Are you navigating the exciting but complex process of a business merger? Crafting a merger agreement can be daunting, but having a solid letter template can streamline the communication between parties involved. In this article, we'll explore key components that should be included in your business merger agreement letter to ensure clarity and transparency. Join us as we break it down and invite you to read more for essential tips and insights!

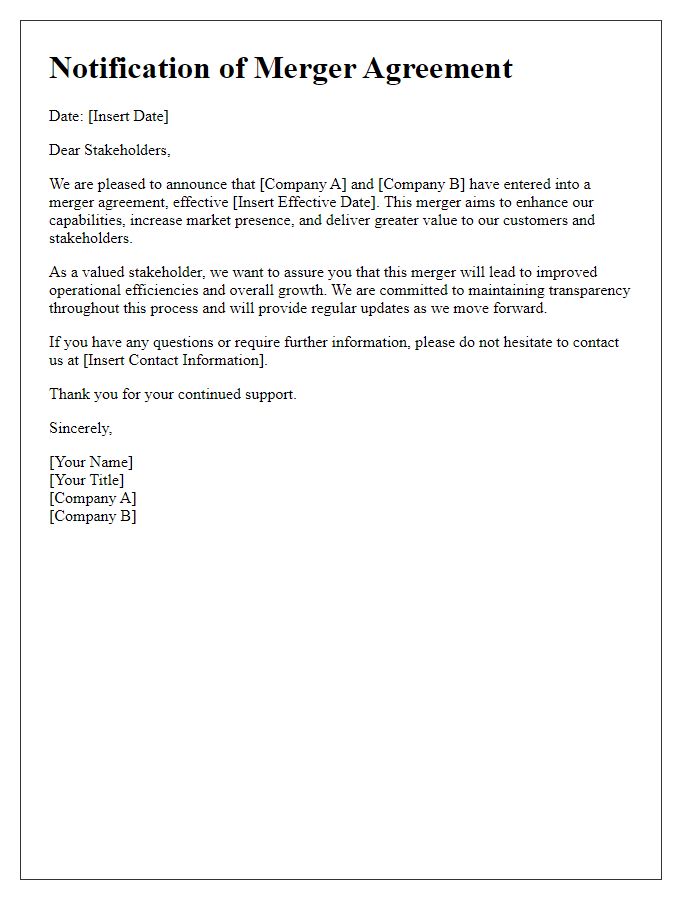

Parties Involved

In a business merger agreement, the involved entities, such as Company A, established in 2005 in New York, and Company B, founded in 2010 in California, are critical to the consolidation process. Company A specializes in innovative software development with an annual revenue of approximately $50 million, while Company B focuses on cybersecurity solutions, generating around $30 million in yearly income. The merger aims to enhance market competitiveness, combining Company A's technological expertise with Company B's security measures. This strategic union anticipates a projected growth of 25% over the next three years, leveraging synergies to create a robust entity in the tech industry, potentially headquartered in a central location like Chicago, known for its business-friendly environment and skilled workforce.

