Are you feeling overwhelmed by your current financial situation and considering a payment deferral? You're not alone; many people find themselves in similar circumstances and seeking relief can be daunting. In this article, we'll explore the steps to craft a compelling letter requesting a payment deferral while maintaining a friendly and professional tone. Stay tuned to discover useful tips and a template that can help you navigate this process with ease!

Polite and Professional Tone

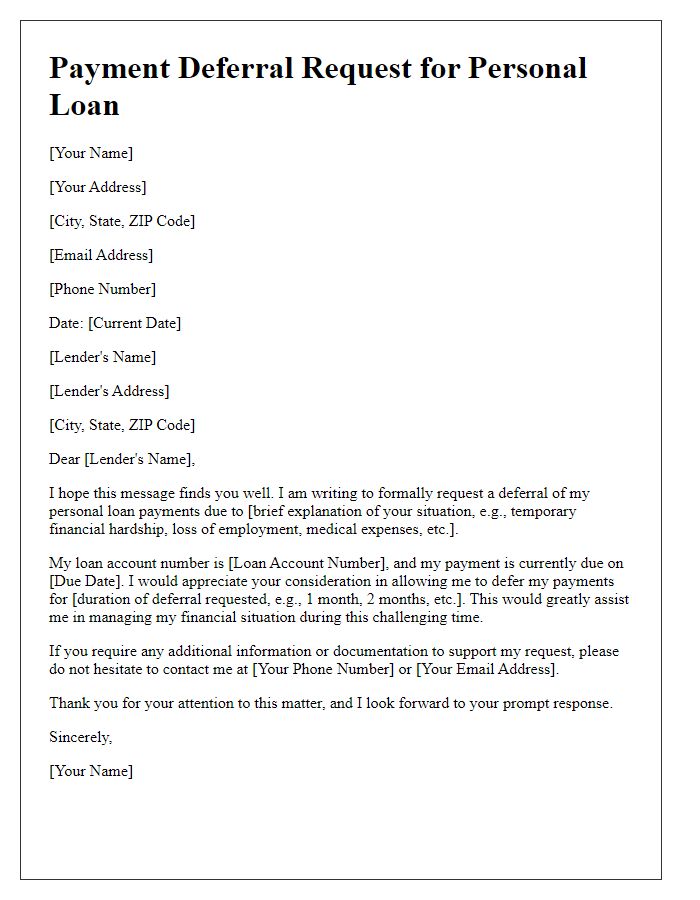

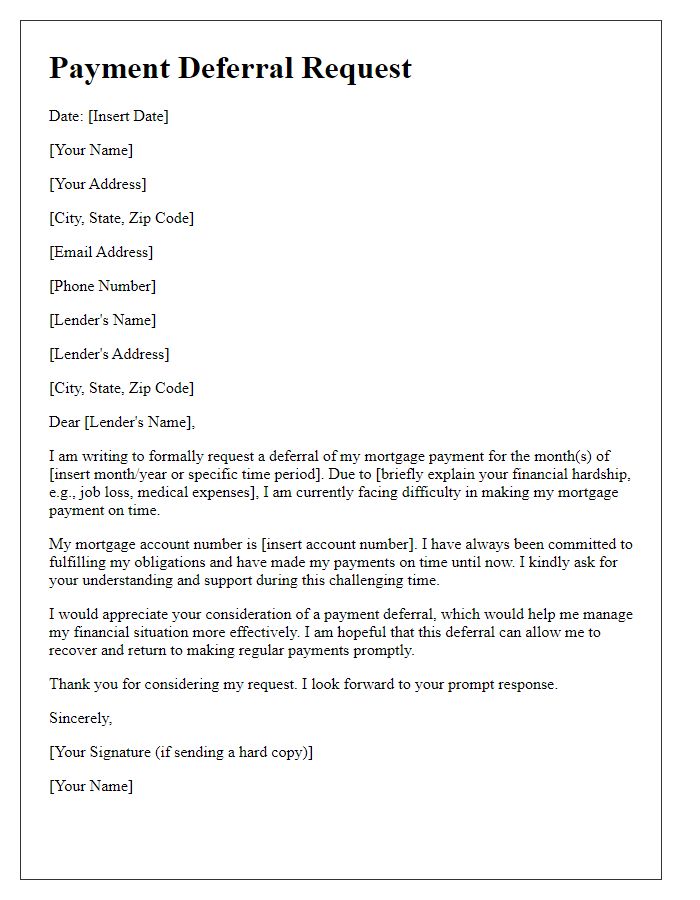

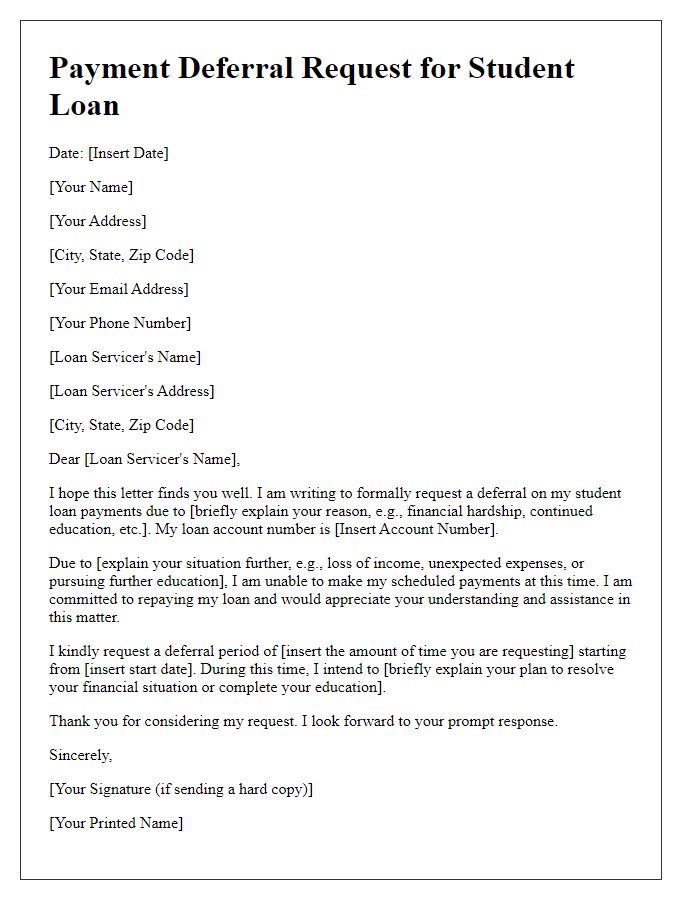

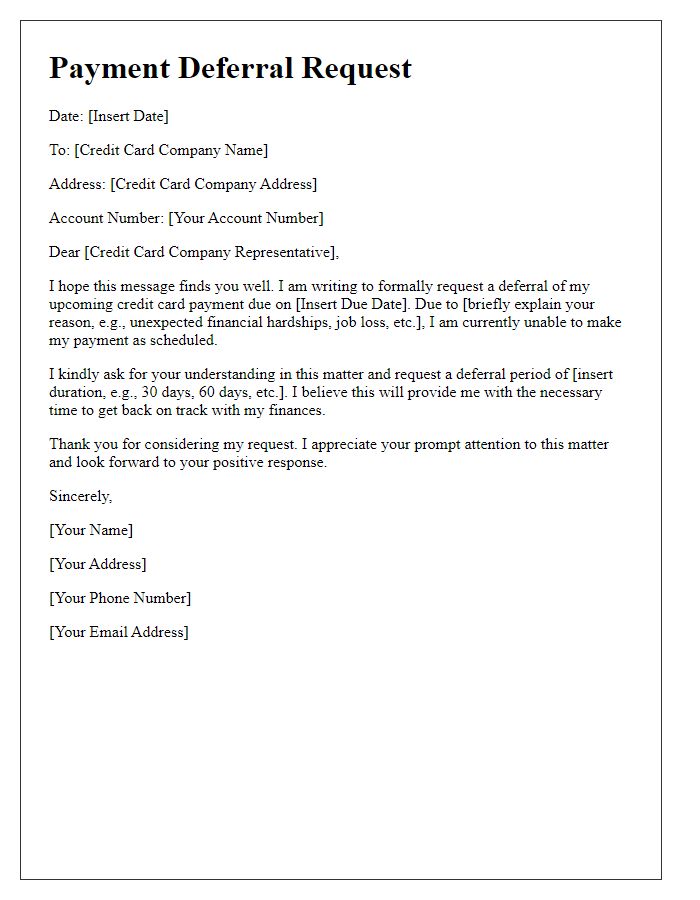

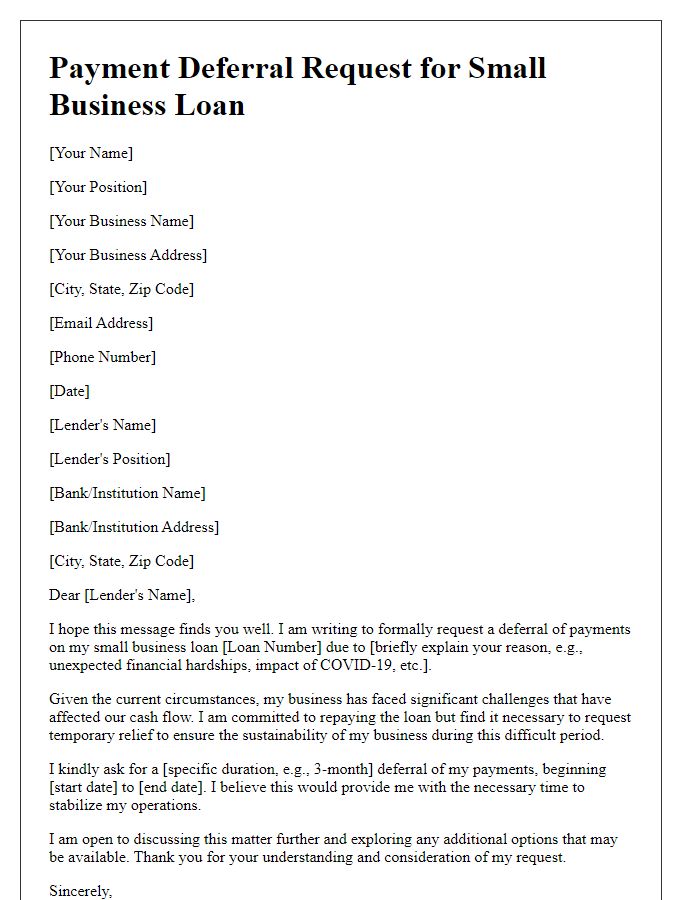

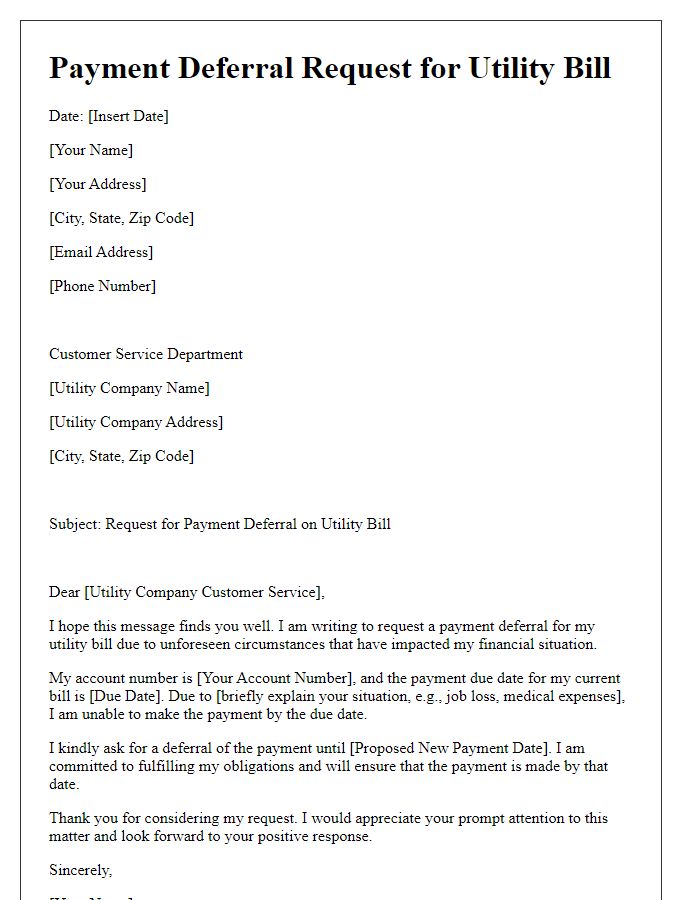

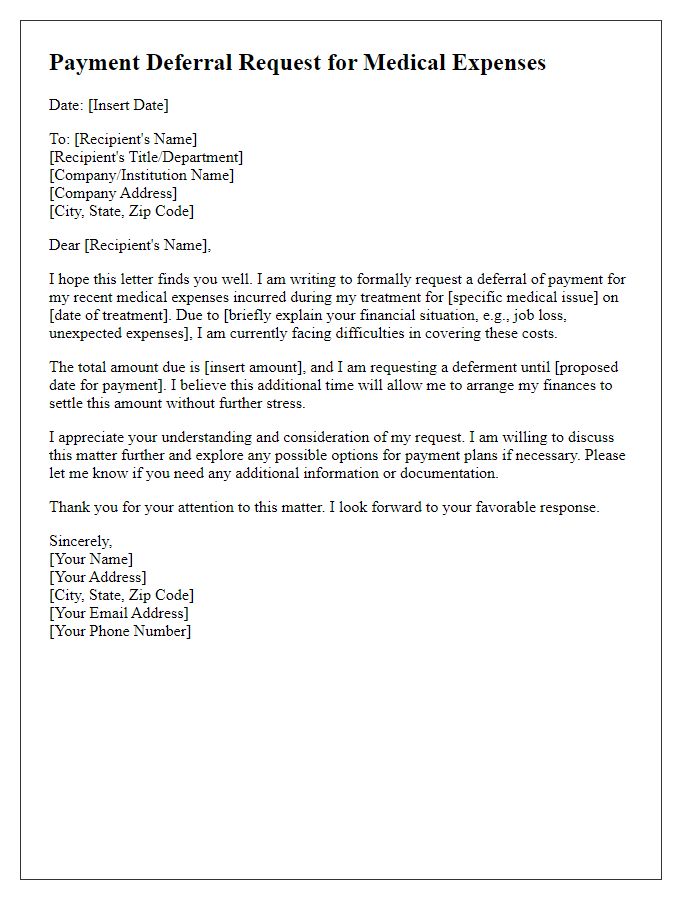

