Are you tired of negative entries tarnishing your credit report? We all know that a clean credit history can open doors to better financial opportunities, but those pesky old debts can linger longer than we'd like. Fortunately, there are effective strategies to petition for the removal of outdated negative entries, giving you a fresh start. Curious about how to craft the perfect letter to get that process rolling? Let's dive in!

Personal Information Verification

Personal information verification is essential for maintaining accurate credit reports. Credit reporting agencies, including Experian, Equifax, and TransUnion, allow consumers to dispute old negative entries that may impact credit scores negatively (below 580 considered poor). A comprehensive approach involves submitting the verification request alongside relevant documentation such as identification, a recent credit report, and supporting evidence to substantiate the claim. Stale negative entries, typically older than seven years from the date of delinquency, can be sought for removal through this process. The Fair Credit Reporting Act (FCRA) protects consumers and mandates that inaccuracies must be corrected, ensuring fair credit opportunities for individuals striving for financial stability.

Account Details

Negative entries on credit reports can significantly impact credit scores, especially accounts in collections or default. The Fair Credit Reporting Act governs the accuracy and privacy of credit information, allowing consumers to dispute incorrect entries. Individuals seeking to improve their credit profile often need to address outdated negative items--typically remaining on reports for seven years from the delinquency date. Removal of these entries can be pursued by sending a dispute letter to credit bureaus (like Experian, TransUnion, or Equifax), requesting verification of the account. Detailed account information, including account number and creditor details, should accompany the letter to ensure proper processing. Upon successful removal, individuals can experience potential boosts in credit scores, increasing loan eligibility and reducing interest rates over time.

Specific Entry Description

Negative credit entries can significantly impact financial health and scores. For example, a 30-day late payment reported by Capital One in March 2021 can stay on credit reports for seven years. Such negative information can lower credit scores by up to 100 points, affecting loan approvals and interest rates. Disputing an entry should include identification of the specific account number, date of the negative entry, and evidence supporting the claim for inaccuracy. Credit bureaus, such as Experian, TransUnion, and Equifax, require comprehensive documentation to initiate an investigation and potentially rectify erroneous entries, thereby improving overall creditworthiness.

Justification for Removal

Old negative credit entries, such as late payments or charge-offs, can significantly reduce credit scores below 600, affecting loan eligibility. These entries typically remain for seven years, limiting financial opportunities like mortgage applications and car loans. Documentation proving prompt payments or updated account statuses can support requests for removal. Credit reporting agencies, including Experian, TransUnion, and Equifax, adhere to regulations under the Fair Credit Reporting Act, allowing individuals to dispute inaccuracies. Positive payment histories and improved financial behavior over time can bolster cases for reconsideration.

Corrective Action or Resolution

Negative credit entries can significantly impact financial health, influencing credit scores and loan eligibility. Identifying these entries is crucial; for example, late payments reported by financial institutions can remain on credit reports for up to seven years. Initiating corrective action involves contacting credit bureaus (Experian, TransUnion, Equifax) to dispute inaccuracies. Documentation like payment receipts or resolution letters from creditors strengthens the case. Thoroughly explaining the nature of the dispute, including dates and amounts, can expedite the removal process. Successful resolution leads to improved credit scores, enhancing opportunities for favorable financing terms and lower interest rates in future loans. Addressing negative entries effectively restores financial credibility in a competitive market.

