Traveling can be one of life's greatest joys, but dealing with travel insurance issues can quickly turn your adventure into a headache. If you've faced challenges with your travel insurance provider, you're not aloneâmany travelers encounter similar frustrations. In this article, we'll explore the most common complaints and provide a helpful letter template to streamline your communication with your insurer. Ready to tackle your travel insurance woes? Read on for essential tips and insights!

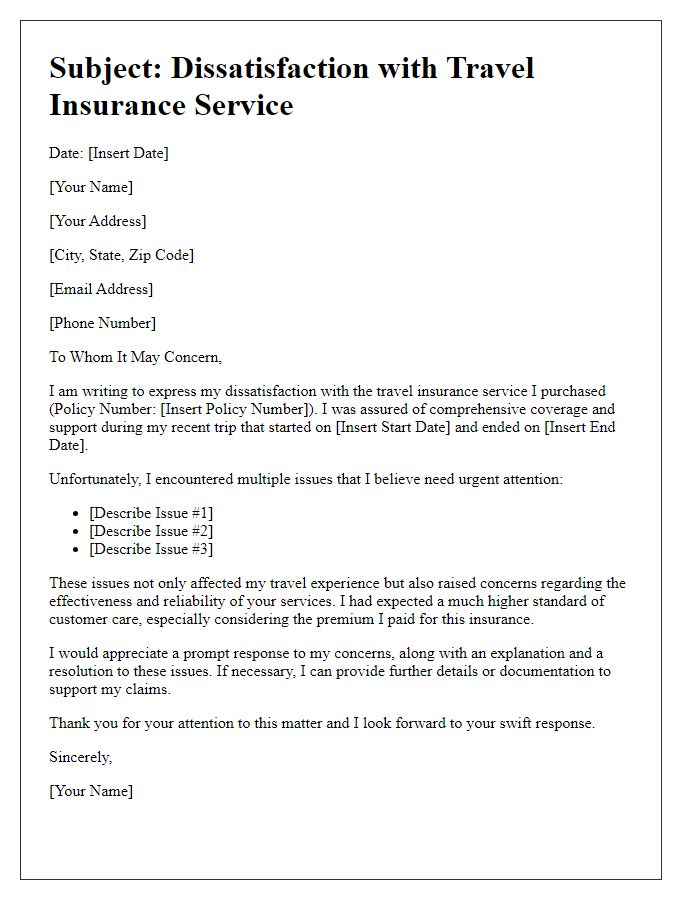

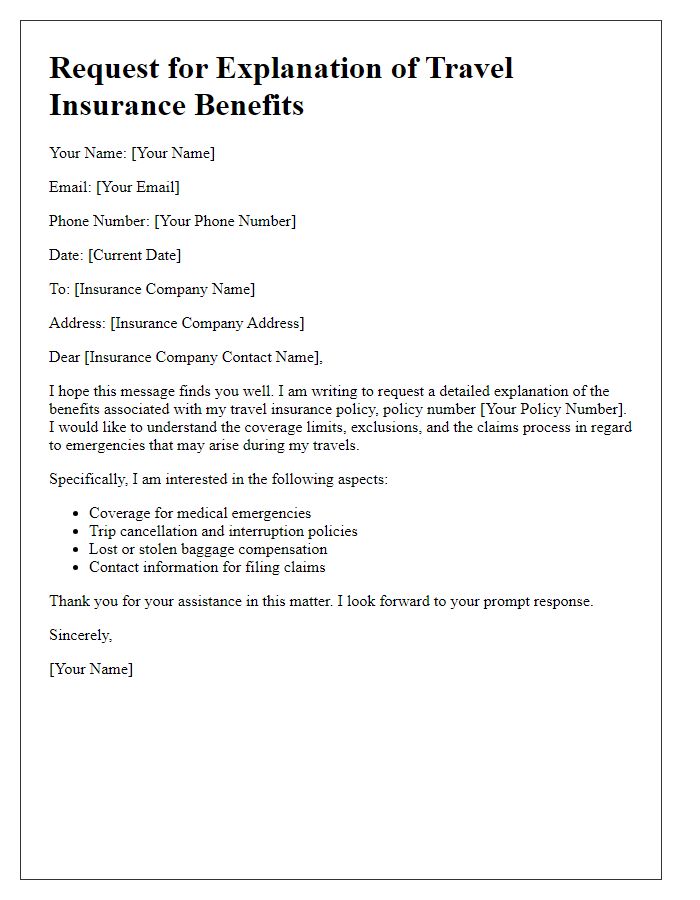

Policy Details & Personal Information

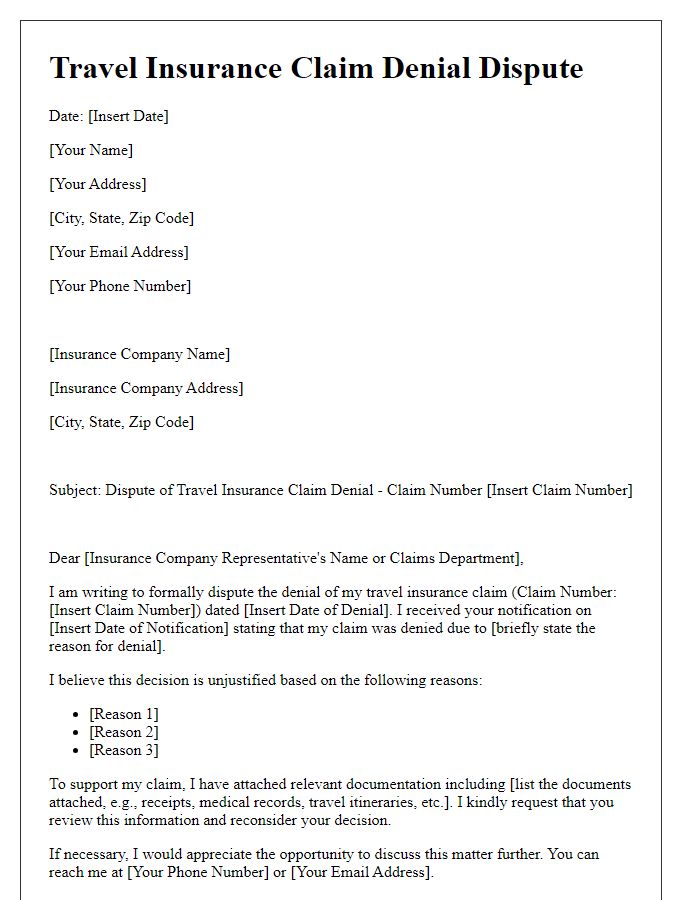

