Are you tired of unexpected charges creeping up on your bank statements? It can be frustrating to see unauthorized transactions that take a bite out of your hard-earned money. Understanding how to effectively address these charges is key to reclaiming your finances. Join me as we delve into the necessary steps to tackle these unapproved expenses and ensure your financial peace of mindâread more to find out how!

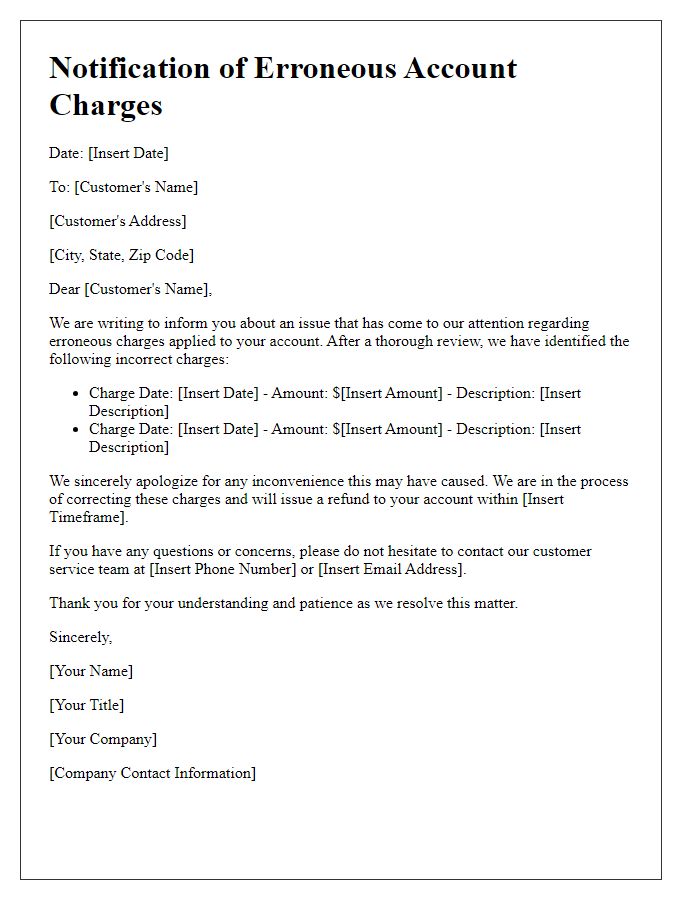

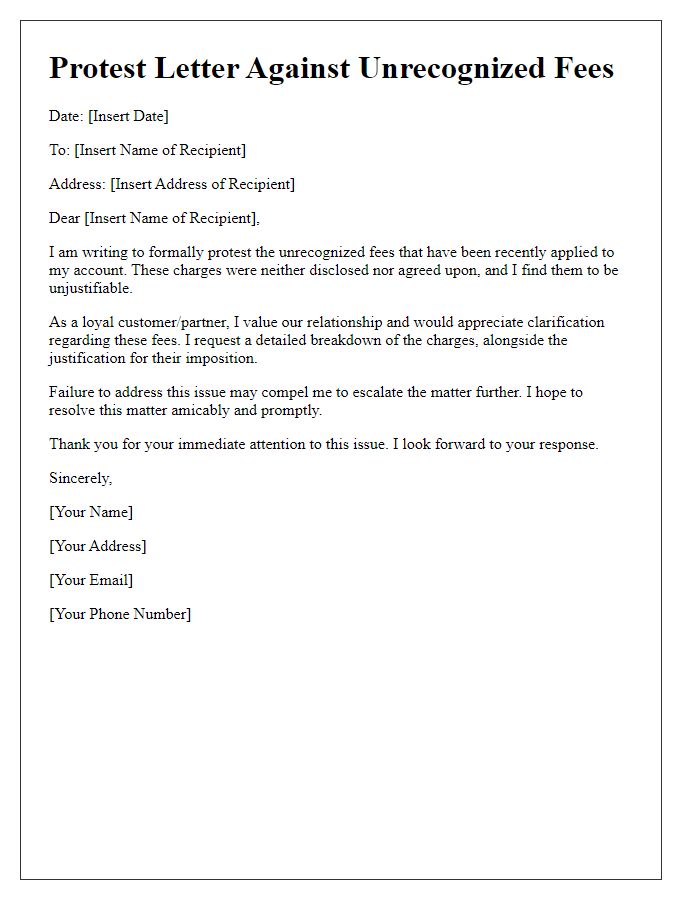

