Are you feeling a bit overwhelmed by a recent late fee on your credit card? You're not aloneâlife happens, and sometimes we miss deadlines despite our best intentions. In this article, we'll guide you through crafting a compelling letter to request a late fee waiver, helping you express your situation clearly and effectively. Let's dive into the details and empower you to take charge of your financesâread on for tips and templates!

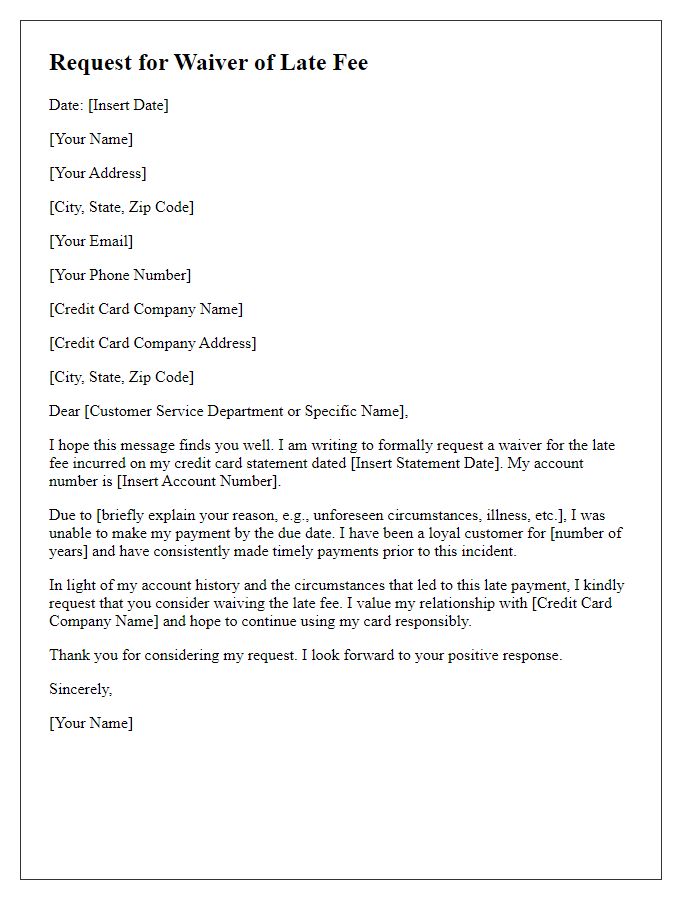

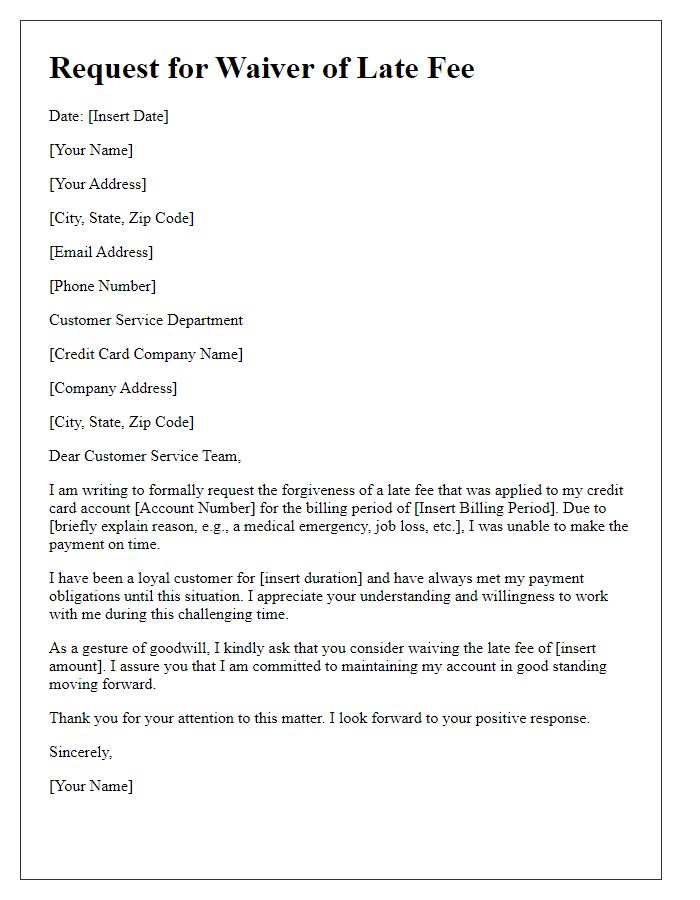

Polite request tone

Concerns about late payment fees on credit cards often arise due to unforeseen circumstances. A customer may reach out to their credit card issuer, mentioning specific situations, such as a medical emergency or temporary job loss, that contributed to the delay. Including the date of the missed payment and the amount can provide clarity. Highlighting a positive payment history, such as consistently on-time payments before this incident, can strengthen the case for a waiver. Expressing appreciation for the issuer's previous support and willingness to maintain a good relationship establishes a polite tone for the request. Additionally, mentioning intent to continue making payments and communicate any future difficulties can reflect responsibility and commitment.

Account details

