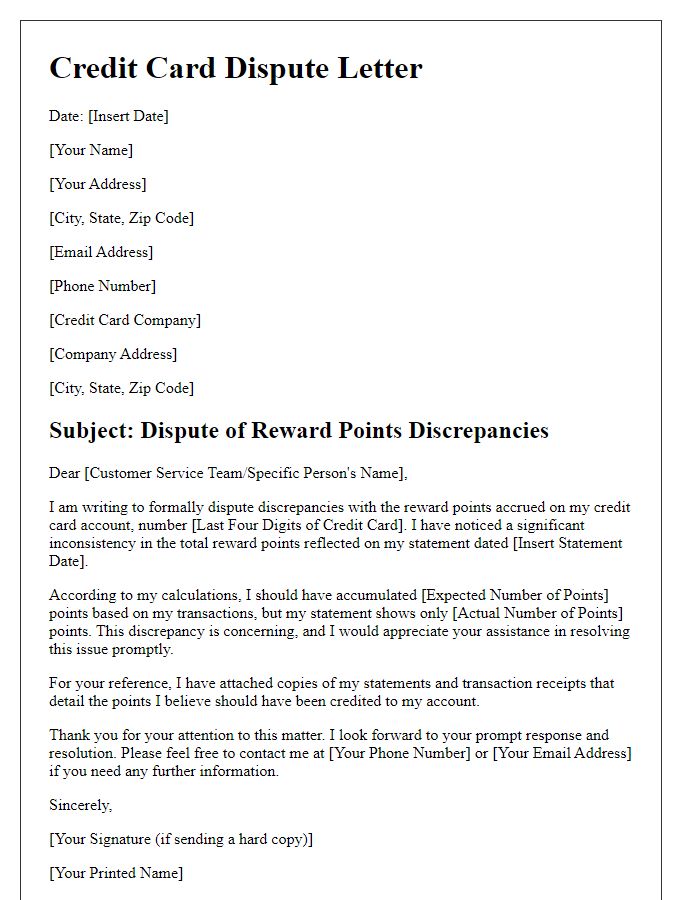

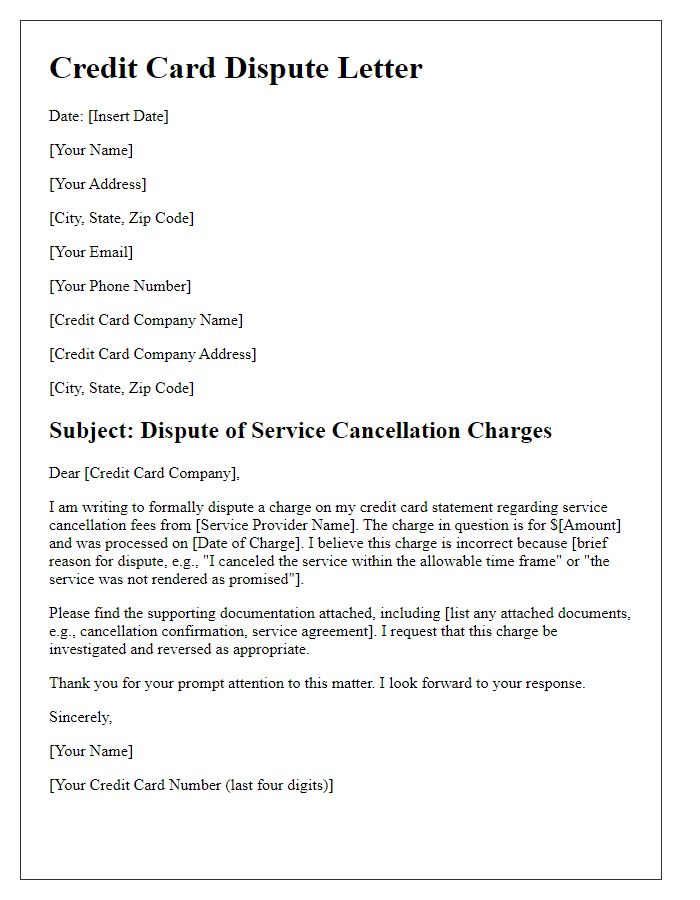

Clear subject line and header.