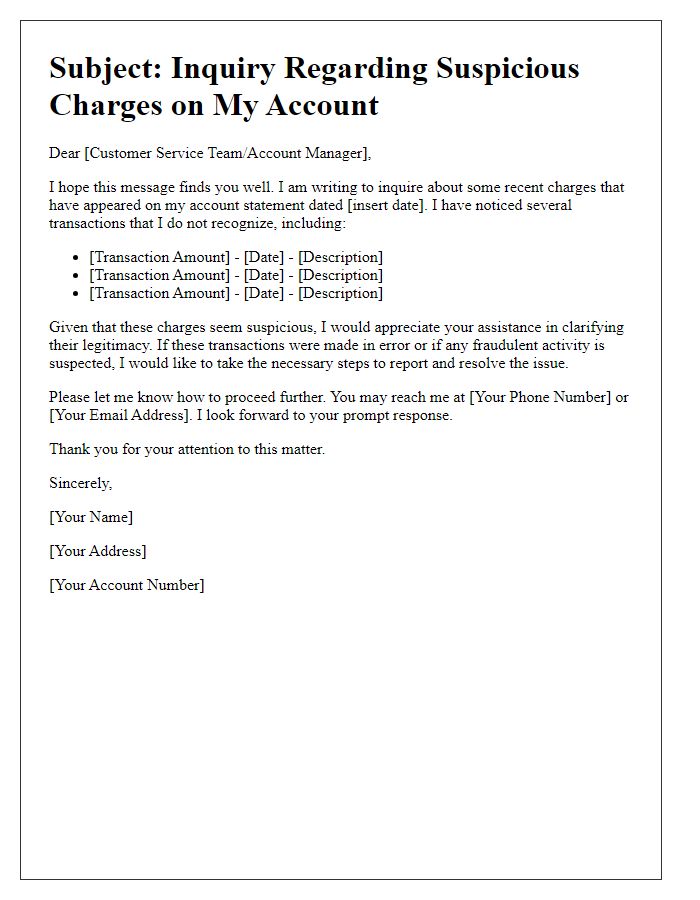

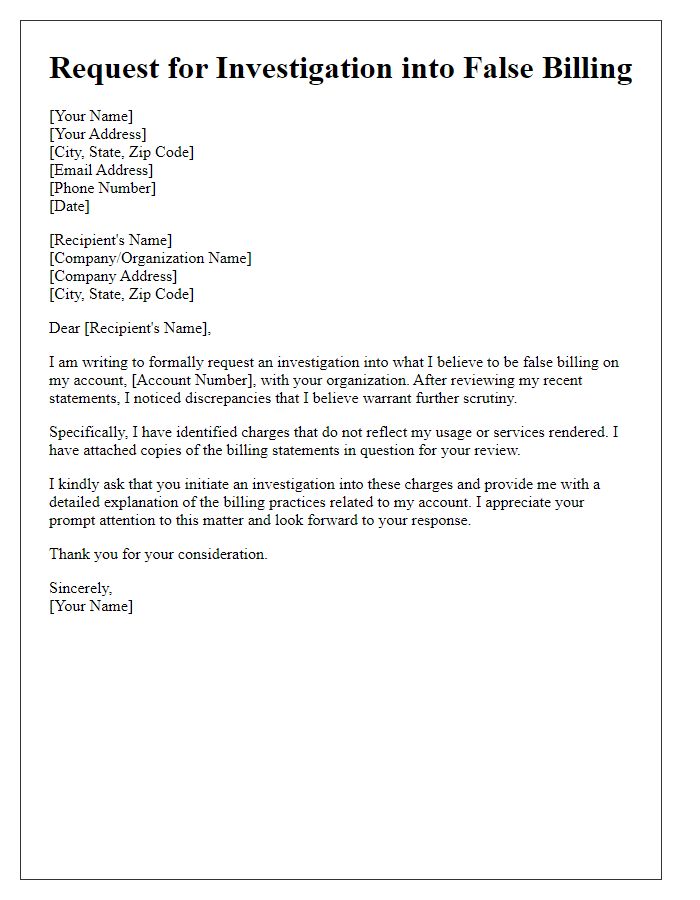

Clear identification of the unauthorized charges.

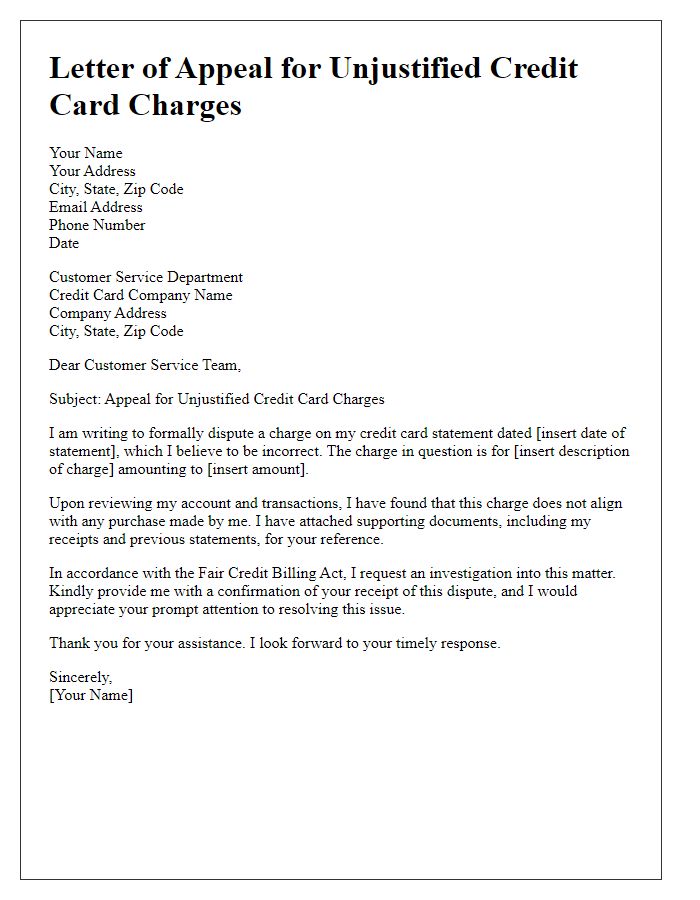

Unauthorized charges on credit card statements can lead to financial discrepancies and distress. Consumers, like those using Visa or Mastercard, may notice unexpected transactions, often categorized under vague merchant names. For instance, a charge labeled "$59.99 from ABC Services" might originate from a subscription service never signed up for, leading to confusion and frustration. Identification of such charges typically requires a meticulous review of monthly statements, often spanning several months. Financial institutions emphasize the importance of timely reporting, urging clients to notify them within 60 days to dispute charges effectively. Most banks provide dedicated dispute resolution teams to assist in rectifying unauthorized transactions, while also ensuring the security of personal and financial information.