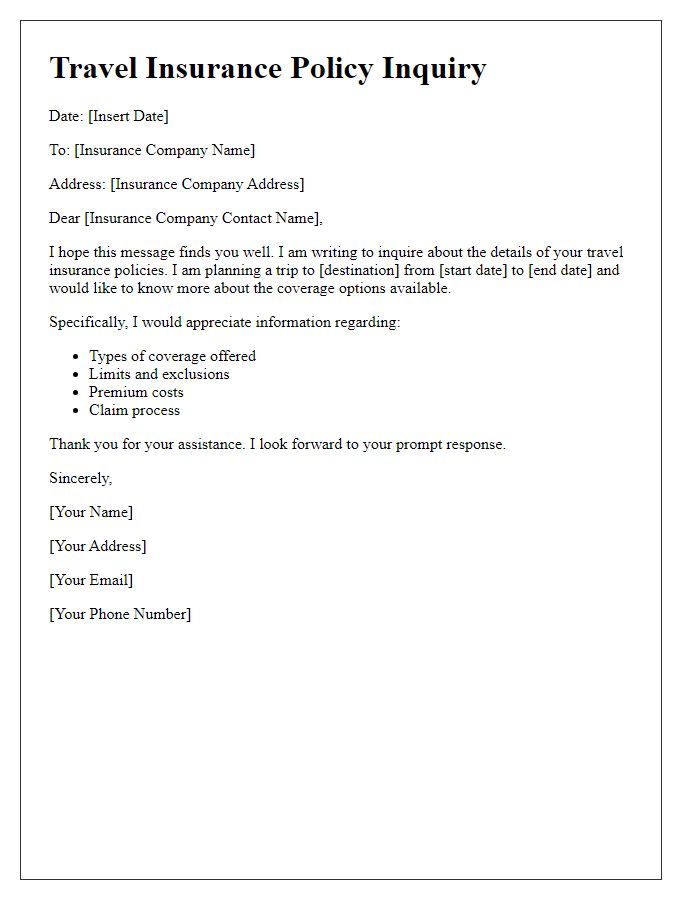

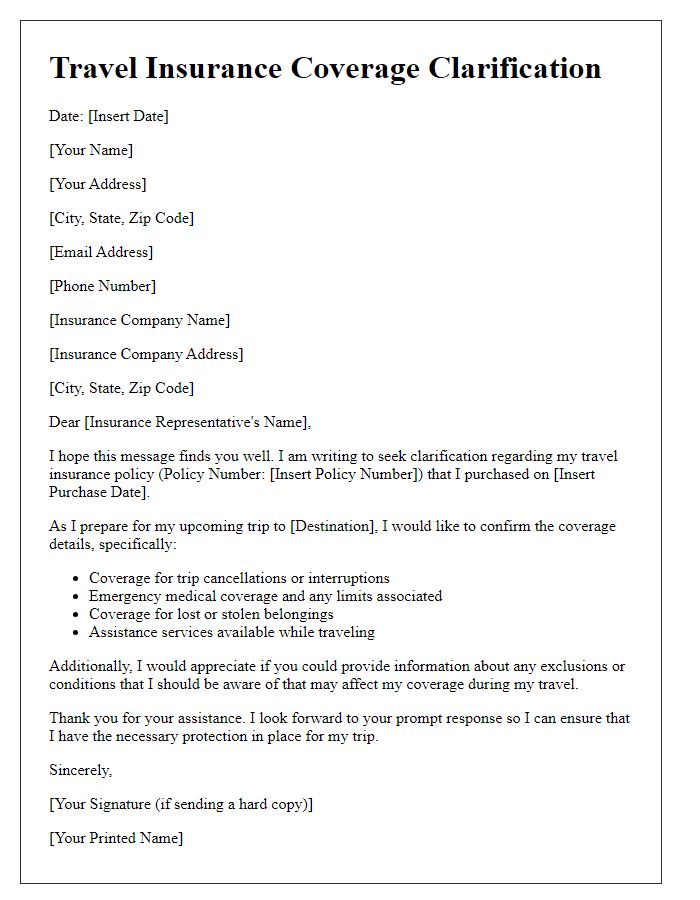

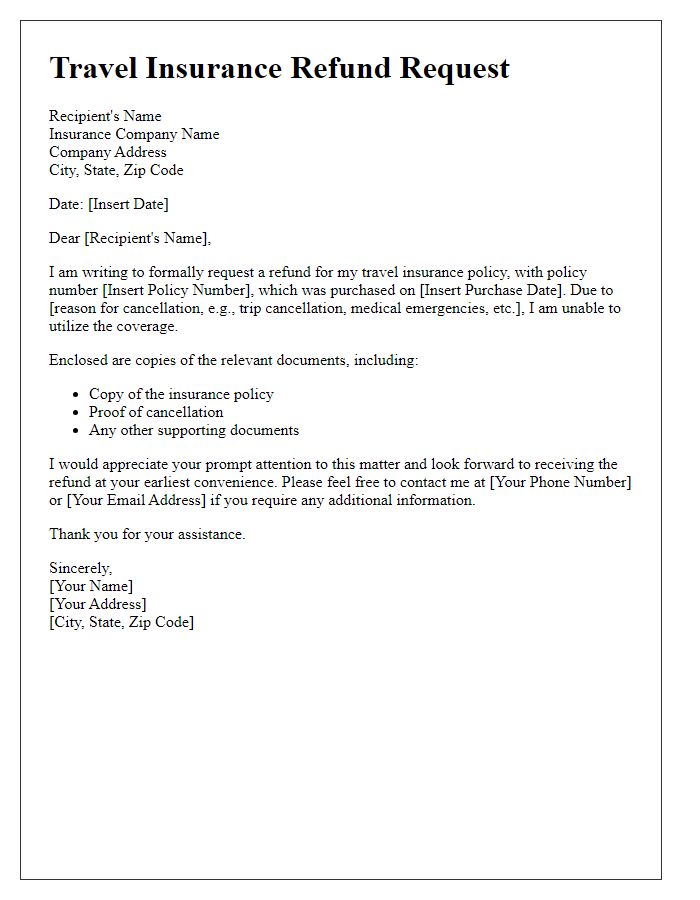

Travel insurance complaints often arise due to denied claims or inadequate coverage. Policies, such as those issued by major providers like Allianz or World Nomads, contain detailed terms regarding coverage limits, exclusions, and claims processes. Personal information, including policy numbers, travel dates, and destinations, plays a critical role in resolving disputes. For instance, a policyholder traveling from New York City to Paris for a two-week holiday may encounter issues if pre-existing medical conditions are not