Letter Template For Removing Old Negative Entries Samples

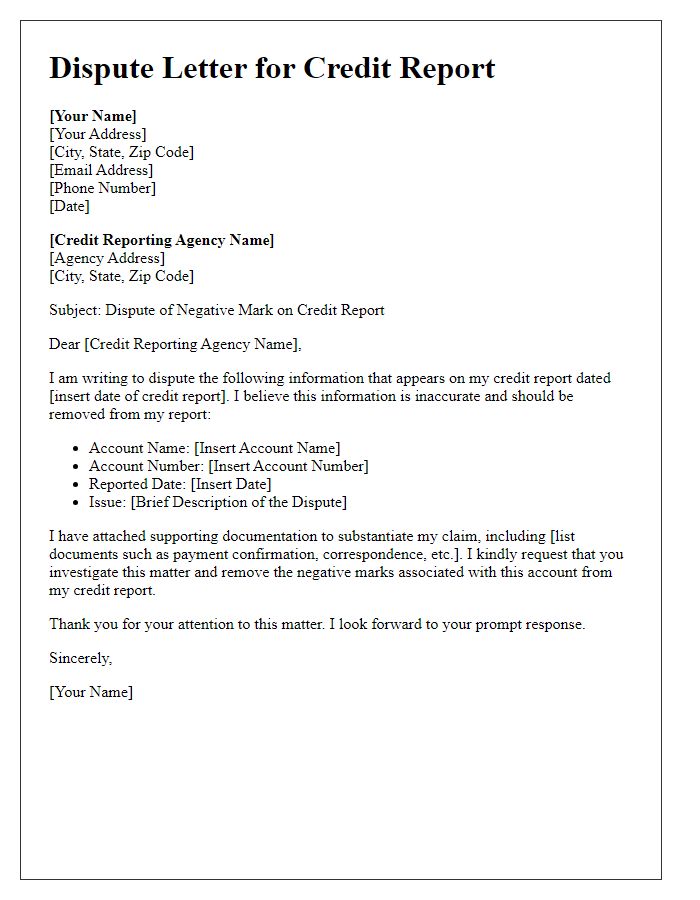

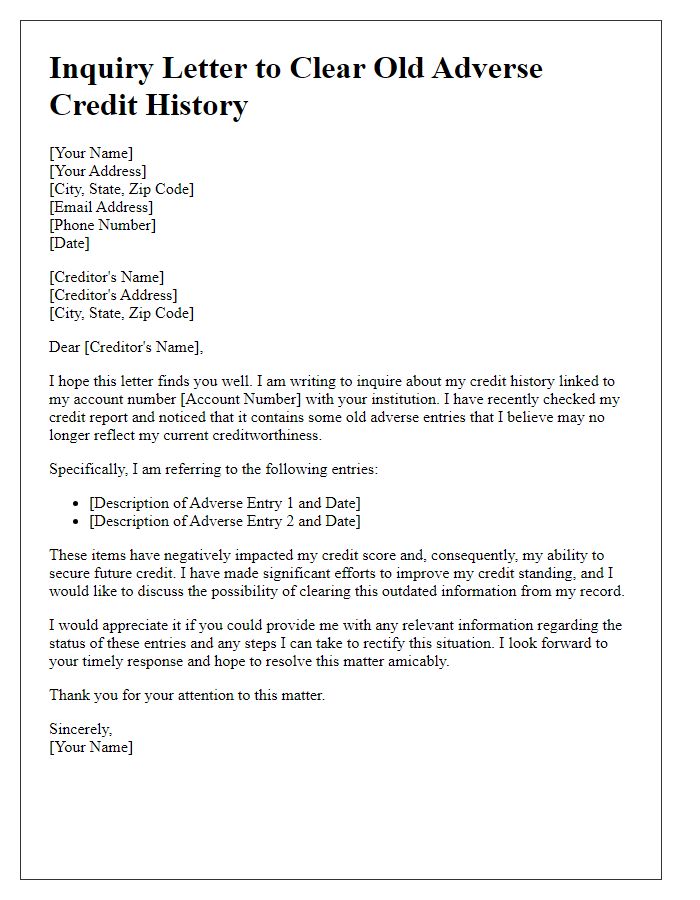

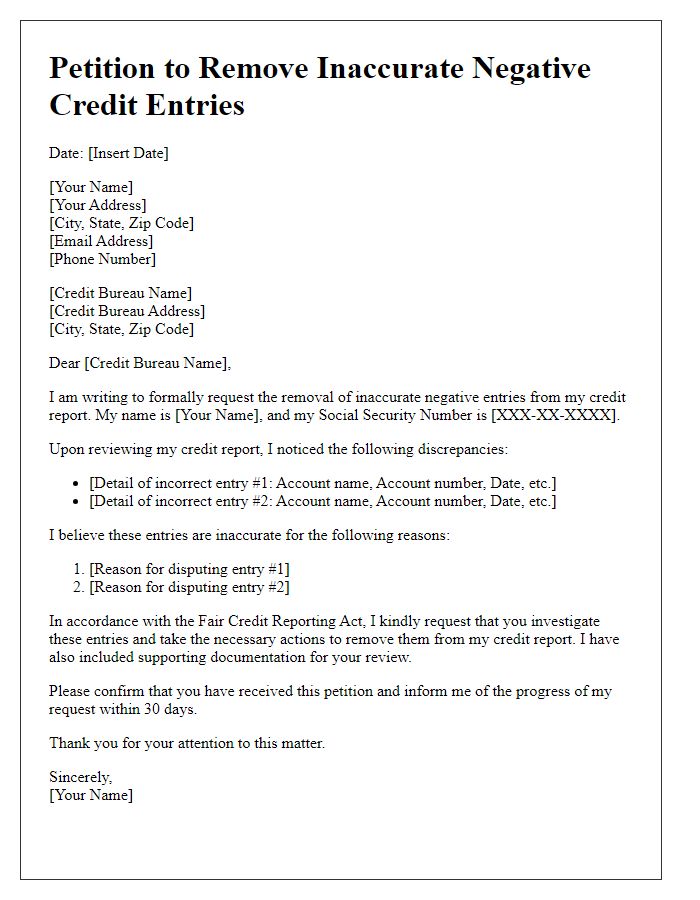

