Are you curious about maximizing your health benefits? Understanding the ins and outs of your health coverage can be a game-changer for you and your family. In this article, we'll break down essential information about your health benefits, from preventive care to prescription coverage, ensuring that you know exactly what's available to you. So, let's dive in and discover how you can make the most of your health benefits!

Clear subject line.

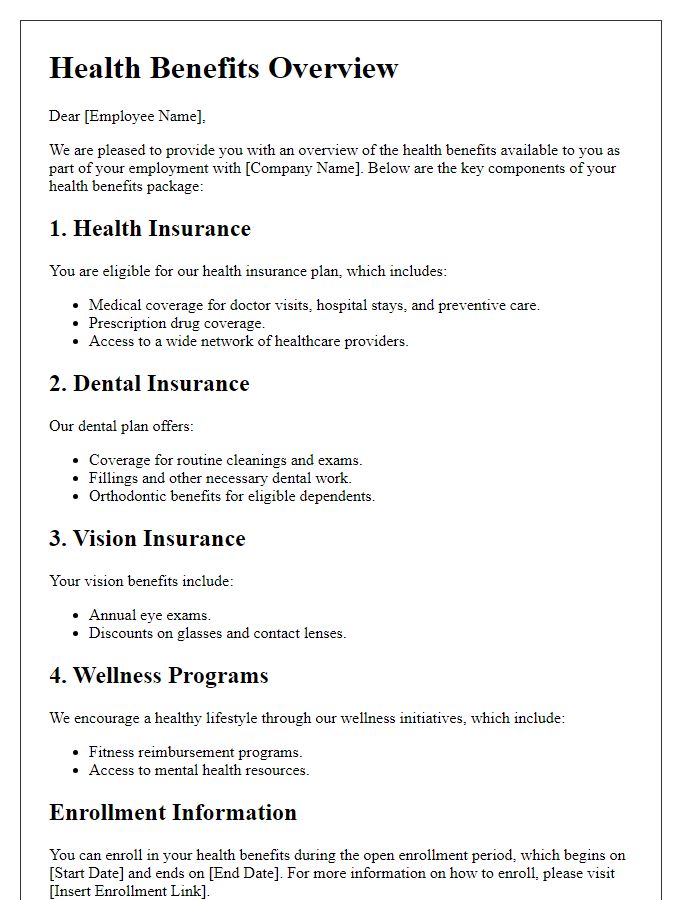

Health Benefits Overview: Essential Information for Employees Health benefits serve as a crucial aspect of employee compensation, providing coverage for medical expenses. Health Insurance (such as Preferred Provider Organization, or PPO, and Health Maintenance Organization, or HMO) often covers routine check-ups, hospital stays, and surgical procedures. According to a recent study by the Kaiser Family Foundation, employers contribute an average of over $7,000 annually towards each employee's family health insurance premium. Additionally, preventive services like vaccinations and screenings are typically fully covered, encouraging regular health maintenance. Furthermore, mental health support, including counseling and wellness programs, is increasingly available, emphasizing holistic employee well-being. Understanding your health benefits can aid in making informed decisions about medical care and financial planning.

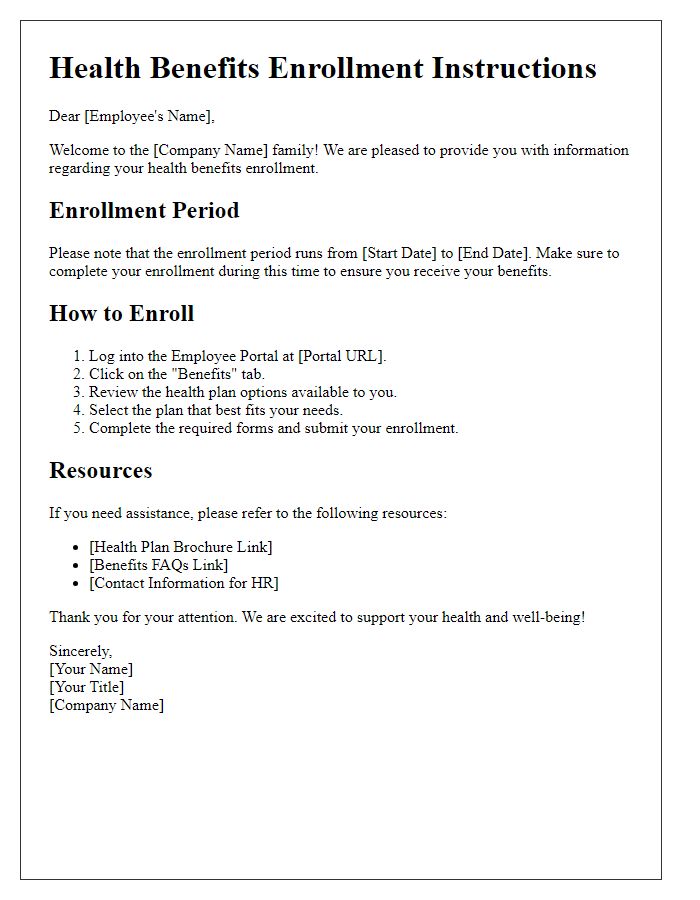

Recipient's details.

