Are you finding yourself frustrated over recurring service charges that seem unjustified? You're not alone, as many consumers face similar challenges in navigating billing disputes. Understanding your rights and knowing how to effectively communicate your concerns can make all the difference in resolving the issue. Join us as we explore a letter template designed specifically for addressing these disputes with clarity and confidenceâlet's dive in!

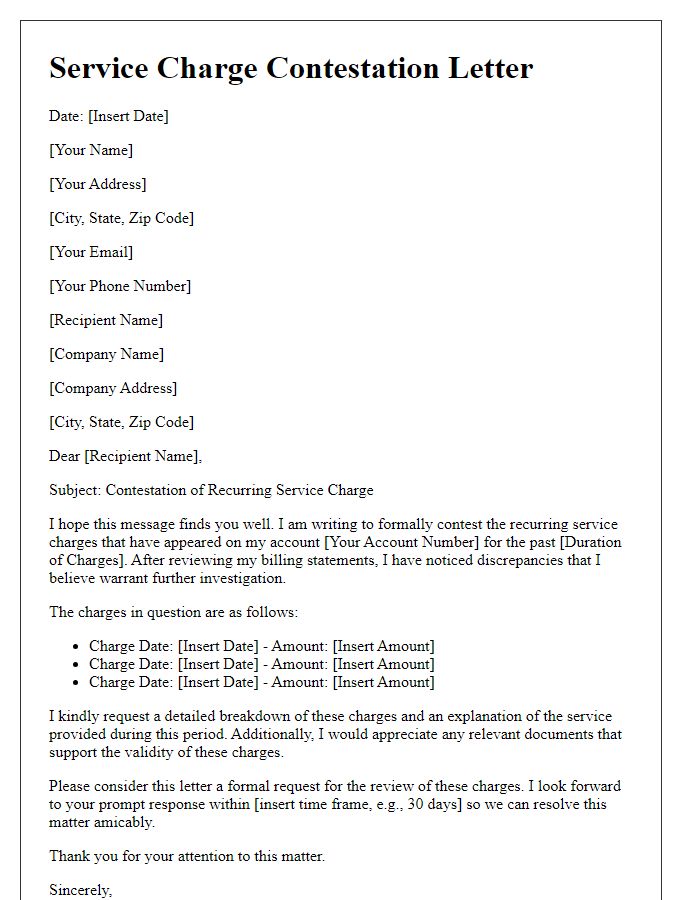

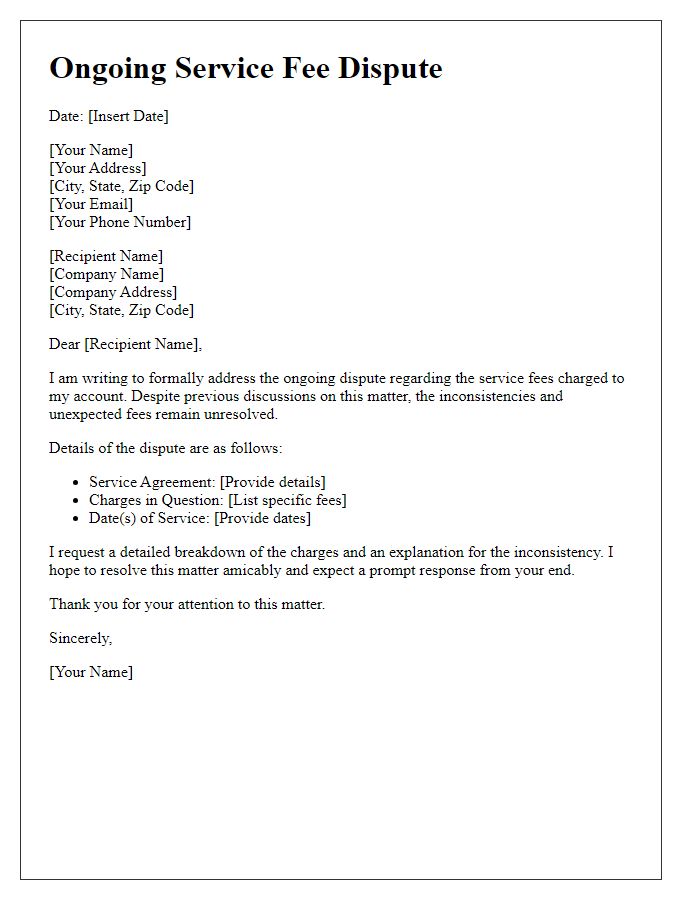

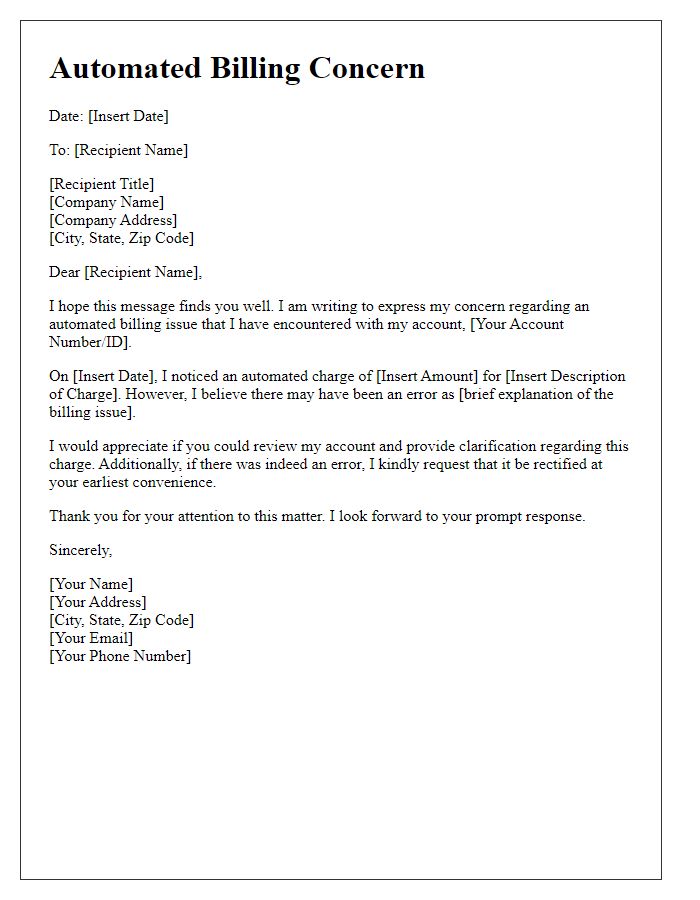

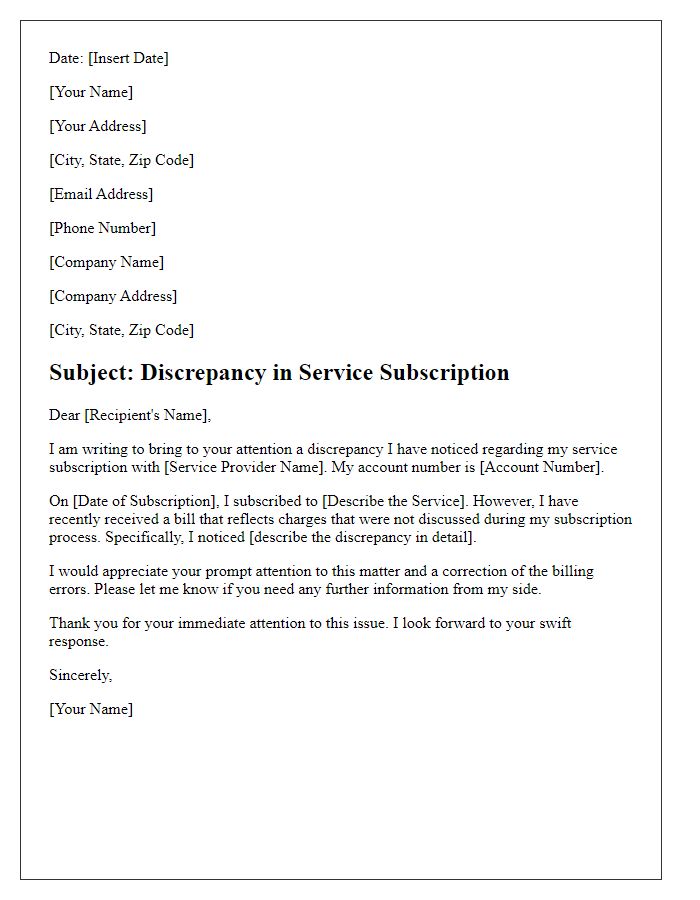

Clear identification of the service and charges

Disputes regarding recurring service charges often arise in various sectors, including telecommunications, utilities, and subscription services. Services like mobile phone plans or internet packages commonly feature monthly charges, which may fluctuate unexpectedly based on promotions or additional fees. It is important to clearly identify the specific service involved, such as the primary internet package providing 100 Mbps speed. Equally crucial is detailing the exact charges, including any promotional rates (e.g., introductory pricing of $29.99 per month for the first year) and standard rates following promotion expiration (e.g., $59.99 per month after the first year). Noting the billing cycle (e.g., monthly on the 15th) and the total amount disputed helps establish context for the disagreement, facilitating resolution. Clarifying the timeline of service changes or billing discrepancies ensures a comprehensive understanding of the situation for both the service provider and the consumer, streamlining communication for a resolution.

