Hello there! It's always a pleasure to keep things organized, especially when it comes to important events like audits. This letter serves as a friendly confirmation of our upcoming audit schedule, ensuring everyone is on the same page and prepared for the process ahead. Curious to learn more about how to set up your audit schedule effectively? Read on!

Recipient's Contact Information

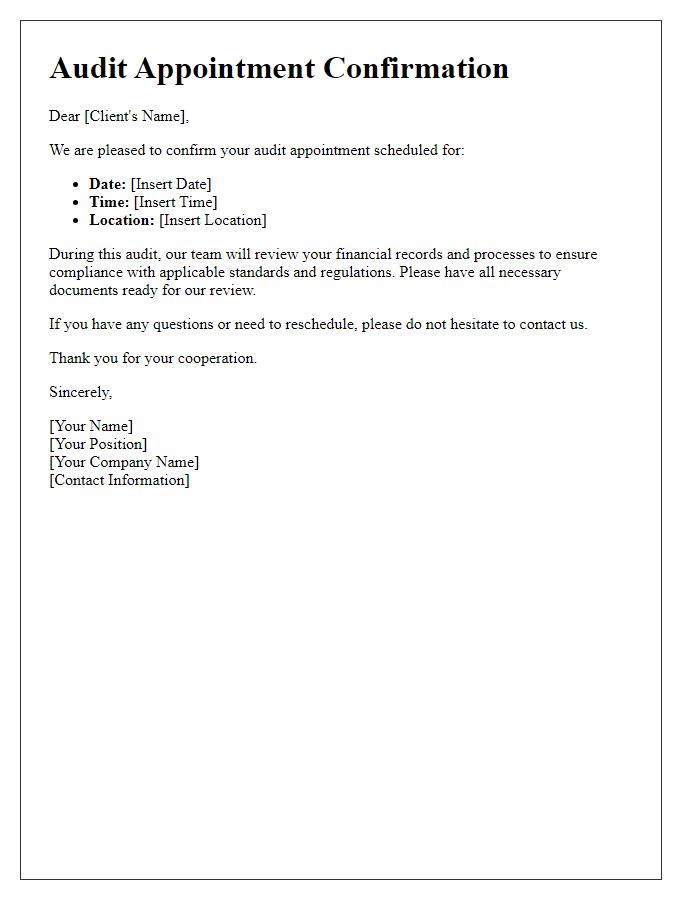

A well-organized audit schedule confirmation is critical for effective financial reporting, especially for businesses in sectors like finance and compliance. The audit, set to begin on October 15, 2023, at 9:00 AM, will be conducted at the company headquarters located at 123 Business Center, Suite 200, Cityville, State, Zip Code. The auditing team from XYZ Auditors Inc. will review financial statements and internal controls for the fiscal year ending June 30, 2023. Key participants include the Chief Financial Officer and the Accounting Manager, who will facilitate all necessary documentation and access to records during the scheduled days. Preparation ensures a thorough evaluation process while adhering to the timelines set forth by regulatory bodies.

Subject Line with Confirmation Details

The confirmation of the audit schedule is essential for ensuring a smooth and efficient audit process. The agreed-upon date for the audit is set for March 15, 2024, at 9:00 AM, taking place at the corporate headquarters located at 123 Business Lane, Suite 200, Audit City, TX 75001. The audit team, comprising four certified auditors from Deloitte, will examine financial records from the fiscal year 2023, focusing on compliance with GAAP standards. Key materials and documents necessary for the audit include financial statements, payroll records, and tax filings. It is imperative that all relevant stakeholders are notified of the schedule, ensuring availability for inquiries and document presentation. Additional preparations should include a review of internal controls and risk assessment reports, which will facilitate a thorough and productive audit.

Formal Greeting and Introduction

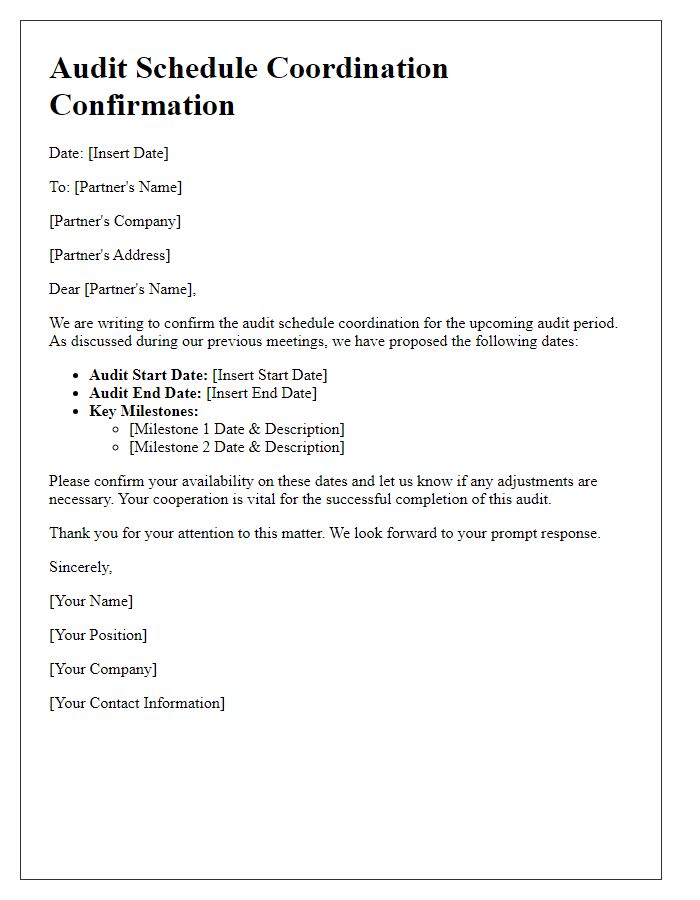

The internal audit schedule has been set for the 2023 fiscal year, firmly planned to commence on April 15, 2023, and conclude on April 30, 2023. Each department, including Finance, Operations, and Compliance, will undergo thorough evaluations to ensure adherence to regulatory standards and internal policies. The audit team, led by Senior Auditor John Smith, will be conducting interviews and reviewing documents during this two-week period. Please ensure all relevant personnel are prepared and available for discussions to facilitate a seamless auditing process.

Clear Details of Audit Schedule

The upcoming audit schedule has been set with specificity to ensure a comprehensive review process. The audit will commence on March 15, 2024, at 9:00 AM and will take place at the headquarters located at 123 Corporate Plaza, New York City. The auditing team, composed of five certified professionals from the firm Anderson & Associates, will systematically evaluate financial records, compliance with regulatory standards, and operational protocols for the fiscal year ending December 31, 2023. Key documents, including the budget reports and expenditure summaries, should be available for review during the allotted two-week period, ensuring transparency and thoroughness in the assessment process. A preliminary meeting to discuss objectives and methodologies will be held on March 14, 2024, at 3:00 PM at the same location.

Contact Information for Queries

The audit schedule confirmation plays a crucial role in ensuring that all parties are aware of their responsibilities and timelines. The specific date and location (for instance, the main office at 123 Corporate Lane, Springfield) need to be communicated clearly. Important contacts should include the lead auditor, Jane Doe, available at jane.doe@auditfirm.com or (555) 123-4567, as well as the client liaison, John Smith, reachable at john.smith@clientcompany.com or (555) 987-6543. This information facilitates efficient communication regarding any questions or adjustments that may arise prior to the audit. Timely responses are encouraged to ensure a smooth audit process.

Letter Template For Confirming Audit Schedule Samples

Letter template of verification of audit arrangements for department heads.

Letter template of formal audit schedule confirmation for auditing firm.

Comments