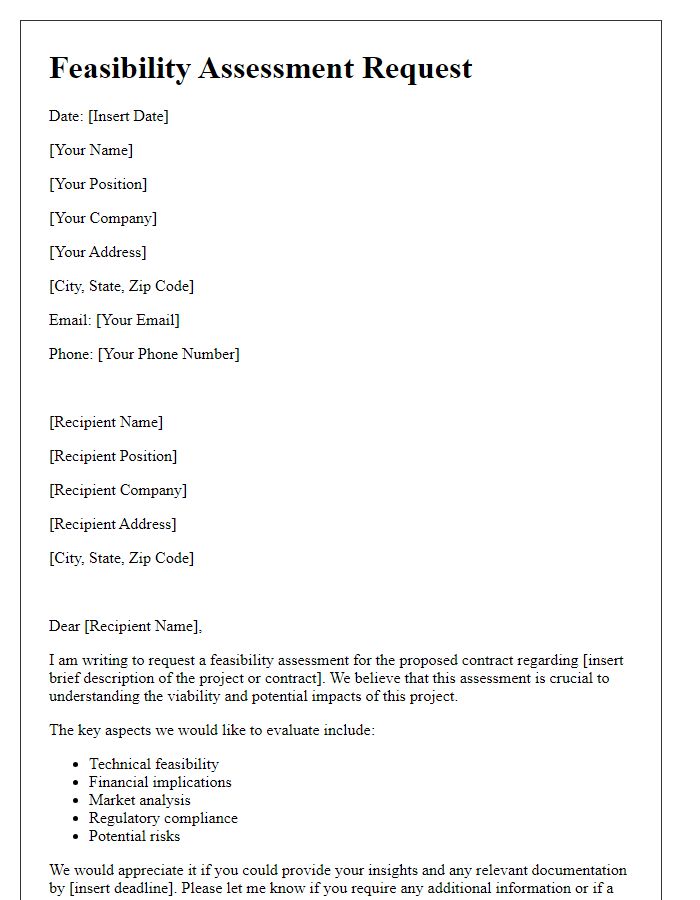

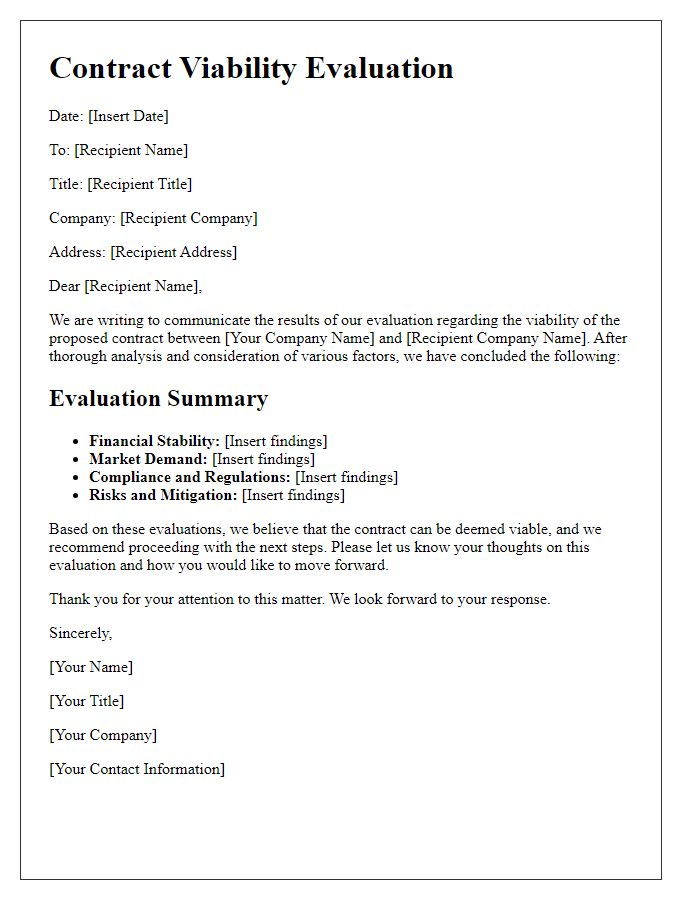

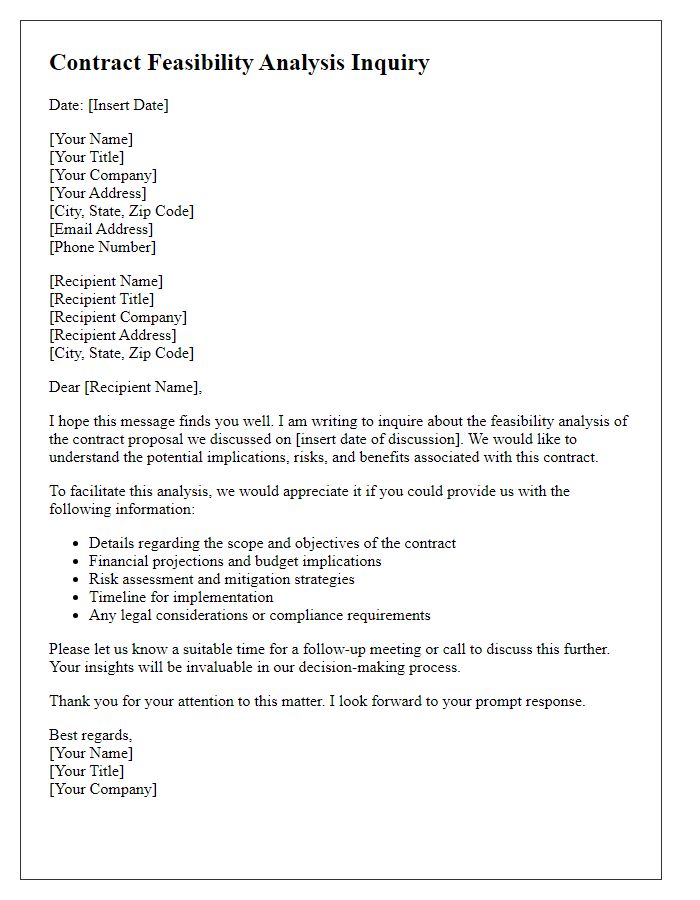

Are you considering a new project and wondering about the feasibility of your contract? A well-structured feasibility study letter can provide clarity and help you make informed decisions. In this article, we'll explore the essential components of a contract feasibility study letter, turning complex legal jargon into simple, actionable insights. Curious to learn how to craft your own impactful letter? Let's dive in!

Purpose and objectives

A contract feasibility study aims to evaluate the practicality of entering into a contractual agreement within specific projects or partnerships. Key objectives include assessing financial viability, analyzing potential risks associated with the contract terms and conditions, and determining compliance with relevant regulations specific to the industry (e.g., construction, technology, healthcare). Furthermore, the study seeks to identify key stakeholders involved, outline timelines for project execution, and establish performance metrics for successful outcomes. Critical analyses of market demands and competitive landscape also play a significant role in ensuring that the contract meets strategic business goals while delivering expected returns on investment.

Key stakeholders and roles

In a contract feasibility study, identification of key stakeholders is essential for understanding project dynamics. Stakeholders include executives from the company (decision-makers influencing contract approval), project managers responsible for implementation, and financial analysts evaluating cost implications. External parties such as legal advisors ensure compliance with applicable laws, while suppliers provide insights into availability and pricing of necessary materials. Regulatory bodies may impact project execution with their guidelines, while community representatives assess potential social impacts. Each stakeholder holds a distinct role in contributing to the study, facilitating informed decision-making processes regarding contract viability and project success.

Methodology and approach

A comprehensive contract feasibility study involves a systematic methodology and approach to assess the viability of potential agreements. This process typically begins with stakeholder analysis, identifying key participants, such as project managers and legal advisors, essential for gaining insights into interests and expectations. Data collection follows, where both qualitative and quantitative methods, including surveys and interviews, gather critical information about market conditions, legal requirements, and