Hey there! If you've ever made a donation to a charity, you know how important it is to receive that confirmation letterâit not only reassures you of your contribution but also provides essential documentation for tax purposes. In this article, we'll explore the key elements that should be included in a charity donation receipt, ensuring transparency and gratitude in every charitable transaction. Plus, we'll share a handy template you can use to streamline your process. So, keep reading to make your donation confirmations a breeze!

Donor Information

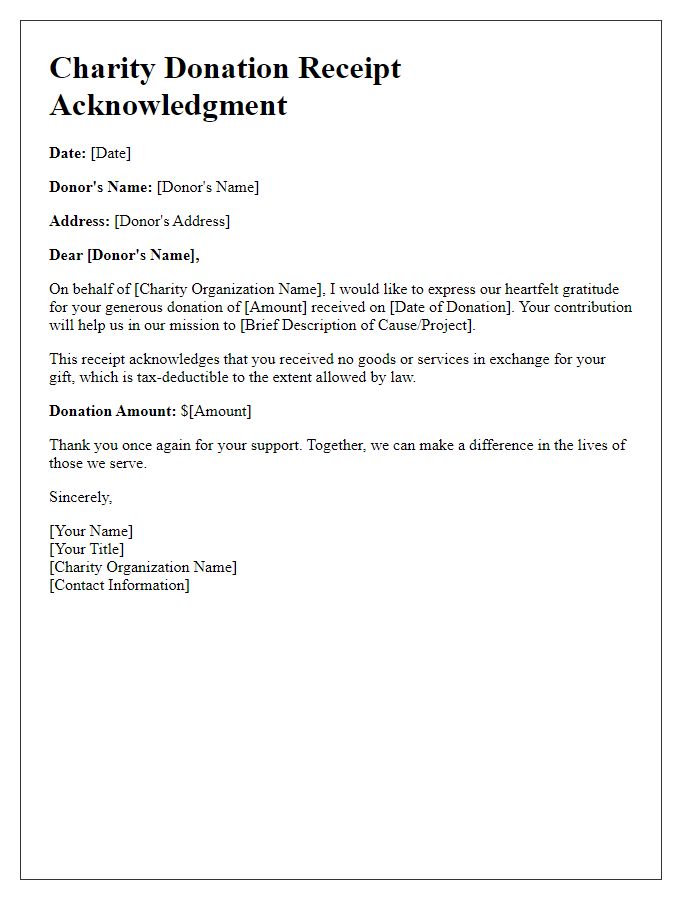

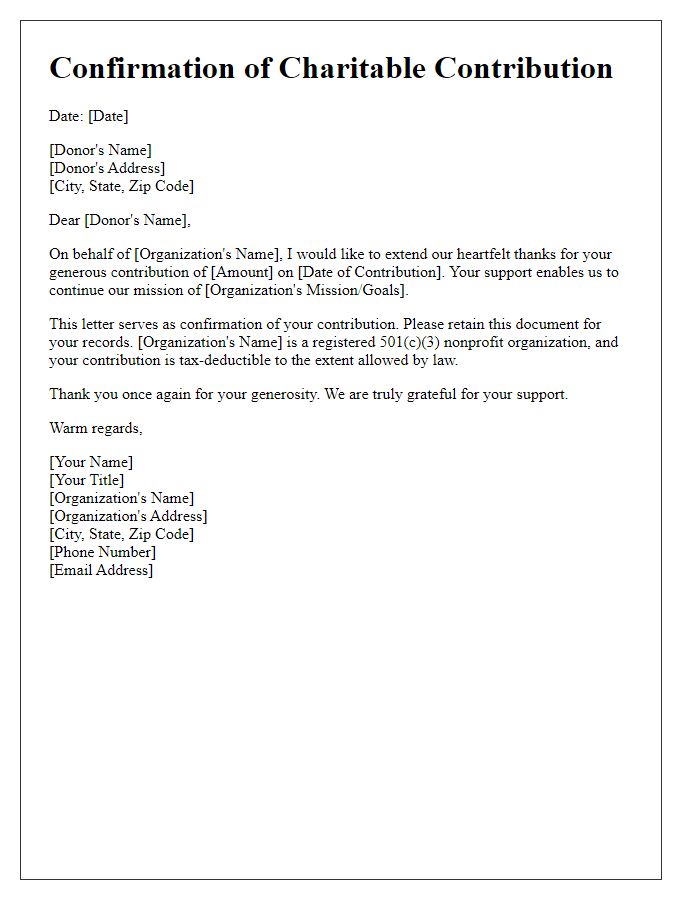

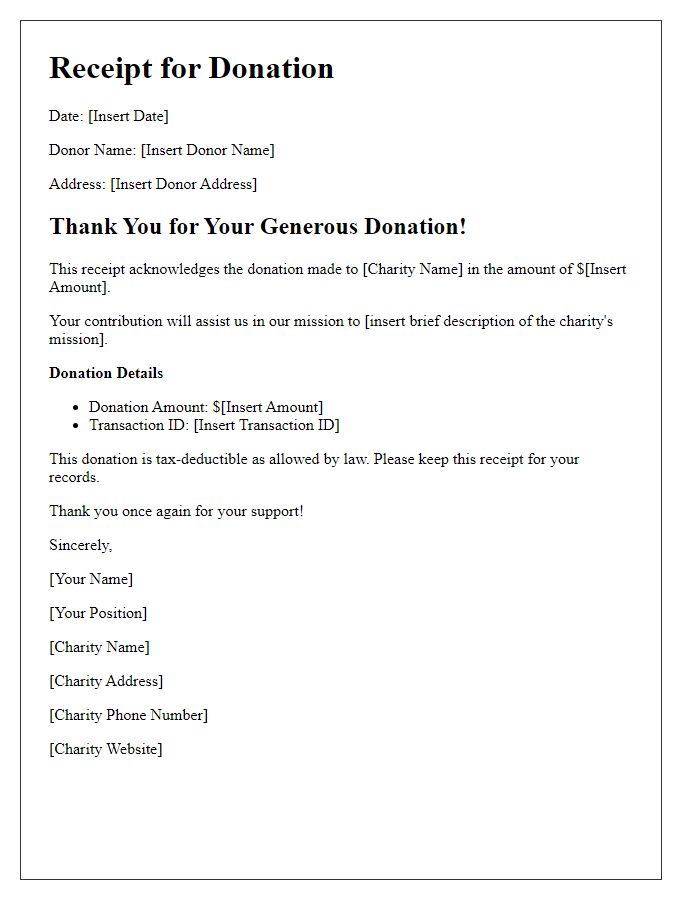

Charity organizations often acknowledge donations as a gesture of gratitude and to ensure transparency. A donation receipt serves as essential documentation for tax purposes and records for both the donor and the charity. Receipt usually includes the donor's name, address, donation amount, and date of the contribution. Nonprofit organizations, under 501(c)(3) status in the United States, issue these receipts to confirm the deductible nature of donations, ensuring compliance with IRS regulations. A clear and well-organized format enhances donor satisfaction and encourages future contributions.

Donation Details

The charity donation receipt confirms a generous contribution towards causes such as education, medical aid, or poverty alleviation. A typical donation can range from $10 to several thousand dollars, depending on the donor's capacity and willingness to support the mission. It is crucial to include the date of the donation, which may occur during fundraising events like galas or online campaigns. The receipt should also feature the charity's official name, registration number, and contact information for transparency and verification. This receipt not only serves as proof for tax deduction purposes but also fosters trust within the community and encourages ongoing support for the charity's initiatives.

