Have you ever found yourself in a situation where an unexpected late payment has marred your credit report? You're not alone, and it's a hiccup that many people experience at some point. Writing a request letter to have that late payment removed can be a straightforward solution if you approach it the right way. Let's dive into the essentials of crafting a compelling letter that could help restore your creditworthiness.

Polite and Professional Tone

Late payment marks on credit reports can significantly impact credit scores. Timely payments are crucial for financial health and maintaining a positive credit history. Companies like Experian, Equifax, and TransUnion play vital roles in collecting and reporting this data. These marks can remain on a credit report for up to seven years, often resulting in higher interest rates for loans and credit cards. Factors contributing to these late payments may include unexpected life events, financial hardships, or misunderstandings about payment deadlines. Crafting a respectful request for removal can enhance the chances of a favorable outcome, particularly when accompanied by supporting documentation showing a positive payment history prior to the late incident.

Clear Identification and Account Information

A late payment can negatively impact credit scores, with scores potentially dropping by 100 points. Notable credit scoring agencies, such as FICO and VantageScore, emphasize timely payments as a significant factor (accounting for 35% of FICO scores). Clear identification of the account holder is crucial, which includes naming the creditor or lender, along with the account number (often 10 to 16 digits) associated with the late payment. If applicable, indicate the date of the late payment occurrence (typically within the last 30 to 180 days) and specify the item in question, such as a missed credit card payment or a loan installment. Documenting previous payment history (on-time payments over the past year, for instance) can strengthen the case for goodwill adjustment requests to have the late payment removed.

Explanation of Late Payment Circumstances

A late payment on a credit report can significantly impact an individual's credit score, particularly if it occurred with major credit bureaus like Experian, Equifax, or TransUnion. Late payments include payments made after the due date, typically ranging from 30 to 180 days late. Situations leading to late payments often involve unforeseen events such as medical emergencies, loss of employment, or financial difficulties resulting from global events, like the COVID-19 pandemic. Addressing this, individuals may submit goodwill letters to creditors, detailing their circumstances and requesting the removal of the late payment. Effective communication can lead to favorable outcomes, especially if the payer has a history of on-time payments, reinforcing their commitment to responsible financial behavior.

Request for Removal of Late Payment

A late payment can significantly impact an individual's credit score, typically a reduction of 50 points or more, depending on the overall credit history. Payment records appear on credit reports for seven years, influencing lending decisions and interest rates for car loans, mortgages, and credit cards. Factors like health emergencies, unexpected job loss, or temporary financial struggles often contribute to late payments. Lenders, such as banks or credit unions, may consider a goodwill adjustment to remove this negative mark, especially if the individual has a history of timely payments before the incident. Formulating a request that outlines the circumstances leading to the late payment, along with supporting documents, can enhance chances of success.

Expression of Gratitude and Follow-up Steps

A late payment removal request can significantly impact credit scores and lending eligibility. Understanding how payment history affects financial status is vital for consumers. Timely payments (made within a 30-day window) enhance credit profiles, while late payments (typically reported after 30 days past due) can drop scores up to 100 points. Addressing late payments, especially during unavoidable circumstances like medical emergencies or job losses, can boost financial health. Communicating clearly to the creditor about the situation and emphasizing consistent past payment behavior can lead to favorable outcomes. Utilizing goodwill adjustment requests, often found in consumer finance bureaus, can be effective in rectifying credit reports and improving financial prospects.

