Navigating the world of legal compliance can feel overwhelming, but it doesn't have to be! Staying informed about your obligations is crucial for protecting your business and avoiding potential penalties. In this article, we'll break down the essential reminders you need to keep on your radar, making compliance a breeze. So, let's dive in and explore how you can stay on top of your legal responsibilities!

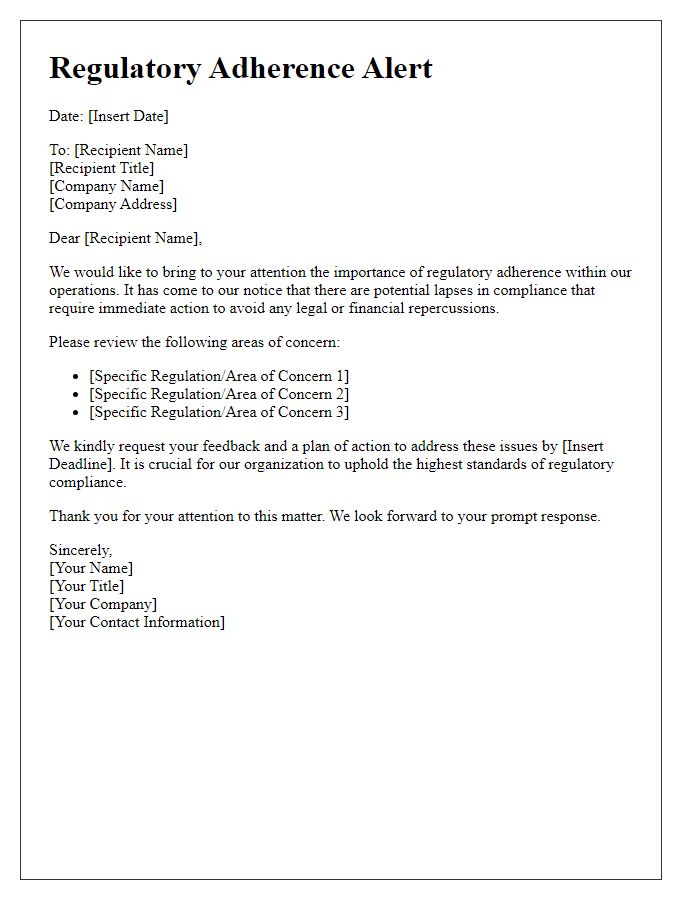

Regulatory requirements

Regulatory compliance reminders serve as critical communications for businesses to adhere to various legal standards and obligations. Legal requirements, such as the Sarbanes-Oxley Act for publicly traded companies or the General Data Protection Regulation (GDPR) for data protection in the European Union, impose strict guidelines on financial reporting and privacy practices. Deadlines for submissions, like the quarterly financial disclosures or annual privacy audits, are significant for maintaining compliance. Specific regulators, such as the Securities and Exchange Commission (SEC) or the Information Commissioner's Office (ICO), enforce these regulations and impose penalties for non-compliance. Additionally, businesses must stay informed about any changes in laws or regulations that may impact their operations, ensuring they are updated promptly to avoid legal repercussions.