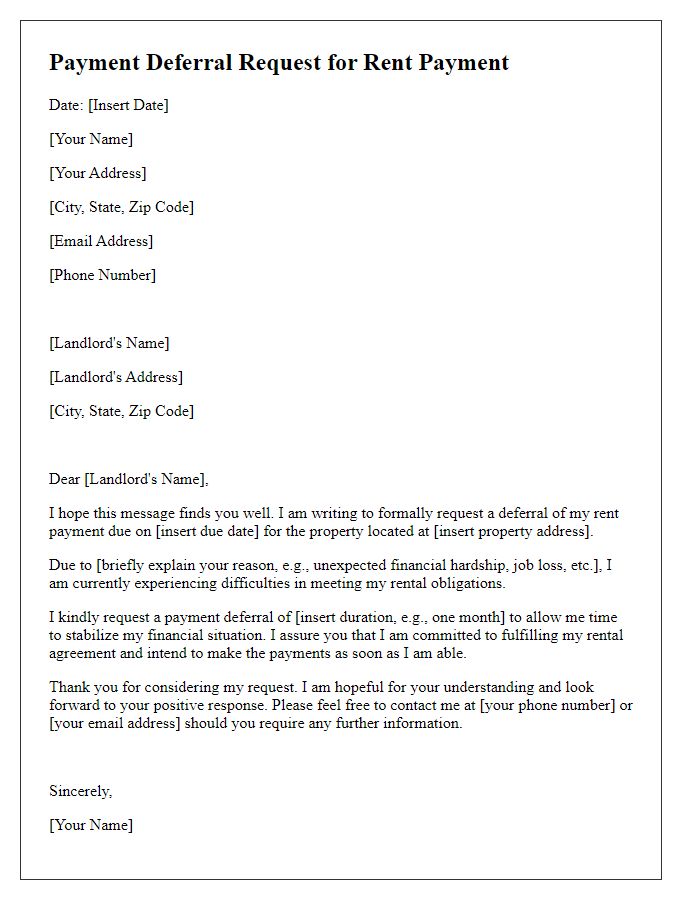

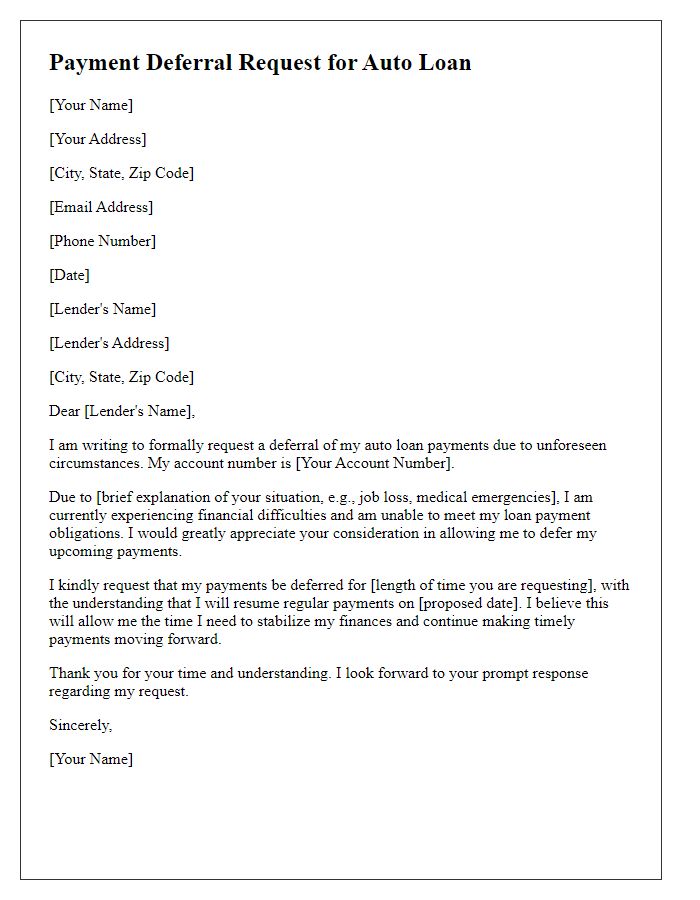

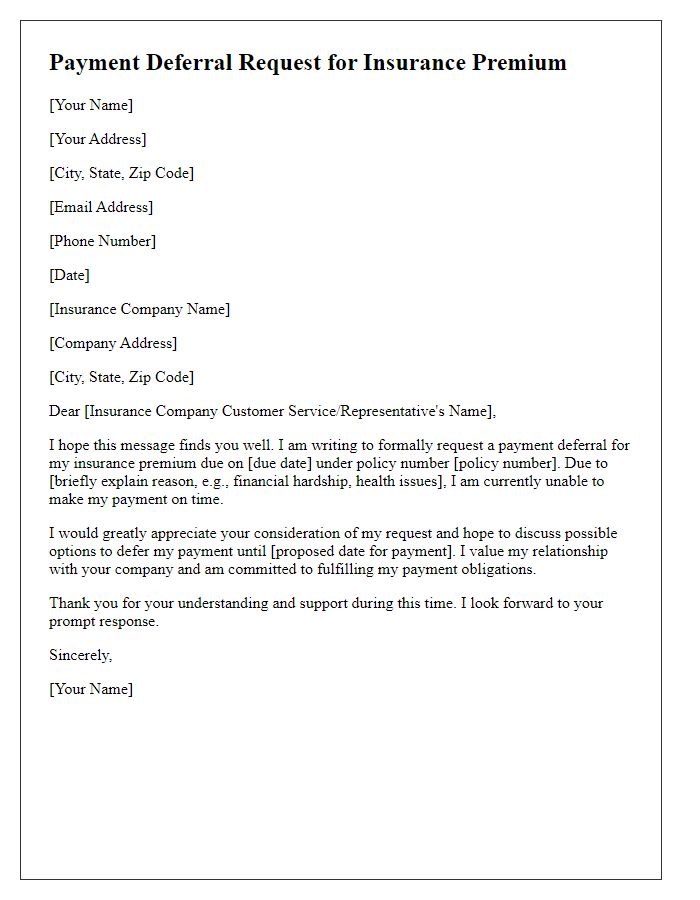

Individuals facing financial difficulties often seek payment deferrals to manage their obligations. A payment deferral request may include specific details about the amount owed, original due dates, and the reasons for the request, such as unforeseen expenses or job loss. Additionally, mentioning your current situation and proposing a new payment plan or timeline may strengthen the request. It's vital to maintain professionalism and politeness in tone while addressing the relevant entity, be it a creditor, landlord, or service provider, to enhance the chances of a favorable response.

Clear Explanation of Circumstances

