Are you navigating the world of construction bonds and unsure where to start? Understanding the requirement for a construction bond can be quite complex, but it's essential for protecting both contractors and project owners. In this article, we'll demystify the various types of bonds, their purposes, and the steps involved in obtaining them. Stick around to learn everything you need to know about securing a construction bond for your next project!

Construction Project Details

Construction projects require financial assurances to ensure compliance and completion, typically through performance bonds. For example, a $1 million bond may be necessary for a commercial development in Los Angeles, California. This bond secures that if the contractor fails to meet project specifications or timelines, the bond can be executed to cover any financial losses or delays. Construction bonds, often mandated by local regulatory bodies, guarantee that all materials, like concrete and steel, will meet specified standards, agency guidelines, and building codes. Essential contract details must encompass the project's timeline, budget allocation, and scope, thus protecting stakeholders such as investors, subcontractors, and local communities.

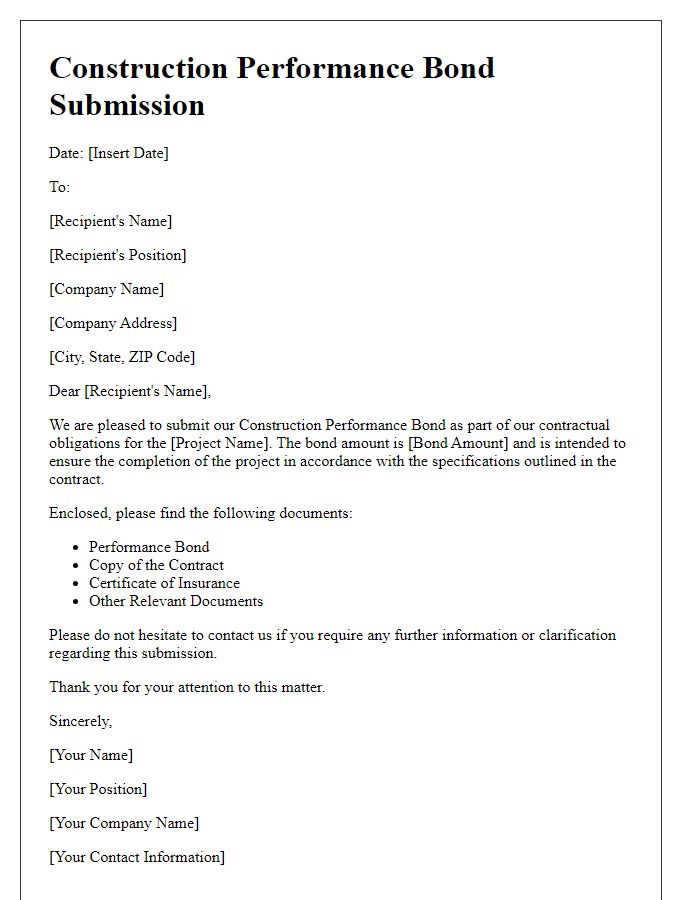

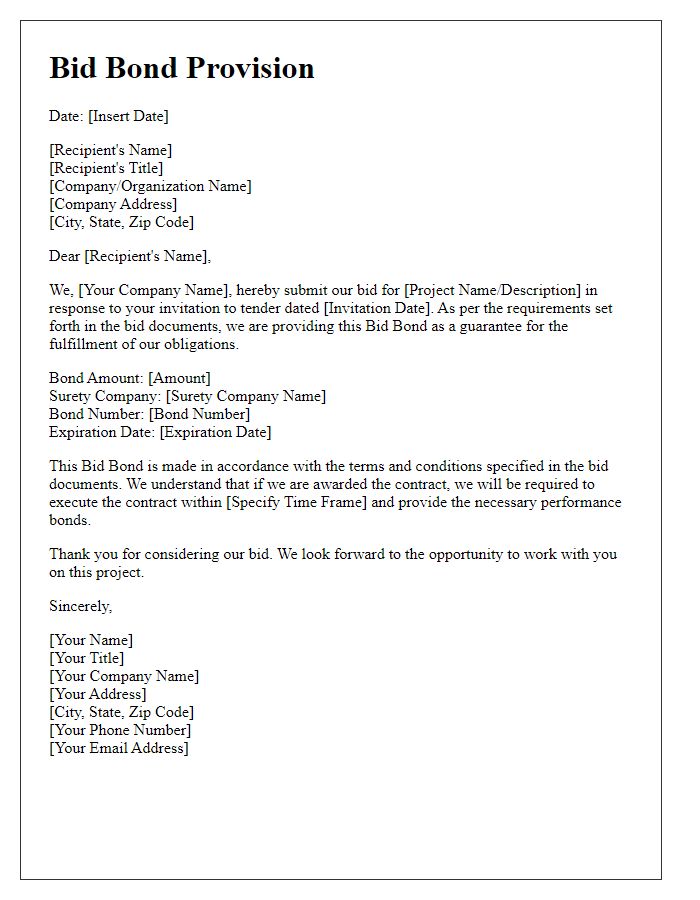

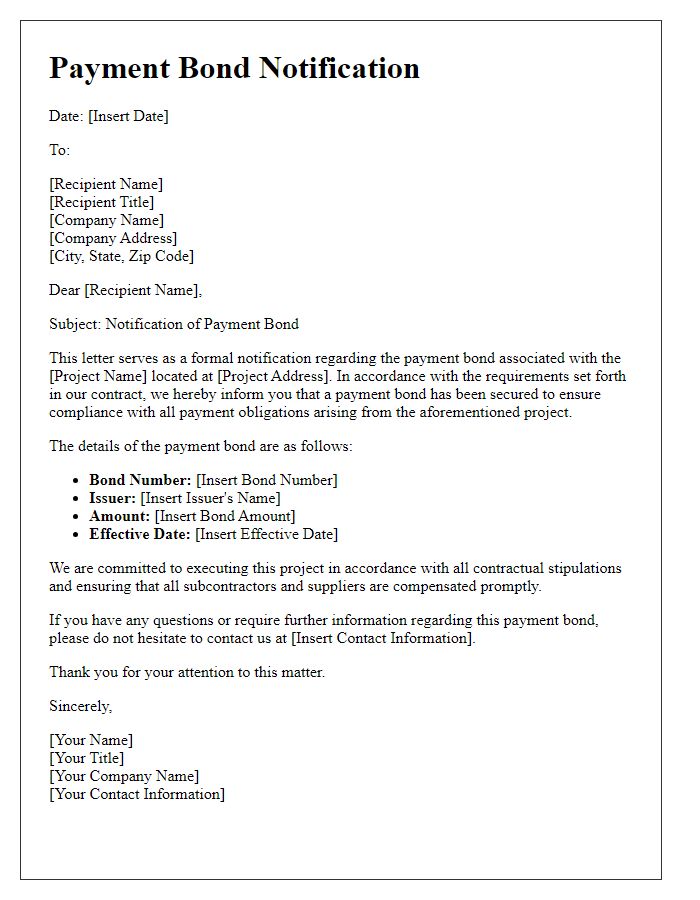

Bond Type and Amount

Construction bonds play a crucial role in ensuring project completion and compliance with contractual obligations. A performance bond guarantees that contractors fulfill their duties, typically amounting to 10% to 20% of the project value. A payment bond ensures sub-contractors and suppliers receive payment, often matching the amount of the performance bond. Together, these bonds provide financial security, safeguarding project owners against potential failures or disputes. The bond amount can vary greatly depending on factors such as project size, location, and regulatory requirements, often dictated by state laws or specific contract agreements (such as those under the Miller Act in the United States). In commercial construction, bonds not only protect owners but also foster trust within the construction industry, promoting timely project delivery and maintaining quality standards.