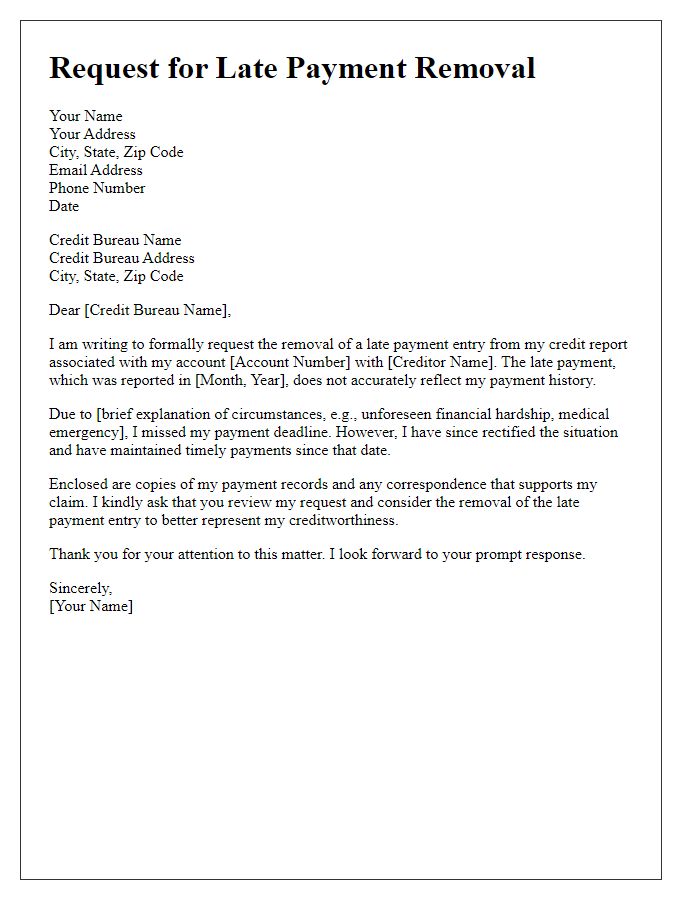

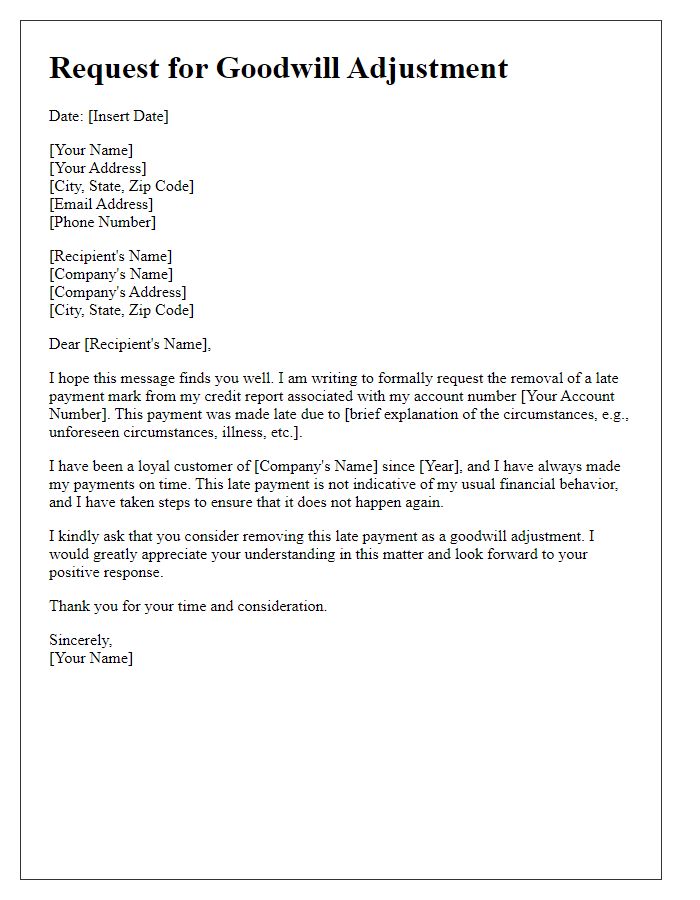

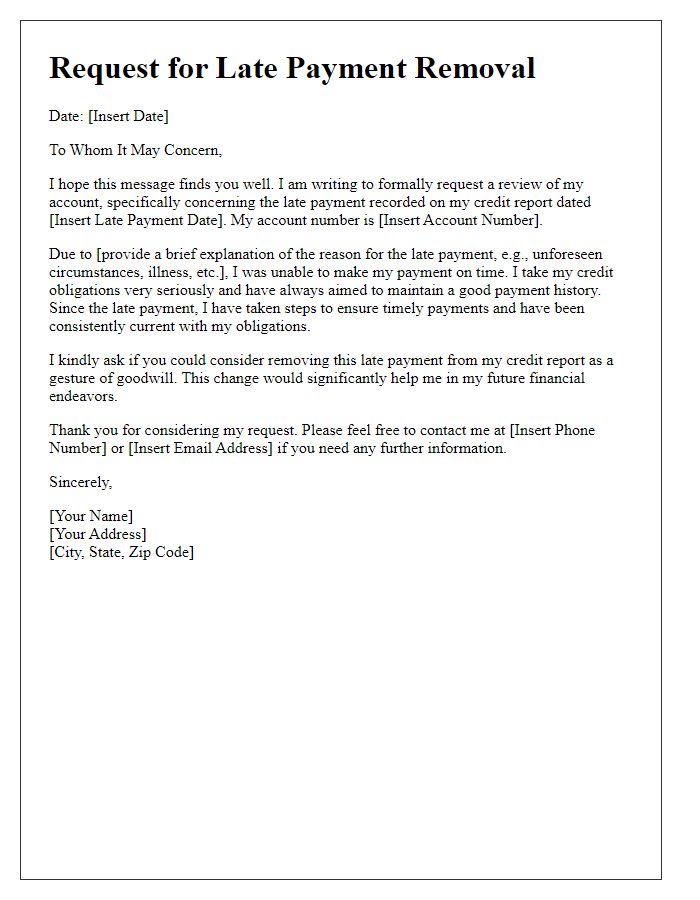

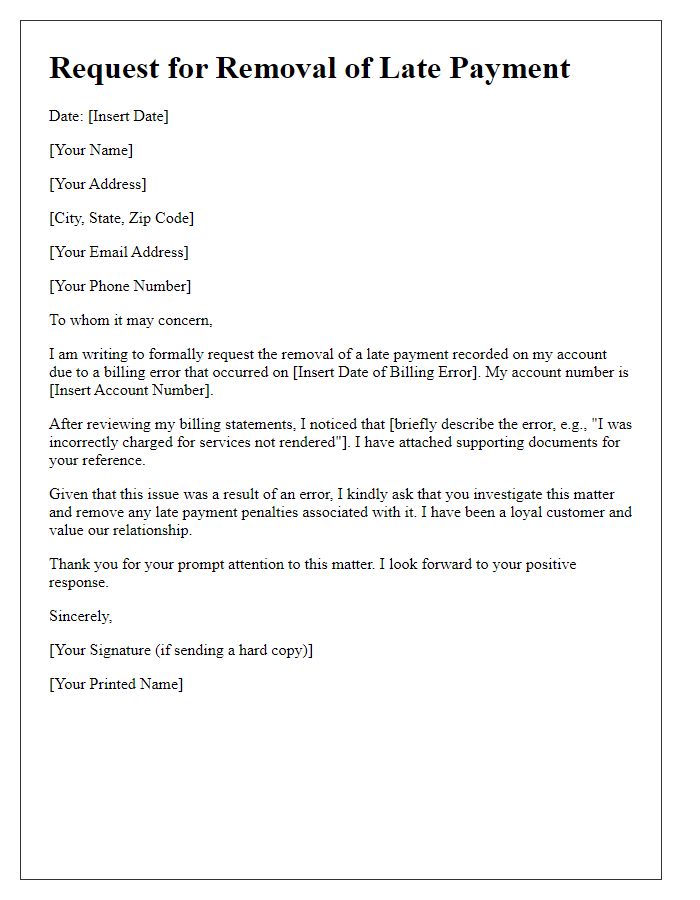

