Are you looking to gain insights into your financial standing? Requesting your credit history is a crucial step in understanding your creditworthiness and preparing for future financial endeavors. In this article, we'll guide you through the process of crafting a simple yet effective letter to obtain your credit report. So, if you're ready to take control of your financial future, read on for helpful tips and a handy template!

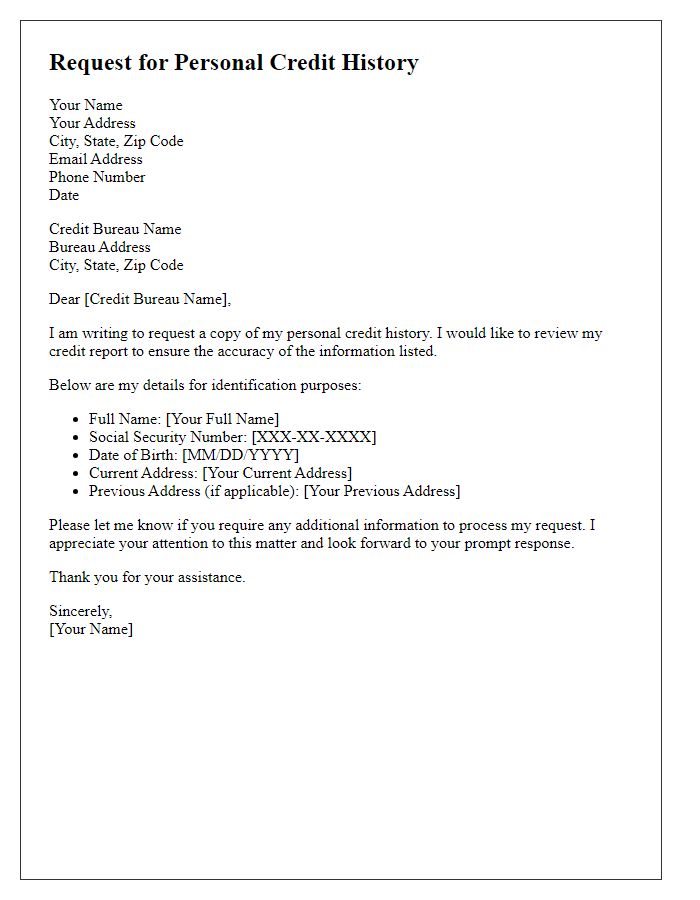

