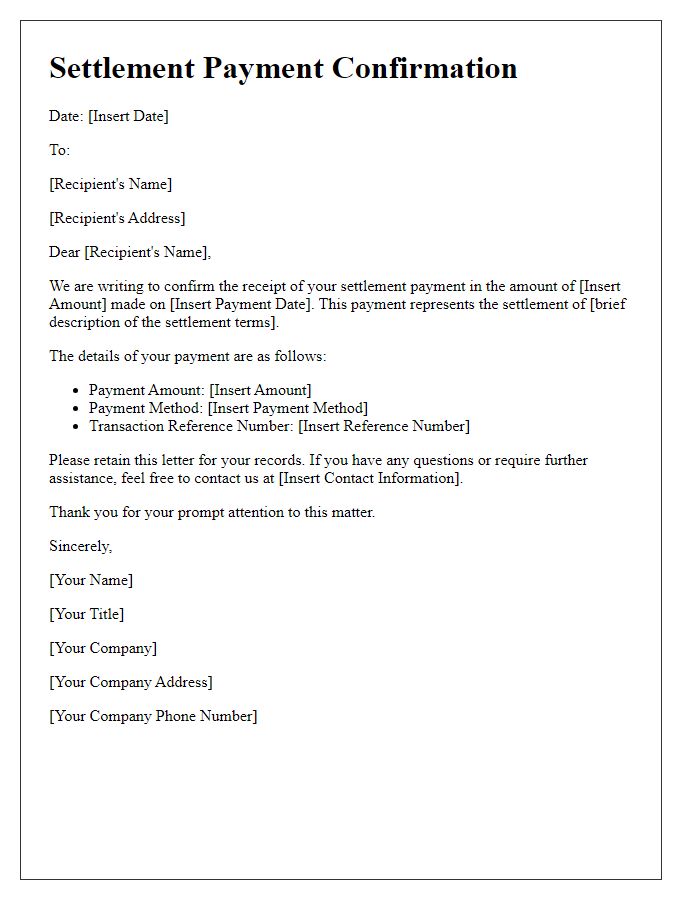

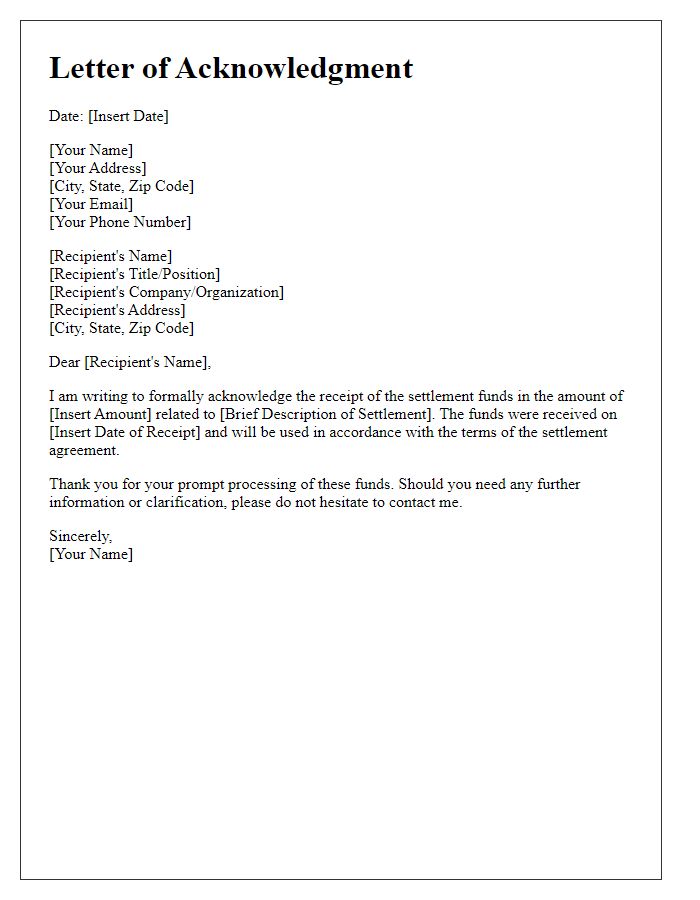

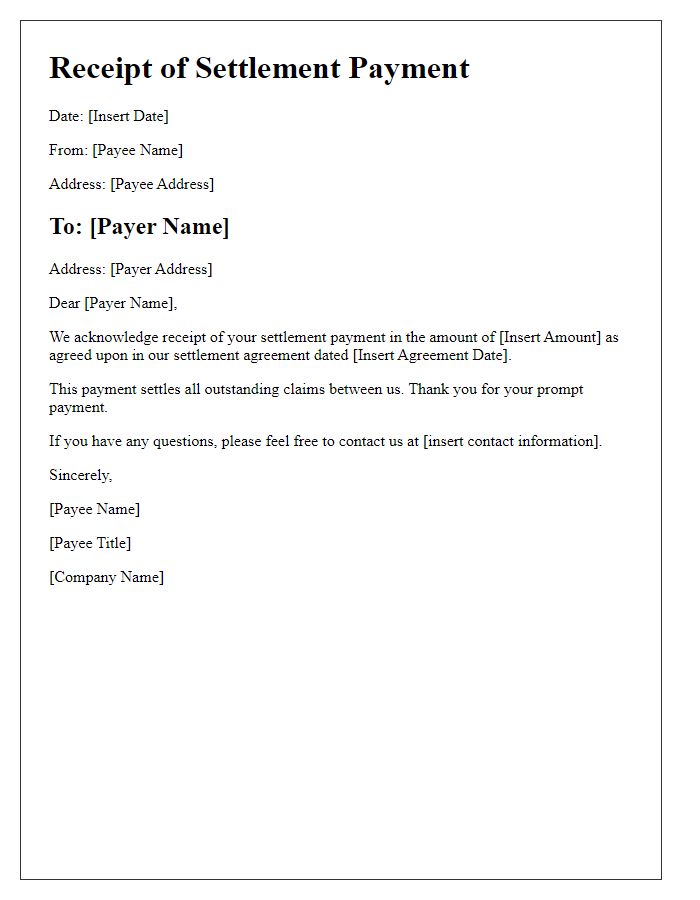

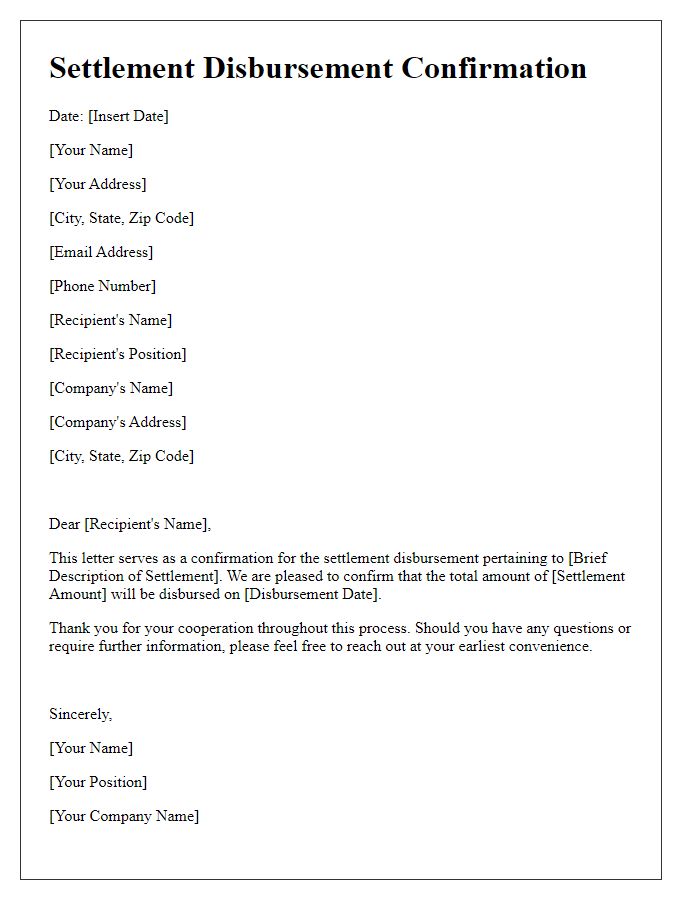

When it comes to settling financial matters, clear communication is key. A well-crafted acknowledgment letter not only confirms receipt of a payment but also lays the groundwork for a smooth transaction process. It's essential to convey gratitude and outline any pertinent details regarding the settlement. Interested in learning how to create the perfect letter template for your needs? Read on!