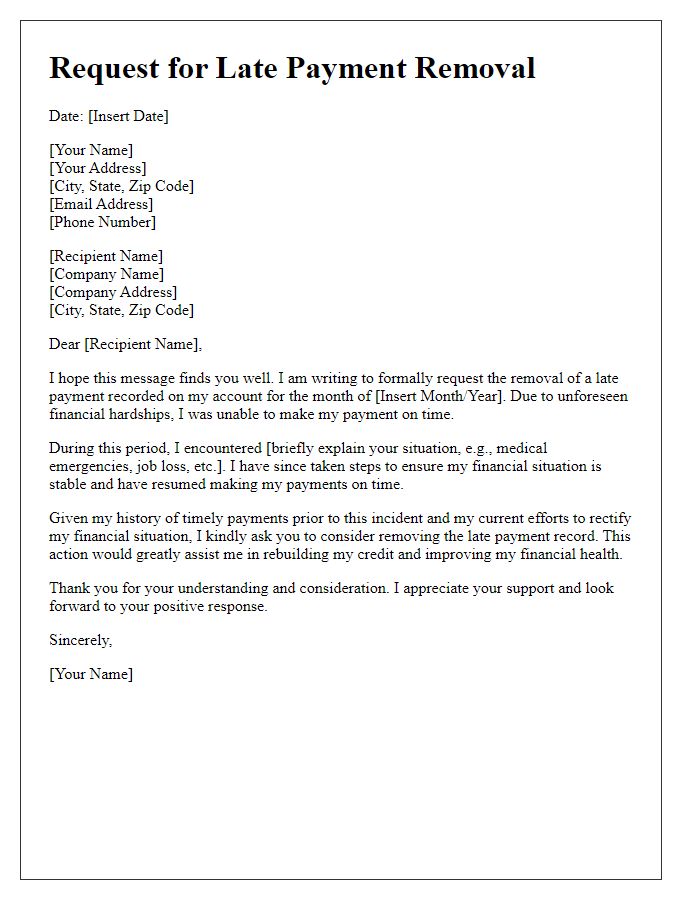

Letter Template For Late Payment Removal Request Samples

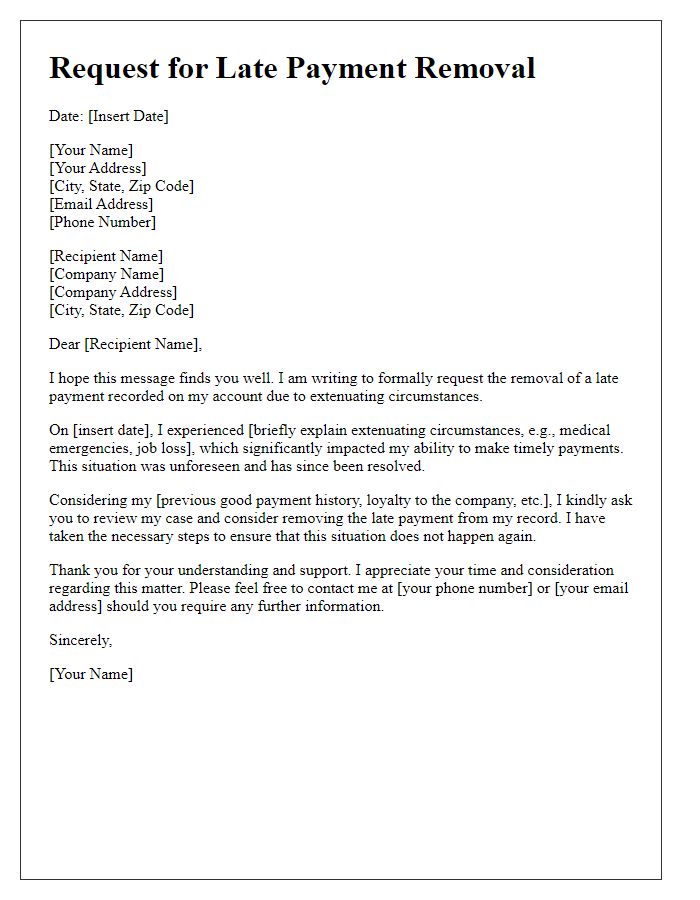

