Do you ever find yourself scratching your head over surprise fees that seem to pop up out of nowhere? You're not alone! Many consumers are frustrated with hidden charges and unfair fees that can strain budgets and disrupt financial plans. If you've been similarly affected, join us as we explore how to effectively address these concerns â read on for tips and a sample complaint letter that can help you take action!

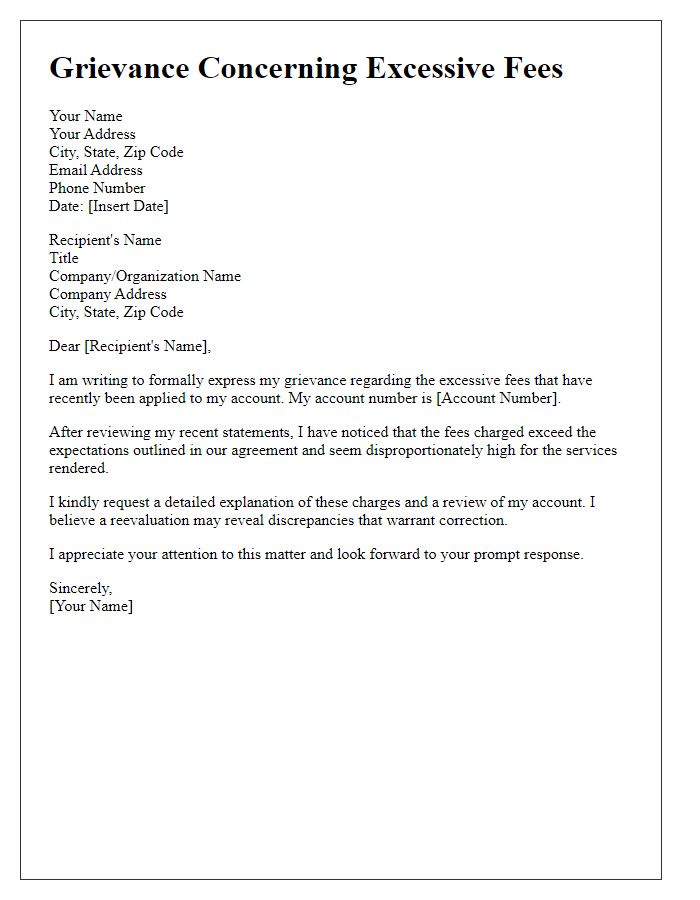

Precise identification of the issue

Unfair fees imposed by financial institutions can lead to significant dissatisfaction among customers. A common example involves excessive bank overdraft fees, often exceeding $35 per transaction, which may accumulate rapidly within a short period. Such charges can occur without adequate notification, leading to unexpected financial strains. Additionally, annual fees for credit cards can reach upwards of $500, despite minimal usage by the account holder. These fees typically lack transparency, leaving customers unaware of their entitlement to dispute or waive them. Addressing such issues through effective complaint channels is essential for consumer advocacy and reform in fee structures.