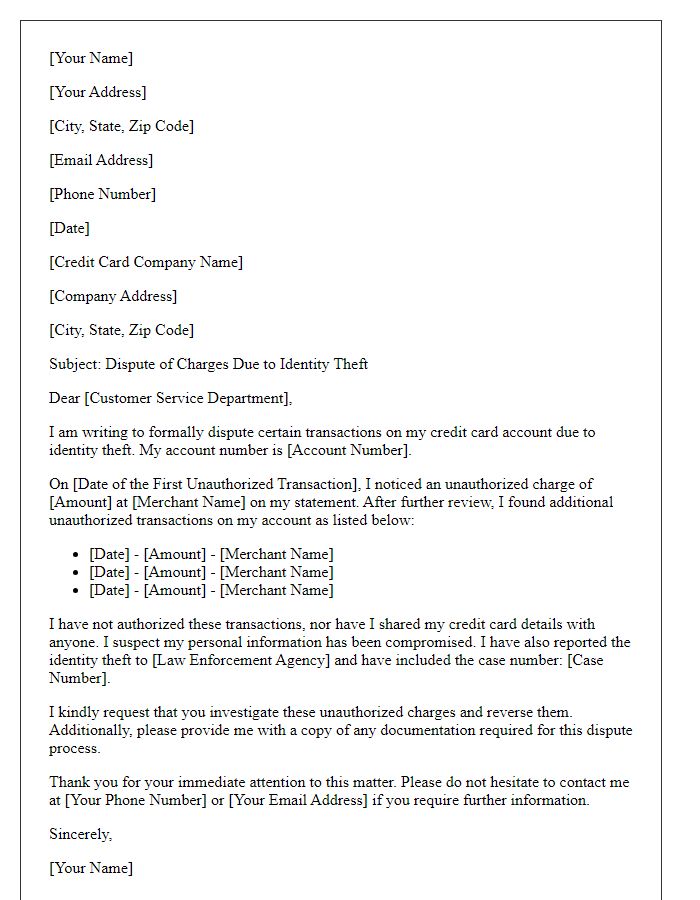

A credit card dispute can arise when discrepancies occur between charged amounts and the expected or agreed-upon expenses. A common cause is fraudulent transactions, where unauthorized users exploit bank card details. Credit card companies, such as Visa or MasterCard, often have specific protocols for addressing such disputes, including required documentation, timelines (typically 30 days), and customer service contacts. Clear communication, including detailed transaction dates, amounts, and merchant names, is crucial in compiling an effective complaint. Documenting the entire process, including follow-up emails and response times, enhances the resolution outcome and can help consumers secure refunds or credit adjustments for erroneous charges.

Detailed description of the dispute.