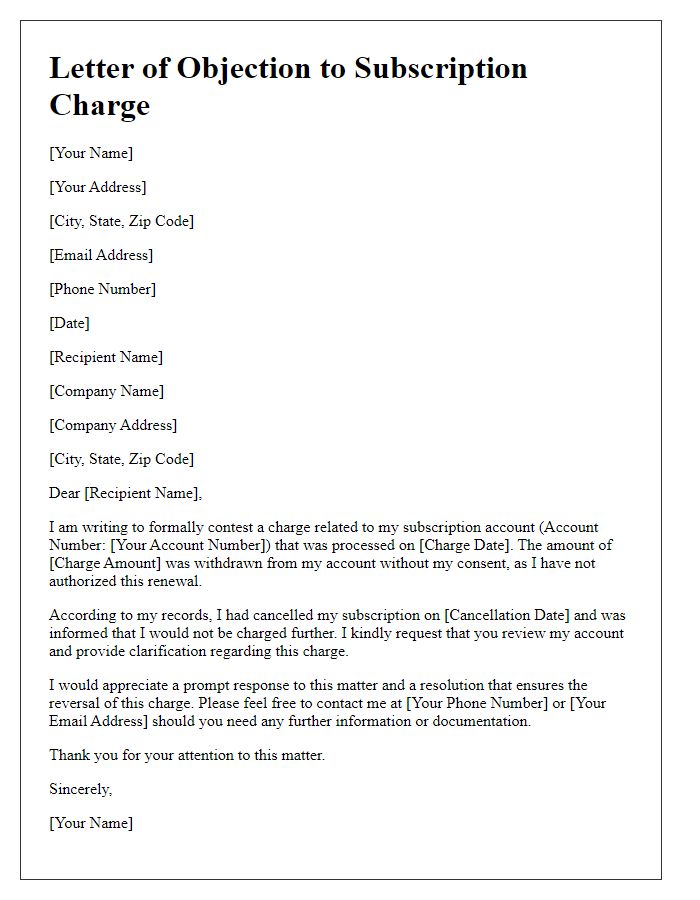

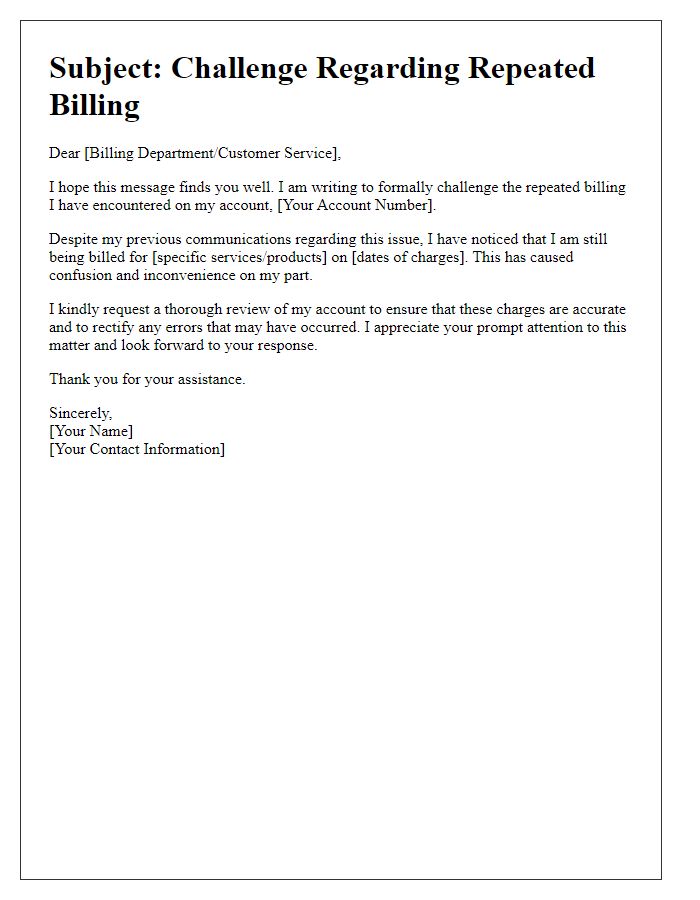

Customer account information and details

Recurring service charges can frequently cause confusion among customers, particularly in subscription-based services like telecommunications or online streaming. Customers facing discrepancies in their bills, such as unauthorized recurring charges or unexpected price increases, often reach out to customer service for clarification. Important details include the customer account number, which uniquely identifies the subscriber, billing cycle (monthly, quarterly), and date of last payment. Providing a detailed overview of previous charges, including the nature of services rendered, helps in resolving disputes efficiently. Documentation such as copies of invoices and communication with support representatives can further support claims, facilitating a clearer understanding of any billing anomalies.