disclosed properly, leading to claim denials for related expenses. Proper documentation and clear communication are essential in these situations to ensure policyholders receive the benefits they are entitled to.

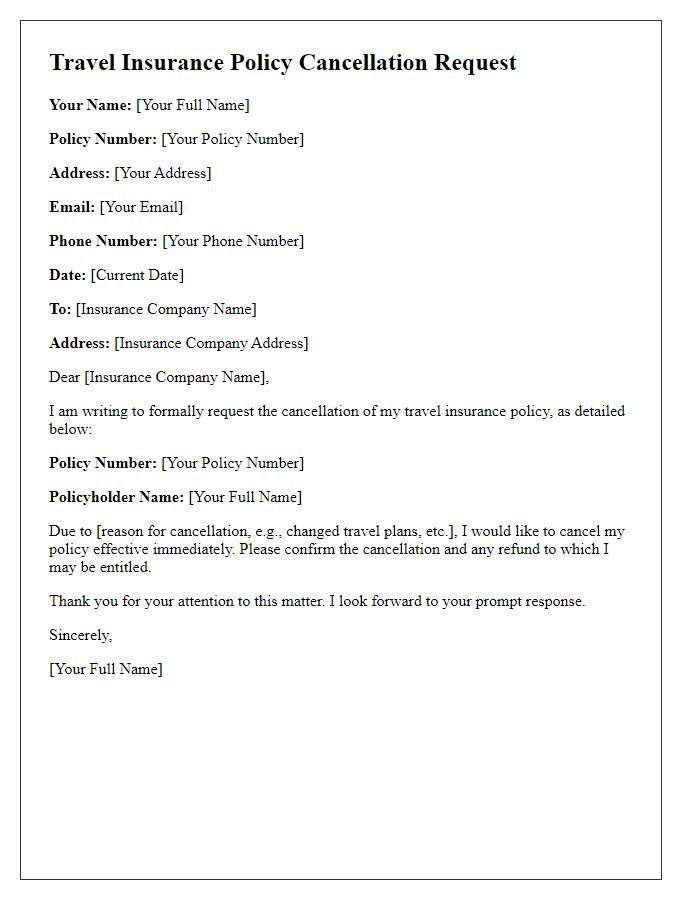

Detailed Incident Description

A travel insurance complaint regarding a delayed flight claim can be crucial for policyholders seeking reimbursement. On December 15, 2022, a flight from Los Angeles International Airport (LAX) to New York's John F. Kennedy Airport (JFK) was delayed due to severe winter weather conditions, specifically a snowstorm that dropped over 10 inches of snow in the New York area. The airline notified passengers of a three-hour delay, resulting in missed connections to international flights. Consequently, accommodation and meal expenses amounted to $300, which exceeded the reimbursement limit outlined in the travel insurance policy from World Traveler Insurance. Despite submitting a claim with the necessary documentation, including receipts and the airline's delay confirmation, the claim was denied on the basis that the snowstorm fell under "operational issues." This decision requires sufficient review, considering the circumstances of severe weather, which should be covered under the policy's criteria for unexpected events.

