Are you looking for a clear and professional way to confirm your audit results? Writing a letter for this purpose doesn't have to be daunting. In this article, we'll explore a simple template that guarantees you cover all the essential points while maintaining a conversational tone. Join us as we delve into crafting a confirmation letter that reflects accuracy and professionalism, and invite you to read more for a comprehensive guide.

Audit Scope and Objectives

The audit scope and objectives defined a comprehensive examination of the financial records and operational processes of ABC Corporation (fiscal year ending December 31, 2023). The evaluation focused on key areas such as revenue recognition, expense reporting, and compliance with applicable regulations like the Sarbanes-Oxley Act. Objectives included identifying areas for improvement, ensuring accuracy in financial statements, and assessing internal controls over financial reporting. The audit involved analyzing documentation, conducting interviews with staff members, and performing substantive testing on selected transactions, ensuring alignment with industry standards. The results will serve as a basis for enhancing operational efficiency and ensuring transparency for stakeholders.

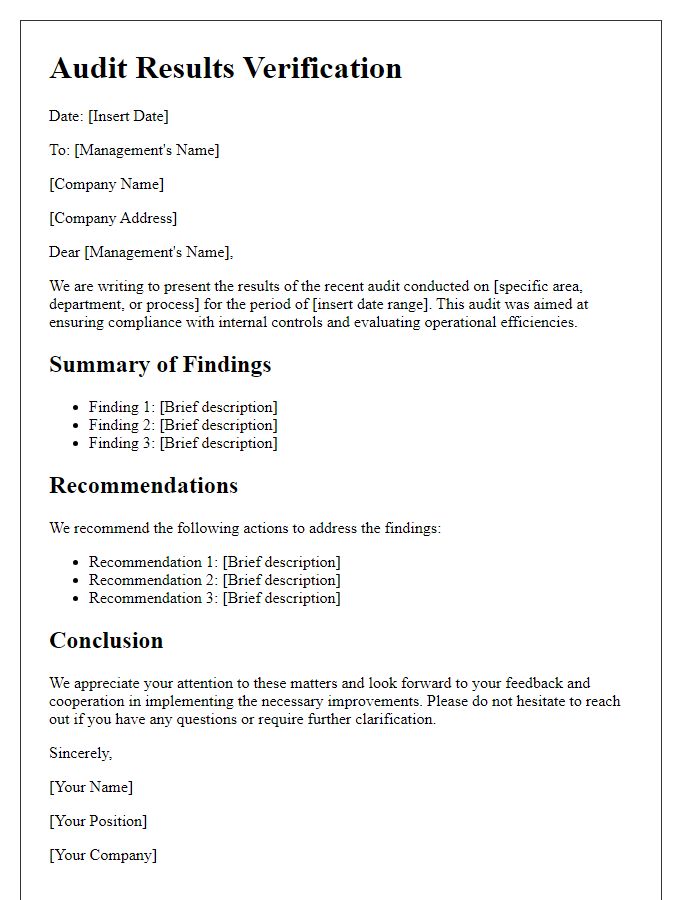

Summary of Findings

The Summary of Findings presents a comprehensive overview of the audit results conducted on the financial records of Company XYZ for the fiscal year ending December 31, 2022. The examination covered key areas such as revenue recognition, expense categorization, and compliance with applicable accounting standards, including GAAP (Generally Accepted Accounting Principles). Significant discrepancies were identified in the revenue reporting, amounting to $150,000, where documentation lacked sufficient support for sales recognized in Q3 2022. Additionally, an overstatement of expenses by $75,000 was noted, primarily due to incorrect classification of capital expenditures instead of operational costs. Overall, the audit reveals areas requiring immediate corrective measures and further review to enhance the accuracy and reliability of financial reporting within the organization. Implementing the recommendations provided will ultimately ensure adherence to regulatory requirements and improve operational efficiency.

Conclusions and Recommendations

The comprehensive audit results for the fiscal year 2023 reveal significant insights into the financial operations of XYZ Corporation, headquartered in New York City. The audit, conducted by the esteemed accounting firm ABC & Co., highlighted discrepancies in inventory management leading to a potential overstatement of assets by 15%, approximately $2 million. Recommendations include the implementation of a robust inventory tracking system and enhancing staff training to prevent future inaccuracies. Furthermore, the audit recommended a quarterly review of financial statements to ensure compliance with the Generally Accepted Accounting Principles (GAAP), thus improving transparency and accountability within the organization. Regular updates and a dedicated task force to oversee the execution of these recommendations will be crucial for maintaining financial integrity and stakeholder trust.

Acknowledgment of Team and Cooperation

The completion of the audit process in October 2023 revealed significant contributions from the audit team, particularly in identifying key discrepancies across various financial statements. The team's analysis spanned fiscal years 2021 through 2023, covering departments such as finance, operations, and compliance. Collaboration with stakeholders, including department heads and external auditors from Deloitte, facilitated a thorough examination of internal controls and operational efficiencies. The successful cooperation of all parties involved led to a seamless verification of data, enhancing the credibility of the findings. Acknowledgment is given to the team members for their meticulous attention to detail, ensuring a comprehensive review that ultimately strengthens the organization's transparency and accountability.

Next Steps and Follow-up Actions

The confirmation of audit results underscores the importance of accuracy in financial statements, specifically in corporate environments like Fortune 500 companies. Key findings, such as discrepancies in financial records amounting to $2 million or more, can lead to regulatory scrutiny from entities like the Securities and Exchange Commission (SEC). Next steps often involve implementing corrective measures, such as enhancing internal controls and providing employee training sessions scheduled for the upcoming quarter. Follow-up actions typically include a review meeting with stakeholders, aiming to discuss progress and ensure compliance before the next audit cycle, set for the end of December 2023. Documentation of these processes is crucial for transparency and accountability within the organization.

Comments