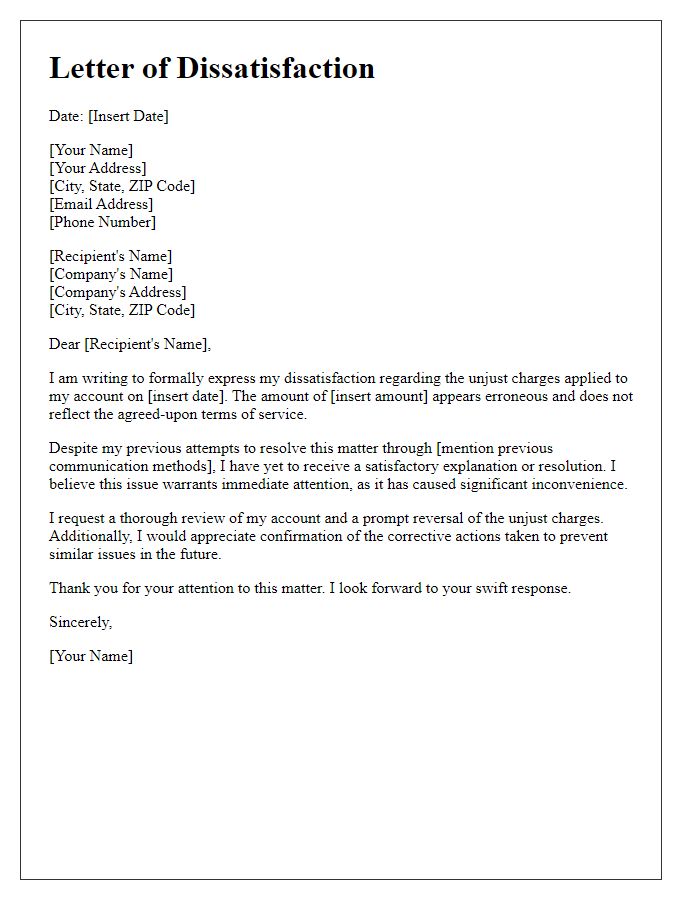

Clear expression of dissatisfaction

Unfair fees can significantly impact consumers' financial well-being, causing frustration and confusion. Unjustified charges, such as hidden bank fees or unexpected service costs, can accumulate over time, leading to substantial economic strain. For instance, a customer facing a recurring monthly fee of $20 without prior disclosure may find their budget adversely affected, resulting in financial stress. Regulatory bodies, such as the Consumer Financial Protection Bureau, monitor these practices to ensure transparency and fairness in financial transactions. Given the potential for abuse, consumers are encouraged to voice their concerns to companies or institutions about such fees, fostering a more equitable financial landscape.