When customers face unexpected financial challenges, they may seek assistance in waiving late fees associated with credit card account management. Major financial institutions, such as Bank of America, Chase, or Citibank, often have established processes for such requests. Customers typically provide their account details, including the account number, due payment date, and specific late fee amount of $25 or $35. Additionally, detailing any mitigating circumstances, such as medical emergencies or job loss, can enhance the request's likelihood of success. This engagement with customer service, whether through phone calls or written communication, reflects a proactive approach to financial responsibility.

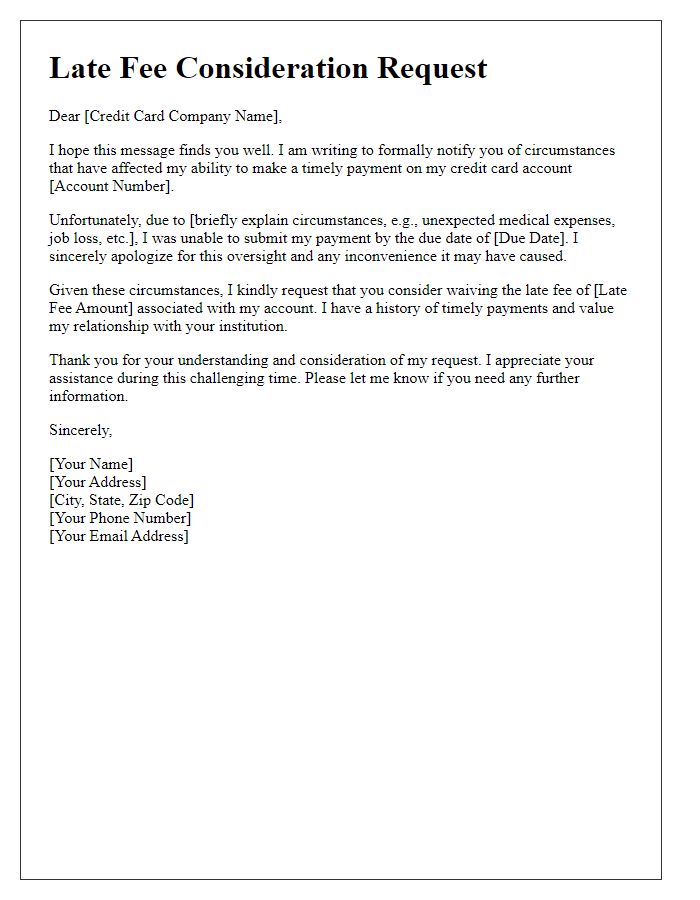

Valid reason for delay

Many credit card issuers offer the possibility of waiving late fees for their customers under certain circumstances. A common valid reason for delay includes unexpected medical expenses, such as emergency room visits costing thousands of dollars or hospital stays. Natural disasters, such as hurricanes or wildfires, can also disrupt financial management, leading to missed payments during times of recovery. Job loss or reduced hours due to economic downturns can affect cash flow significantly. On occasion, technical issues, like online banking outages or payment processing problems, may add to the delay. Providing documentation, such as hospital bills, notices from employers, or screenshots of system outages, can bolster a late fee waiver request.

