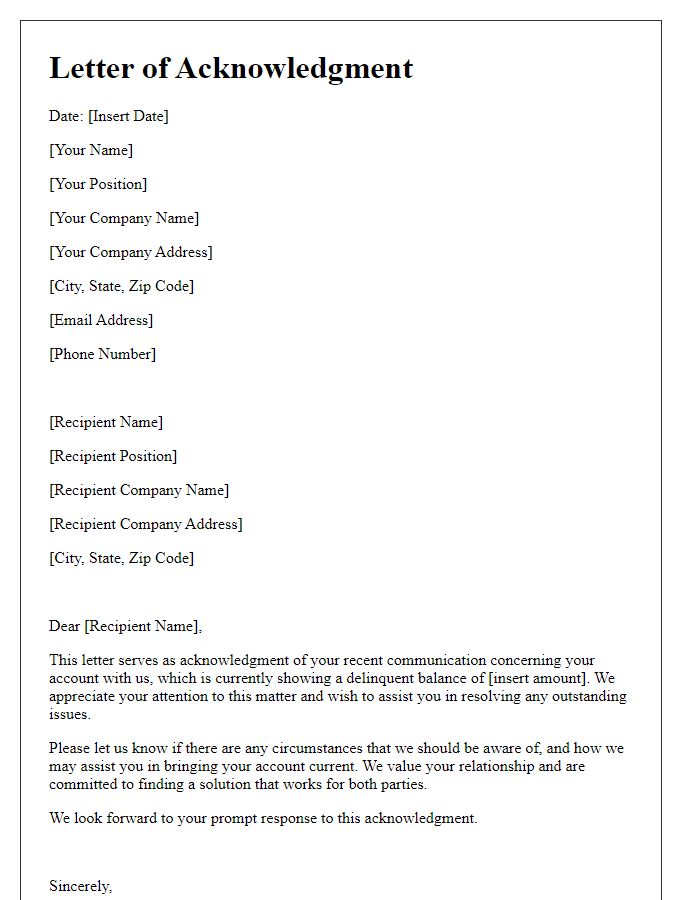

Have you ever found yourself in a situation where a payment slipped through the cracks? It happens to the best of us, but acknowledging missed payments is an important step in maintaining healthy financial relationships. In this article, we'll guide you through a friendly letter template that not only addresses the oversight but also reaffirms your commitment to resolving the matter. So, if you're ready to tackle missed payments with grace, keep reading for our helpful tips!