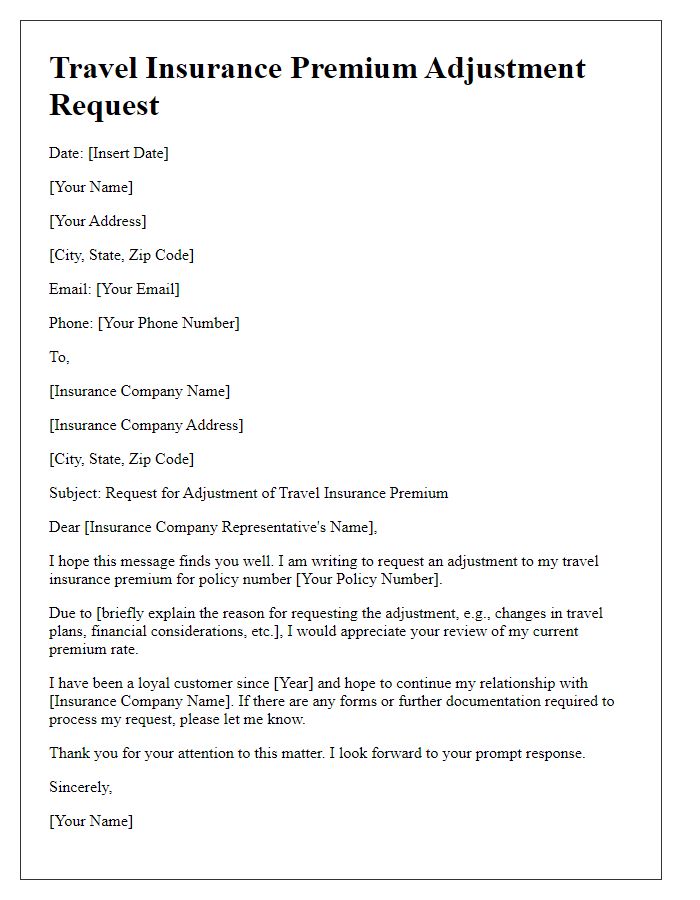

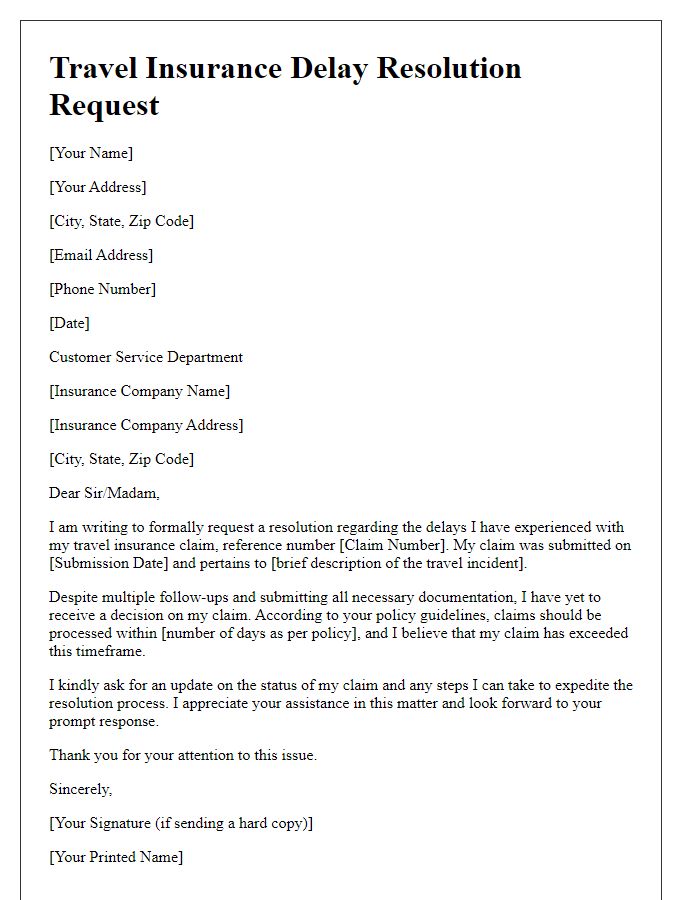

Dates & Times of Correspondence

Travel insurance complaints often arise from issues such as delayed claims or insufficient coverage. Important dates include the day of the incident (e.g., January 15, 2023), the filing date of the claim (e.g., January 20, 2023), and the date of the first correspondence with the insurance company (e.g., January 25, 2023). Each communication should be documented, noting the time and the representative contacted at the insurance provider (e.g., Customer Service, Claim Department). Resolution efforts often require persistence, emphasizing timelines around responses, such as a lack of reply within designated response periods (typically 15 business days). Keeping meticulous records sends a clear message of urgency and accountability to the insurance provider.