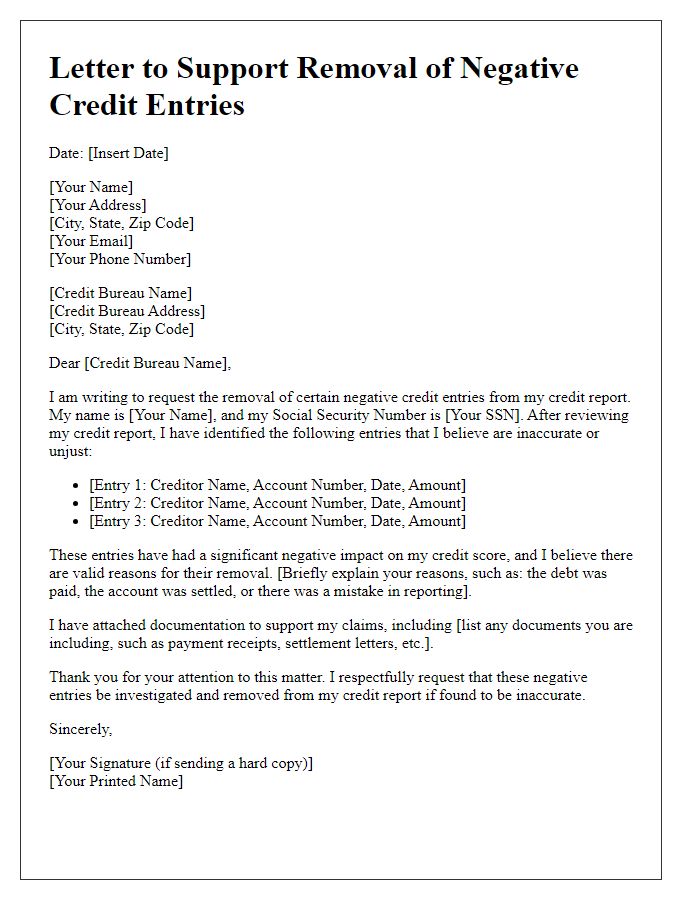

Letter template of dispute for eliminating negative marks from credit report

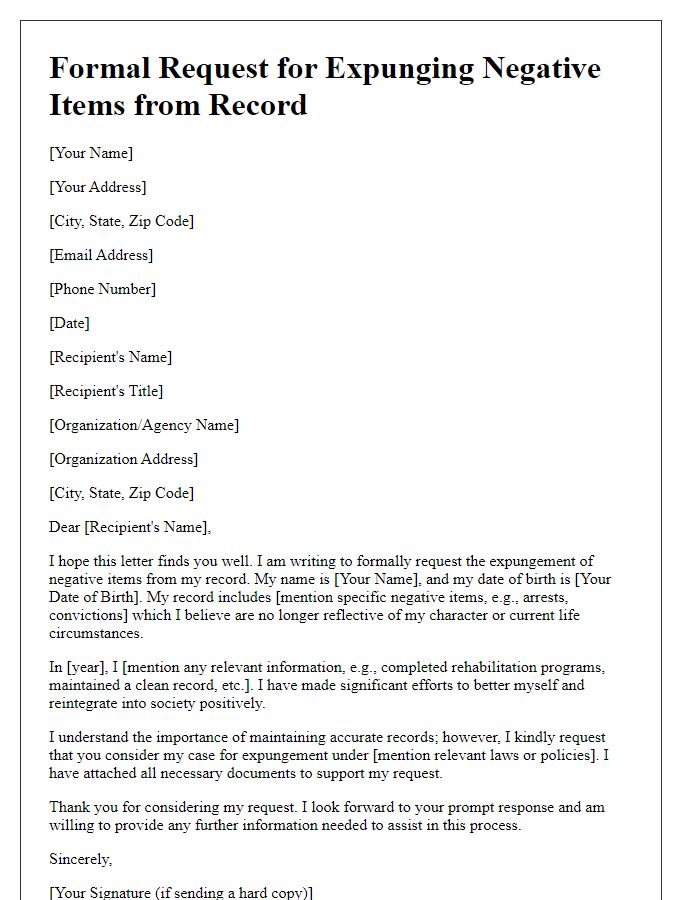