Positive payment history

A credit card late fee waiver request hinges on an individual's payment behavior with the credit card issuer, emphasizing the importance of maintaining a positive payment history. A reliable payment history typically includes consistent, timely payments over several billing cycles, demonstrating financial responsibility and trustworthiness. Additionally, consumers might reference specific events, such as a recent medical emergency or unexpected job loss, to explain any occasional late payments that contrast with an otherwise sparkling record. Creditors, recognizing loyal customers, may grant waivers on late fees ranging from $25 to $50, particularly when a customer has shown a commitment to making timely payment across multiple years. Reinforcing customer relationship value is essential, prompting potential approval decisions while encouraging future financial responsibility and adherence to timely payment schedules.

Assurance of future timeliness

Late payment fees can become a burden on individuals when managing finances, especially with credit card bills from major banks such as Chase and Citibank. Missed payments can result in fees typically ranging from $25 to $40, impacting consumers' credit scores, which is calculated based on payment history over the previous 24 months. A request for waiver of these fees may be justified by previous good payment standing and a sudden financial hardship, such as unexpected medical expenses or job loss. Assuring the creditor of future timely payments can strengthen the case, emphasizing a commitment to improved financial management. Documented evidence of past payments can further substantiate the request, illustrating responsible credit behavior and adherence to payment deadlines.

