Have you ever opened your bank statement only to be surprised by unexpected subscription charges that you didn't authorize? It's an experience that can leave you frustrated and confused, especially when it feels like your hard-earned money is slipping away without your consent. In this article, we'll dive into how to draft a compelling complaint letter that effectively addresses unauthorized subscription fees and promotes a swift resolution. So, if you're ready to reclaim your finances, keep reading to learn the steps to take!

Clear Subject Line

An unauthorized subscription fee can significantly disrupt personal finances, with charges often appearing unexpectedly on bank statements. Many users, particularly with online services such as music streaming platforms or content providers, may experience monthly deductions ranging from $9.99 to $29.99 without prior consent. Instances of these fees commonly arise after free trials, which can mislead individuals into automatic renewals. Consumer protection agencies, including the Federal Trade Commission (FTC) in the United States, advise documenting all related communications and maintaining records of subscription attempts. Resolving these disputes often requires contacting customer service representatives, verifying account details, and potentially disputing the charges through financial institutions.

Detailed Account Information

Unauthorized subscription fees can cause significant distress to individuals and their finances. Commonly linked to services like streaming platforms such as Netflix or software applications like Adobe Creative Cloud, unauthorized subscriptions may appear on credit card statements unexpectedly. Users often notice these charges ranging from $9.99 to $59.99 monthly without prior consent. Customers frequently report these fees through customer support channels, only to discover that their accounts (often tied to email addresses like Gmail or Yahoo) had been compromised or mismanaged due to lax security measures. It is crucial to regularly monitor account activity and swiftly address any discrepancies, keeping financial security in mind. Consumers should always ensure the use of strong, unique passwords and consider enabling two-factor authentication to mitigate potential unauthorized access.

Description of Unauthorized Charges

Unauthorized subscription fees can significantly impact personal finances. For instance, recurring charges of $9.99 from the streaming service Netflix can accumulate unexpectedly, leading to an annual cost of approximately $119.88, when services were assumed to be canceled. Frequent checking of bank statements can reveal these unauthorized deductions, often linked to forgotten trials or stolen payment information. Companies like Amazon Prime may also contribute to this confusion with automatic renewals every 12 months, amounting to $139 annually, even when users believed they had opted out. Consumers must be vigilant about these severe implications on their budgets and ensure close monitoring of their financial accounts to prevent such issues.

Request for Resolution

Unauthorized subscription fees can lead to unexpected charges on bank statements, often leaving consumers frustrated and confused. Individuals may notice these charges appearing from various services, typically monthly deductions ranging from $9.99 to as much as $49.99, without any prior consent or notification. Companies, particularly in the digital content sector, may employ practices that result in automatic renewals of subscriptions, catching users off guard. It's essential for consumers to promptly address these discrepancies by contacting customer service representatives to request immediate resolution. Documentation, such as receipts or screenshots of canceled subscriptions, strengthens the case during disputes. Reviewing terms of service or privacy policies is also necessary to ensure awareness of potential subscription pitfalls in the future.

Contact Information for Follow-up

Unauthorized subscription fees can lead to financial distress for individuals and households. Monthly charges, such as $9.99 for streaming services or $14.99 for premium apps, can accumulate unnoticed, resulting in unexpected deductions from bank accounts. These invisible charges often stem from free trials or deceptive marketing practices, leaving consumers bewildered and frustrated. Companies frequently employ automatic renewal clauses, making it challenging for customers to opt-out. It is crucial for consumers to monitor their financial statements regularly, as proactive measures can mitigate the impact of these unauthorized fees and protect financial health.