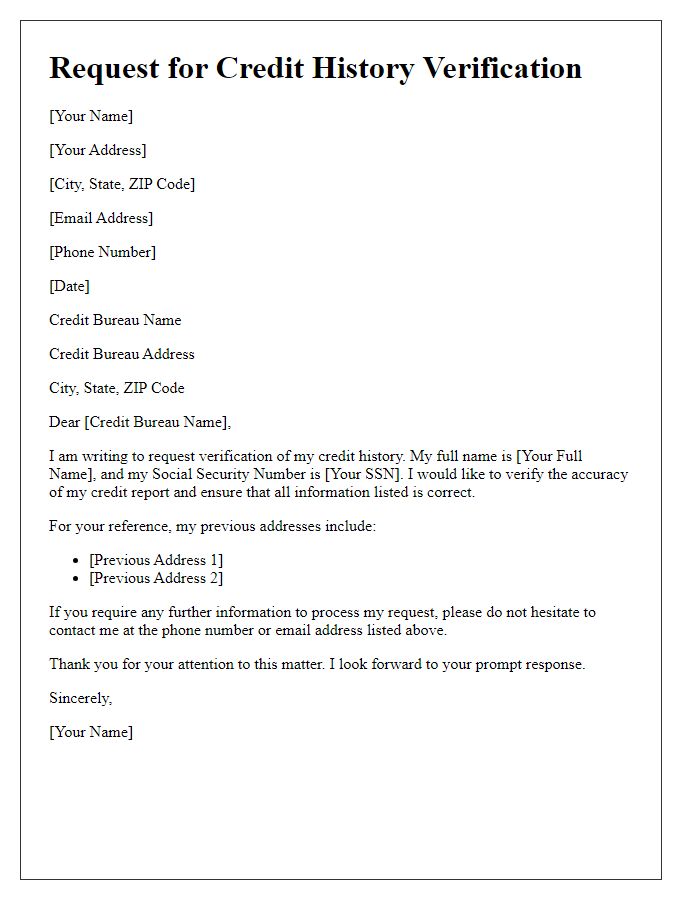

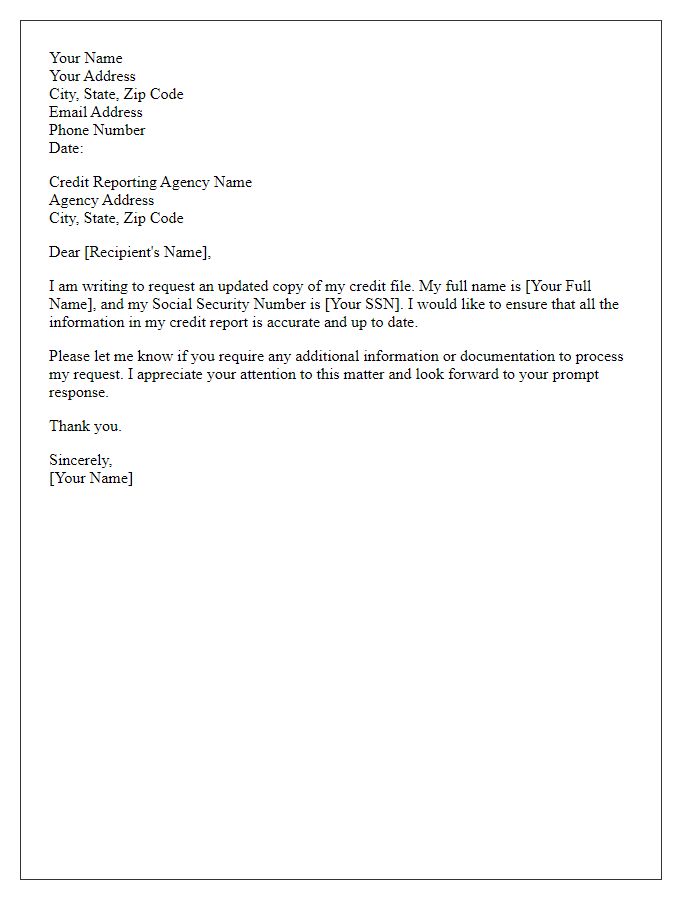

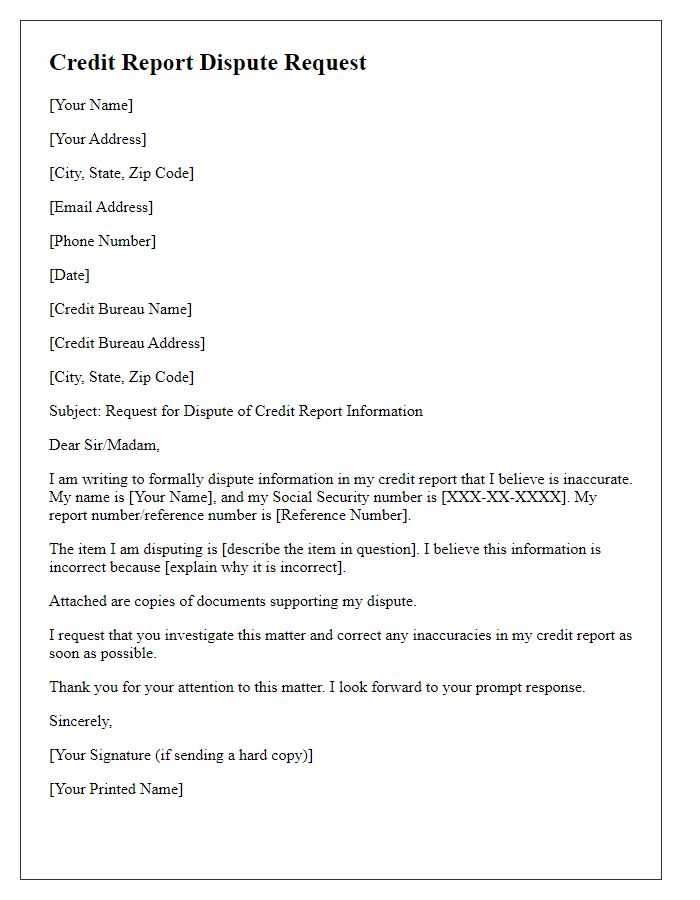

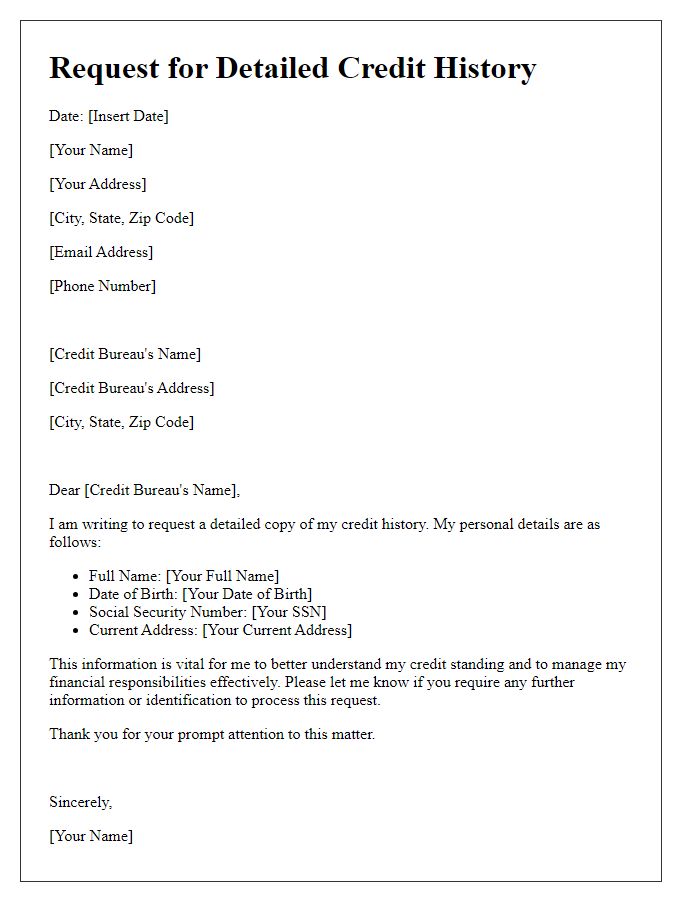

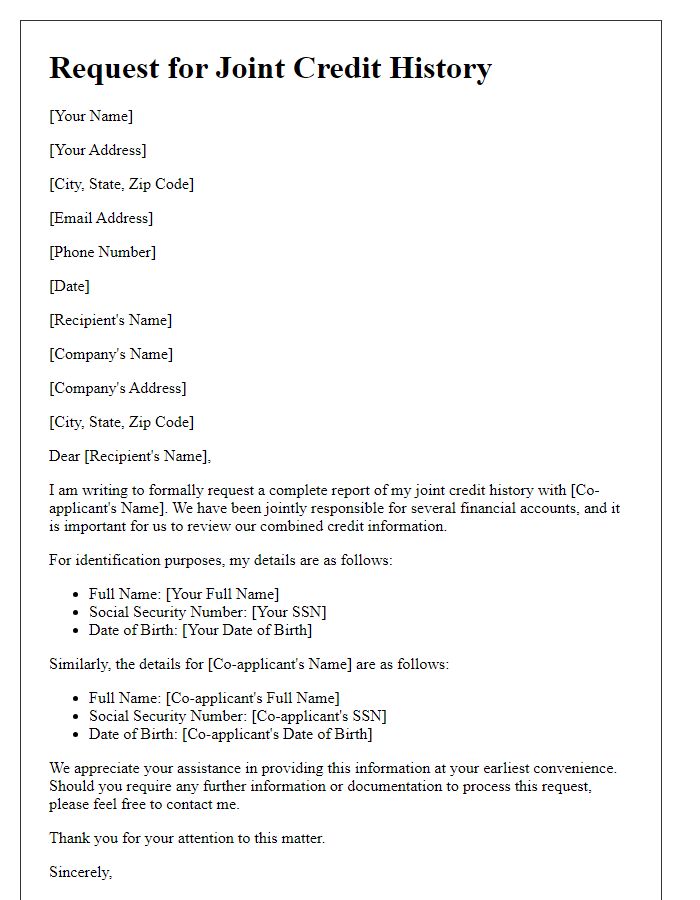

Personal Information

Requesting a credit history report is essential for individuals seeking to understand their credit standing. A typical request includes the individual's name (first and last), Social Security Number (for accurate identification), date of birth, and current address (including city, state, and zip code). Additionally, past addresses may be included to trace credit history accurately, especially if the individual has moved frequently. The request should specify the purpose, such as applying for a mortgage or personal loan, to assist credit bureaus in processing the request efficiently. Mentioning preferred methods of delivery (email or postal mail) may also expedite the process, ensuring timely receipt of the credit report.

