Are you feeling overwhelmed by unpaid invoices? You're not alone, as many businesses face the challenge of chasing down payments. In this article, we'll provide a clear and effective letter template for issuing a final demand for payment that respects both your needs and those of your client. Ready to reclaim your dues and maintain a positive business relationship? Let's dive in!

Clear identification of parties involved.

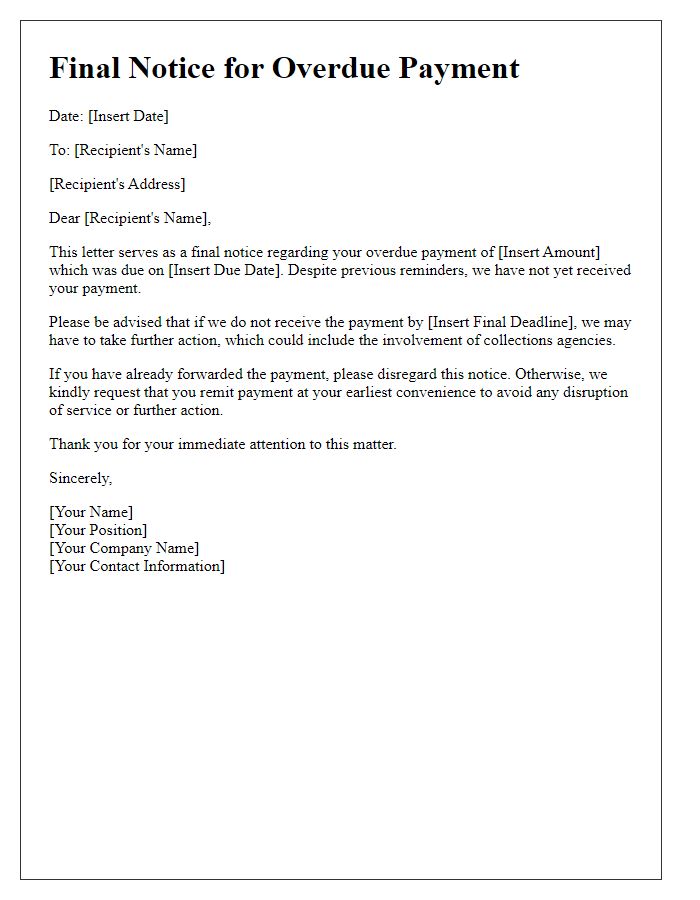

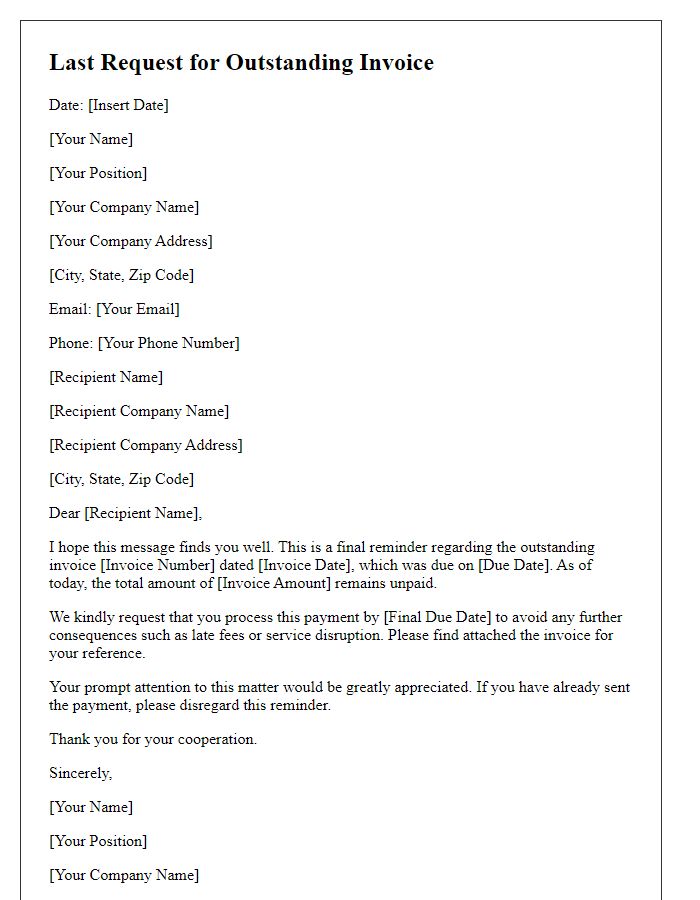

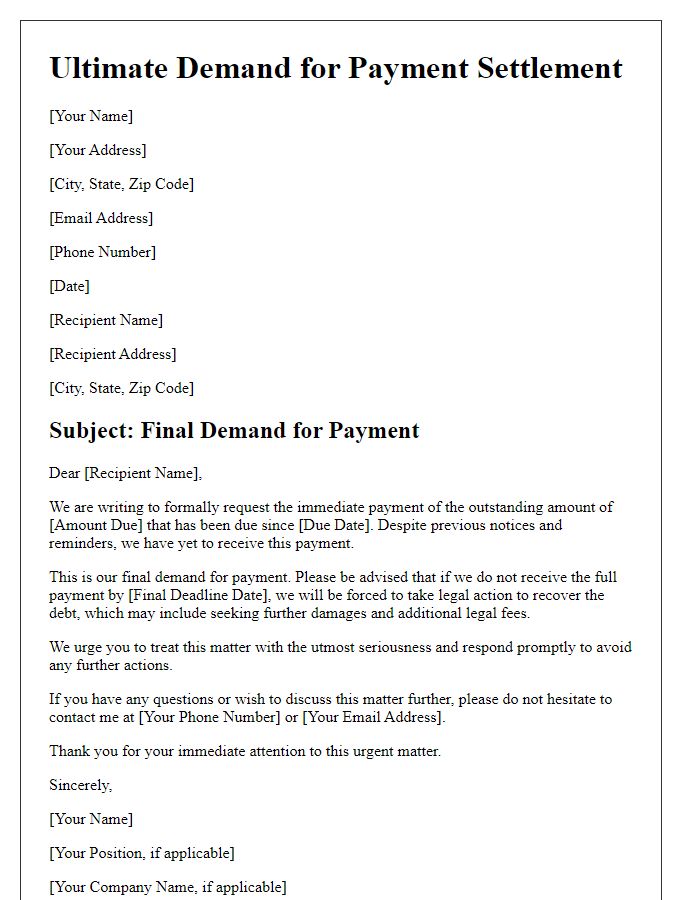

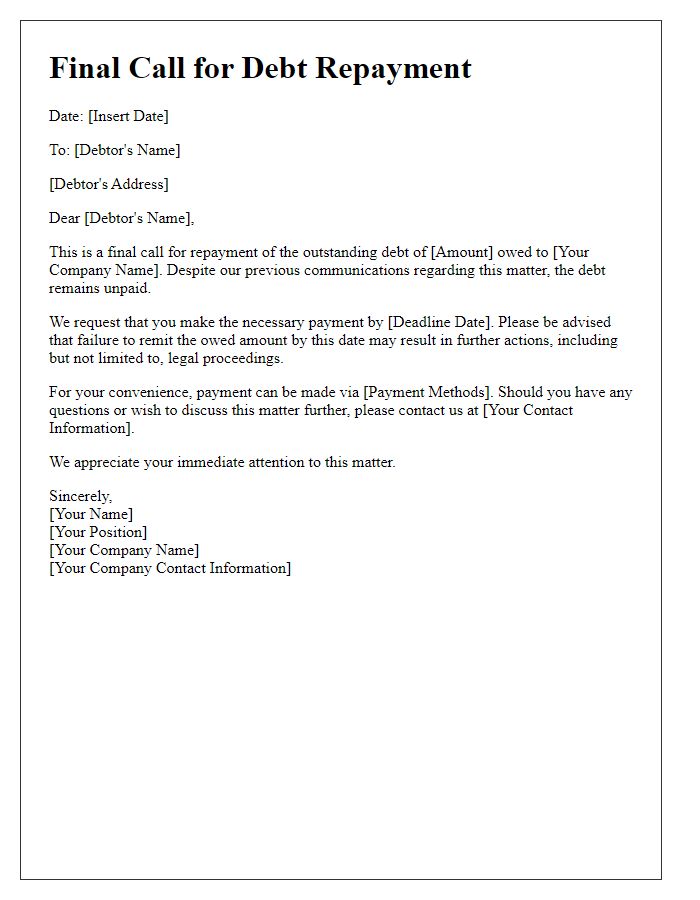

A final demand for payment must clearly identify all parties involved, providing necessary context and details. The sender's information must include the full name, address, and contact details, ensuring that the