Clear Identification of Parties

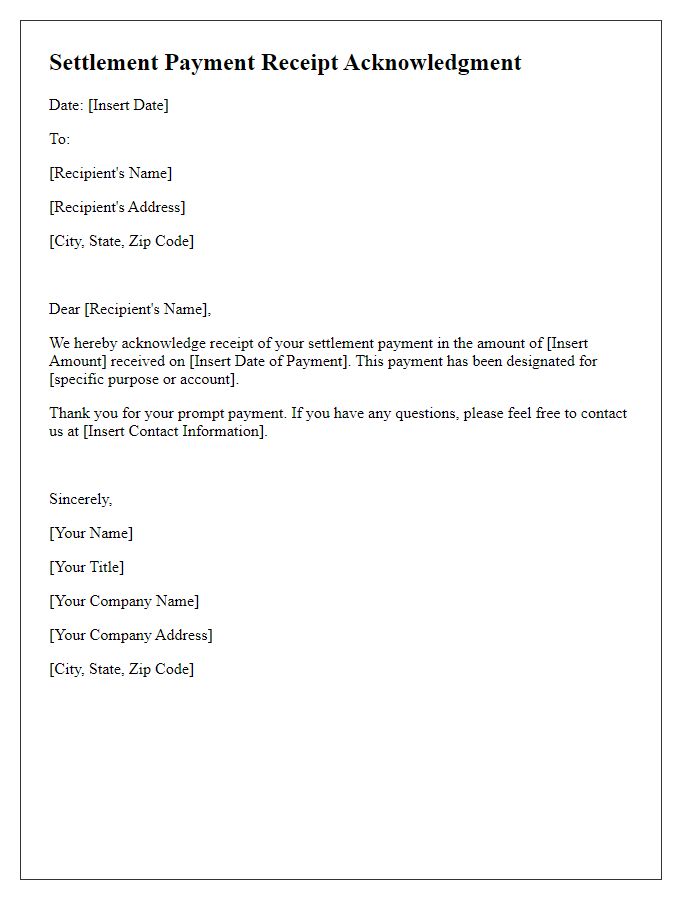

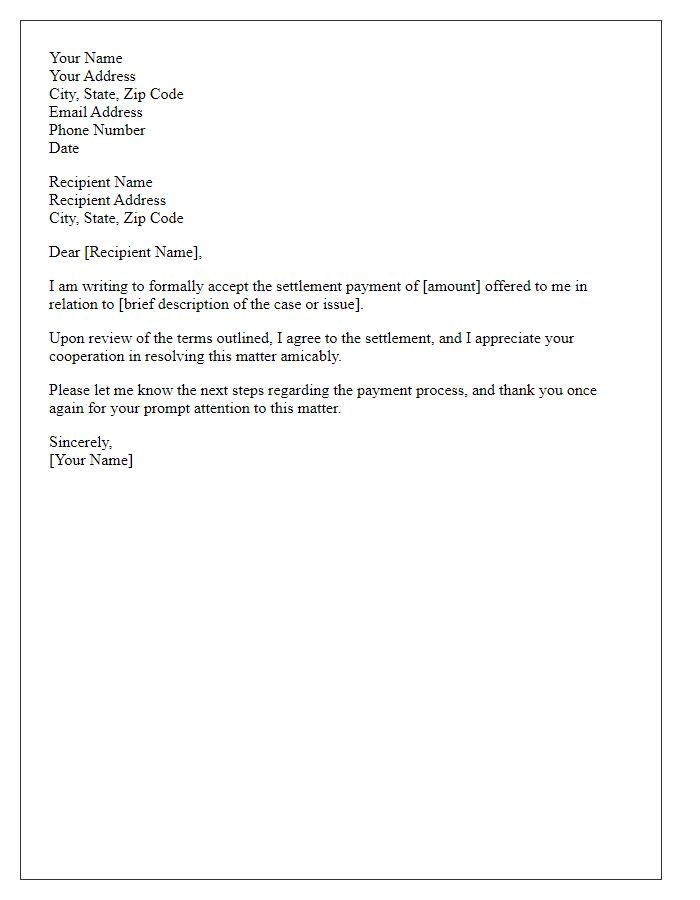

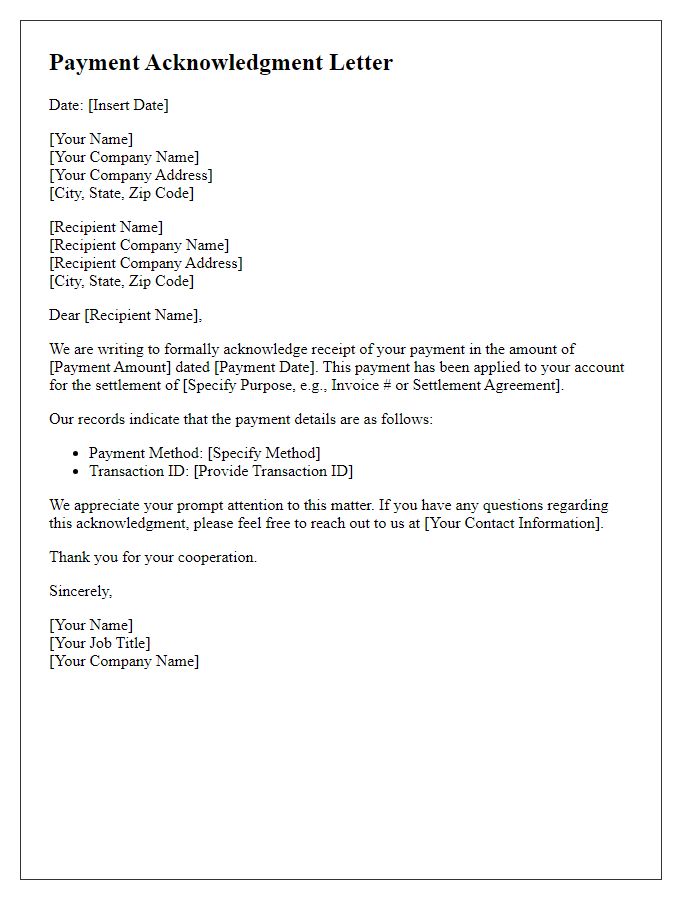

The settlement payment acknowledgment typically includes essential information such as names, addresses, and contact details of both parties involved in the agreement. The "Claimant," such as John Doe residing at 123 Main Street, New York, must be clearly identified alongside the "Respondent," for instance, ABC Corporation located at 456 Elm Avenue, Los Angeles. Furthermore, the date of the acknowledgment along with case or settlement reference numbers aids in precise identification and record-keeping. A clear mention of the terms of the settlement, including payment amounts and deadlines, establishes accountability and expectations for both parties. Proper documentation ensures transparency and fosters trust, crucial in post-litigation scenarios.