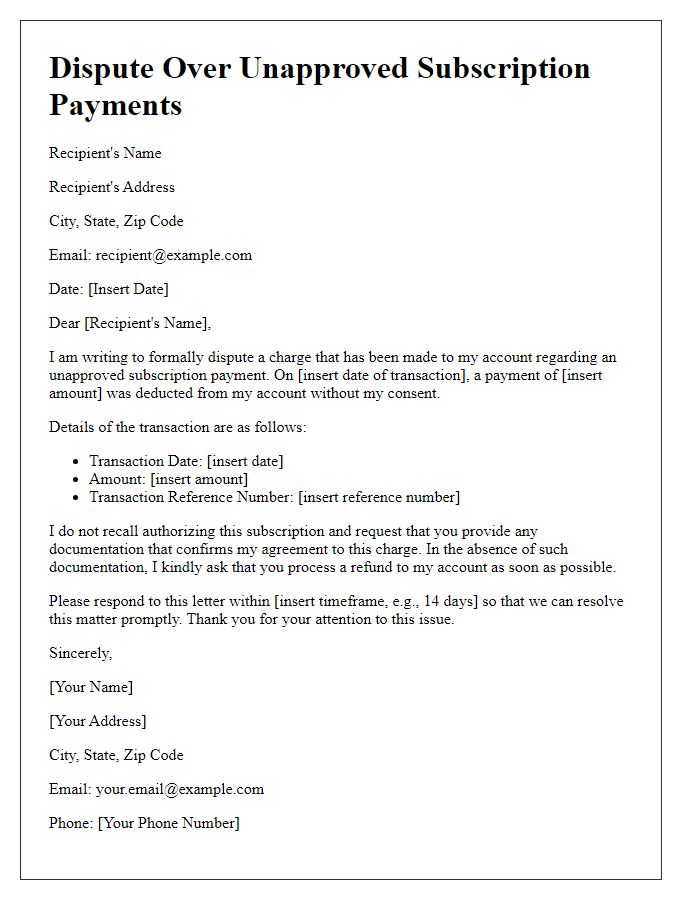

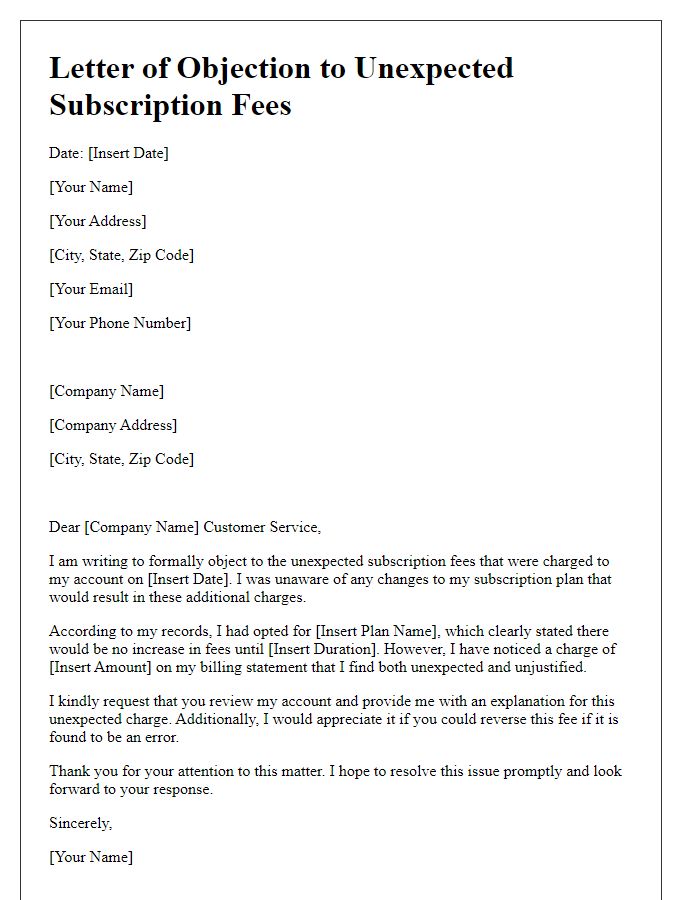

Letter Template For Complaint About Unauthorized Subscription Fees Samples