Many individuals may encounter financial difficulties that necessitate a payment deferral request. Common circumstances include unexpected medical expenses (averaging over $2,000 in surgeries), job loss (unemployment rates reaching 6.2% during economic downturns), or significant home repairs (with costs often exceeding $5,000). These situations can create severe cash flow challenges, making it difficult to meet scheduled payments for loans or bills. A detailed explanation of these hardships, such as recent illnesses or layoffs, can provide the lender with context, leading to potential approvals for delayed payment arrangements or modified repayment plans. Effective communication about the timeline of events and specific financial impacts may bolster the request for assistance.

Specific Request and Details

Payment deferral requests often arise in challenging financial circumstances. Individuals may seek to delay scheduled payments for loans, mortgages, or credit cards due to unexpected events. A comprehensive request typically includes essential details such as the account number, the reason for the deferral (like job loss or medical expenses), and the duration of the requested delay (potentially three to six months). Including relevant financial documents, such as pay stubs or medical bills, can support the request's legitimacy. Additionally, providing a proposed repayment plan upon resuming payments demonstrates responsibility and commitment. Such requests may ultimately facilitate better financial management during tough times while maintaining communication with lenders.

Supporting Documentation

A payment deferral request requires supportive documentation to substantiate the claim. Relevant documents may include recent bank statements reflecting financial hardship, such as unexpected job loss or medical expenses like treatment bills exceeding $10,000. Income statements from the previous three months can also provide a clear picture of current financial status. Additionally, copies of utility bills showcasing late fees due to payment delays can strengthen the case. Formal communication, such as a letter from an employer confirming reduced working hours or a termination notice, may further support the request for deferral. Such documentation offers clear evidence of the financial situation impacting the ability to meet payment obligations.

Contact Information and Follow-up

A payment deferral request requires clear communication and relevant contact information to streamline the process. The request should include essential details such as the name of the entity managing the financial agreement, such as ABC Financial Services located in Chicago, Illinois. Dates of previous payments, total outstanding balance, and specific reasons for the deferral, like unexpected medical expenses or job loss, should be outlined. Essential contact information, such as a phone number (e.g., 555-123-4567) and a professional email, is vital for prompt follow-ups. Additionally, include a clear timeline for requesting a response, like a week from the date of the initial request, to ensure accountability and facilitate timely communication between parties involved.

Comments