Are you tired of dealing with payment discrepancies that seem to pop up out of nowhere? You're not alone; many face the challenge of ensuring their accounts align perfectly. This article will guide you through a simple but effective letter template designed to resolve payment discrepancies quickly and professionally. So, grab a cup of coffee and join us as we explore the best way to tackle this issue!

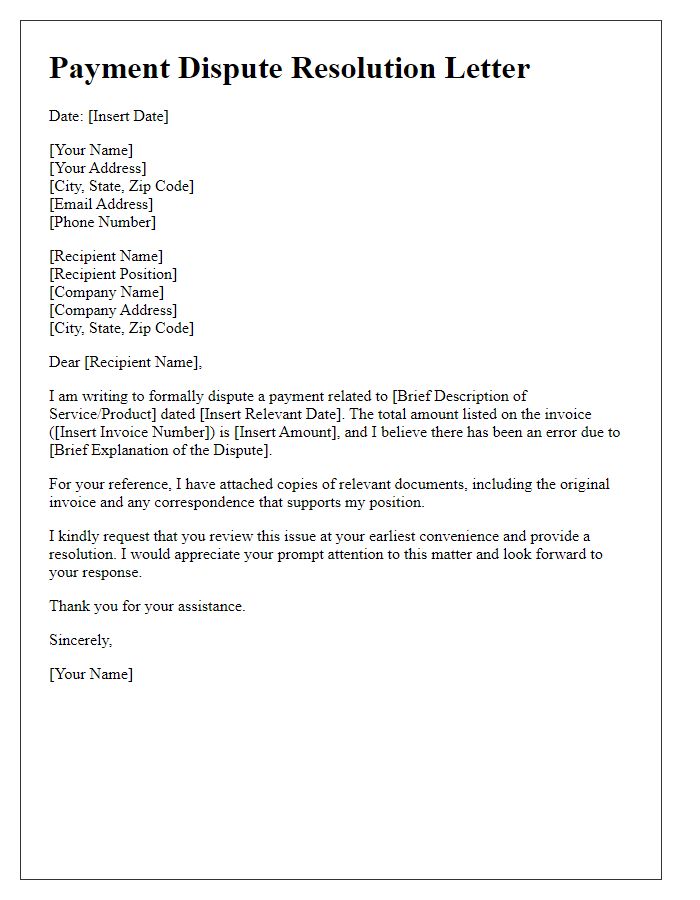

Clear subject line and header

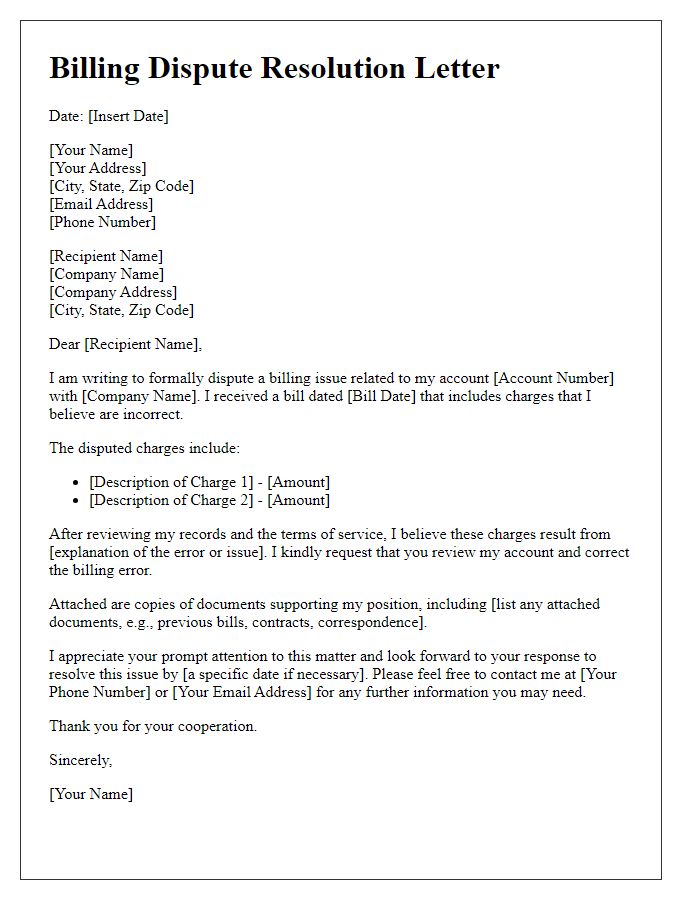

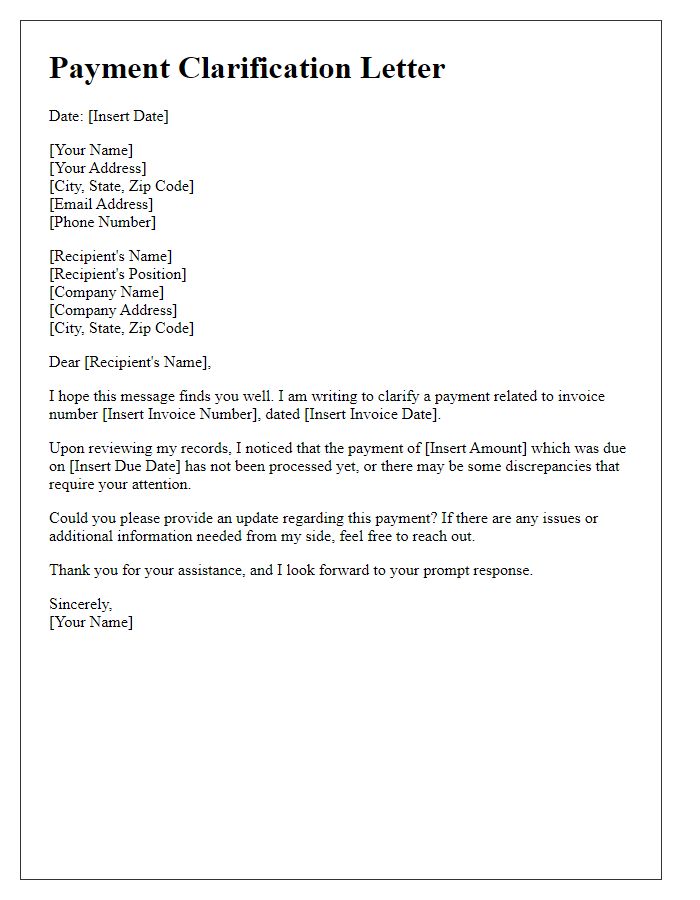

A payment discrepancy can disrupt financial operations for businesses, leading to unresolved issues in accounts receivable. Timely communication (ideally within 48 hours) is essential to initiate resolution. Include a clear subject line such as "Urgent: Payment Discrepancy Resolution Required." The header should display relevant details like the invoice number (e.g., INV-2023-0456), date, and transaction amount ($2,500). Attach necessary documentation, such as payment receipts or bank statements, to support the claim. Properly identifying the involved parties (e.g., supplier name, contact information) enhances clarity. Utilize professional language to convey urgency while remaining cordial, ensuring a cooperative approach to resolving the financial issue promptly.