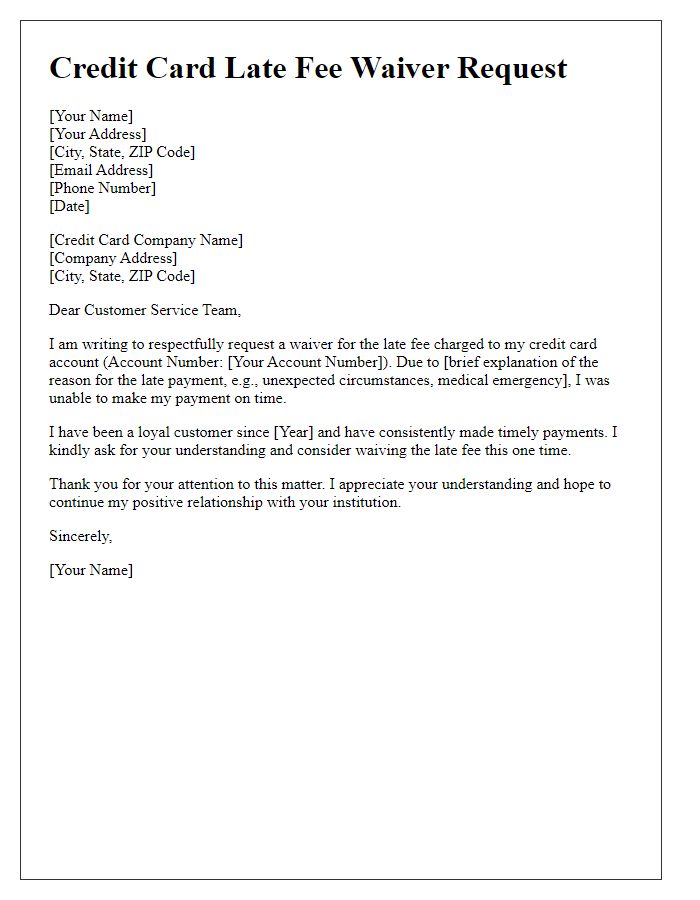

Letter Template For Credit Card Late Fee Waiver Request Samples

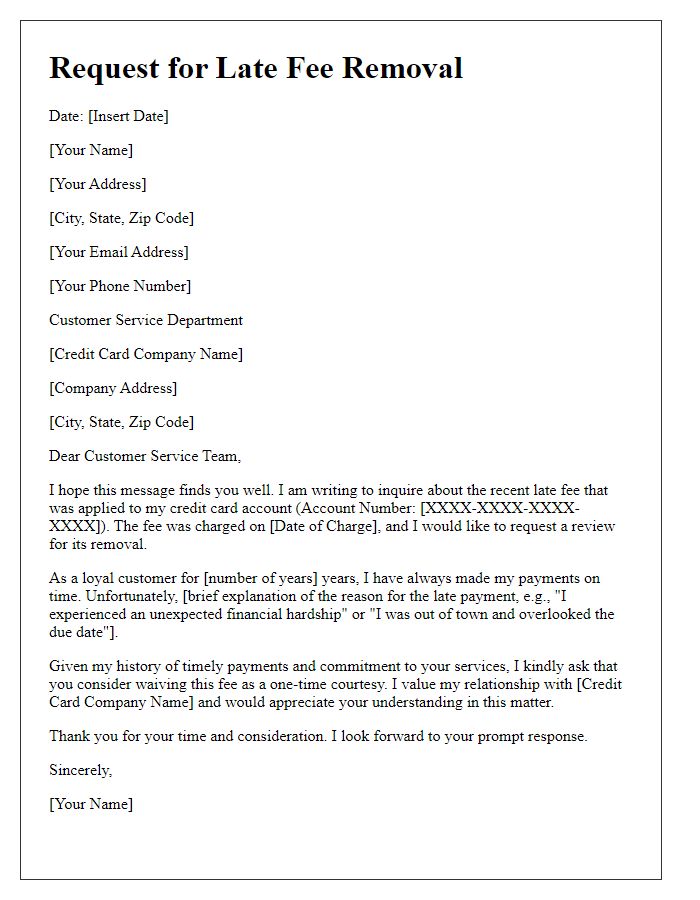

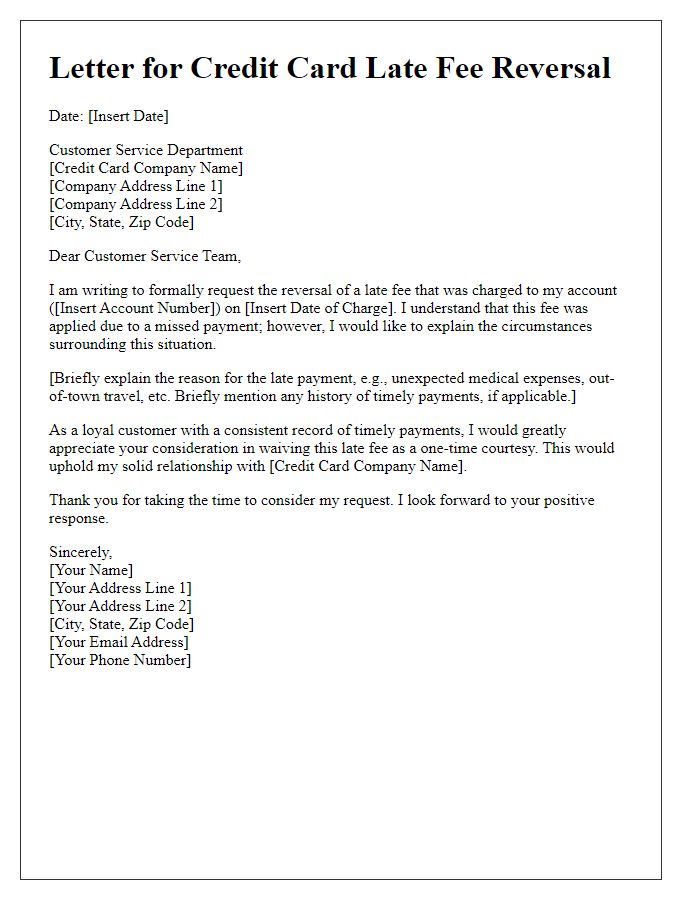