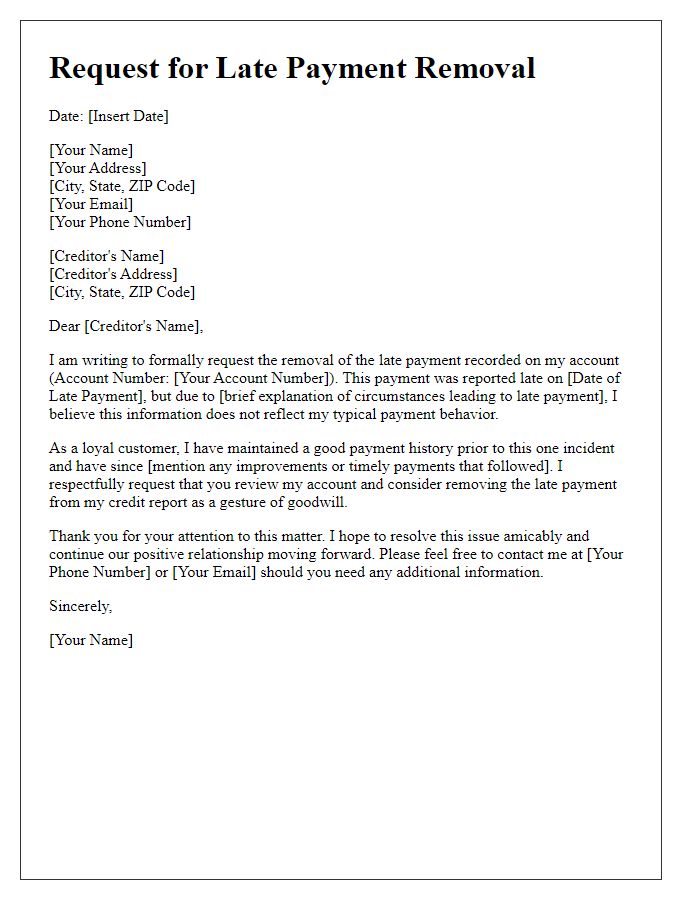

Letter template of late payment removal due to extenuating circumstances

