Are you curious about understanding your financial habits better? An account activity summary can be a game changer, providing you with insights into your spending patterns, saving trends, and overall financial health. With this tool, you can take control of your finances and make informed decisions. Join me as we explore how to create an effective account activity summary that can empower your financial journey!

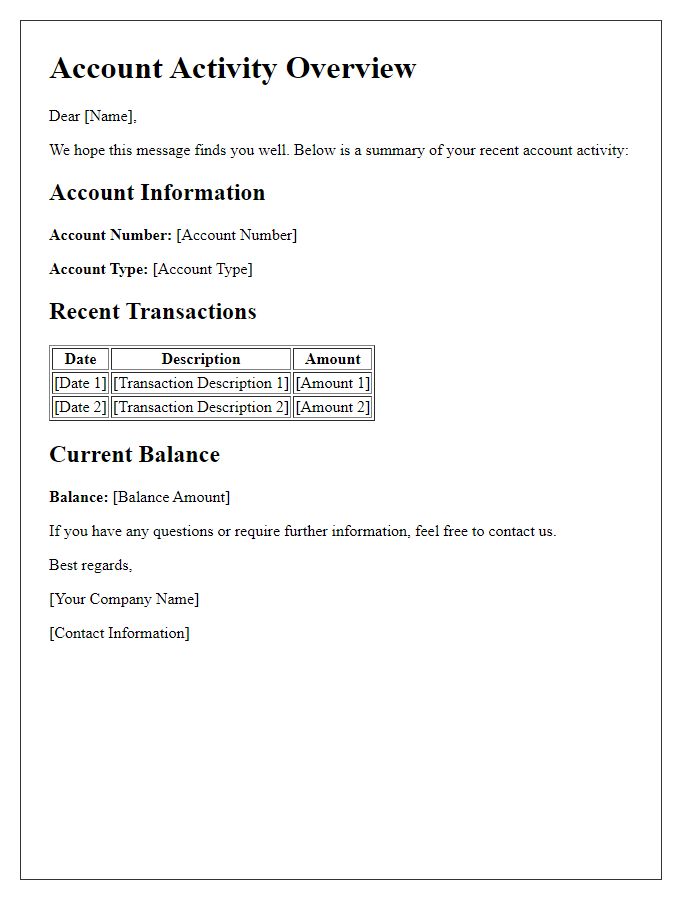

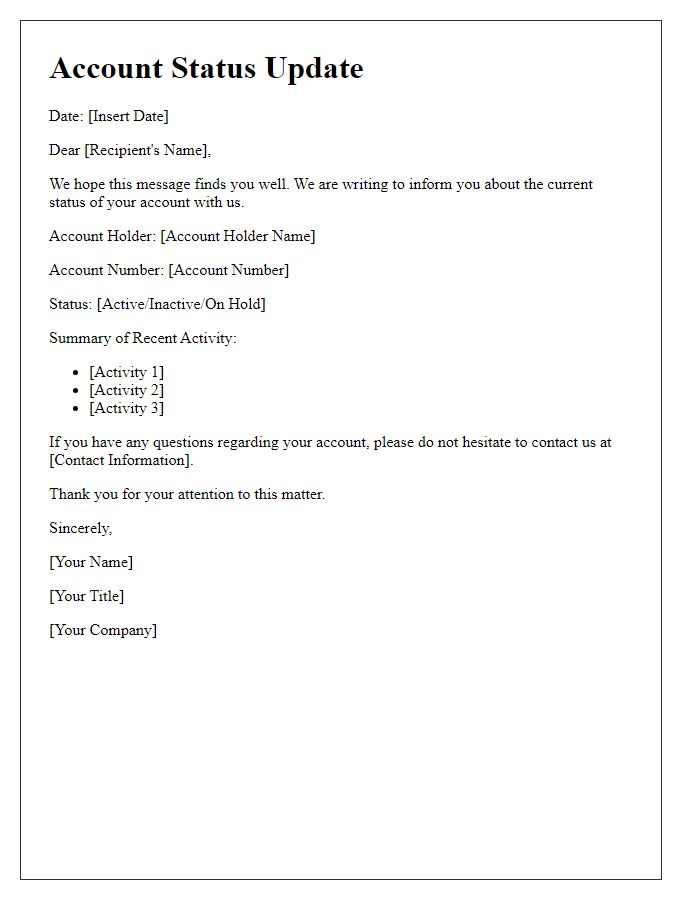

Salutation and Recipient Information

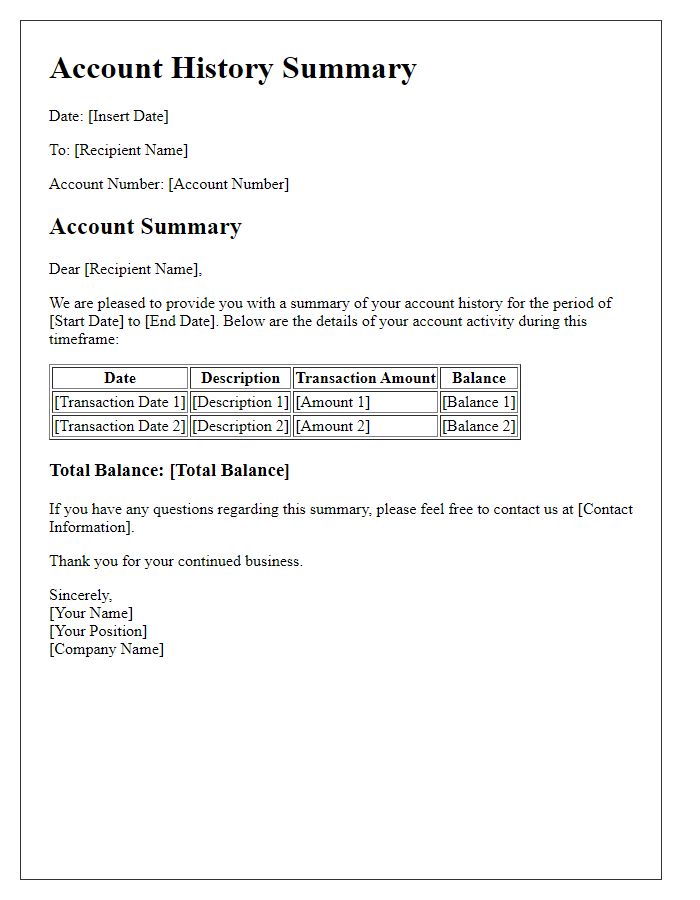

The account activity summary provides a detailed overview of financial transactions over a specified period. This summary typically includes key information such as account number, activity dates, transaction types (deposits, withdrawals, transfers), and balance changes. Accurate records of this nature are crucial for tracking spending habits and ensuring budget adherence. Additionally, financial institutions may highlight significant transactions or unusual patterns that require the account holder's attention. Comprehensive summaries help users maintain awareness of their financial status and encourage proactive financial management.