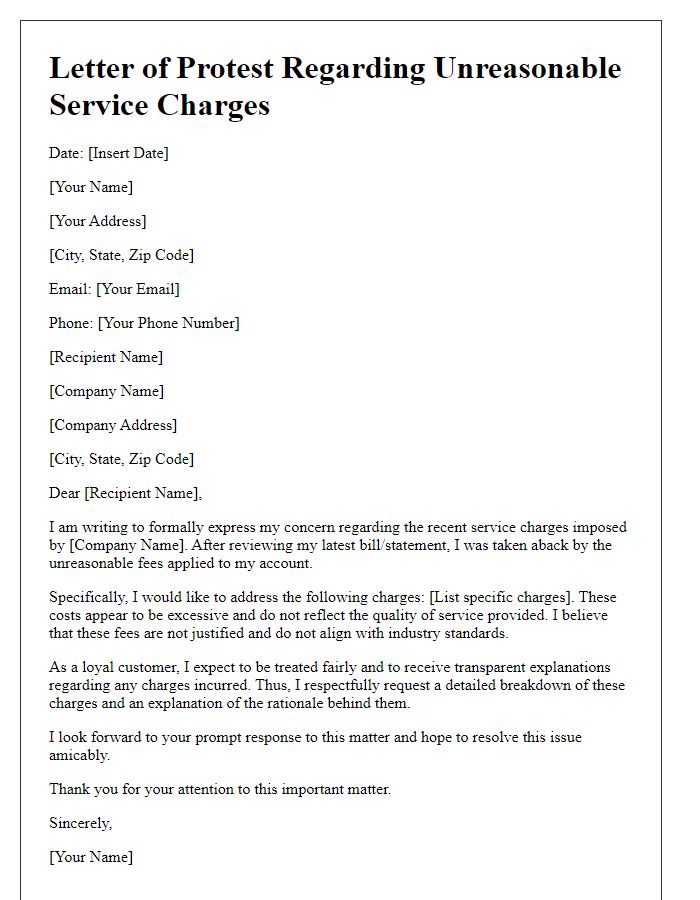

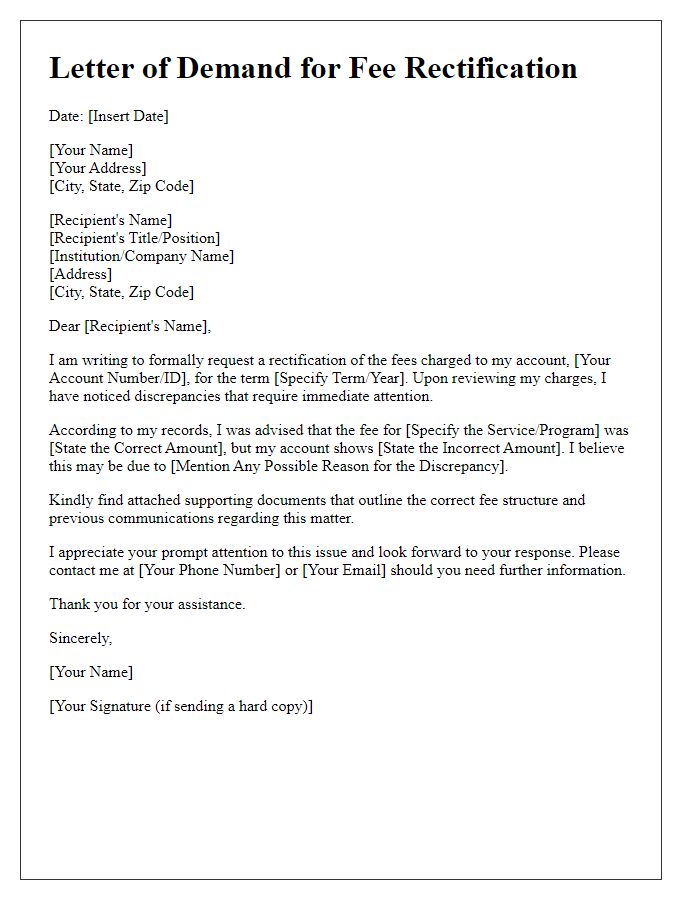

Specific details and evidence supporting your claim

Unjust fees imposed by financial institutions can create significant financial strain for consumers. For example, a $35 overdraft fee charged by banks such as Bank of America can lead to compounded costs, especially if it occurs multiple times within a month, resulting in a total of $140 in fees for just four overdrafts. Documentation stating the transaction dates and amounts reveals that the account holder was not informed about the insufficient funds until after the transactions were processed. Additionally, internal policies regarding fee waivers, which may only apply under certain conditions (such as receiving account alerts), contribute to the confusion and resentment felt by customers. Data from customer service interactions can further illustrate the lack of support in resolving these issues, as many claim to have been misinformed about account terms. The persistent nature of these fees raises questions about fairness and transparency in the banking industry.