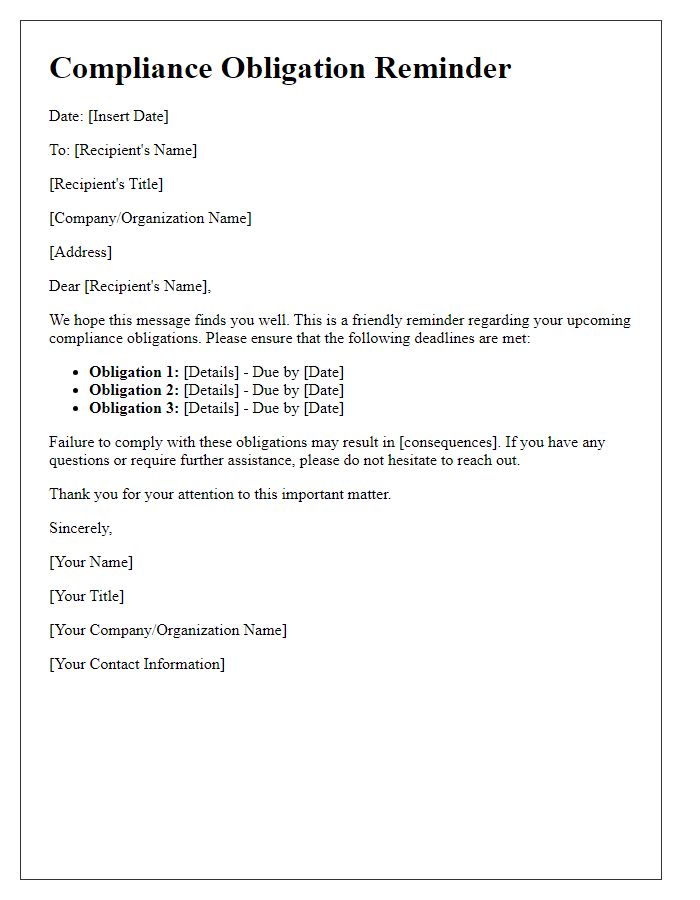

Deadlines and schedules

Legal compliance deadlines play a critical role in various industries, ensuring organizations adhere to regulations such as the General Data Protection Regulation (GDPR) and Occupational Safety and Health Administration (OSHA) standards. For example, GDPR mandates businesses to conduct annual data protection impact assessments by May 25, necessitating thorough documentation of data processing activities. Meanwhile, OSHA requires companies to update their injury and illness records by December 1 each year, with potential fines for non-compliance reaching up to $7,000 per violation. Staying ahead of these deadlines through effective scheduling and reminders can safeguard businesses against legal penalties and maintain operational integrity.

Jurisdiction-specific guidelines

Jurisdiction-specific compliance guidelines are critical for businesses to adhere to local laws and regulations, ensuring legal integrity and avoidance of penalties. Each region, such as the European Union with its General Data Protection Regulation (GDPR) affecting data privacy, or California's Consumer Privacy Act (CCPA), outlines distinct requirements that must be followed. Organizations must remain vigilant about deadlines, submission processes, and required documentation, which can vary significantly across jurisdictions. For example, the state of New York mandates cybersecurity measures for financial institutions under the New York Department of Financial Services (NYDFS) regulations. Staying informed on these evolving frameworks is essential for maintaining compliance and fostering trust with clients and stakeholders.

Documentation and record-keeping

Legal compliance reminders regarding documentation and record-keeping play a vital role in various industries, such as finance, healthcare, and education. Maintaining accurate records for audits ensures adherence to regulations set by bodies like the Financial Accounting Standards Board (FASB) or the Health Insurance Portability and Accountability Act (HIPAA). Essential documents include contracts (legally binding agreements), invoices (itemized bills for services rendered), and employee records (information pertaining to workforce management). Compliance violations may result in significant fines, events that can disrupt business operations and result in legal disputes. Regularly scheduled reviews of documentation processes can help mitigate risks associated with non-compliance. Implementing an organized filing system, both physical and digital, contributes to efficient retrieval of records during audits or inspections.

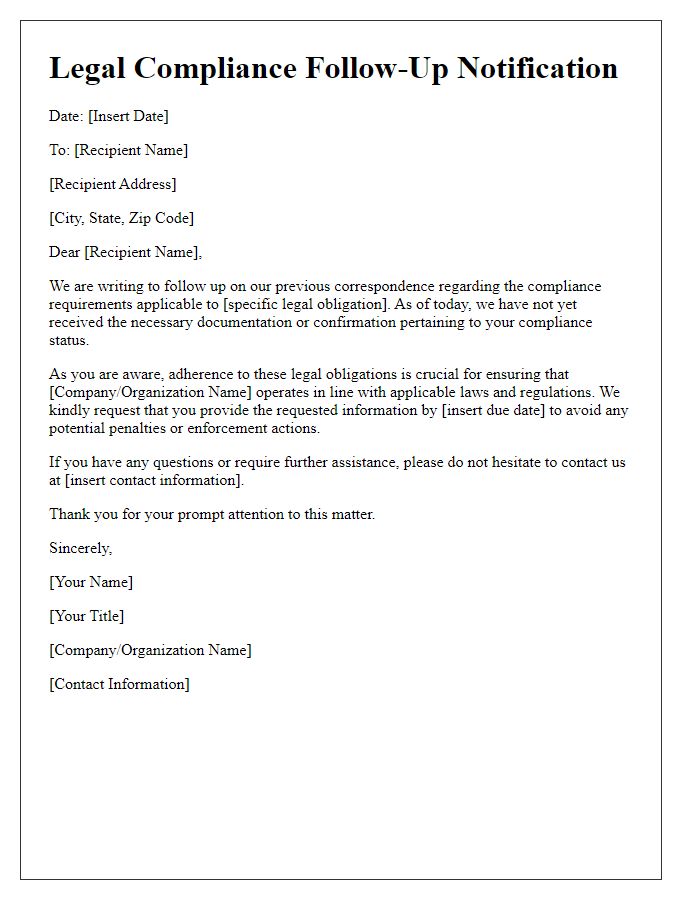

Contact information for inquiries

Legal compliance reminders are essential for businesses to adhere to regulations such as GDPR or HIPAA. These reminders can include crucial contact information for inquiries, ensuring a clear channel for addressing compliance issues. For example, a dedicated compliance officer's email (compliance@companyname.com) allows for streamlined communication regarding policy updates or regulatory questions. Providing a phone number such as (123) 456-7890 makes it easy for employees or clients to reach out for immediate concerns. Including a physical address for formal correspondence, like 123 Compliance Way, Suite 100, Cityville, ST 12345, ensures that all stakeholders can submit documents or grievances efficiently. This approach promotes a culture of transparency and accountability within the organization.

Comments