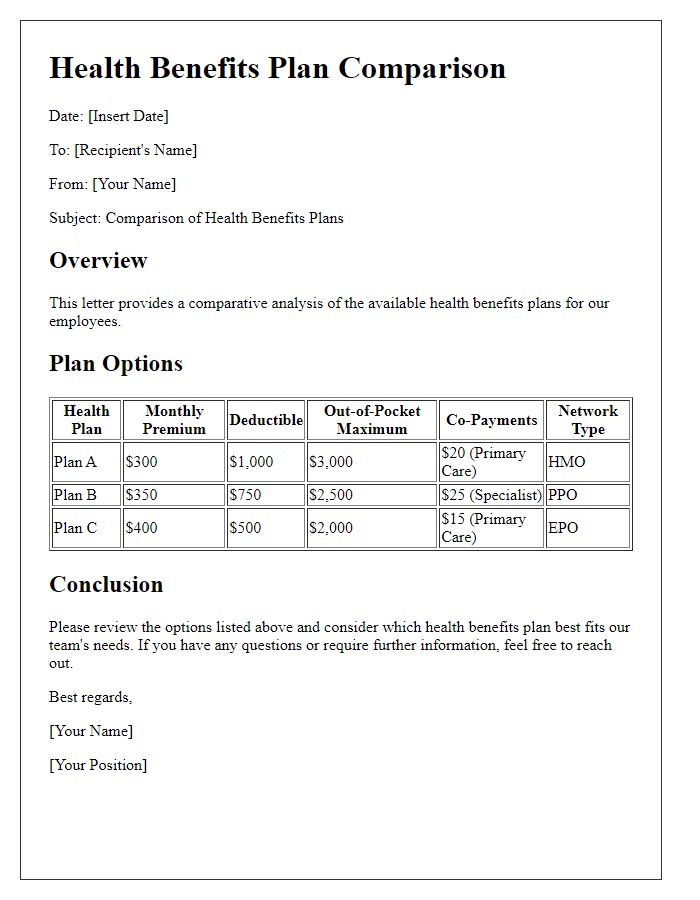

Health benefits information plays a crucial role in understanding coverage options and available services for individuals. These benefits, often administered by organizations such as insurance companies or employers, can include preventative care, prescription drug coverage, and mental health resources. For instance, under the Affordable Care Act, most health plans must cover essential health benefits, categorizing them into ten areas, including maternity care, emergencies, and hospitalization. Employees, covered under workplace plans, might receive detailed summaries outlining their rights and the appeals process in case of denied claims. Additionally, understanding deductible amounts, co-payments, and out-of-pocket maximums is essential for effectively utilizing benefits throughout the policy year.

Company logo and branding.

Health benefits information often emphasizes essential coverage options like medical, dental, and vision plans. Many companies offer a variety of health insurance providers, such as UnitedHealthcare or Blue Cross Blue Shield, featuring comprehensive packages tailored for different family sizes. Eligibility typically requires full-time employment status, where employees must work a minimum of 30 hours weekly. Enrollment periods, like the annual open enrollment in November, are crucial for selecting or updating coverage options, while various deductibles may apply depending on the plan chosen. Additionally, wellness programs may provide incentives for regular check-ups, screenings, or gym memberships, fostering healthier lifestyles among employees. Understanding these benefits can significantly improve employee well-being and satisfaction.

Detailed benefits description.

Health benefits programs provide vital support for medical needs, encompassing services like preventive care, hospitalization, and prescription medications. Comprehensive coverage often includes annual physical exams that promote routine health assessments, immunizations to protect against infectious diseases, and screenings for conditions such as diabetes and hypertension. Mental health services, including therapy sessions and psychiatric evaluations, are crucial for emotional well-being. Furthermore, specialized treatments like chiropractic care and physical therapy enhance recovery from injuries. Virtual care options, such as telehealth consultations, offer convenience and accessibility, especially in rural areas. Dental and vision coverage typically accompanies health plans, ensuring holistic care for members. All these benefits aim to foster overall health and improve outcomes for individuals enrolled in the program.

Contact information for queries.

Health benefits programs often provide crucial support for employees in various sectors. For inquiries regarding personal health coverage, employees can reach out to the Human Resources department at their respective companies. Specific contact details usually include phone numbers, such as a dedicated helpline like 1-800-555-0199, and email addresses, commonly formatted as hr@companyname.com, ensuring streamlined communication. In addition, companies may offer user-friendly online portals, accessible via secure links, where employees can find resources, policy details, and FAQs related to their health benefits. Keeping this information handy is vital for prompt assistance during critical times.

Comments