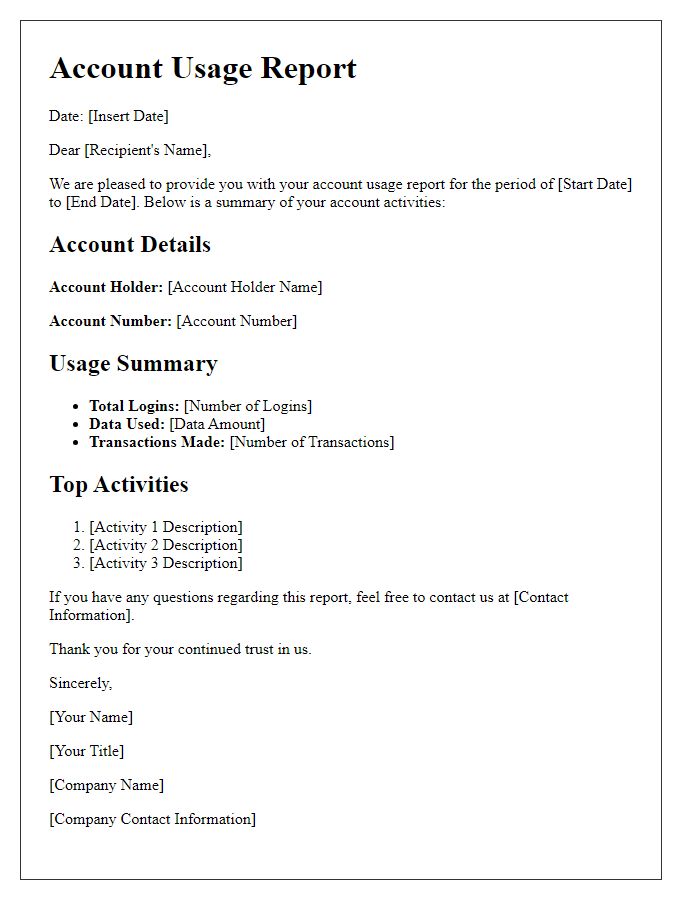

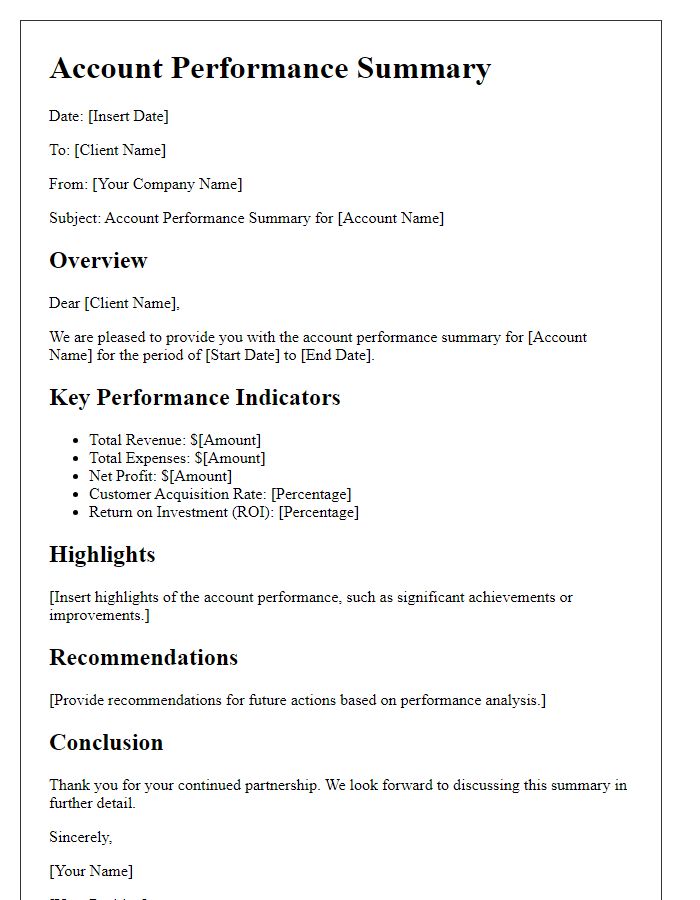

Overview of Account Activity

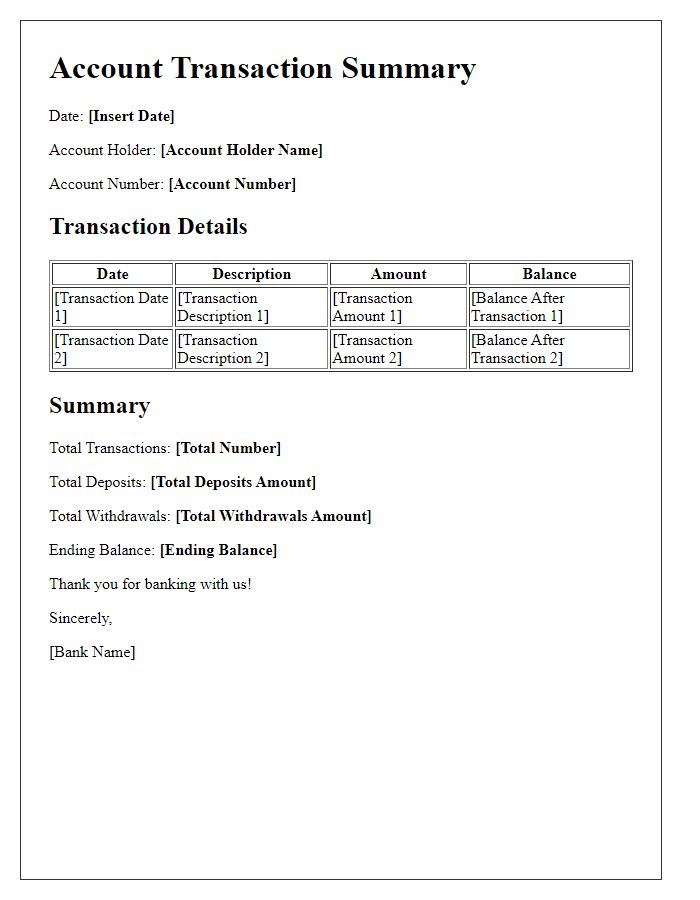

The account activity summary provides a comprehensive overview of transactions made within the last fiscal quarter. This includes a total of 150 transactions totaling $15,000, with the highest single transaction amounting to $1,500 on July 15, 2023. The summary reflects diverse categories of spending, showcasing expenditures such as groceries from local supermarkets in New York City, utility payments in California, and subscription services. Notably, this summary also highlights any unusual activity, including a one-time charge from an unknown vendor, which requires further investigation. Overall, the account activity summary serves as a valuable tool for tracking financial health and ensuring ongoing budget management.