recipient can easily recognize who is requesting payment. The recipient's information should similarly feature their full name, address, and any relevant account or reference numbers that can assist in identifying the transaction in question. The document typically specifies the nature of the debt, such as unpaid invoices or overdue bills, along with the exact amount owed, including any applicable late fees or interest accrued. Dates of the original invoice and deadlines for payment should be highlighted to underscore urgency, while a description of any previous communication regarding the debt, such as notices or calls, should also be included to demonstrate due diligence. This comprehensive identification of parties and details establishes clear accountability and reinforces the seriousness of the demand.

Outstanding debt details and payment terms.

Outstanding debts create significant financial strain on businesses and relationships. A final demand for payment serves as a crucial reminder for overdue invoices typically exceeding thirty days. Relevant details include the invoice number (identifier for record-keeping), the amount owed (clear statement of financial obligation), and the payment due date (often set for fourteen days from the demand date). The document may specify consequences for non-payment, such as collection agency involvement or legal proceedings, emphasizing the urgency of resolution. Effective communication is vital to maintain professionalism while ensuring clarity regarding responsibilities.

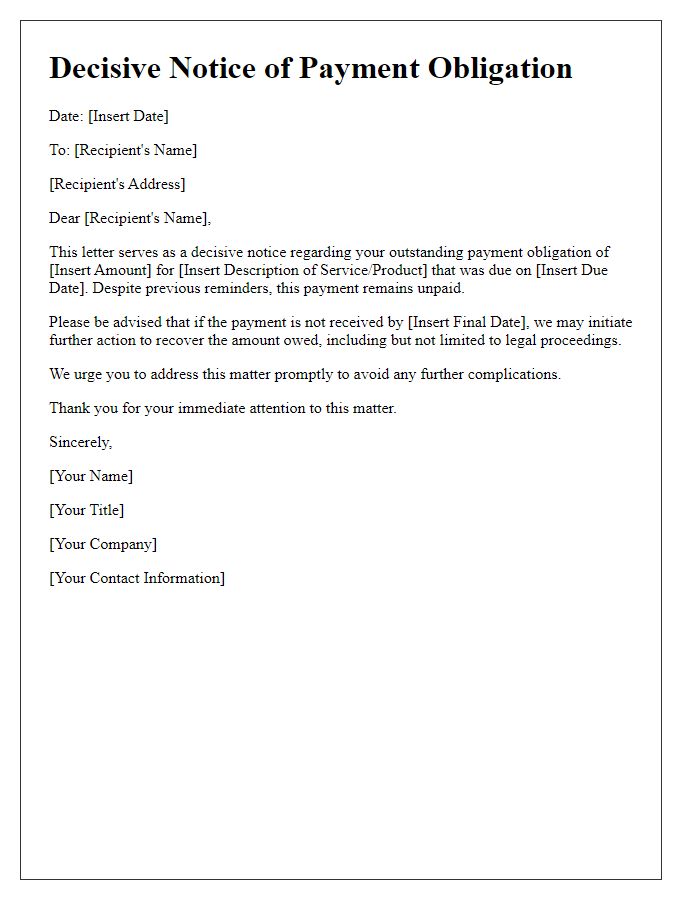

Consequences of non-payment.