Settlement Amount and Terms

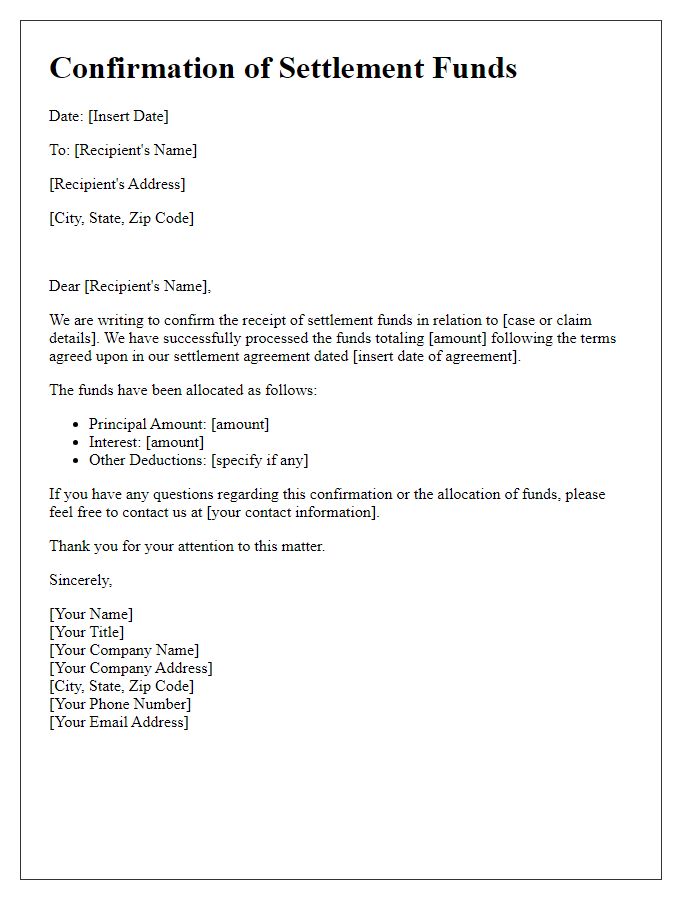

Acknowledgment of settlement payment illustrates the agreement reached. Defined settlement amount of $50,000 is specified in the resolution negotiated between the involved parties. Terms include payment due date of December 15, 2023, with payments distributed in four installments. First installment of $12,500 is to be paid upon signing the acknowledgment. Remaining three installments scheduled for January 15, February 15, and March 15, 2024. The agreement requires confirmation of receipt for each payment. Additionally, any delays beyond the due dates will incur a late fee of 5% of the installment amount. Signed documentation validates the acceptance of these terms, ensuring both parties' adherence.