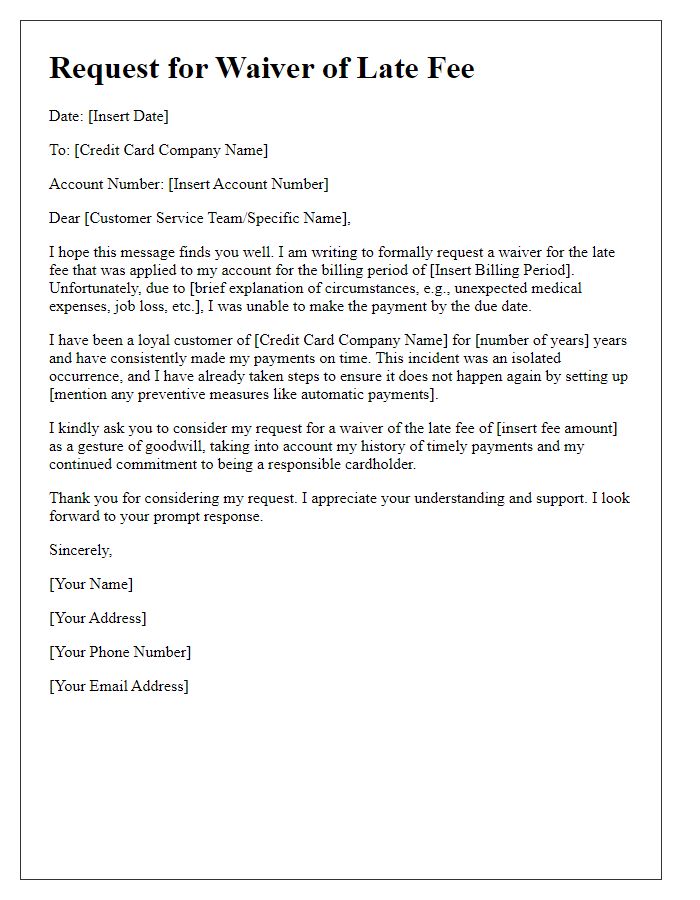

Letter template of request for waiver of late fee on credit card statement

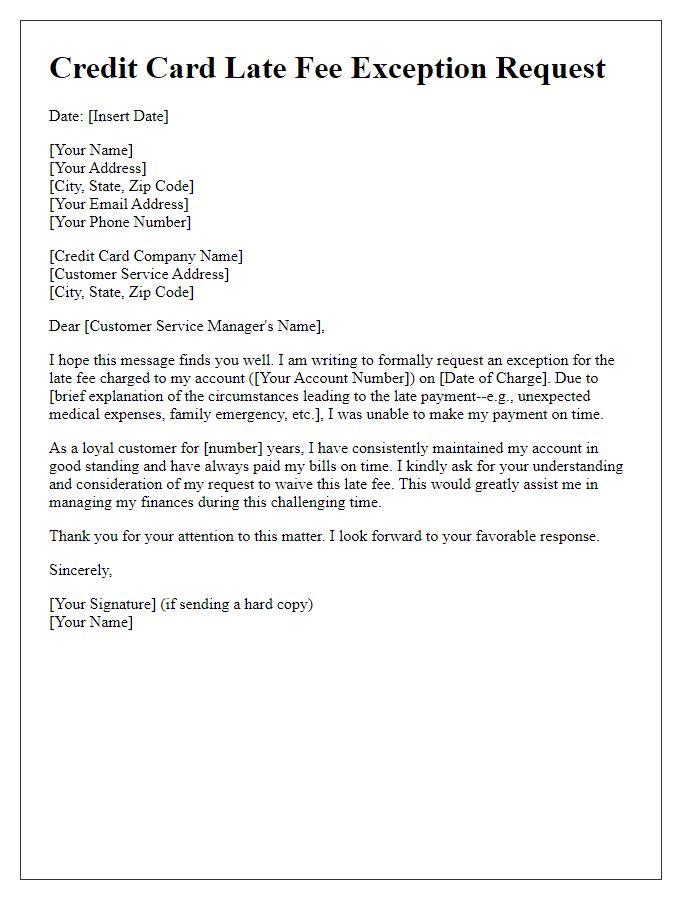