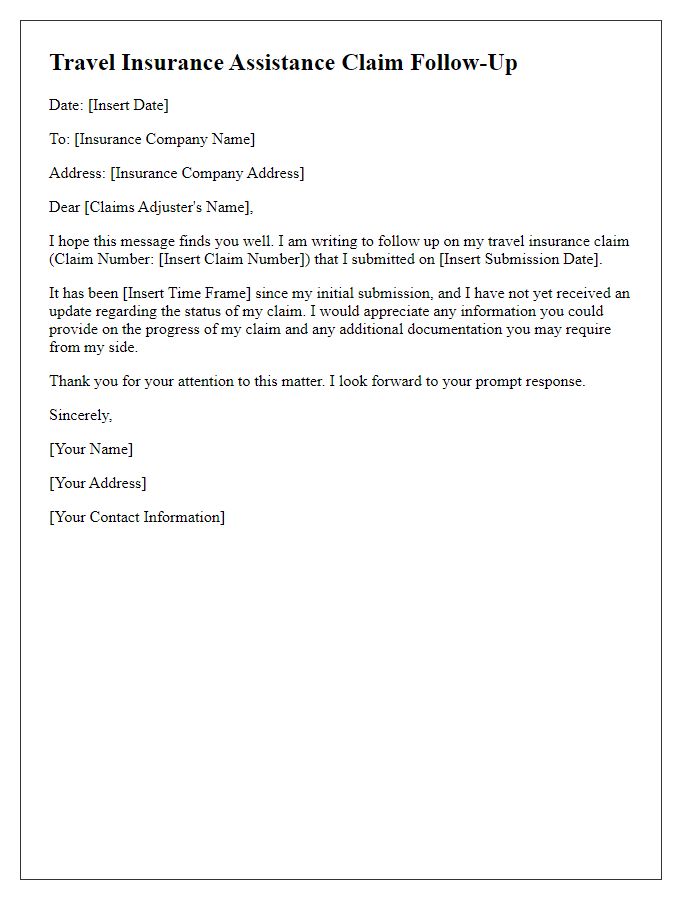

List of Claimed Expenses

Travel insurance complaints often arise due to the denial of claimed expenses related to unexpected incidents during trips. Common expenses include medical bills incurred for emergency treatment (averaging $2,000 per visit in foreign hospitals), accommodation costs stemming from trip cancellations (which can exceed $150 per night), and transportation expenses for unanticipated delays (typically ranging from $50 to $300, depending on distance). Other significant costs may involve lost personal belongings (with the average claim for luggage theft reaching $1,500), trip interruption fees (with an average of $500 lost per itinerary change), and emergency evacuation expenses (which can skyrocket to over $100,000 in remote locations). When addressing complaints, it is crucial to provide detailed documentation of all claimed expenses, including receipts and medical reports, to support the case effectively.

Resolution Desired & Contact Preference

Travel insurance complaints often arise from unsatisfactory claims processes or inadequate coverage. Many travelers experience issues related to trip cancellations, medical emergencies, or lost luggage while abroad. Insurance providers, such as Allianz Global Assistance or AIG Travel Guard, may face complaints regarding long response times or insufficient customer support (often reported to exceed 48 hours during peak travel seasons). Providing clear documentation, including policy numbers and detailed incident descriptions, can help facilitate resolutions. Contact preferences typically include emails or phone calls, with a desire for prompt acknowledgment and ongoing updates on the status of the complaint. Travelers seek transparency in claims procedures to ensure their rights are honored and services rendered as promised.

Comments