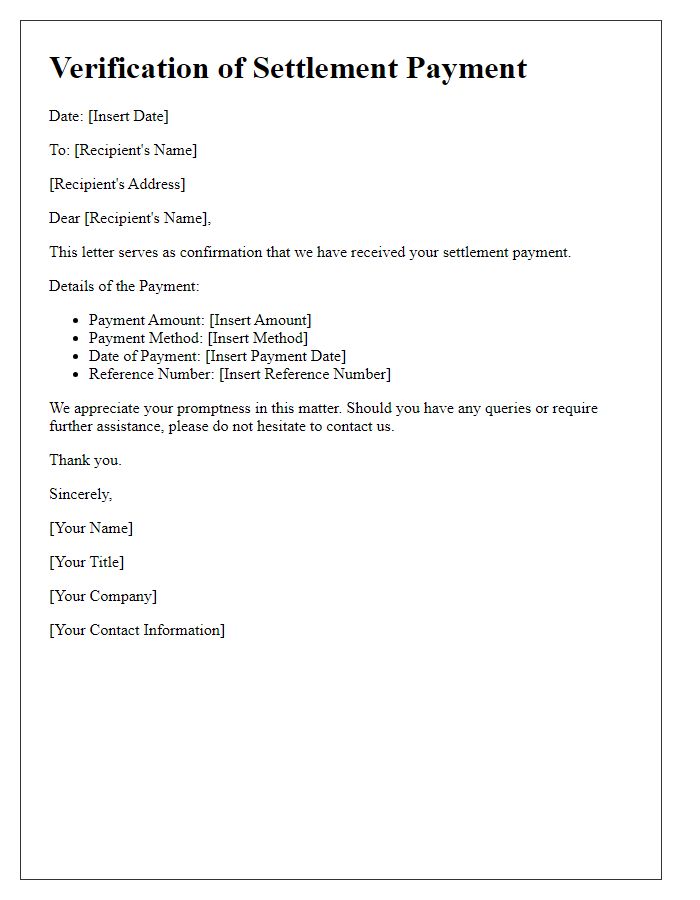

Date of Payment and Receipt Confirmation

Date of Payment serves as the official record indicating when funds were transferred to settle an obligation, ensuring clear financial documentation for both parties involved in the transaction. Receipt Confirmation acts as verification that the payment has been successfully received by the creditor, creating an acknowledgment of the settlement agreement's fulfillment. This confirmation often includes transaction reference numbers or associated documentation such as bank statements, providing transparency and accounting accuracy for financial reconciliation. Such acknowledgments are essential in legal contexts and financial audits, reinforcing trust and accountability in business relations.

Release and Discharge Clauses

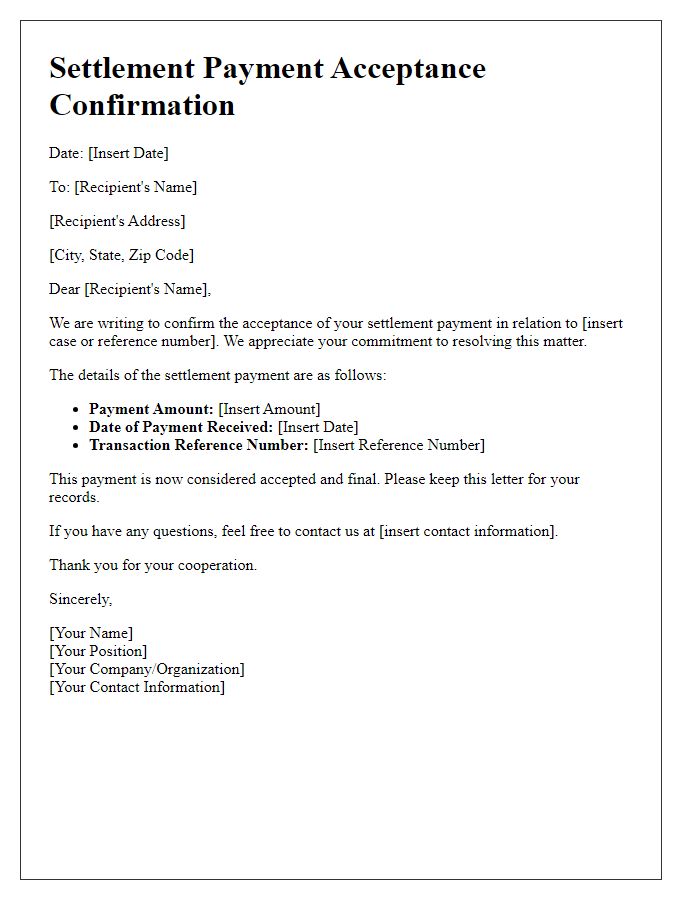

In the settlement payment acknowledgment process, several key elements must be included. The agreement serves to confirm the receipt of a financial settlement, specifying the amount received, often noted in U.S. dollars, and the date of the transaction. Under the Release clause, the individual acknowledges that upon receiving the settlement, they relinquish any further claims or demands against the entity involved, typically named as the other party in legal matters. The Discharge clause affirms that any legal obligations or disputes related to the case have been resolved. In many instances, this settlement may involve specific legal cases from jurisdictions such as California or New York, which could affect the terms stated. The acknowledgment should also include the signatures of both parties and may reference case numbers for official documentation.

Confidentiality and Non-Disclosure Agreements

Settlement payment acknowledgment serves as a formal confirmation of receipt for funds received through legal or contractual agreements. These documents often pertain to disputes resolved outside of court. Confidentiality clauses, typically included in these agreements, protect sensitive information from being disclosed publicly. Non-Disclosure Agreements (NDAs) reinforce this confidentiality, prohibiting parties from sharing details about the settlement terms or processes. For example, a settlement of $50,000 related to a business contract dispute might be outlined in this acknowledgment, ensuring both sides are legally bound to maintain privacy. Violating these agreements can result in legal repercussions, emphasizing the importance of securing financial and personal information in sensitive negotiations.

Comments