In the world of construction and contracting, ensuring that all parties are adequately protected is crucial, and that's where subcontractor insurance verification comes into play. By confirming that your subcontractors have the right coverage, you not only safeguard your project but also foster a responsible working environment. Understanding the essential components of a solid insurance policy can make all the difference in reducing risks and liabilities. Let's dive deeper into the specifics of subcontractor insurance verification to protect your investment and peace of mind.

Company Information

Subcontractor insurance verification involves confirming that the subcontractor possesses the necessary insurance coverage to mitigate risks associated with their work. Typical requirements include general liability insurance, workers' compensation insurance, and any additional coverage specific to the project type. For instance, a roofing subcontractor may need specific liability protection due to the hazards associated with working at heights. Verification may involve reviewing insurance certificates, ensuring coverage amounts meet contractual obligations, and confirming that the policy is active and has not lapsed. Compliance with local regulations, such as those set by the Occupational Safety and Health Administration (OSHA), also plays a critical role in this verification process.

Subcontractor Details

Subcontractor details are essential for insurance verification to ensure compliance and risk management in construction projects. The subcontractor's company name, such as Smith & Sons Electric, includes critical information like the business address located at 123 Electric Ave, Springfield, IL. The subcontractor's contact number (555-123-4567) allows for direct communication regarding insurance matters. Additionally, details about the subcontractor's insurance coverage, including policy numbers and provider information, such as Acme Insurance Co., are vital for confirming current liability limits, which typically range from $1 million to $5 million, protecting against potential claims. Furthermore, the verification process requires information on the type of coverage, including general liability and workers' compensation policies, to ensure adequate protection for both the subcontractor and the primary contractor throughout the project's duration.

Insurance Coverage Types

Subcontractor insurance verification is a critical step in ensuring compliance with safety regulations and risk management measures. Common types of insurance coverage include General Liability Insurance, which protects against bodily injury and property damage claims, often requiring a minimum coverage of $1 million per occurrence and $2 million in total; Workers' Compensation Insurance, mandated in many states, covering medical expenses and lost wages for employees injured on the job; and Professional Liability Insurance, essential for subcontractors offering specialized services, covering claims related to errors or omissions in their work. Additionally, Auto Liability Insurance is crucial for subcontractors who use vehicles during their operations, protecting against damages from accidents involving company vehicles. Each of these insurance types plays a vital role in safeguarding both the subcontractor and the principal contractor from potential financial losses linked to unforeseen events.

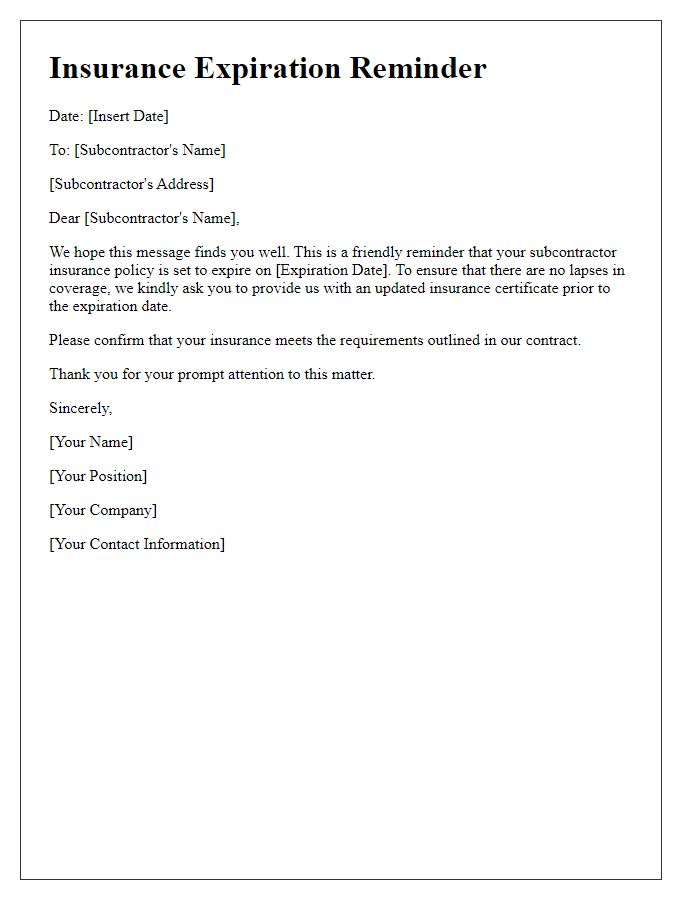

Policy Expiration Dates

Verification of subcontractor insurance is crucial for safeguarding projects and ensuring compliance with contractual obligations. Insurance policies typically include vital information such as policy numbers, coverage limits, and expiration dates. For instance, a General Liability Insurance policy may have an expiration date set for November 30, 2023, while a Workers' Compensation policy could be valid until December 15, 2023. It is essential to confirm these dates consistently, as lapsed coverage can lead to significant financial risks and legal liabilities for the main contractor. Additionally, any changes to the status of the subcontractor's insurance, such as non-renewal notices or amendments, should be documented and reviewed promptly to maintain proper risk management practices within the organization.

Contact Information

Subcontractor insurance verification involves a meticulous examination of various elements that ensure compliance and protection in business dealings. Essential details include the subcontractor's name, business address, and phone number, often matched against a certificate of insurance that covers general liability (typically a minimum of $1 million), workers' compensation (aligned with state requirements, such as California's $1,000,000 aggregate), and any additional endorsements required for the specific project. The verification process must also confirm policy duration, usually one year, and check for any lapses in coverage that could pose risks during operations. Providing these critical pieces of information ensures that risks are minimally managed and contractual obligations are fulfilled effectively.

Comments