Hey there! We're reaching out to remind you about the upcoming payment deadline that's just around the corner. Timely payments help keep everything running smoothly, and we want to ensure you have all the information you need to stay on track. So, if you're curious about how to manage your payments effectively, read on for some useful tips!

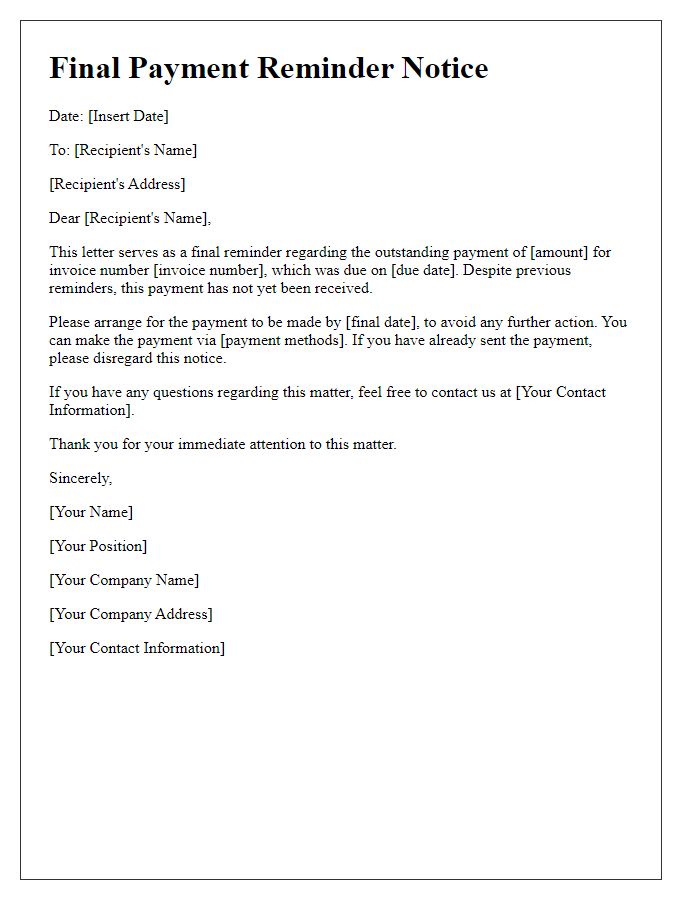

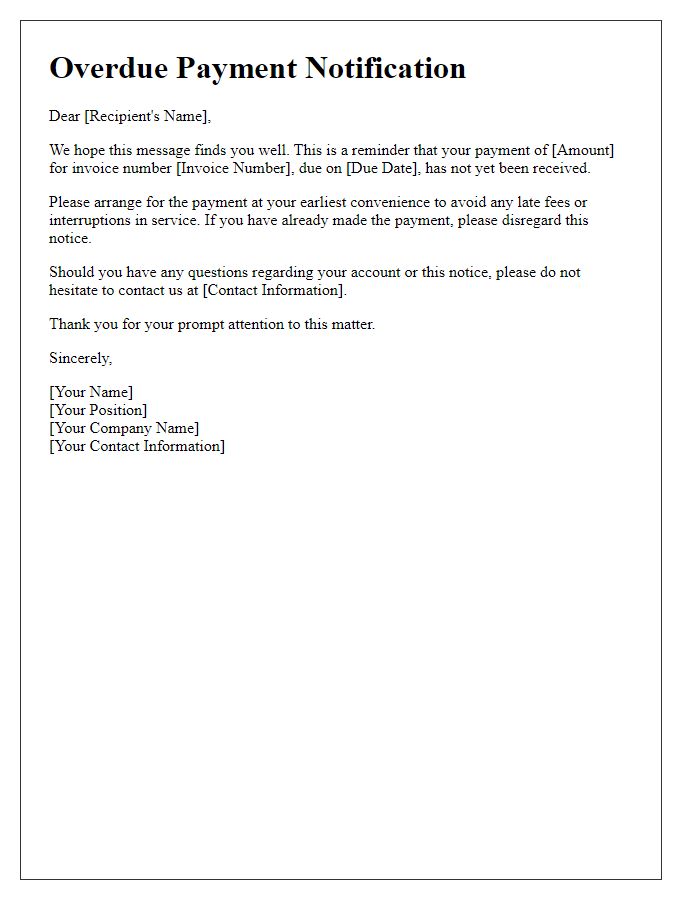

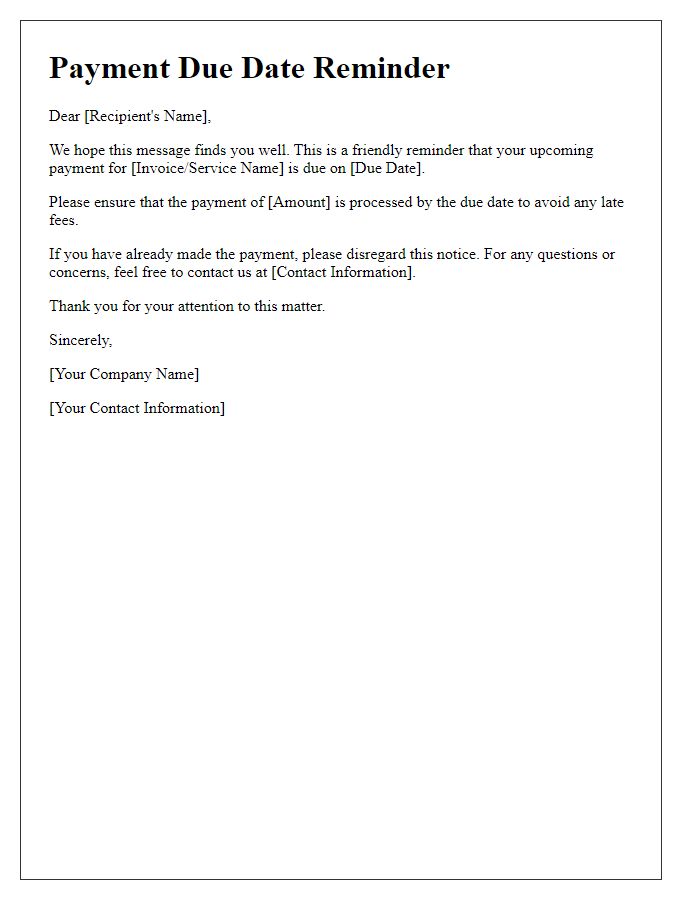

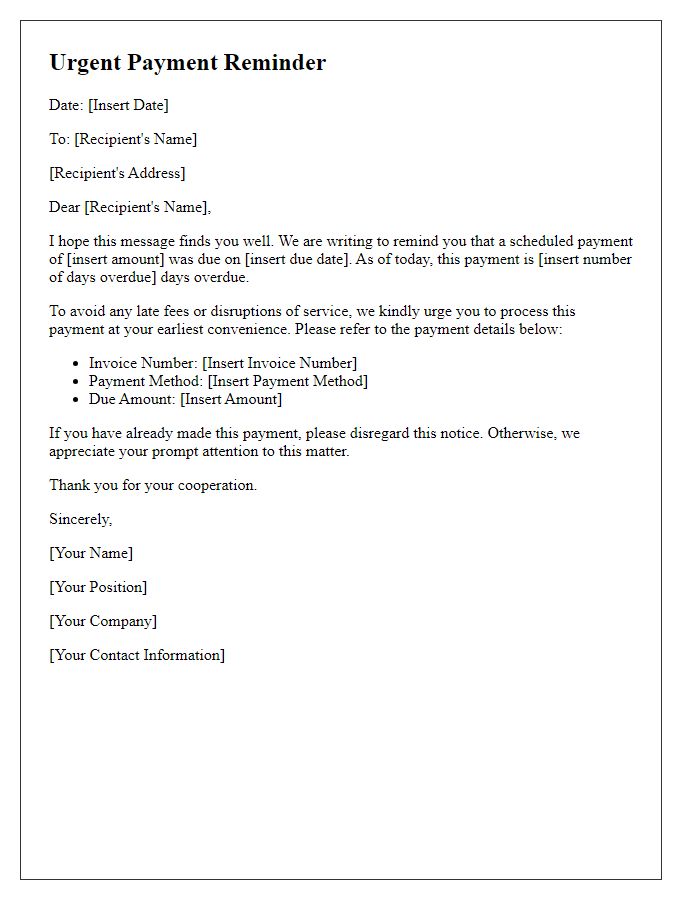

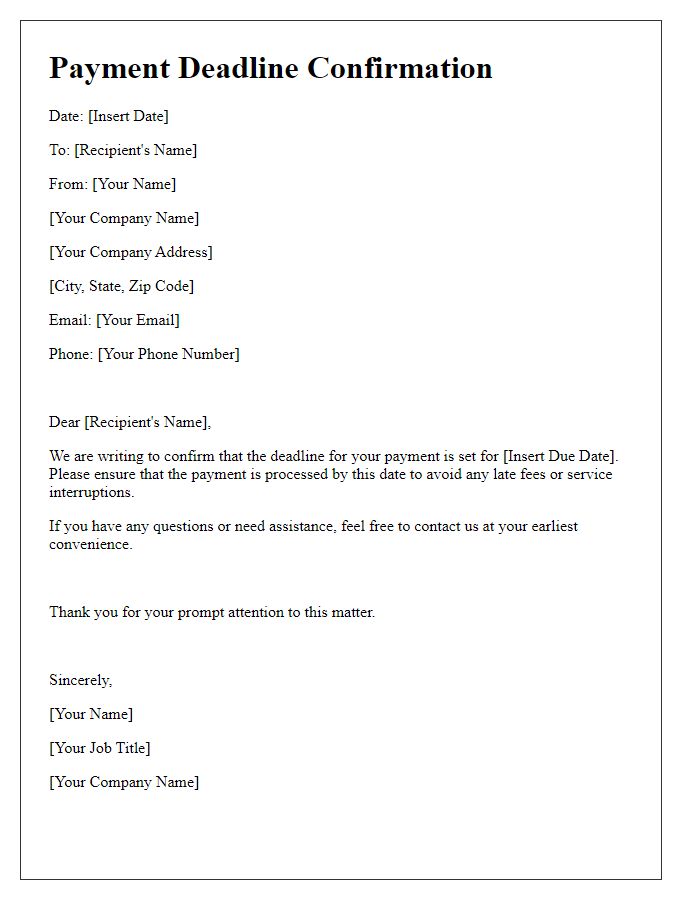

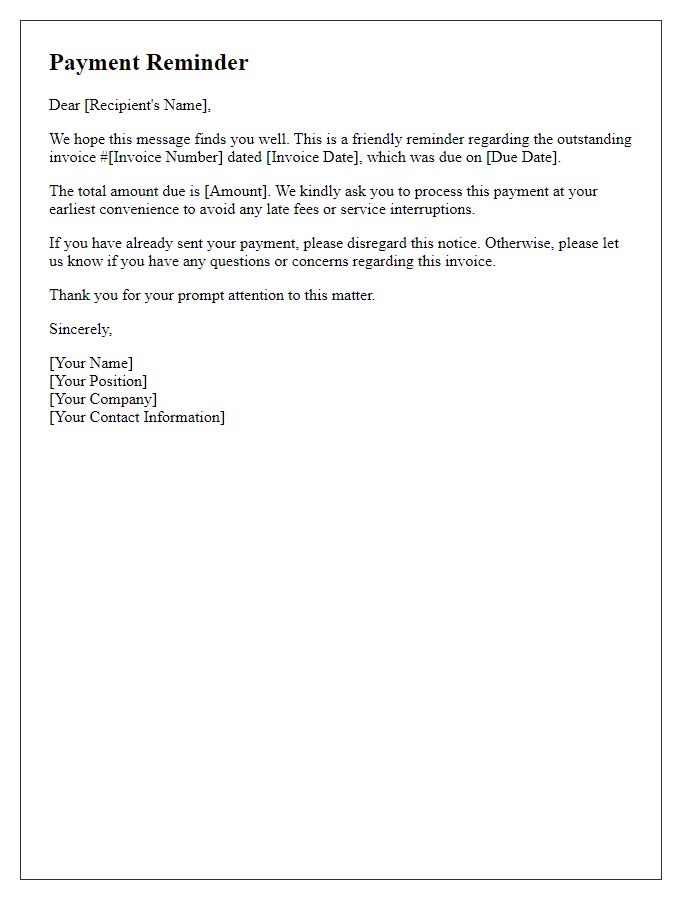

Polite tone

Invoices that remain unpaid past the due date can create complications for cash flow management within businesses. For example, failing to settle invoices within 30 days can lead to late fees or interest charges, depending on the terms established at the time of the transaction. Regular reminders, which may be sent out two weeks, one week, and then 48 hours before the deadline, can effectively prompt timely payments. Moreover, consistent