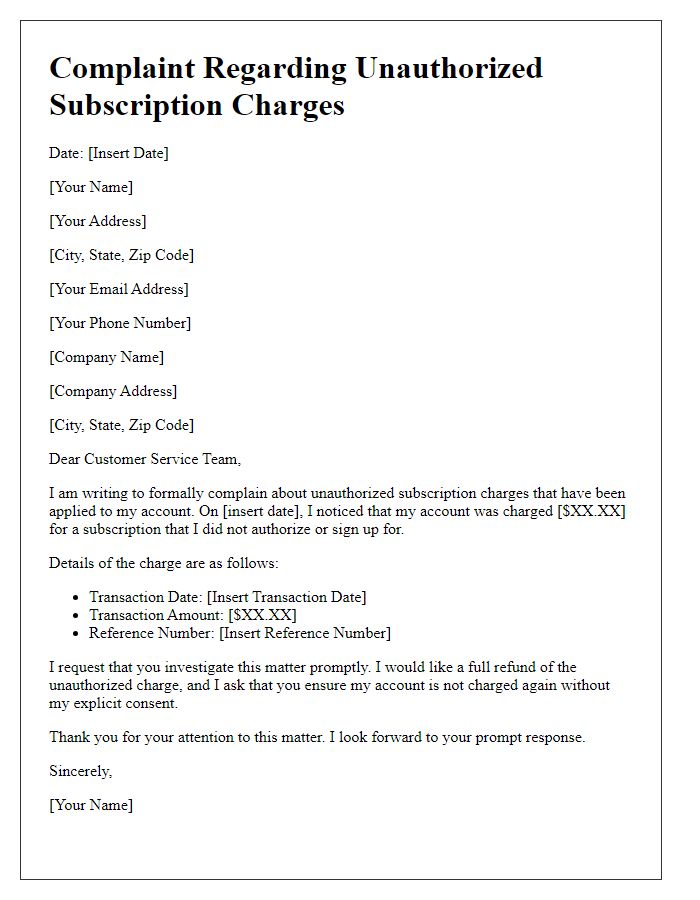

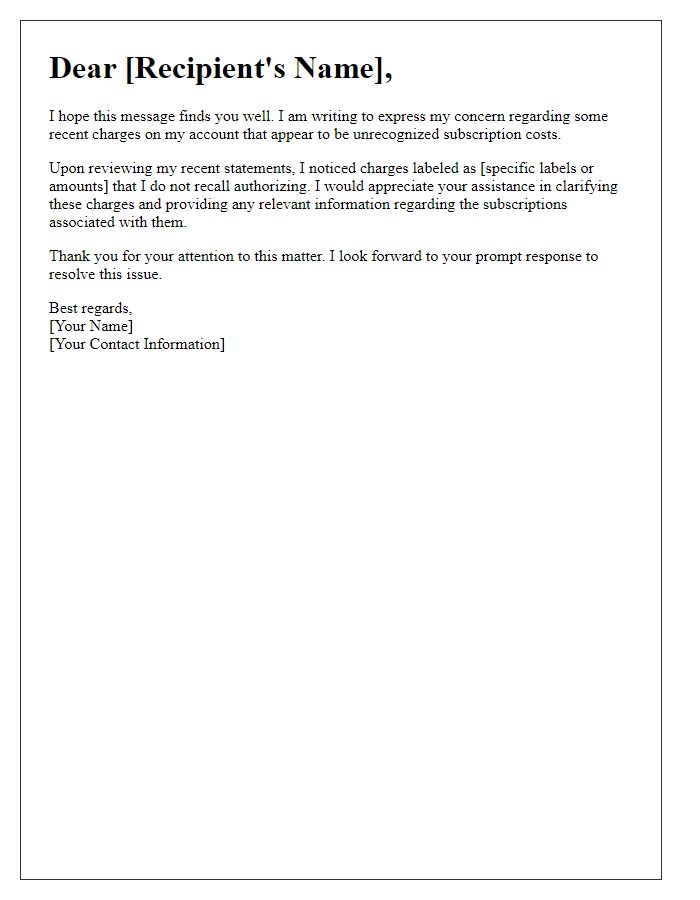

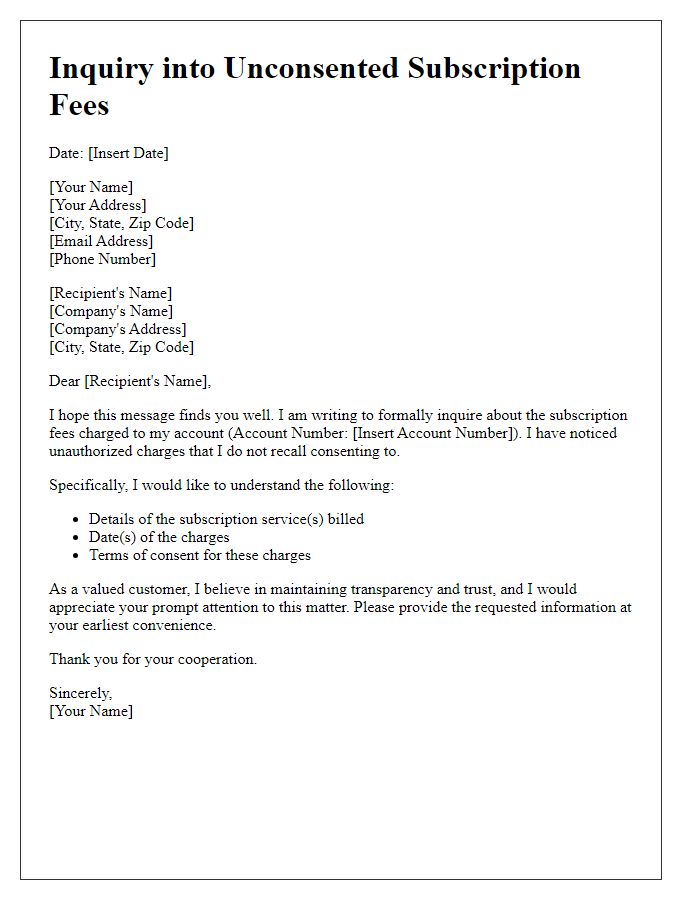