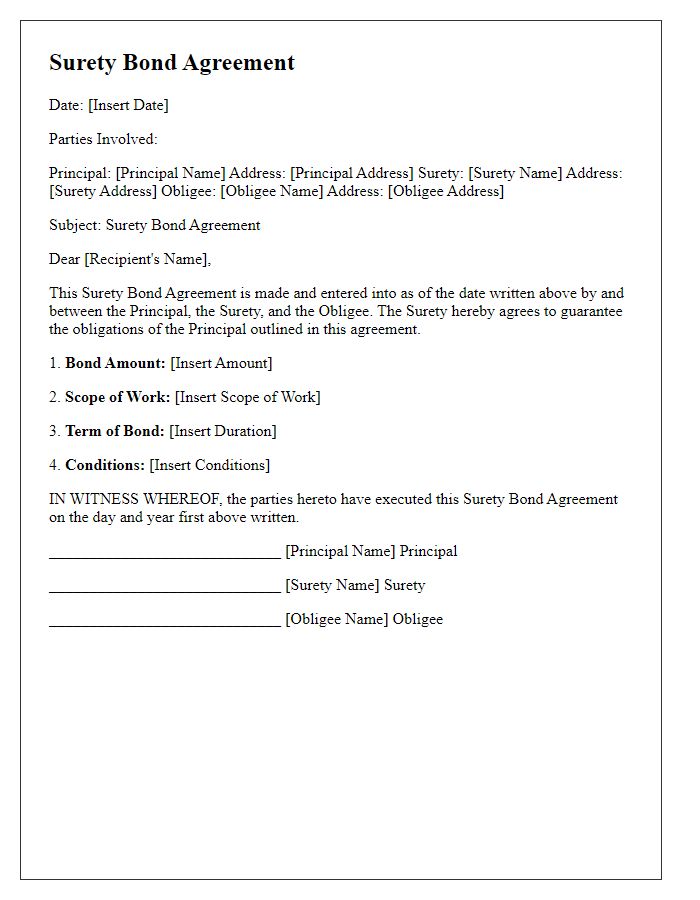

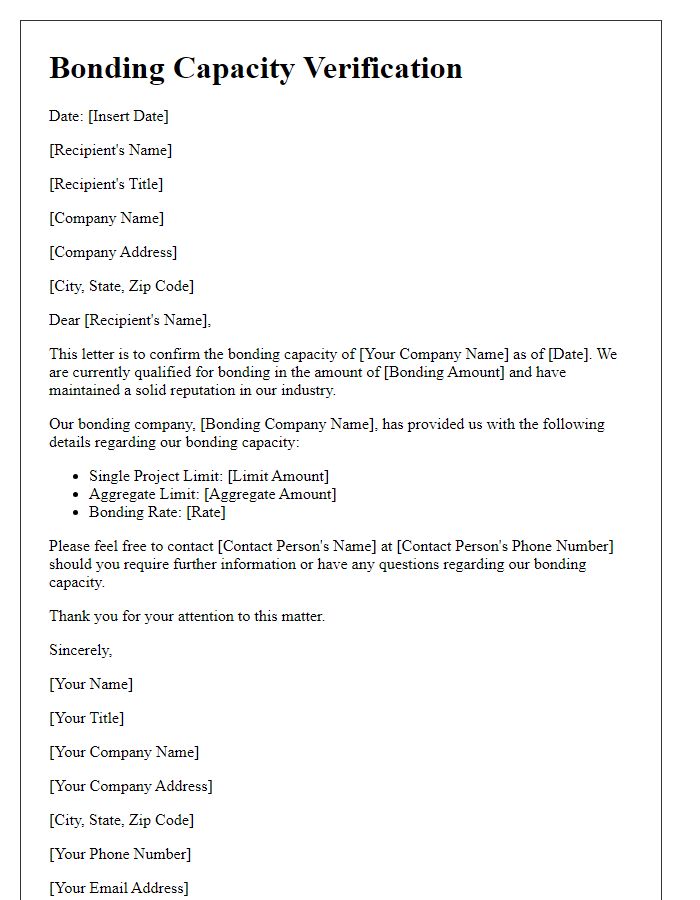

Surety Company Information

Surety companies are crucial in the construction industry, especially concerning bonding requirements. A surety company, such as The Hartford or Travelers, provides bonds that guarantee the completion of a project, protecting the project owner ( obligee) against potential losses. The purpose of a construction bond is to ensure that contractors fulfill their contractual obligations. Key information includes the surety company's license number, which confirms its authorization to operate in specific states, and financial stability ratings from agencies like A.M. Best, indicating the company's ability to meet claims. Furthermore, the history of the surety company in handling claims and providing customer service can also be significant to project stakeholders evaluating potential partnerships. Understanding these factors contributes to the overall reliability and assurance in construction projects.