Final demand for payment is an essential document in the collection process, addressing overdue balances (typically over 30 days) owed by a debtor. This notice informs the recipient of the outstanding amount and outlines potential consequences of continued non-payment. Legal actions such as filing a lawsuit can lead to judgment against the debtor, impacting their credit score (often resulting in a decrease of 100 points or more). Additionally, late fees (which can be 1.5% of the total amount per month) may be imposed, increasing the overall debt. Collection agencies may be engaged, subjecting the debtor to persistent contact and potential asset seizure. Furthermore, reliance on personal loans and credit facilities could be compromised, leading to restricted access to future financing options. Timely settlement of the debt, usually within a specified timeframe, can prevent these adverse outcomes and maintain a positive financial standing.

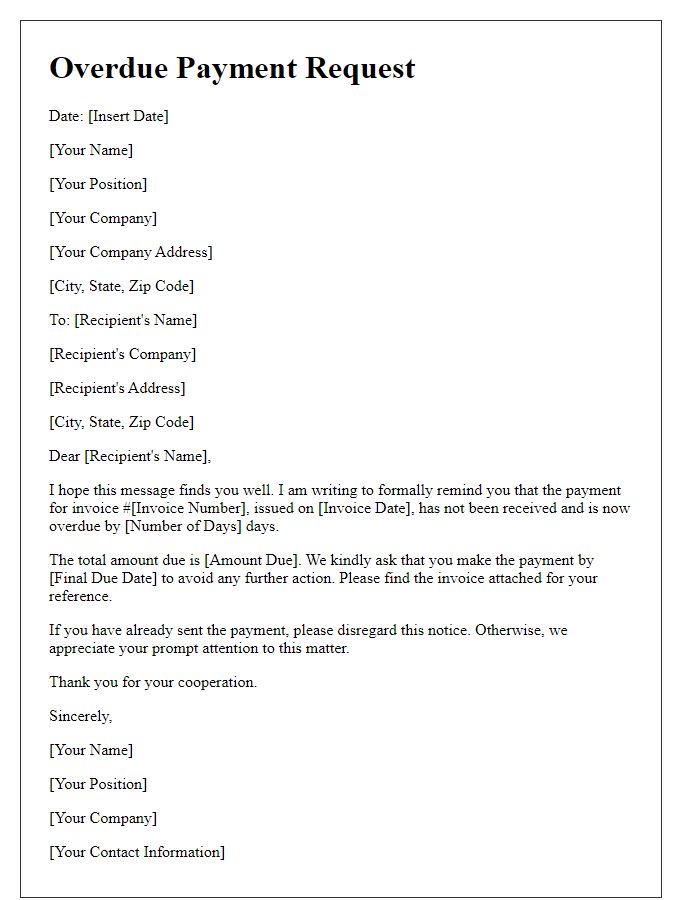

Request for immediate payment or contact.

Customers experiencing late payments commonly face challenges with their accounts, particularly past due invoices exceeding 30 days. Issuing a final demand for payment (FD) typically occurs after multiple reminders. Important details include the outstanding amount, specified due date, and payment methods. For instance, a business might demand a payment of $1,500 due on March 15, 2023. It is essential to communicate the consequences of non-payment, which may involve collection actions or legal proceedings. Providing a contact number ensures customers have a channel for addressing queries or disputes, fostering communication. Accurate record-keeping plays a vital role in maintaining a clear account history for both parties involved, ensuring a professional approach to debt recovery.

Contact information for resolution.

Final payment demands often arise in business settings when debts remain unsettled. In these communications, it is imperative to include essential details like the amount owed (for example, $1,500), the original due date (such as June 30, 2023), and a clear deadline for payment (e.g., within 14 days of receipt). The invoice number (Invoice #98765) should be referenced for clarity. Contact information for resolution typically includes the name of the accounts receivable manager at the business (for instance, Jane Doe), her direct phone number (555-123-4567), and an email address (janedoe@example.com). Fostering an open line of communication can lead to satisfactory resolution of outstanding dues without escalating to collections.

Comments