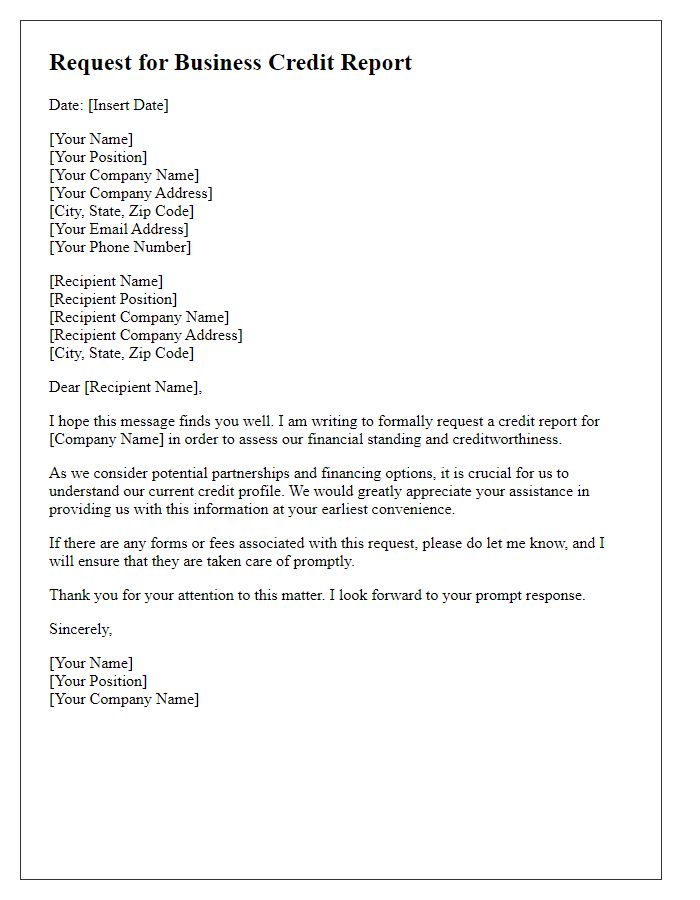

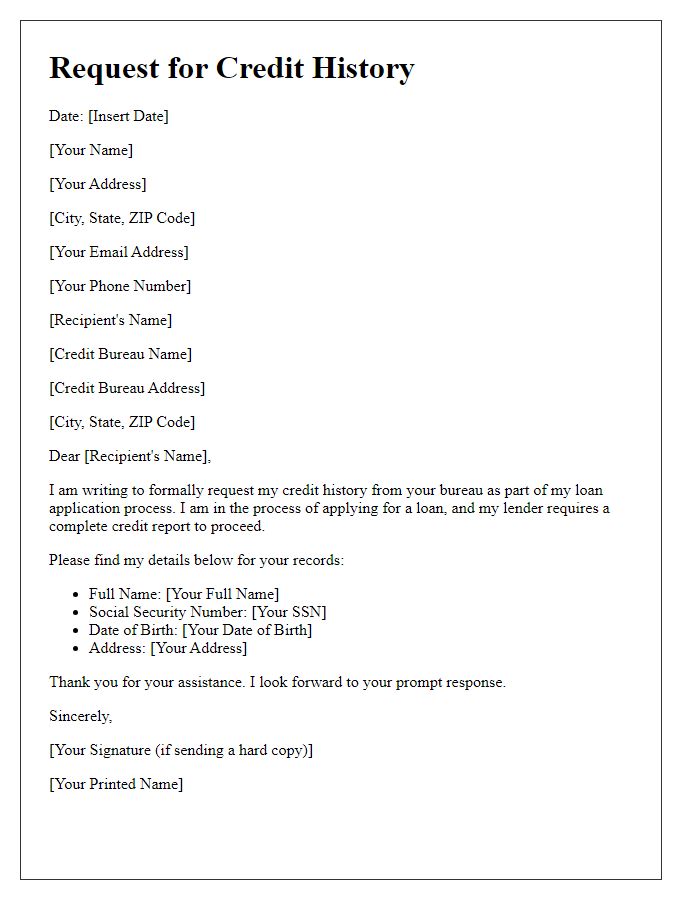

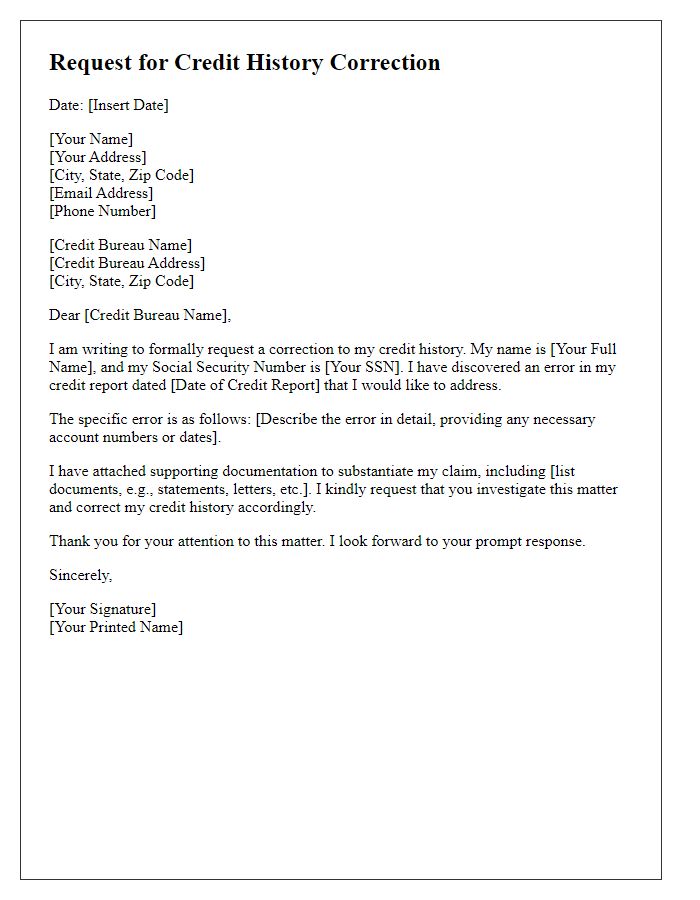

Recipient Details

Requesting a credit history report requires a precise format to ensure all necessary information is conveyed clearly. The recipient details should include the name of the credit bureau, such as Experian, Equifax, or TransUnion, followed by their official mailing address including the street name, city, state, and zip code. Additionally, including the contact number for inquiries can facilitate any further communication regarding the request. Providing a formal salutation using the appropriate title, like "Dear Customer Service," sets a professional tone for the letter.