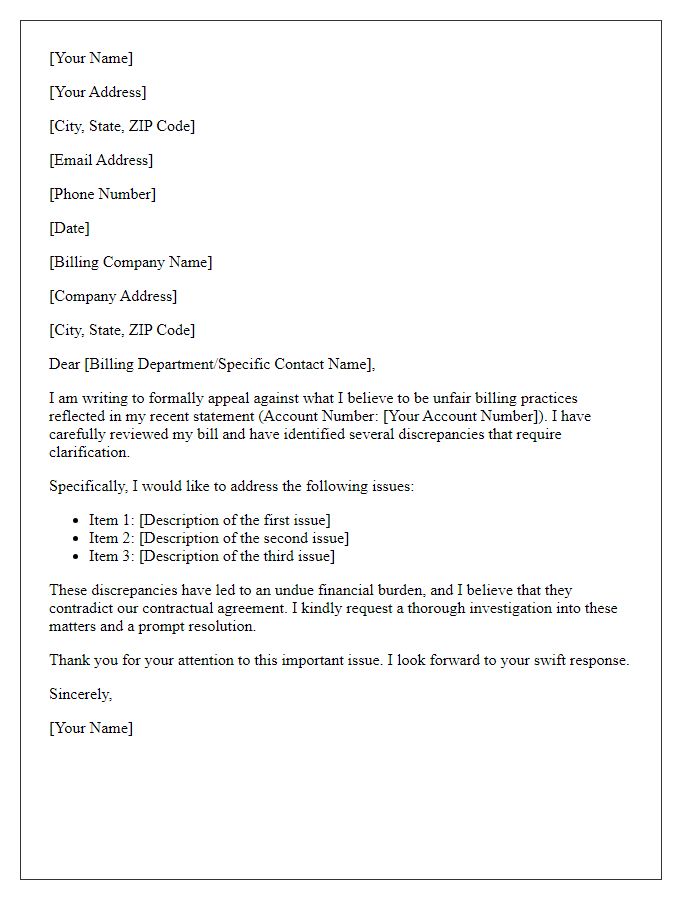

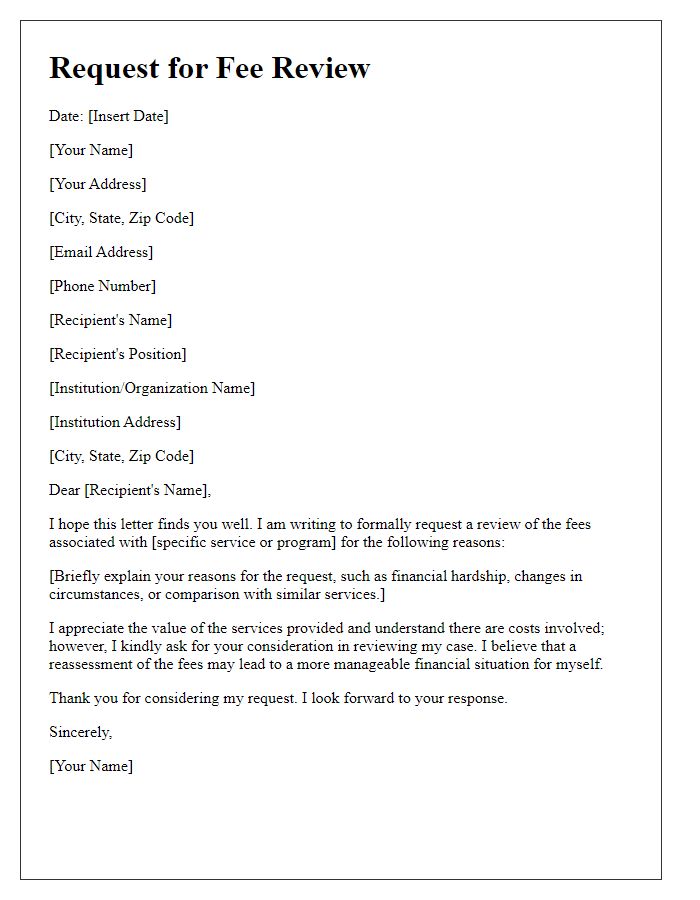

Request for resolution or action

Unfair fees can significantly impact personal finances, often leading to frustration and confusion among consumers. In many financial institutions, such as banks and credit unions, unexpected fees related to account maintenance or transaction processing can accumulate quickly. For example, overdraft fees may reach upwards of $35 per transaction, while monthly maintenance charges can total $15 or more. Consumers often feel compelled to address these issues directly with customer service representatives, frequently through formal complaints. Thorough documentation of fee discrepancies and previous communications is essential for supporting claims. Ultimately, clear resolutions are necessary to restore trust between consumers and financial service providers, ensuring transparent practices in fee assessments and customer accountability.

Professional and courteous tone

Unfair fees can significantly impact financial well-being, especially when associated with banking services, such as monthly maintenance charges or transaction fees. Customers may encounter discrepancies in their account statements reflecting unexpected costs, often exceeding industry standards (averaging around $15 monthly for many institutions). Regulatory bodies, such as the Consumer Financial Protection Bureau, aim to protect consumers from unjust fees. Additionally, specific cases of excessive fees are being scrutinized, affecting numerous individuals across various regions, especially urban areas where the cost of living is already high. Addressing these issues with the financial institution can lead to potential redress and improved transparency in fee structures.

Comments