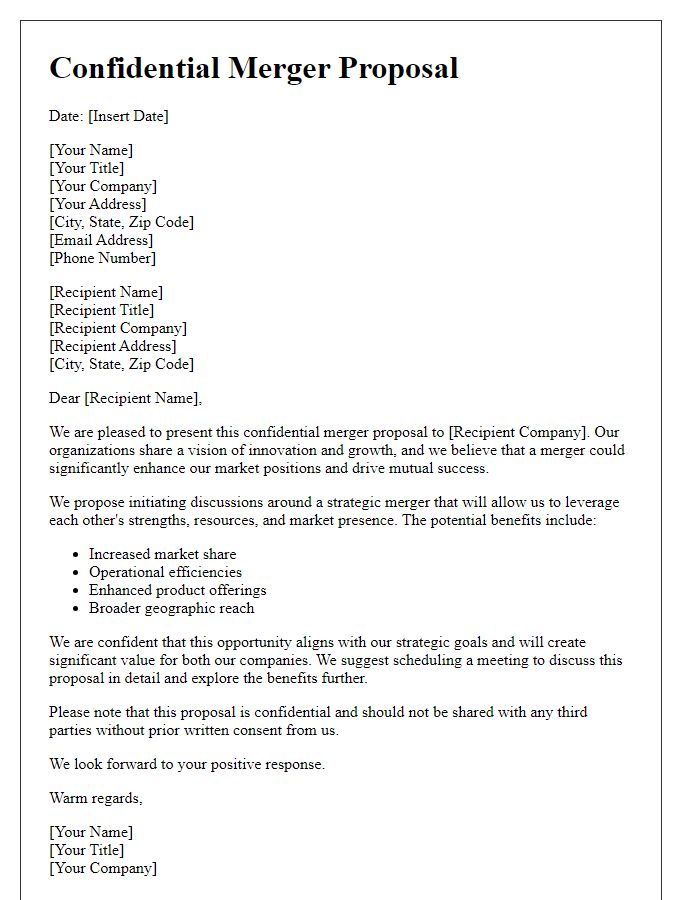

Merger Objectives

A business merger agreement typically outlines the objectives of the merger, emphasizing synergy, growth, and market expansion. The primary objective is to create a unified entity that leverages combined resources, enhancing operational efficiency and cost-effectiveness. For instance, merging Company A, specializing in software development, with Company B, a leader in cloud solutions, aims to create a comprehensive service offering that attracts a broader client base. The merger also targets increased market share, with projected growth in revenue exceeding 20% within the first fiscal year post-merger, as both companies capitalize on complementary strengths. Additionally, the agreement may aim to foster innovation by integrating diverse talent pools, resulting in an enriched product development pipeline, ultimately leading to enhanced competitiveness in the technology sector.

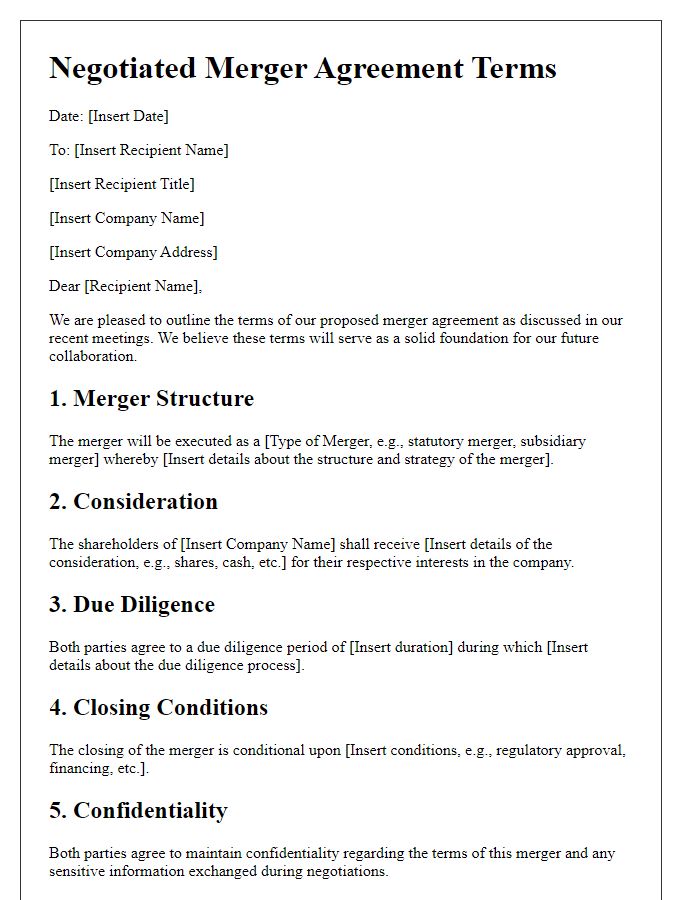

Terms and Conditions

A business merger agreement outlines the terms and conditions that govern the consolidation of two organizations, such as acquiring companies X and Y. This document typically specifies the effective date of the merger, often considered the "Closing Date," which may be set for a specific date in the fiscal calendar, such as January 1, 2024. It includes detailed descriptions of the parties' obligations, such as the requirement for both organizations to submit financial statements, adhering to Generally Accepted Accounting Principles (GAAP), which may include auditing by a third-party firm like Deloitte. Additionally, the agreement may delineate the process for merging assets and liabilities, clarifying how the combined entity will manage operational synergies and employee integration, affecting approximately 1,000 staff members across both brands. Governance structures, including board composition and management roles, must also be explicitly defined to prevent future disputes. Critical timelines for due diligence, board approvals, and regulatory compliance, such as obtaining clearance from the Federal Trade Commission (FTC), are highlighted to ensure legally enforceable transitions.