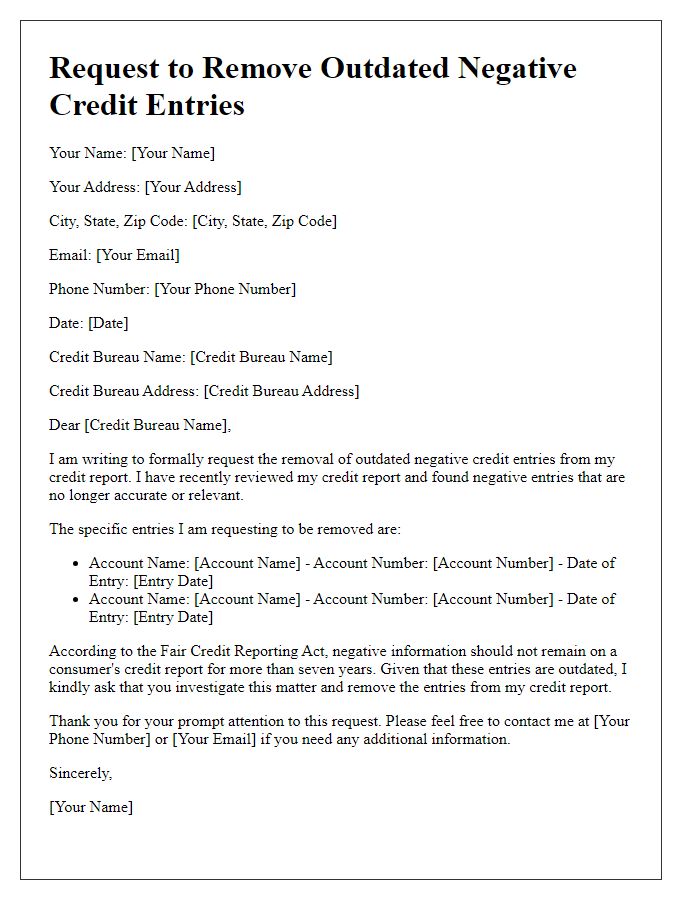

Letter template of formal request for expunging negative items from record

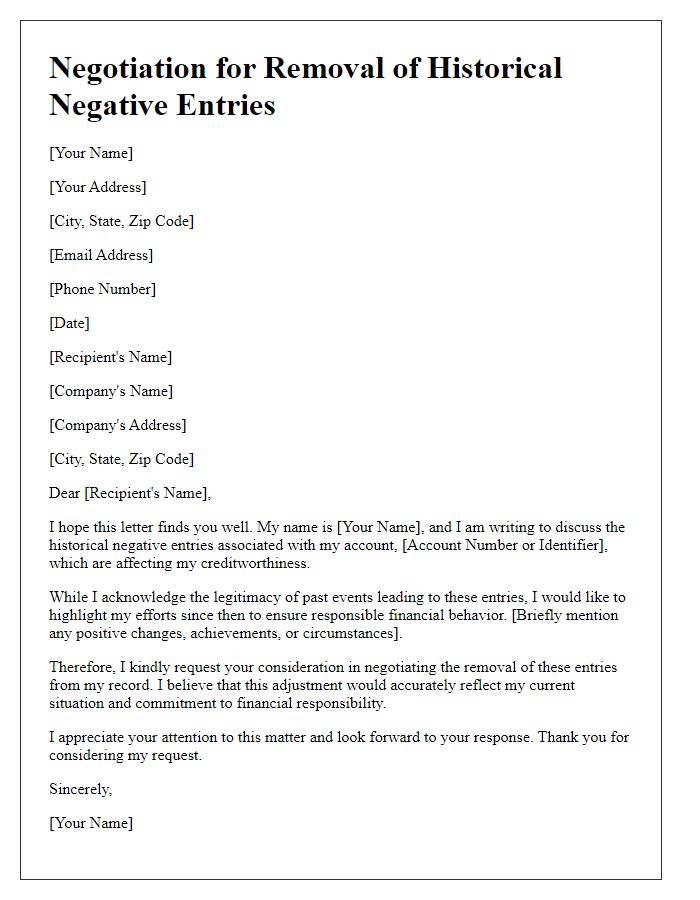

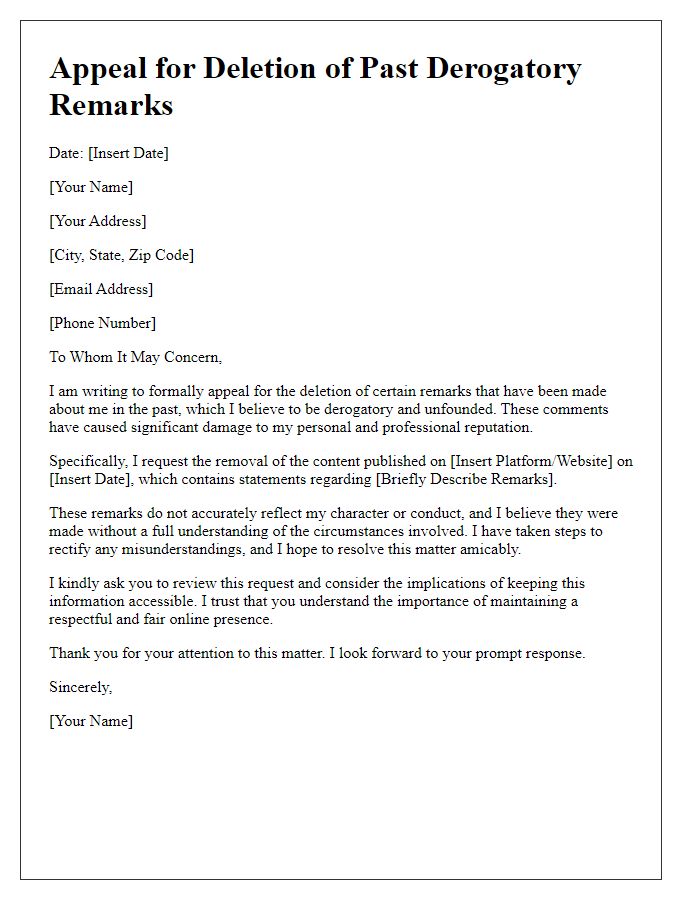