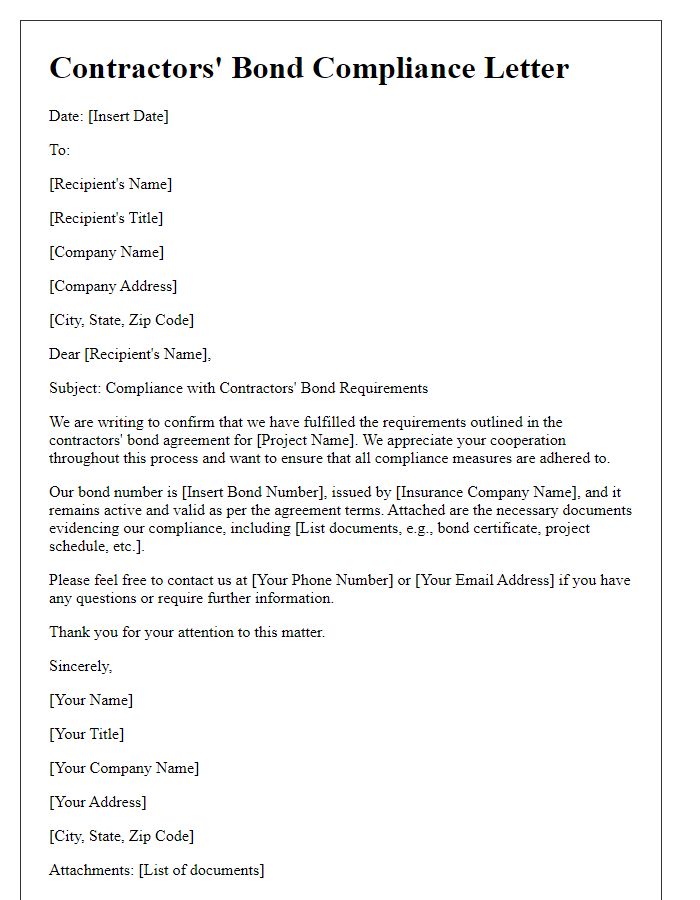

Compliance and Legal Obligations

A construction bond is a crucial financial instrument ensuring compliance with legal obligations within the construction industry. These bonds, often ranging from 1% to 3% of the total project cost, serve as a guarantee that contractual work will be performed according to specific standards and timelines. Typical bonds include performance bonds, which ensure project completion, and payment bonds, which protect subcontractors and suppliers by guaranteeing payment for their services. Entities involved in construction, such as general contractors and subcontractors, must understand local regulations and licensing requirements, particularly in states like California, Texas, and Florida, where specific bonding laws exist. Failure to meet these obligations can lead to significant penalties, including project delays, legal disputes, and financial losses. Understanding the bond process and requirements is essential for compliance and successful project execution.

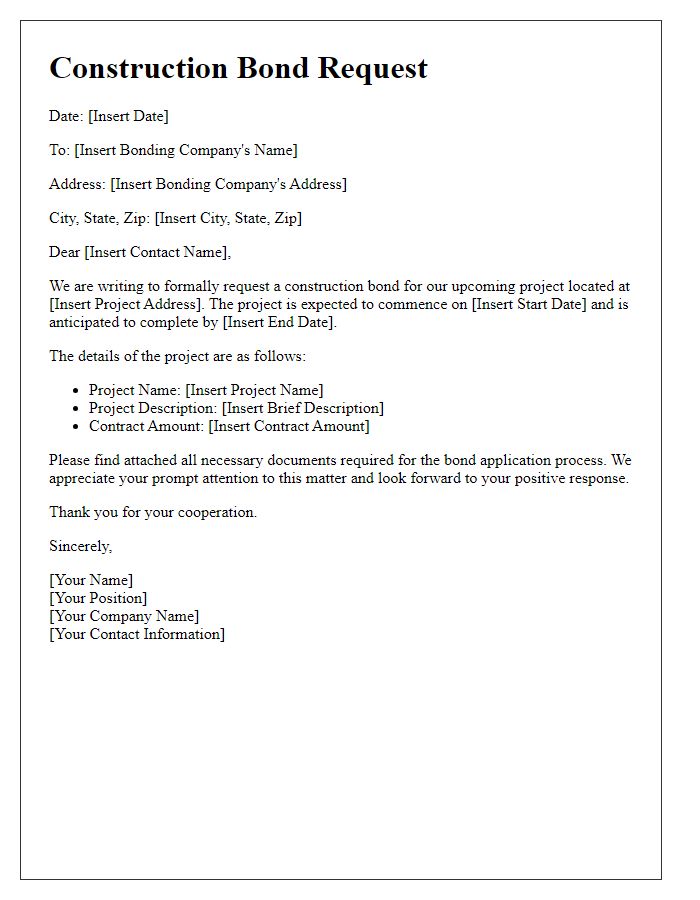

Contact Information and Deadline

A construction bond requirement ensures financial security for construction projects, such as performance bonds or payment bonds. These bonds, typically issued by surety companies, protect project owners against contractor default. Contact information should include the surety company's name, address, and telephone number for prompt communication. Key deadlines, such as submission date for the bond before project commencement, often set by state regulations or contract specifications, are crucial for compliance. Missing these deadlines can lead to project delays or financial penalties, emphasizing the importance of timely communication with all stakeholders involved, including contractors and project managers.

Comments