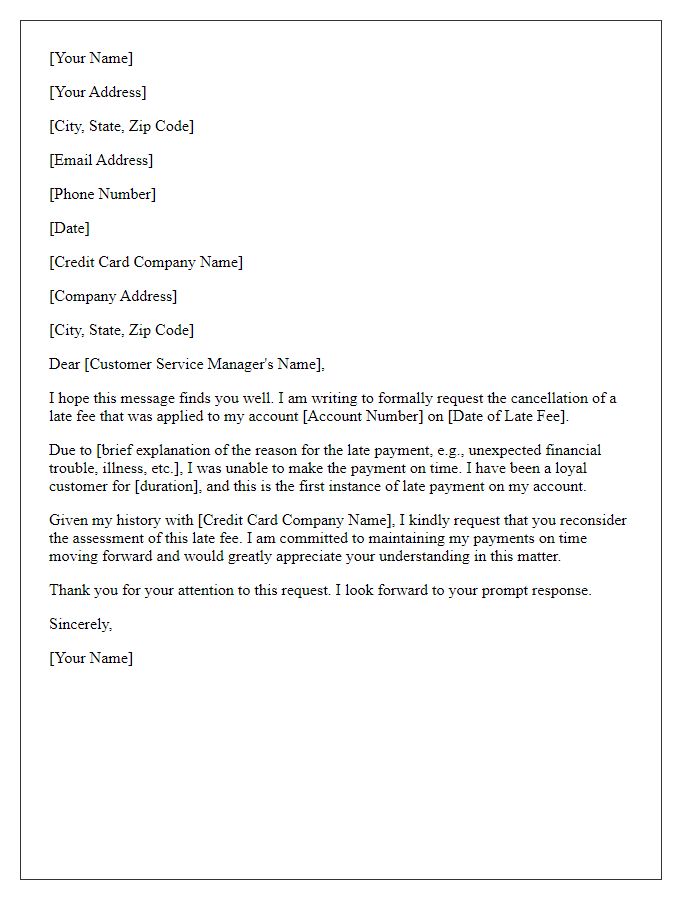

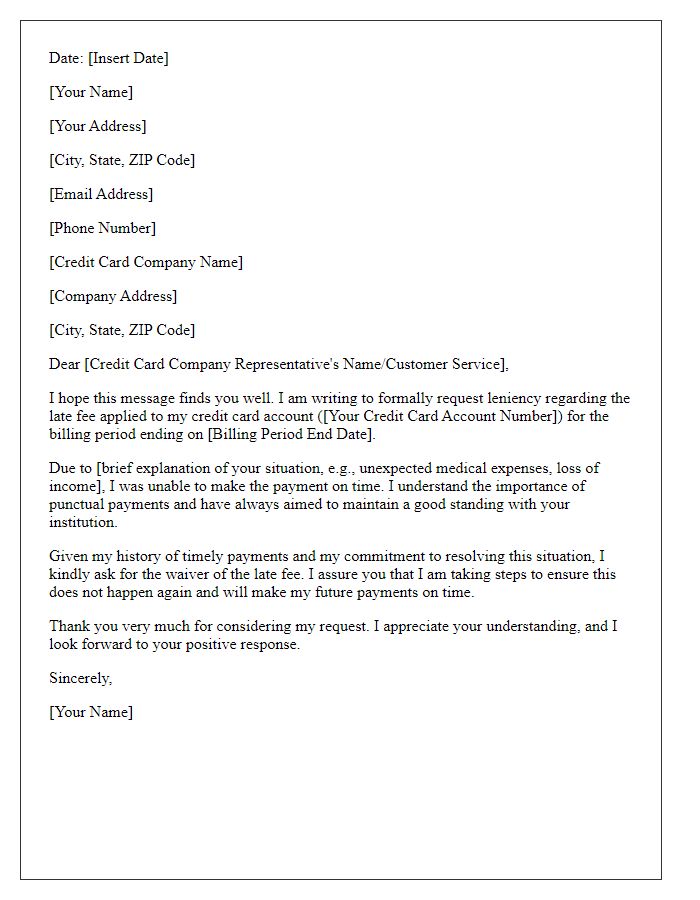

Letter template of notification of circumstances for credit card late fee consideration

Comments