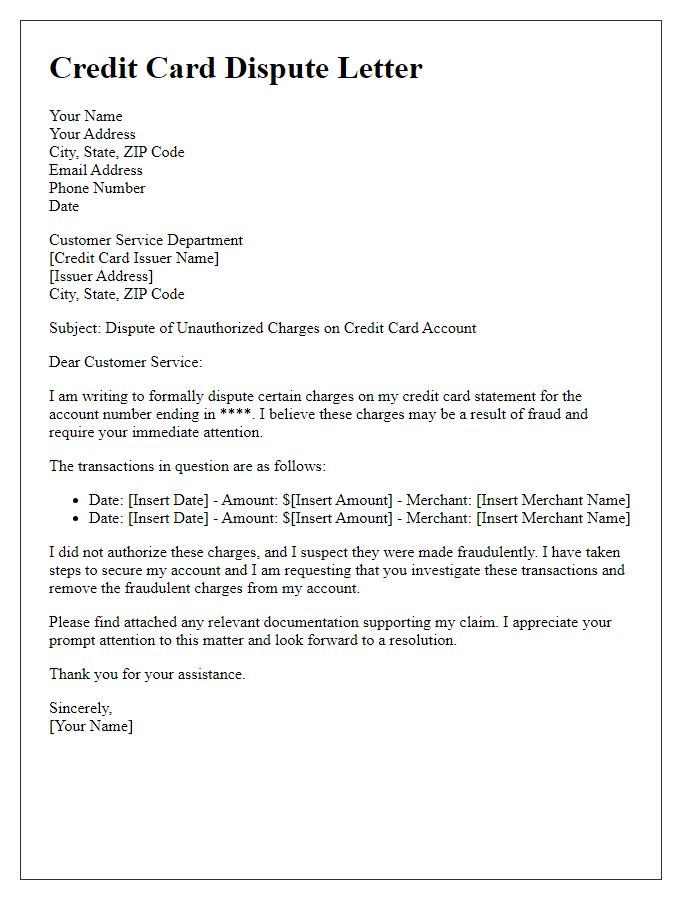

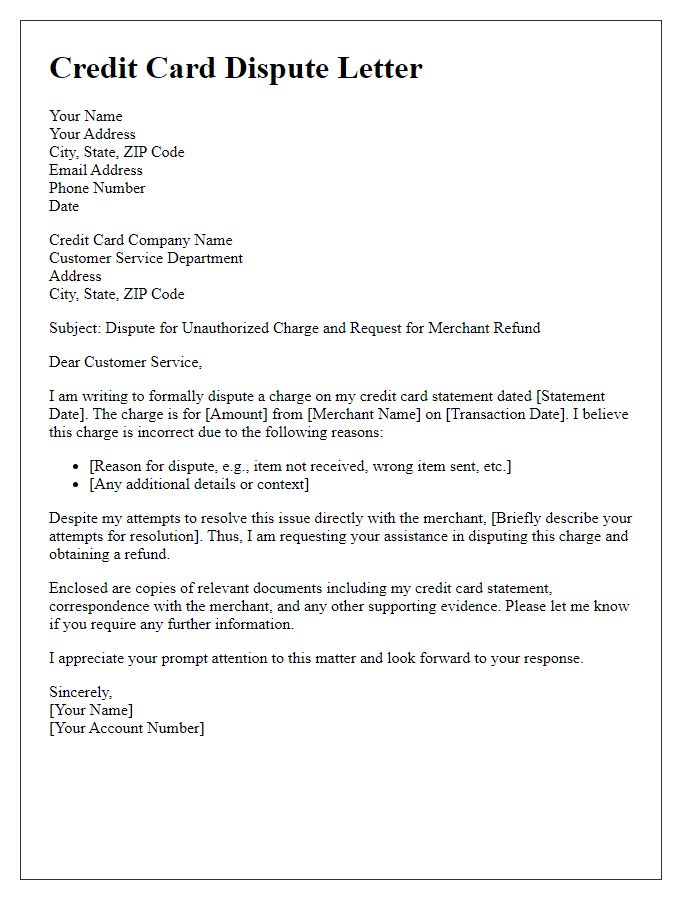

A credit card dispute can arise when unauthorized charges appear on a customer's statement, such as transactions from a restaurant chain like Olive Garden in July 2023 that were never made by the cardholder. This situation often involves amounts exceeding $100, creating financial strain. Additionally, the credit card issuer, such as Chase Bank, may require a detailed account of the disputed transaction, including the transaction date, amount, and merchant information. Cardholders must also consider the Fair Credit Billing Act (FCBA), which outlines the necessary steps for reporting such disputes and ensures protections under federal law. Promptly addressing these issues can lead to favorable resolutions and refunds, ensuring consumer rights are upheld.

Relevant transaction information.

A credit card dispute involves specific transaction details that require careful documentation. The transaction date, typically formatted as Month Day, Year, indicates when the charge occurred. The transaction amount, often represented in dollars and cents, specifies the disputed charge. The merchant name, such as "Acme Retailers," provides context regarding where the transaction took place. Furthermore, the associated credit card number, usually masked for security but referenceable as the last four digits (e.g., 1234), identifies the specific account involved. The reason for the dispute might include unauthorized charge, merchandise not received, or billing errors, necessitating thorough explanation for clarity. Accompanying receipts or transaction confirmation emails can serve as supporting evidence during the resolution process.

Supporting documentation.

Credit card dispute resolution involves a structured process where customers (cardholders) address unauthorized charges or billing errors with their credit card issuer. Supporting documentation, such as transaction statements (detailed records showing all charges and payments), receipts (proof of purchase that may validate or contradict the disputed amount), and correspondence (emails or letters exchanged with the merchant) play crucial roles in substantiating claims. Transactions highlighted for dispute may include fraudulent purchases (unauthorized transactions that impact the cardholder financially) or billing discrepancies (inconsistencies between what was charged and what was agreed upon). The Fair Credit Billing Act (FCBA) ensures that cardholders can dispute charges within 60 days of the statement date, safeguarding consumer rights and prompting timely investigations (actions taken by financial institutions to resolve disputes). Proper organization and submission of all relevant documents can significantly enhance the chances of a favorable outcome in the resolution process.

Formal closing and contact information.

Credit card dispute resolution processes often involve various details such as initial transaction amounts, specific dates, and merchant names. Providing a formal closing can enhance the professionalism of the communication. Include contact details such as a phone number (typically a ten-digit format) and an email address to facilitate swift responses. It is essential to use clear descriptions, ensuring that the resolution request is understood and taken seriously by the financial institution. The inclusion of the account number can aid in identifying the specific case.