Letter template of negotiation for the removal of historical negative entries

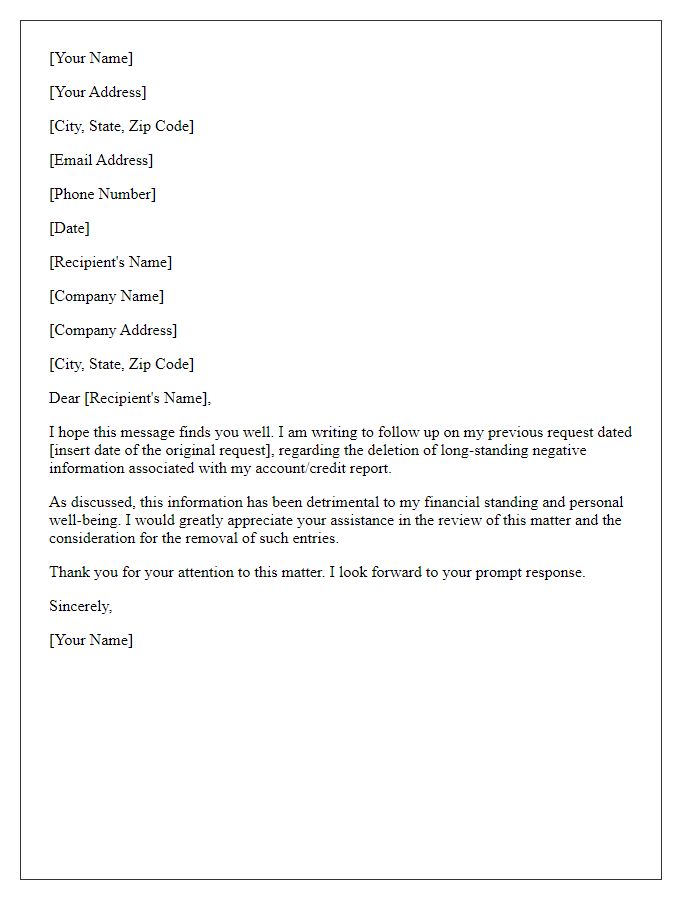

Letter template of follow-up for