financial implications. Afterward, a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) evaluates the circumstances surrounding the proposed contract. Risk assessment identifies potential pitfalls, utilizing tools like risk matrices to prioritize issues based on likelihood and impact. Finally, the findings culminate in a detailed report, highlighting recommendations and an actionable roadmap for contract negotiation and implementation, facilitating informed decision-making by all involved parties.

Budget and timeline

A comprehensive feasibility study for a contract involves an in-depth evaluation of the project budget, including all associated costs and resource allocations. This study should specify the estimated budget, detailing direct costs such as materials, labor, and equipment, alongside indirect costs like overhead and administrative expenses. For example, total estimated expenses may range from $50,000 to $200,000 depending on project scope and complexity. Additionally, the timeline must outline key milestones and phases, indicating the expected duration of each phase, from initial planning (approximately 2 weeks) through execution (estimate of 3-6 months), to final assessment and closure (around 1 month). Stakeholders should clearly understand the critical path and deadlines to ensure effective communication and alignment throughout the project lifecycle.

Risk assessment and mitigation strategies

Conducting a comprehensive risk assessment and implementing effective mitigation strategies are crucial components of a contract feasibility study, particularly in complex projects such as infrastructure development, which often involves multiple stakeholders, significant financial investment, and regulatory compliance. Identifying potential risks such as cost overruns, schedule delays, and environmental impact is essential. For instance, financial risks associated with budget estimates may fluctuate based on market conditions or unforeseen expenses. Legal risks can arise from regulatory changes or compliance issues, affecting project timelines or operational capabilities. Effective mitigation strategies may include establishing contingency budgets, conducting regular project reviews, and engaging legal experts to ensure compliance with local laws in specific regions like New York City or Los Angeles. Additionally, employing risk management frameworks like SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis can help prioritize potential issues while aligning with organizational goals. Early identification and proactive management of risks can enhance project viability and ensure alignment with contractual obligations.

Comments