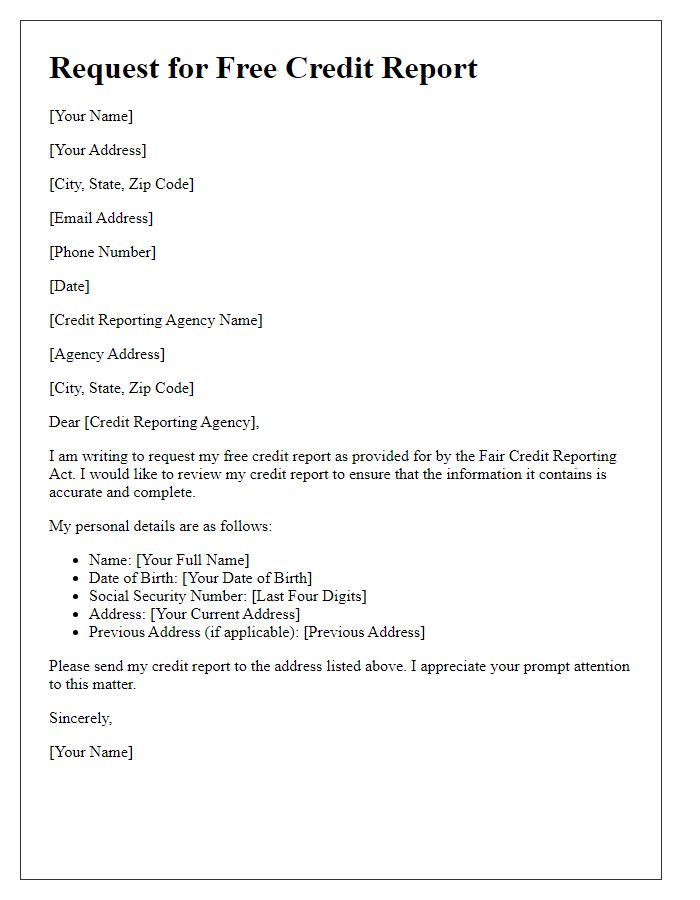

Purpose of Request

Requesting a credit history report is essential for numerous financial decisions. Individuals often seek this information when applying for loans, mortgages, or rental agreements. Credit history outlines an individual's borrowing behavior, detailing payment history across various institutions, such as banks and credit card companies. It may include significant data points like outstanding debts, length of credit accounts, and any bankruptcies or defaults recorded in the past seven to ten years. Accessing this report allows lenders to assess creditworthiness, influencing interest rates and approval odds. Obtaining a personal credit history can also aid in identifying inaccuracies or fraudulent activities, ensuring consumers maintain a healthy financial profile.

Consent and Authorization

The request for credit history requires a clear expression of consent and authorization from the individual. Significant details include providing personal identification information, such as full name, Social Security number (SSN), date of birth, and current address. This data helps credit reporting agencies, like Experian or TransUnion, to verify identity and retrieve accurate credit reports. Additionally, specifying the purpose of the request, whether for loan applications, renting, or employment, enhances the context of the request. It is also advisable to attach a government-issued ID, like a driver's license, to prevent identity theft and ensure compliance with the Fair Credit Reporting Act (FCRA). A clearly defined timeframe for the response, preferably within 30 days, should also be included to ensure timely processing.

Contact Information

To obtain a comprehensive credit history, individuals must contact credit reporting agencies such as Experian, TransUnion, or Equifax. Each agency maintains detailed records of credit accounts, payment history, and inquiries, all crucial for understanding creditworthiness. Individuals should provide relevant personal details including full name, social security number, and current address to facilitate accurate processing of their request. Agencies typically allow access to credit reports annually under the Fair Credit Reporting Act (FCRA), enabling consumers to verify their credit status and resolve any discrepancies, ensuring responsible financial management.

Comments