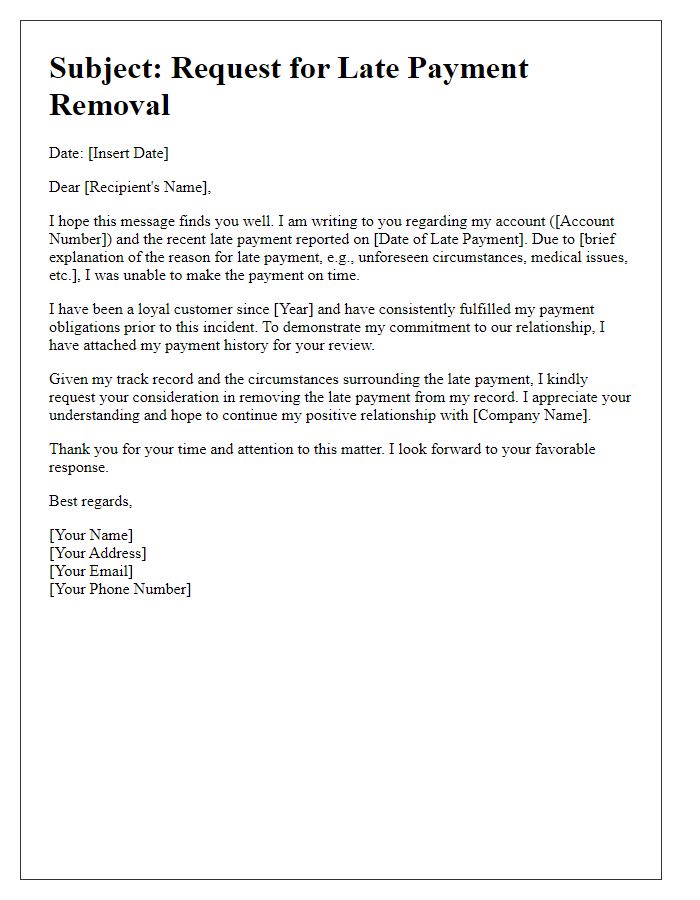

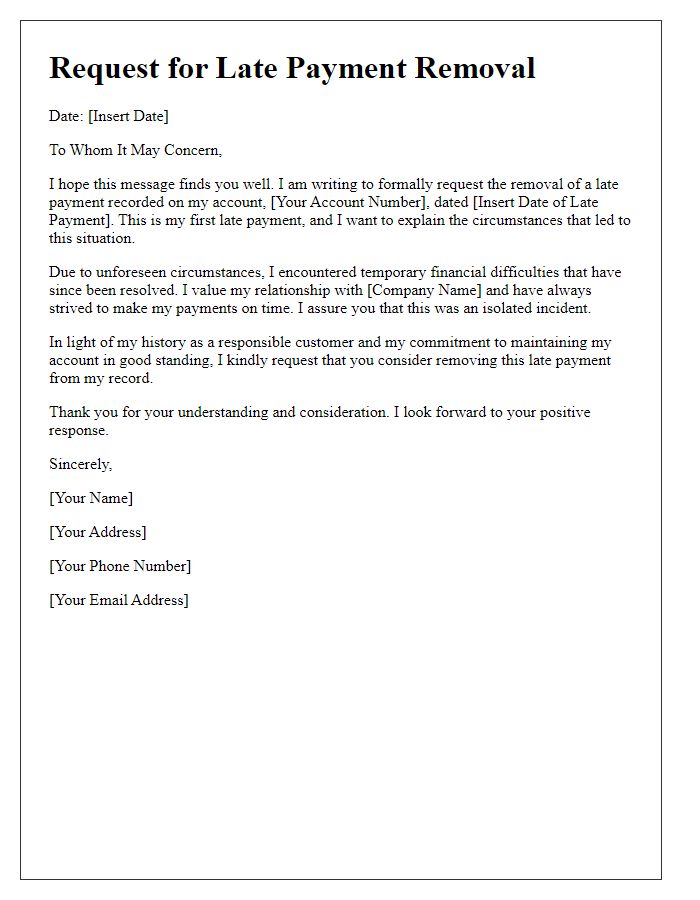

Letter template of late payment removal for customer loyalty consideration

Comments