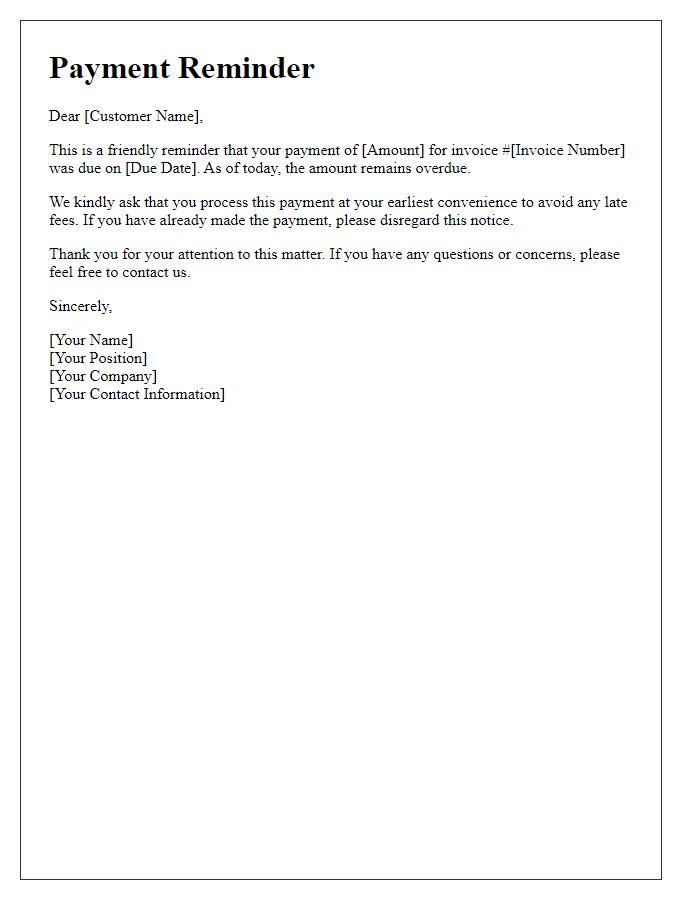

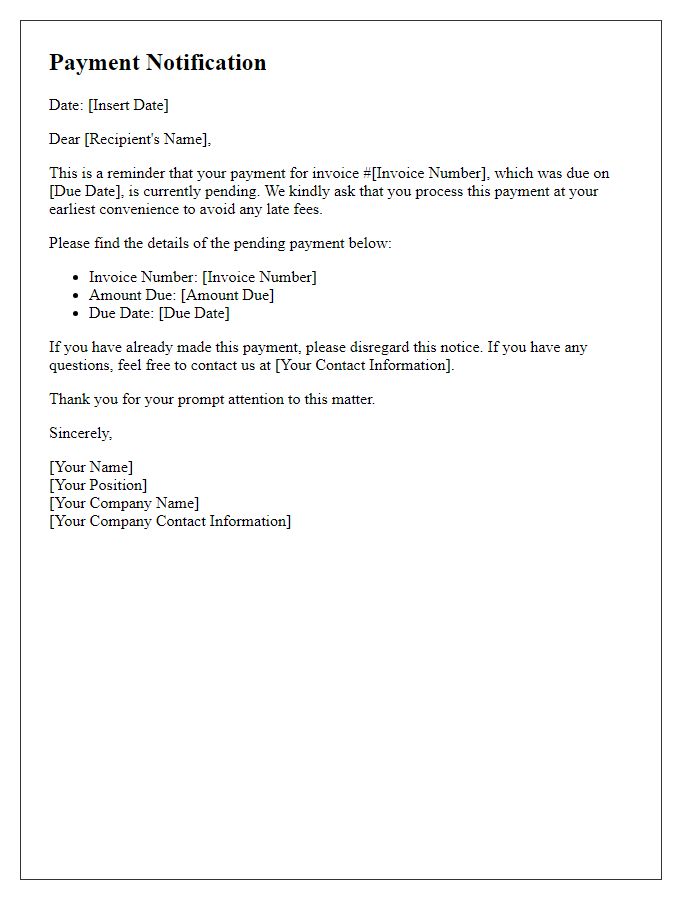

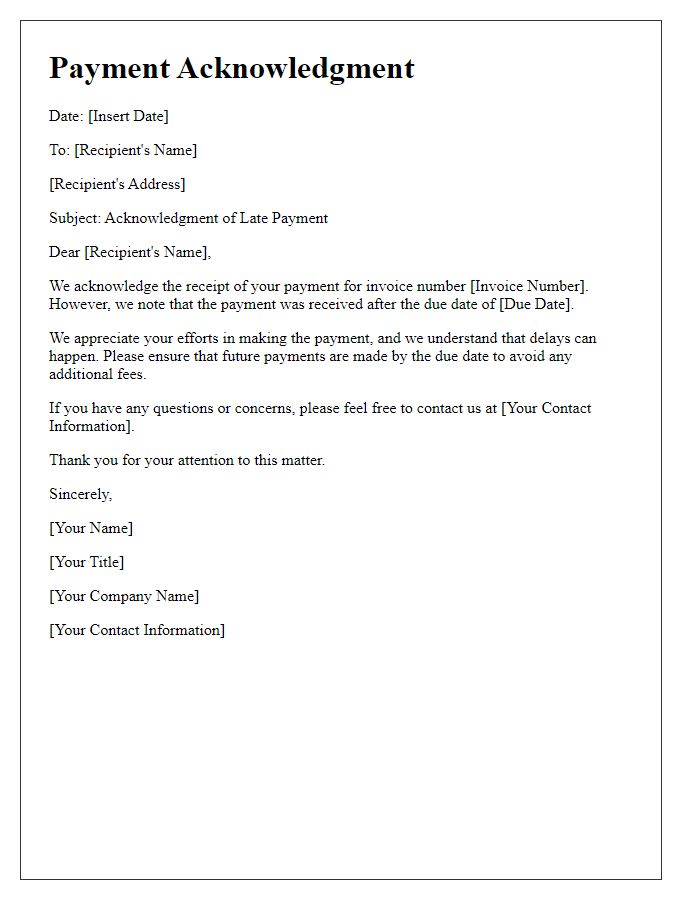

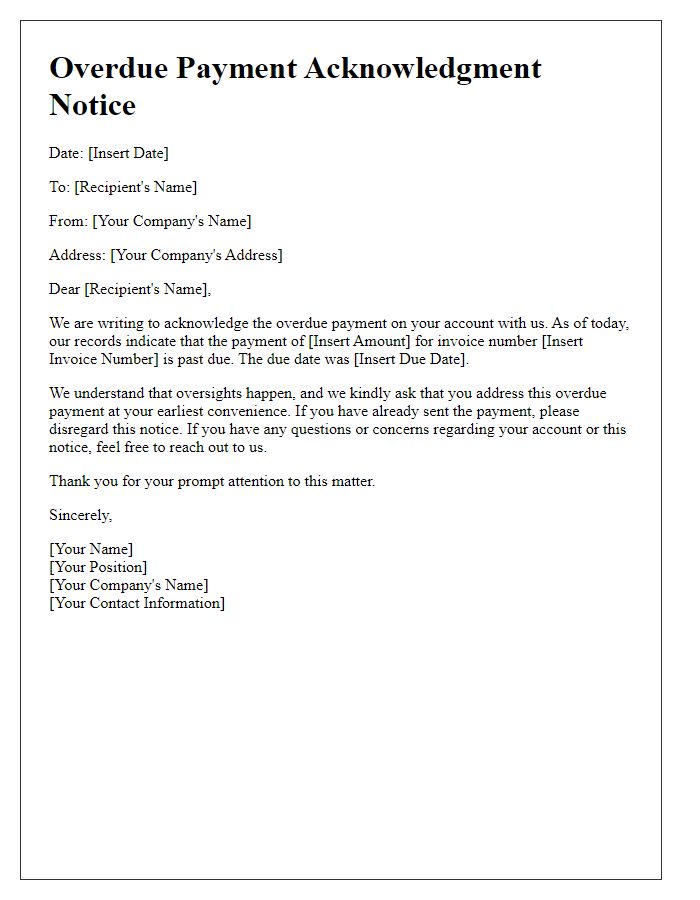

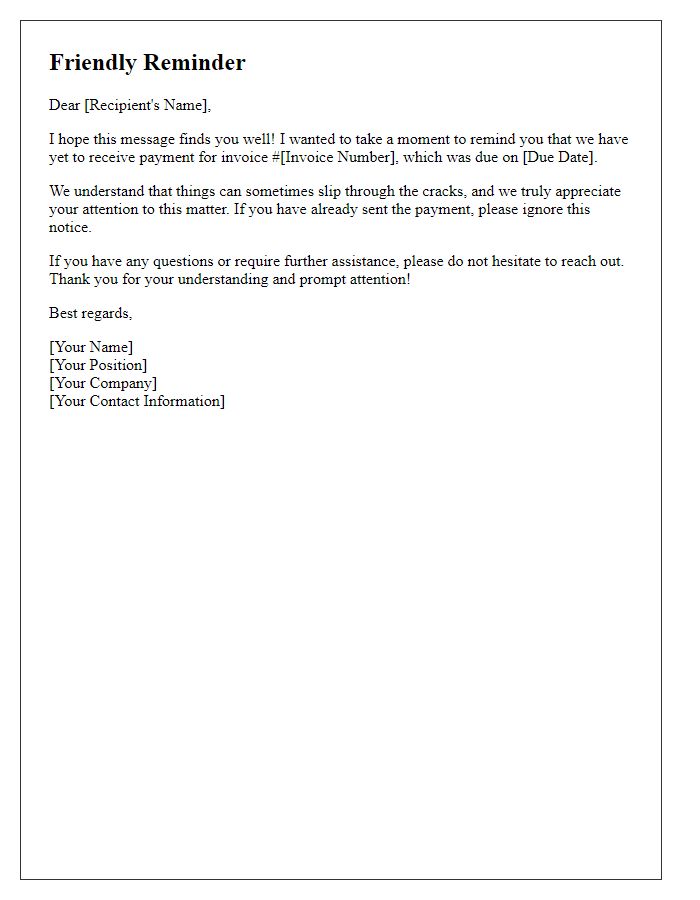

Clear Subject Line

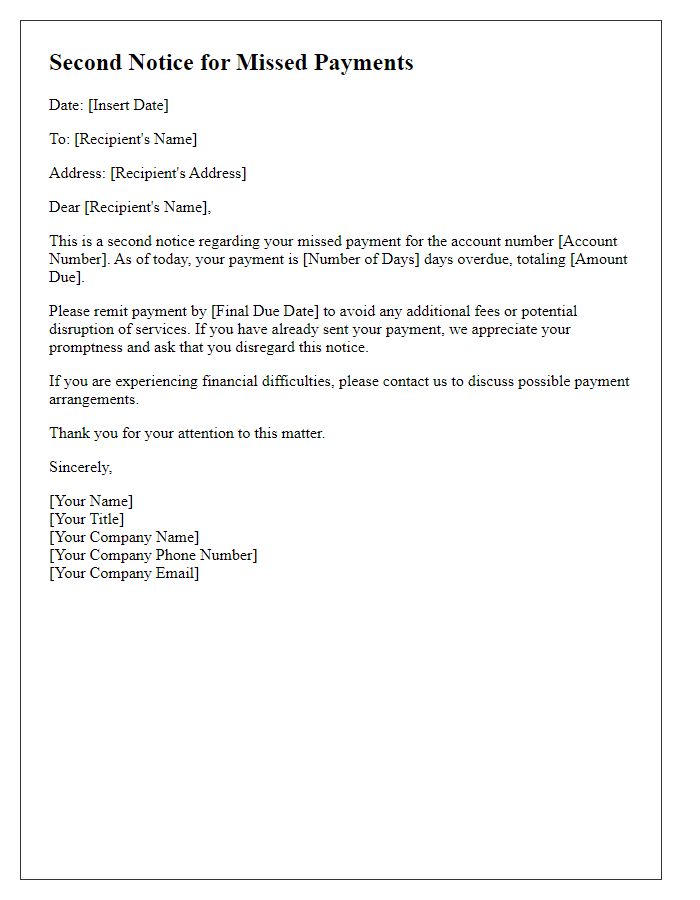

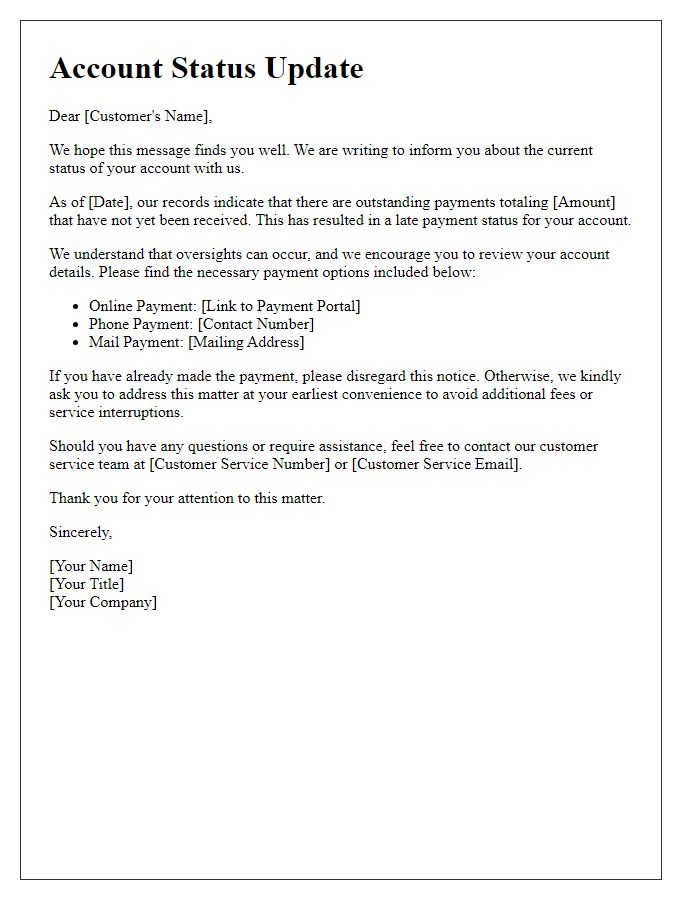

Missed Payment Acknowledgment can impact financial stability for individuals and businesses alike. Timely communication is crucial in situations involving overdue invoices, installment payments, or loan repayments. Factors such as payment due dates, amounts owed, and payment methods play significant roles in maintaining healthy financial