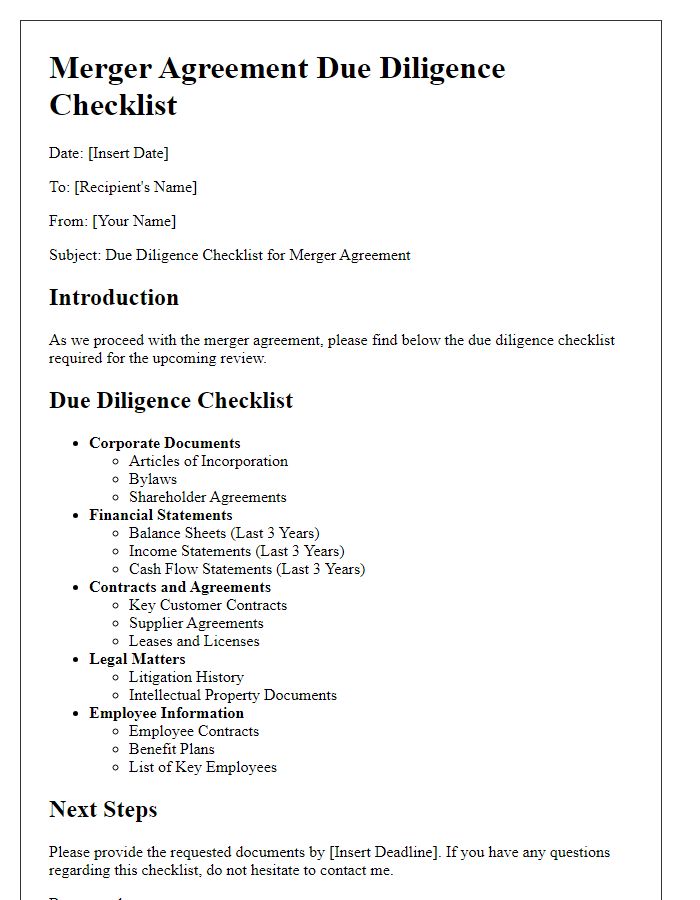

Confidentiality Clause

The confidentiality clause in a business merger agreement ensures that sensitive information exchanged between the combining entities remains protected throughout the negotiation and integration process. Serious consideration must be given to define confidential information clearly, often encompassing trade secrets, financial data, and proprietary processes, all of which can significantly impact competitive advantage in the market. Legal jurisdictions, such as the state of Delaware, often dictate specific regulations surrounding mergers and the handling of confidential materials. Violations of this clause can lead to substantial liabilities, reinforcing the importance of compliance by all parties involved in the merger. Mandatory non-disclosure durations, typically spanning several years post-merger, also serve to safeguard against potential misuse of shared information, fostering trust between the entities as they work toward a successful integration and enhanced operational synergy.

Closing and Execution

The closing of a business merger agreement signifies the culmination of negotiations and due diligence, involving multiple parties including legal advisors and financial experts. This event typically occurs at a designated location such as a corporate office or a law firm meeting room, often accompanied by the signing of various legal documents. Key components of this process include the final review of the merger agreement, financial disclosures, and the exchange of shares or payment. All participants must ensure that the documentation aligns with regulatory standards, such as compliance with the Securities and Exchange Commission (SEC) rules, depending on the size of the companies involved. A successful closing marks a new chapter in the collaboration between the entities, aiming for synergistic growth in market share, brand recognition, or product offerings as outlined in the strategic plans following the merger.

Comments