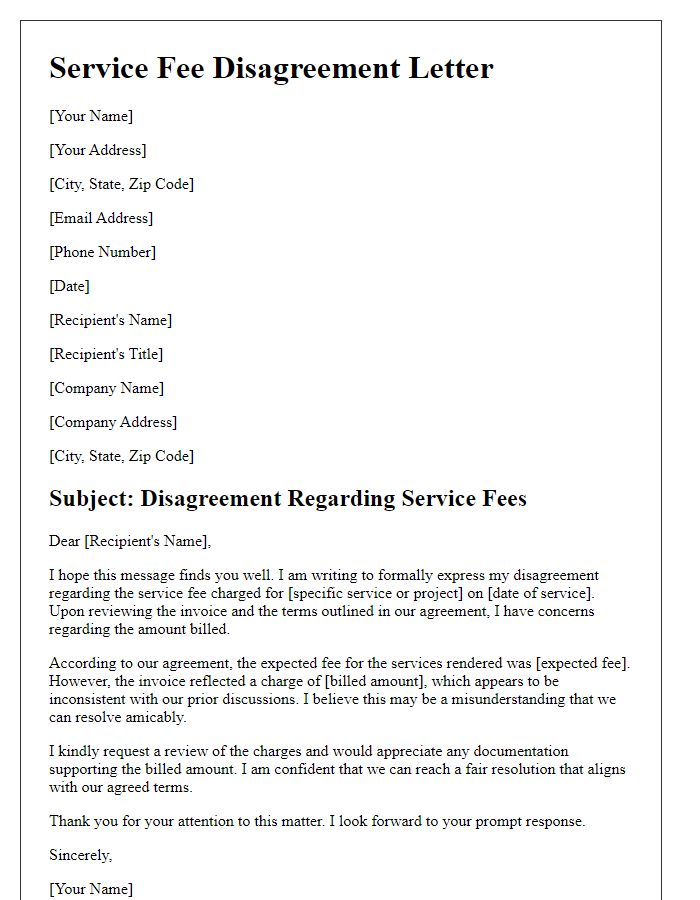

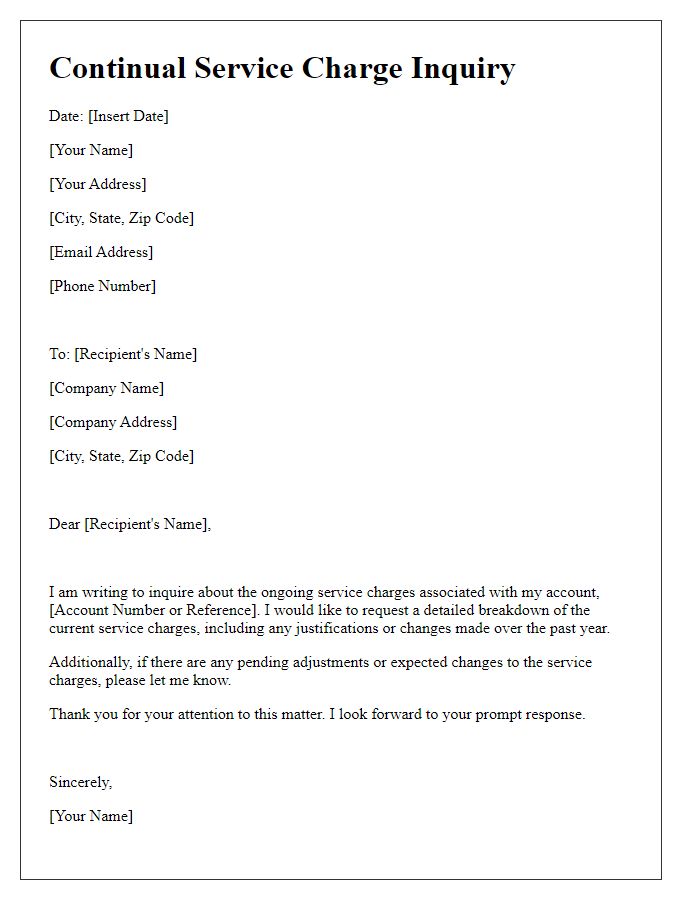

Explicit description of the dispute and issue

Recurring service charges can lead to financial discrepancies in customer accounts, particularly in the case of unauthorized fees. High transaction amounts (such as $49.99 for monthly subscriptions) can accumulate over time, resulting in unexpected financial burdens. In this instance, the customer (based in New York City) identified a monthly charge discrepancy on their bank statement dated March 1, 2023, and subsequently contacted customer support. Discrepancies arise when services (like streaming subscriptions or gym memberships) are billed without proper notification or lack of clear service agreements. Prompt resolution is crucial as continued unauthorized charges can lead to account suspension and reputational damage for the service provider. Detailed documentation of each transaction should accompany the dispute for clarity and resolution.

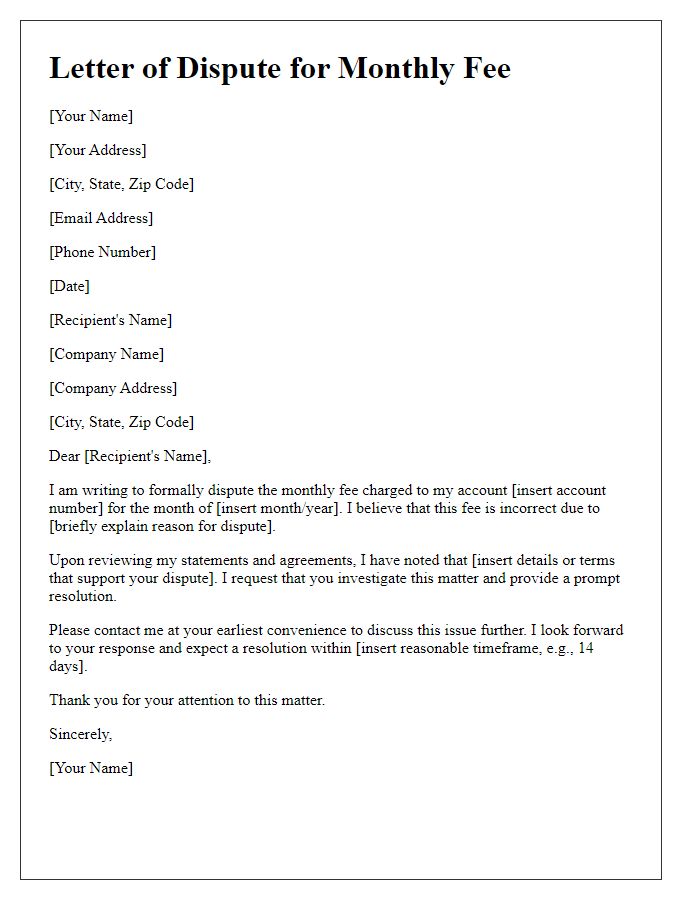

Supporting documents and evidence

Recurring service charges often spark disputes, particularly when customers notice inconsistencies in billing. Supporting documents such as account statements detailing charge dates and amounts can substantiate claims. Evidence may include service agreements outlining terms and conditions relating to fees. Screenshots demonstrating discrepancies between agreed upon charges and those billed are also vital. Further, correspondence with customer service representatives can illustrate attempts to resolve the issue. Documented timelines of service interruptions or changes may provide context, enhancing credibility in the dispute. Accurate and comprehensive documentation strengthens a case, demonstrating diligence in addressing recurring charges.

Request for resolution or adjustment

Recurring service charges, often seen in subscription services like digital platforms or utilities, can lead to disputes. Instances may arise when customers discover unexpected monthly fees, sometimes resulting from automated renewals or price adjustments. These charges, frequently listed as "service fees" or "administrative costs" on billing statements, can catch clients off guard if proper notification isn't provided. Customers can seek resolution by contacting customer service departments, usually through dedicated support lines or email channels, detailing specific charges, account numbers, and dates of billing discrepancies. Documentation, such as previous correspondence or account agreements, often helps facilitate quicker resolutions and potential adjustments to erroneous charges.

Comments