Are you curious about how credit card loan offers can enhance your financial flexibility? In today's fast-paced world, having access to credit can be a game-changer, allowing you to manage unexpected expenses or make that big purchase without the pressure of immediate payment. With tailored loan options and enticing interest rates, these offers could be just what you need to take control of your finances. So, let's dive deeper and explore the benefits and details of credit card loan offers!

Personalized Salutation

Credit card loan offers provide consumers with flexible financial options to manage expenses efficiently. Many banks, such as JPMorgan Chase and Citibank, offer these loans with varying interest rates, often ranging from 9.99% to 24.99% APR. These offerings typically include promotional periods, like 0% APR for the first 12 months, which allows borrowers to pay off balances without incurring interest initially. Eligibility for such offers often necessitates a minimum credit score of 600 or higher. Loan amounts can vary significantly, with limits stretching from $500 to over $50,000 based on the applicant's creditworthiness and income level. Monthly payments are generally structured, making it easier for individuals to budget their finances responsibly.

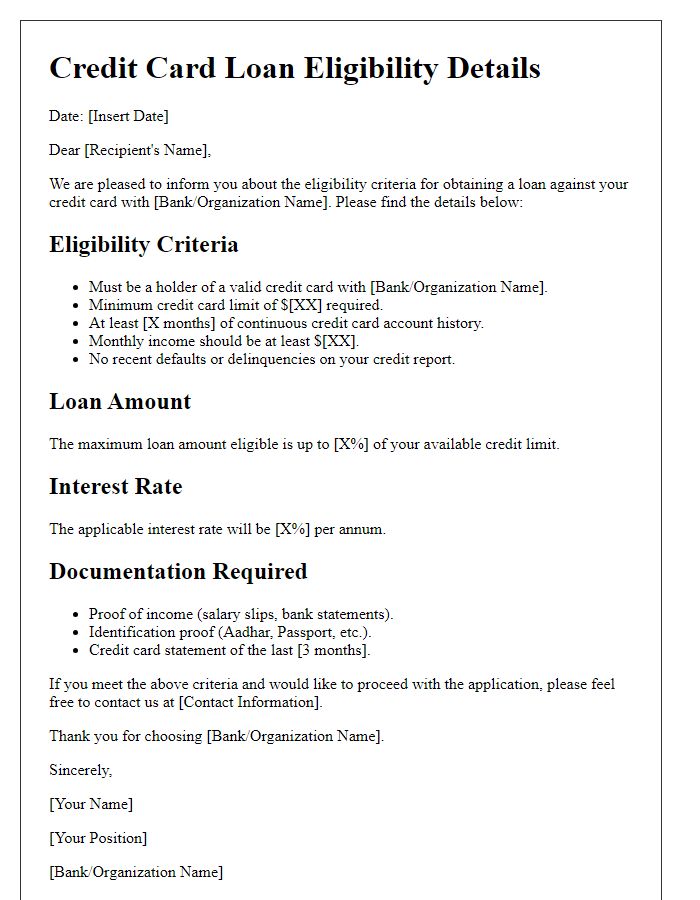

Interest Rate Details

When consumers receive a credit card loan offer notification, several key details regarding interest rates are essential. Fixed interest rates, typically ranging from 14% to 25%, can significantly impact the total cost of borrowing depending on the principal amount and repayment period. Variable interest rates may fluctuate based on benchmarks like the Prime Rate, which stood at approximately 7.25% as of October 2023. Additionally, introductory offers may present promotional rates as low as 0% for the first 12 months, enticing users to use their credit cards. Annual Percentage Rate (APR) should also be clearly outlined, displaying the true cost of borrowing over one year, including fees and interest. Understanding these details can help consumers make informed financial decisions regarding their credit utilization and repayment strategies.

Loan Amount and Terms

Credit card loan offers can provide access to significant funds, typically ranging from $1,000 to $50,000 depending on creditworthiness. Terms generally span 12 to 60 months, with annual percentage rates (APRs) varying between 6% and 30%. These loans can be utilized for various purposes, including debt consolidation, major purchases, or emergency expenses. Eligibility requirements often include a minimum credit score of 600, steady income verification, and a debt-to-income ratio below 40%. Approval processes can take as little as 24 hours, providing quick access to needed funds. Be mindful of potential fees, such as origination and late payment charges, which can impact overall loan costs.

Benefits and Features

Credit card loan offers present numerous benefits and features designed to enhance financial flexibility for consumers. Interest rates typically range from 12% to 24% annually, which can be significantly lower than personal loan rates. Cardholders can access immediate cash through cash advances, offering funds almost instantly for urgent expenses, subject to a maximum limit often around 50% of the available credit. Additionally, many credit card loans come with rewards programs, allowing users to earn points or cashback on purchases, which can amount to 1% to 5% back. Promotional offers may include 0% introductory APR for a period, often lasting six to twelve months, allowing cardholders to pay off debts without accruing interest initially. Moreover, the flexibility of minimum monthly payments ensures that cardholders can manage their budgets responsibly, with an average payment structure around 2% to 4% of the outstanding balance. Credit utilization impacts credit scores positively when managed effectively, as responsible borrowing and repayment can lead to improved credit ratings.

Contact Information and Call to Action

Receiving a credit card loan offer notification can be an exciting opportunity for financial empowerment. The notification typically includes details such as the offered credit limit, interest rate (APR), and repayment terms, tailored to personalize the customer experience. It emphasizes the importance of thoroughly reviewing terms alongside potential fees, especially when considering the offer from popular financial institutions like Chase and Bank of America, which may vary significantly. Key details may also include a contact number for customer service--often found on the back of the card--and additional resources, such as online account management features, to streamline the loan process. A clear call to action usually encourages prompt responses to ensure eligibility, often accompanied by a sense of urgency to seize the offer before the specified expiration date.

Comments