relationships. Notifying relevant parties promptly about missed payments, specifying due dates (e.g., October 15, 2023) and payment consequences, fosters transparency. Formal acknowledgment helps prevent misunderstandings, promotes accountability, and encourages resolution through payment plans or extensions, maintaining goodwill between clients and service providers in diverse industries.

Formal Salutation

Missed payments can significantly impact financial stability and credit scores. For example, a late payment on a credit card can result in a fee of up to $40 and potentially drop a credit score by 50 points or more. In 2022, the percentage of consumers with delinquent payments reached 6.5% according to the Federal Reserve. Addressing missed payments promptly is crucial to avoid complications and regain good standing. Communication with creditors, such as banks or lenders, can provide options for payment plans or hardship programs. It is essential to review the specific terms and conditions associated with each loan or credit account for comprehensive management of financial responsibilities.

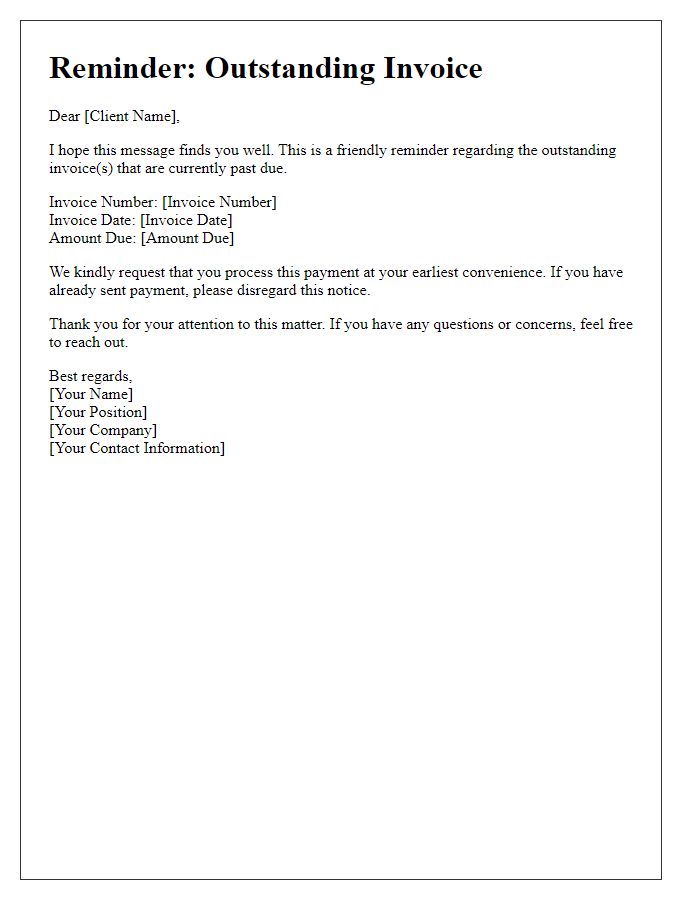

Reference Invoice or Account Number

When an individual misses payment obligations, it can significantly impact financial stability. For instance, an acknowledgment of missed payments could reference invoice number 123456 from September 2023, associated with a total amount due of $500. This situation frequently arises in various sectors, such as utilities, where service providers like XYZ Energy have policies regarding late fees. Typically, after a 30-day grace period, accounts may incur additional charges. Furthermore, persistent non-payment could lead to actions such as account suspension or collections by firms like ABC Collections, which specialize in recovering overdue debts. Proactive communication is essential for all parties to mitigate the potential escalation of financial repercussions.