Precise details of the payment discrepancy

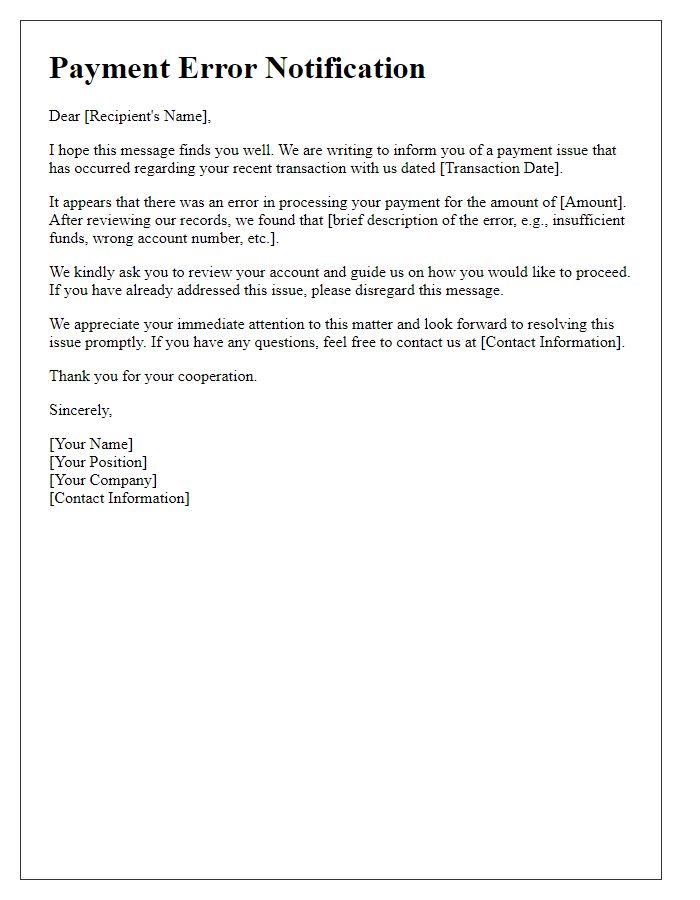

Payment discrepancies can cause significant issues for businesses and customers alike, stemming from factors such as incorrect invoice amounts, duplicate charges, or missed payments. For instance, an erroneous charge of $250 on a July 2023 invoice from XYZ Corporation could lead to cash flow challenges, adversely affecting operations. Missing required documentation, such as purchase orders or receipts, complicates the resolution process. Timely communication with the finance department is crucial, as delays can hinder expeditious resolution. Clarifying the specific nature of the discrepancy--whether it's related to a payment dated August 15, 2023, or an unrecognized credit--enables swift investigation. Keeping detailed records, such as transaction statements and correspondence, facilitates reaching a satisfactory resolution promptly.