Letter template of complaint regarding unauthorized subscription charges

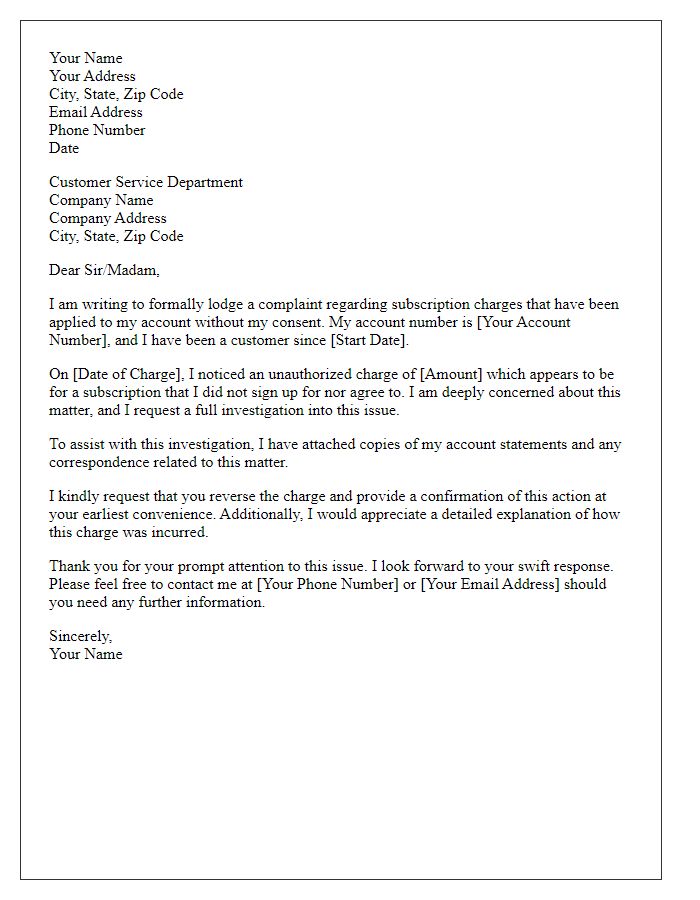

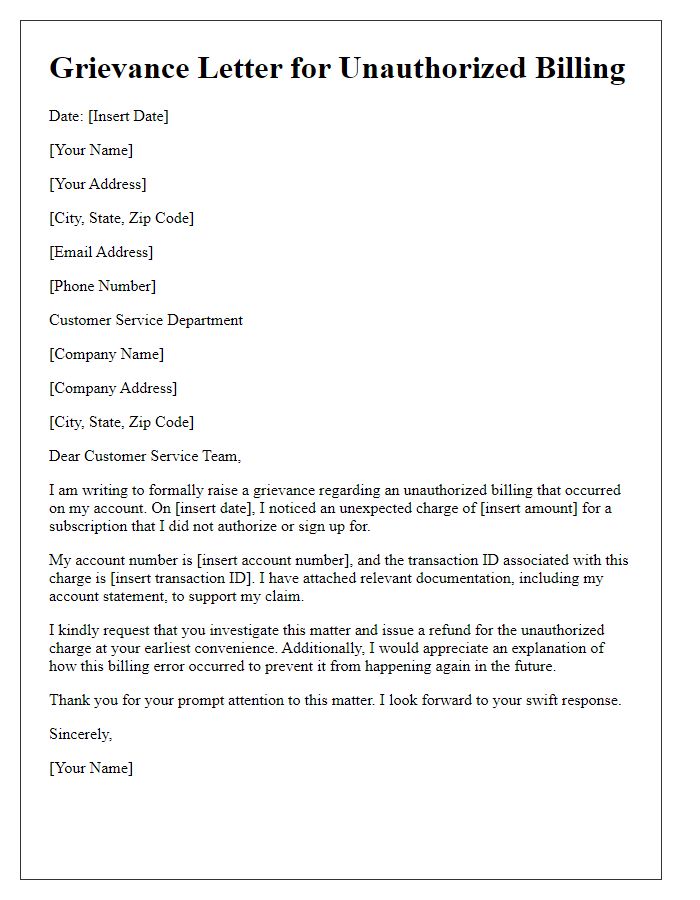