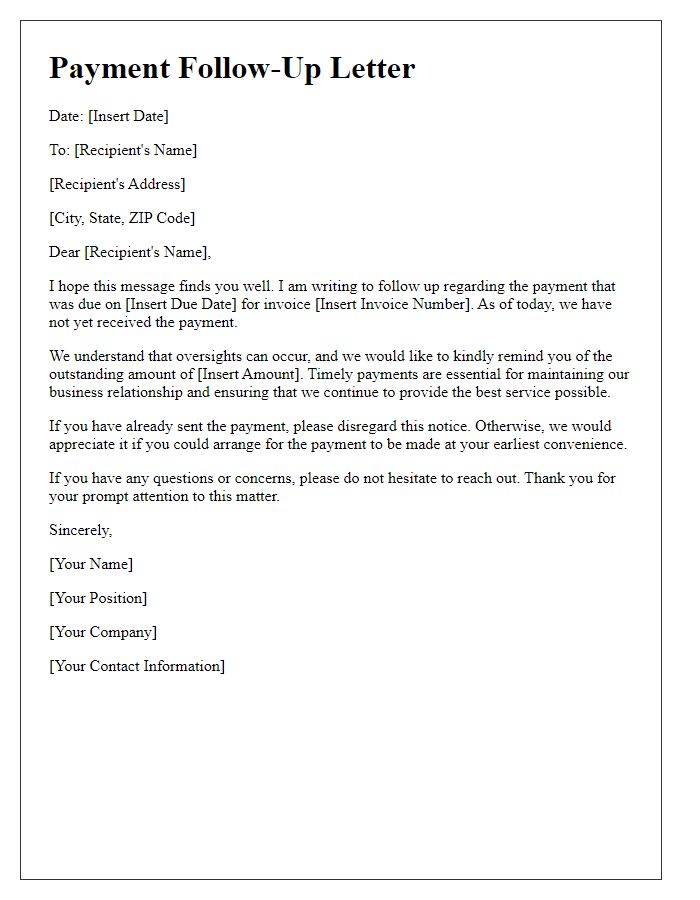

Explanation of Missed Payment

Missed payments on credit accounts can significantly impact both the borrower and the lender. A missed payment occurs when a scheduled payment, typically due on the first of each month, is not made within a 30-day grace period. This can affect borrowers' credit scores, potentially lowering them by 30 to 100 points, depending on the credit reporting agency such as FICO or VantageScore. The lender, often a financial institution like a bank or credit union, may charge late fees, which can range from $25 to $50, or even higher, depending on the terms of the loan. Consistently missed payments can lead to severe consequences, including account delinquencies, which may escalate to collection actions. Furthermore, understanding the reasons behind missed payments--whether they involve unforeseen circumstances like job loss, medical emergencies, or budgeting challenges--can help both parties work toward a resolution.

Contact Information for Resolution

Acknowledgment of missed payments can lead to serious financial implications for both creditors and debtors. Financial institutions, such as banks or credit unions, often have established protocols for handling overdue accounts. Timely communication regarding payment status is crucial. Contact information for resolution usually includes specific departments or representatives that manage collections or customer service, such as the accounts receivable department in companies like Acme Corp. Failure to address missed payments can result in increased interest rates, late fees, and negative impacts on credit scores, which might hinder future financial opportunities. Regular correspondence through emails or phone calls can facilitate a more effective resolution process, allowing for potential payment arrangements or extensions, ultimately benefiting both the lender and borrower.

Comments