Tax Deductibility Statement

A charity donation receipt serves as an official acknowledgment of contributions made to a non-profit organization, providing essential details such as the donation amount, date, and designation of funds (e.g., for specific projects). Tax deductibility is crucial for donors, allowing them to claim contributions on their income tax returns, aligning with IRS regulations (particularly sections 170(c) and 501(c)(3)). For instance, a donation of $500 made in March 2023 towards community health initiatives can significantly reduce taxable income. The receipt must include the charity's EIN (Employer Identification Number) and a statement confirming no goods or services were received in exchange for the donation, ensuring full compliance with tax law requirements. Donors should retain this receipt for potential audits and tax preparation.

Organization's Information

The nonprofit organization, Helping Hands Foundation, specializes in providing educational resources and support for underprivileged children globally. Established in 2005, the foundation operates in over 15 countries, touching the lives of more than 100,000 children annually. Donations received, such as the recent contribution of $250 on October 1, 2023, are crucial for funding various programs, including after-school tutoring and scholarship opportunities. The organization is recognized under IRS 501(c)(3) guidelines, ensuring that contributions are tax-deductible for donors. Confirming receipt of donations not only enforces transparency but also builds trust within the community and strengthens financial support for future initiatives in education and child welfare.

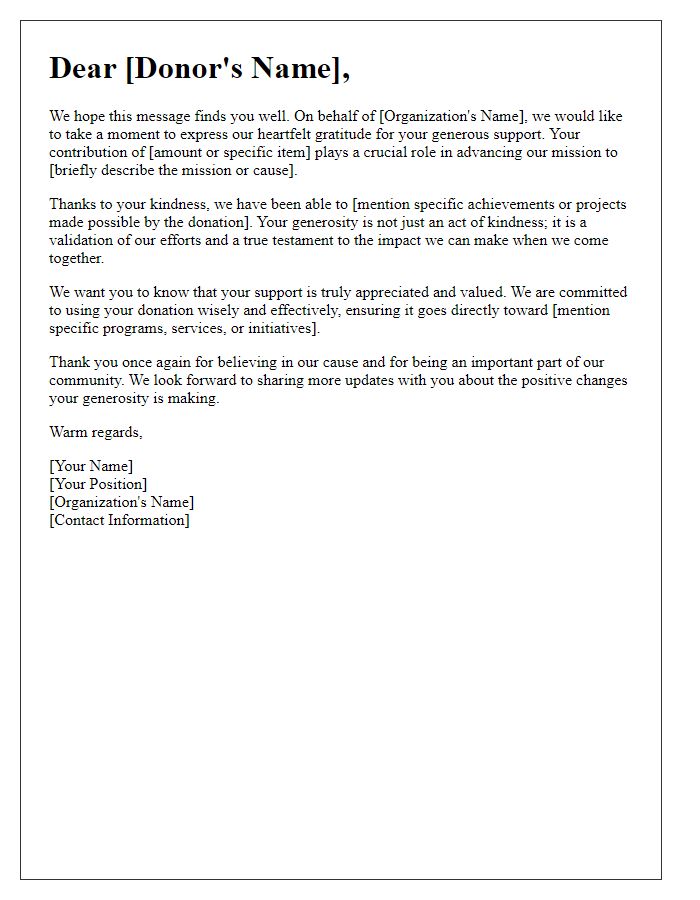

Expression of Gratitude

Charitable donations play a crucial role in supporting non-profit organizations, such as the Red Cross, which provides disaster relief and humanitarian aid globally. These contributions, whether monetary or in-kind, often exceed specific dollar amounts (e.g., $50 or $100), which can significantly impact communities in need. Receipt of such donations, typically documented in a formal letter, includes essential details like the date of the donation, the amount given, and the charitable organization's tax identification number (EIN). This acknowledgment not only expresses gratitude but also informs donors of their tax-deductible status under the IRS guidelines, making it a vital practice for organizations relying on public support.

Letter Template For Confirming Charity Donation Receipt Samples

Letter template of Validation of Your Generosity in Supporting Our Cause

Comments