deleting long-standing negative information

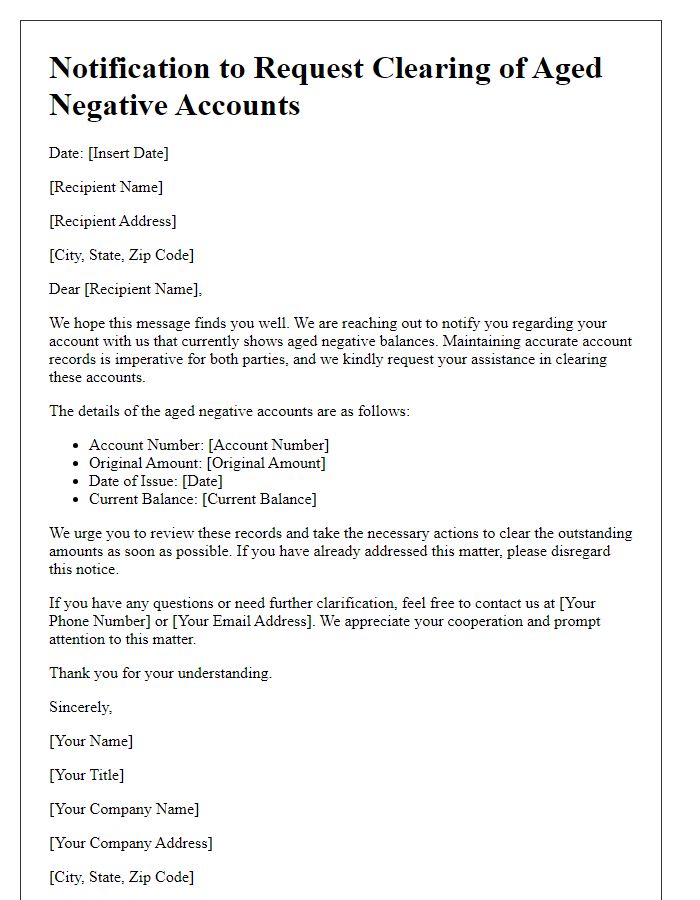

Letter template of notification to request the clearing of aged negative accounts

Comments