communication fosters a dependable relationship between service providers and clients, ensuring satisfaction on both ends and reducing the risk of misunderstandings. Maintaining clear records of all communications is crucial to establishing accountability and fostering trust in business dealings.

Clear subject line

Subject lines play a crucial role in ensuring effective communication, especially in business interactions. A well-crafted subject line such as "Payment Deadline Reminder: Invoice #12345 Due on March 15, 2024" provides essential information upfront. It captures attention by specifying the purpose--payment deadline--and includes relevant details like the invoice number and due date. This approach increases the likelihood of timely action from recipients, as it minimizes ambiguity. Moreover, clarity in subject lines facilitates easier tracking and management of invoices, benefiting both senders and recipients in their financial exchanges.

Specific deadline date

Payment reminders are crucial for maintaining cash flow in businesses. A payment deadline is often specified as a date in a contract or invoice, such as March 15, 2024. On this day, clients are expected to fulfill their financial obligations, ensuring that companies receive due payments on time. Failure to meet this deadline may result in late fees or penalties outlined in agreements, emphasizing the importance of adhering to payment schedules. Effective communication before the deadline can foster positive relationships and prompt timely payments.

Consequences of late payment

Late payment can lead to several consequences for individuals and businesses alike. Increasing late fees may be implemented, often starting at 1.5% of the overdue amount per month, leading to financial strain. Furthermore, the borrower's credit score, recorded by credit reporting agencies such as Experian and TransUnion, can suffer significantly due to late payments, potentially decreasing by 100 points or more. This credit score decrease can impact future loan applications, resulting in higher interest rates or denials. Legal action may also ensue, with claims being filed in local courts if debts remain unpaid for an extended period, increasing overall cost due to legal fees. Ultimately, a consistent pattern of late payments can lead to a loss of trust with creditors, limiting future financial opportunities.

Contact information

Late payments can significantly impact cash flow for small businesses. A payment deadline reminder increases the likelihood of receiving overdue invoices. Effective communication channels, such as email or phone, are essential for clarity. Including specific payment amounts, due dates, and invoice numbers ensures thorough understanding. Utilizing polite language, emphasizing consequences, such as late fees, can foster timely responses. For example, a business may send reminders starting seven days before the due date, followed by a second reminder one day prior to the deadline. Accurate contact information, such as the accountant's business email address or direct phone line, is crucial for facilitating prompt communication.

Comments