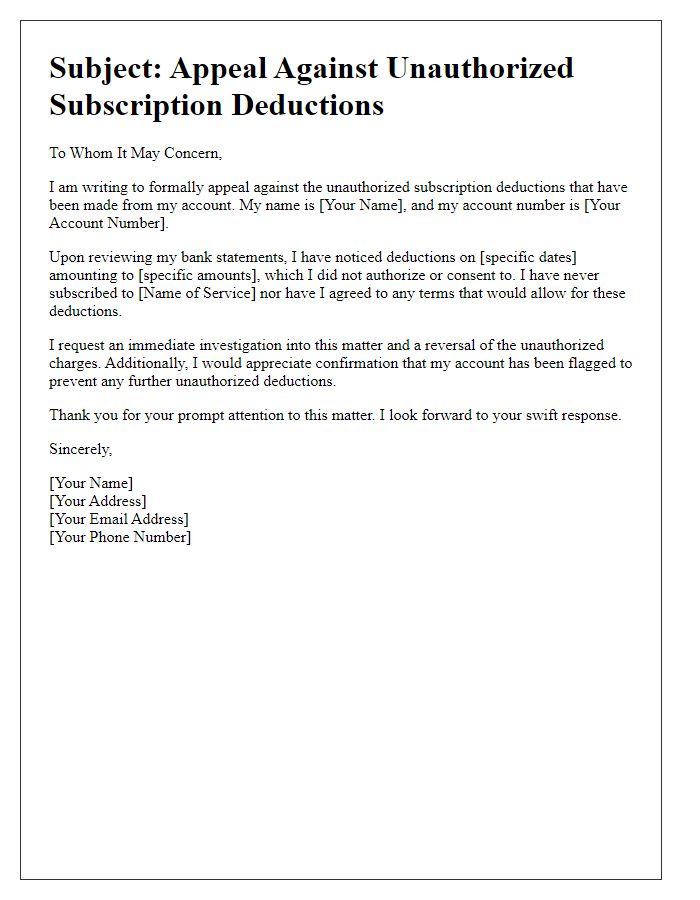

Letter template of formal complaint for subscription charges without consent

Comments