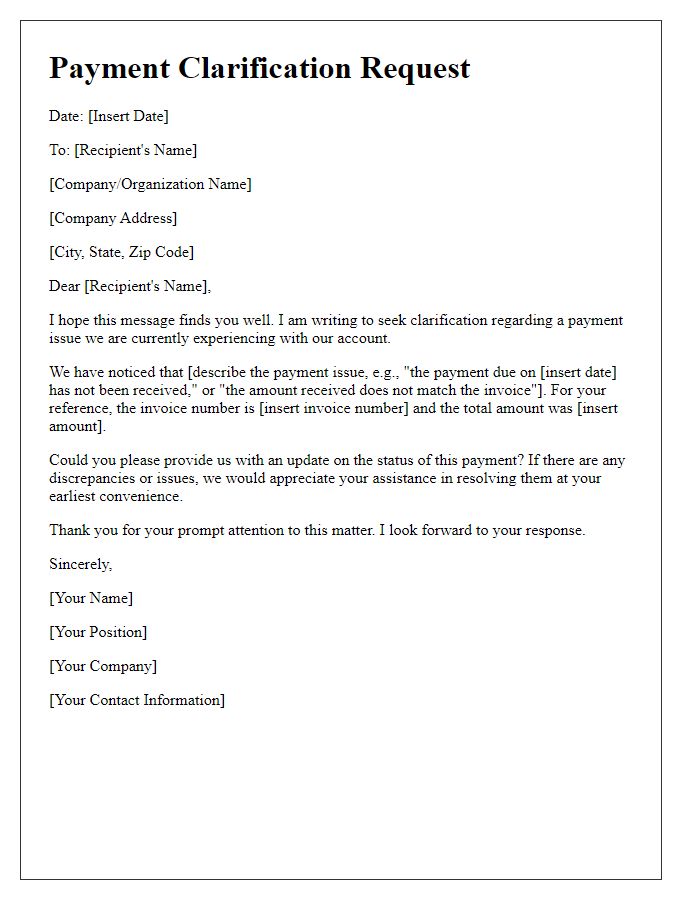

Contact information for further communication

Payment discrepancies can arise, leading to potential financial misunderstandings between businesses and clients. Common issues include invoice errors (such as incorrect amounts or missing items), payment delays (often due to banking processing times), and misapplied payments (where funds are credited to the wrong account). Maintaining clear documentation, such as invoices and payment confirmations, is crucial in resolving these discrepancies. In many instances, reaching out via email or phone to the accounts receivable department can facilitate quicker resolutions. It is recommended to include detailed transaction references (like invoice numbers or payment dates) in communications to streamline the correction process.

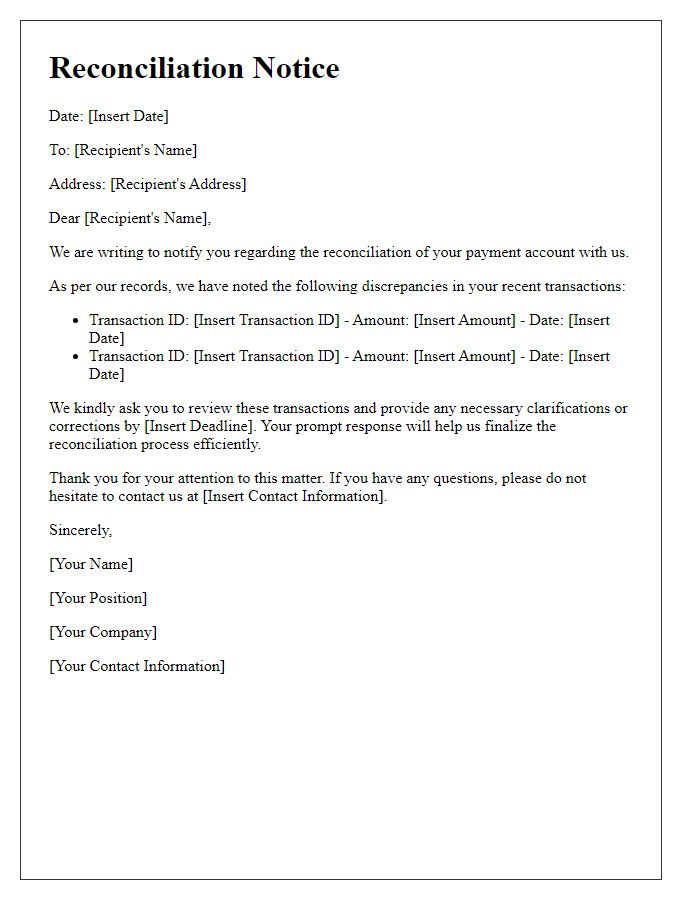

Proposed resolution and timeline

In addressing payment discrepancies, a proposed resolution may involve a thorough review of transaction records and invoices related to the disputed payments. For instance, examining the invoice dated August 15, 2023, and matching it with the bank statement from XYZ Bank can clarify any inconsistencies. Additionally, both parties should establish a clear timeline: initiate this review process by September 1, 2023, conduct follow-up communications by September 15, 2023, and aim for final resolution or payment adjustments by September 30, 2023. Clear communication throughout this timeline is essential for maintaining positive business relations and ensuring that all discrepancies are resolved effectively.

Professional and courteous tone

Payment discrepancies can often arise in business transactions, leading to misunderstandings and delays. It is essential to address these issues promptly to maintain good relationships. In such cases, businesses should outline specific details for clarity, including transaction dates, invoice numbers, and amounts involved. Clear communication with timelines for resolution, such as a 14-day period for adjustments, is crucial. The mention of previous correspondence regarding the issue can reinforce urgency and context. A professional tone, emphasizing cooperation and willingness to resolve the matter, contributes to a constructive dialogue, ultimately fostering trust and collaboration between involved parties.

Comments