Letter Template For Credit Card Dispute Resolution Complaint Samples

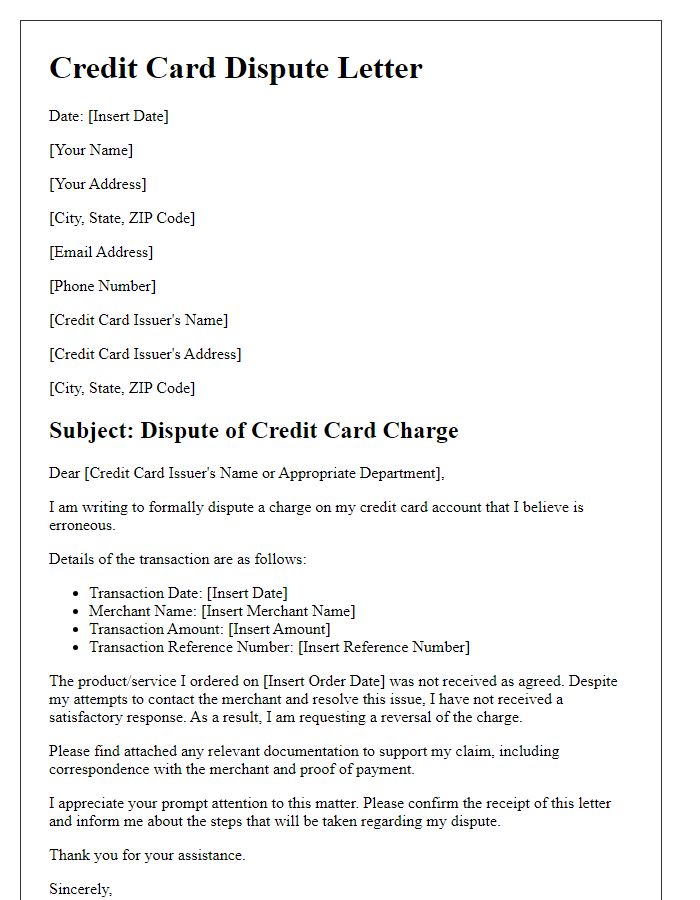

Letter template of credit card dispute over product/service not received

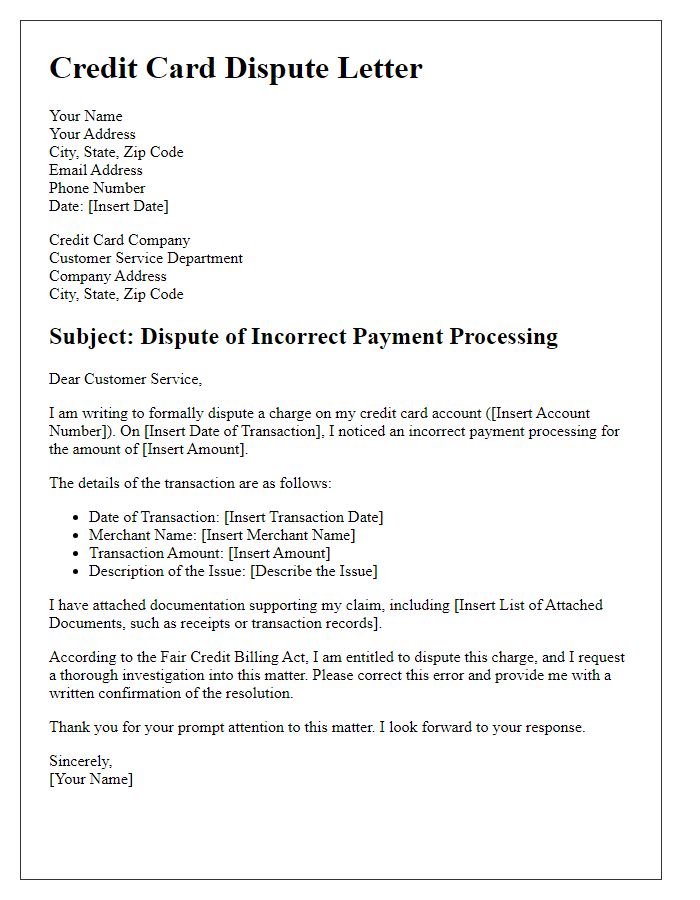

Letter template of credit card dispute about incorrect payment processing

Comments