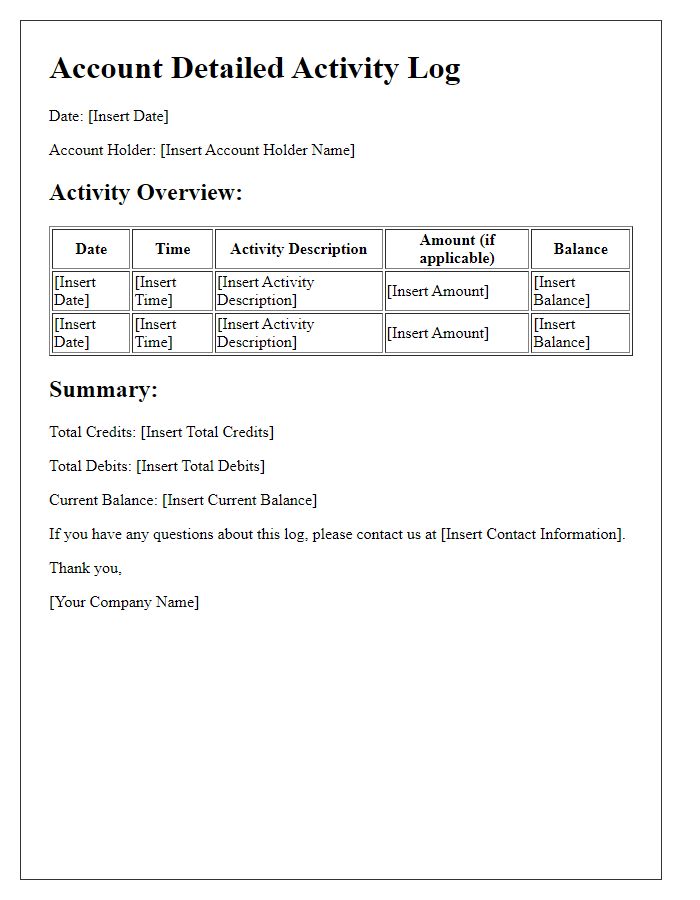

Detailed Transaction List

A comprehensive account activity summary includes a detailed transaction list showcasing each financial activity within a specified time frame. This list typically presents transaction dates, specific merchant names or transaction sources, amounts involved, and transaction types. For instance, a retail purchase at Target on March 12, 2023, might be listed alongside its corresponding amount of $76.89, categorized as a debit transaction. Bank transfers and direct deposits would also feature prominently, with descriptors such as the payment source (like Employer XYZ) illustrating income received. Furthermore, notable charges or fees, such as the monthly maintenance fee of $15 from Wells Fargo for maintaining the account, provide transparency. This detailed documentation enables account holders to track spending habits, identify discrepancies, and maintain overall financial awareness.

Account Balance and Status

Account balance reflects the current amount of funds available for withdrawal and spending, often displayed in currency values like USD or EUR. Regular updates on account status, generated monthly or quarterly, detail transactions (deposits and withdrawals), interest accrued, and any overdraft occurrences. Institutions such as banks or credit unions provide this information through online statements or printed documents. Maintaining a balanced account is essential for avoiding fees and ensuring sufficient funds for bills or purchases, with a recommended minimum balance often set by the institution. Reconciliation of accounts helps identify discrepancies and maintain financial health.

Contact Information and Assistance Options

Account activity summaries provide users with a comprehensive overview of recent transactions, changes, and notifications associated with online accounts. Detailed reports include contact information for customer support, such as phone numbers (e.g., 1-800-555-0199), email addresses (support@example.com), and live chat options available on company websites. Assistance options typically encompass FAQs, user guides, and forums, fostering community help where users can interact to resolve common issues. Regular updates on activities, including successful logins, password changes, and transaction alerts, enhance security awareness. Notifications about suspicious activity ensure prompt corrective actions to protect personal data and account integrity.

Comments