Are you considering a business acquisition and need a well-crafted agreement template? Navigating the complexities of business buyouts can be daunting, but having a clear and comprehensive letter template can simplify the process. This template not only outlines key terms and conditions but also ensures all parties are on the same page, reducing the risk of misunderstandings. Let's delve deeper into how you can streamline your acquisition with our detailed guide!

Intent and Purpose

The business acquisition agreement serves a critical function in formalizing the intent and purpose behind the transaction between the acquiring company and the target company. This agreement outlines specific terms, including the desired acquisition price and conditions for the transfer of ownership of assets, intellectual property (valuable patents or trademarks), and any other relevant business entities such as contracts or customer agreements. It establishes key obligations for both parties, ensuring compliance and determining the timeline for the acquisition process. Additionally, it must address confidentiality provisions to protect sensitive information and may incorporate conditions for due diligence evaluations, where the acquiring company investigates financial statements and operational aspects of the target business. This structured framework aims to facilitate a smooth transition of business ownership and safeguard the interests of both sides involved in the acquisition process.

Terms and Conditions

Business acquisition agreements entail essential terms and conditions that delineate the specifics of the transaction. Key elements often include purchase price, outlined as a specific monetary figure agreed upon for the transfer of ownership, and payment structure, which may involve installments or a lump sum. Representations and warranties detail the assurances made by both parties regarding the accuracy of financial statements and legality of operations, emphasizing the legitimacy of claims made. Confidentiality clauses protect sensitive information exchanged during negotiations, ensuring proprietary data remains secure. Closing conditions stipulate the necessary steps to finalize the sale, often requiring due diligence, regulatory approvals, and necessary consents. Indemnification provisions safeguard parties against potential future claims that could arise post-acquisition. These components collectively ensure a comprehensive framework for a seamless transition of ownership and operational control.

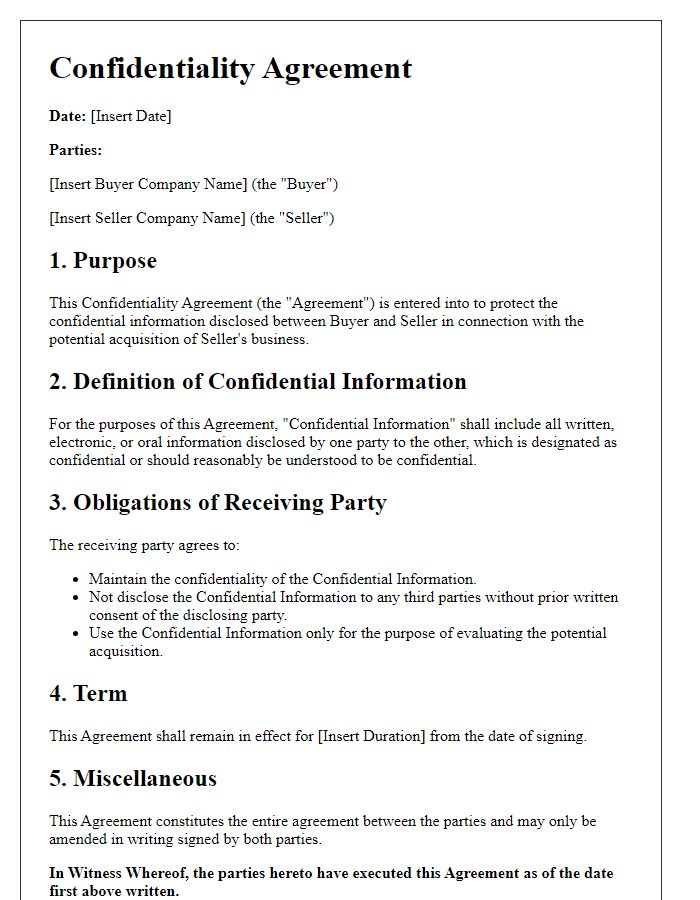

Confidentiality and Non-disclosure

A business acquisition agreement often includes a confidentiality and non-disclosure clause to protect sensitive information exchanged between parties. This clause typically specifies the obligation of each party to keep proprietary information, such as financial records, trade secrets, and strategic plans, confidential. For example, during negotiations for the acquisition of a tech startup in Silicon Valley, the acquiring company may need access to the startup's source code and customer databases. The confidentiality clause ensures that any leaked information could harm competitive advantage or lead to financial loss. Breach of this agreement might result in significant penalties, potentially including lawsuits or financial restitution, and thus underscores the importance of protecting intellectual property and business strategies throughout the acquisition process.

Representations and Warranties

The section on Representations and Warranties in a business acquisition agreement serves to establish certain assurances from the seller regarding the status and condition of the business being acquired. These warranties typically include the seller's declaration that the business operates in compliance with all applicable laws and regulations, such as federal, state, and local legislation. It may also encompass representations about the accuracy of financial statements, confirming that they fairly represent the business's financial condition as of a specified date, often accompanied by details such as revenue figures, liabilities, and assets. Key components might include the ownership of intellectual property (such as trademarks or patents), confirming no ongoing litigation or disputes, and ensuring all necessary licenses and permits are in place for operational continuity. Any breach of these representations can have significant implications, often leading to indemnification or financial recourse, thereby playing a crucial role in the due diligence process and overall transaction integrity.

Closing and Implementation Procedures

Efficient closing and implementation procedures are essential for the successful execution of a business acquisition agreement. Typically, the closing date occurs at a designated location, often the offices of legal counsel for one of the parties, or a mutually agreed location, such as a conference room. Prior to closing, stakeholders must gather all necessary documentation, including financial statements from the past three years, contracts, employee agreements, and regulatory approvals. The due diligence process is comprehensive, typically lasting from four to eight weeks, allowing for thorough verification of the target company's assets, liabilities, and operational integrity. Upon completion, a final closing statement is drafted to outline the final purchase price, any adjustments, and conditions precedent. After closing, the integration team, consisting of representatives from both companies, typically works collaboratively to merge operations, harmonizing policies and procedures, facilitating communication between departments, and aligning corporate cultures to ensure a seamless transition.

Comments