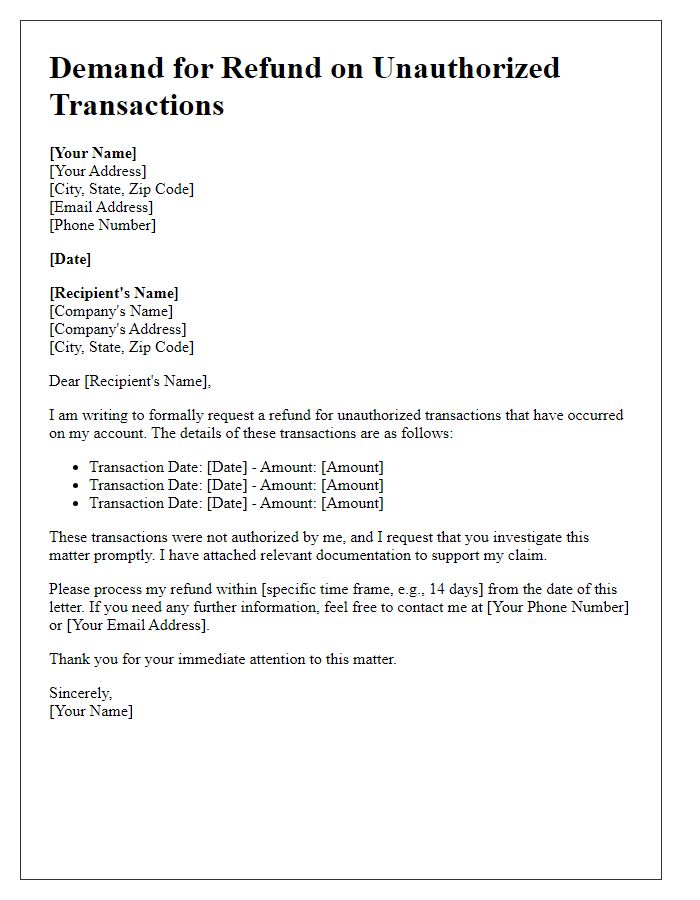

Specific account and transaction details.

Unauthorized charges can significantly impact financial security and peace of mind. Recent transaction discrepancies on account number 123456789, dated October 12, 2023, reveal charges of $75.99 from a vendor named "TechHub" not recognized by the account holder. Review of previous statements shows no affiliations or prior transactions with this entity, suggesting a potential fraud incident or clerical error. Immediate investigation is essential to rectify the account details and prevent future unauthorized withdrawals, while safeguarding personal financial information from further misuse.

Demand for resolution and credit reversal.

Unauthorized charges can occur on credit card statements, often leading to financial disputes. Consumers experiencing such issues should promptly gather evidence including transaction dates, amounts, and merchant names. It is essential to contact the bank or credit card company immediately, typically through their customer service hotline, to report the unauthorized activity. Key details must be provided, such as account numbers and specific charges in question. A formal complaint should request a thorough investigation into the charges and demand for a credit reversal, highlighting consumer rights under laws such as the Fair Credit Billing Act. Providing a deadline for resolution encourages timely responses. Ultimately, effective communication can facilitate the reversal of unauthorized charges and restore financial integrity.

Contact information for follow-up.

Unauthorized charges can lead to significant financial distress for consumers, especially when a monthly bill suddenly includes unexpected fees. Consumers should review their statements from financial institutions, such as Visa or Mastercard, for discrepancies. Customer service departments often handle such complaints; however, long wait times (averaging 20 minutes) can frustrate customers. It is crucial to provide detailed documentation, including transaction amounts, dates (like September 15, 2023), and merchant names (e.g., Amazon or Walmart), to expedite the investigation process. Account numbers and personal identification information (such as a Social Security Number) may also be required for verification. Keeping records of all communications is important for future reference.

Request for confirmation of receipt and action plan.

Unauthorized charges can cause significant distress for consumers, highlighting vulnerabilities in financial transactions. For instance, a recent incident involved unauthorized charges of $200 from a customer's credit card by an online retailer, leading to immediate panic and the need for resolution. Customers typically request confirmation of receipt from the financial institution or the retailer involved, ensuring their complaint is acknowledged. Additionally, they seek a detailed action plan outlining the steps to investigate these charges, including a timeline for response and potential restitution. Establishing a direct point of contact, such as a fraud resolution specialist, enhances communication efficiency, providing customers with peace of mind during resolution processes.

Comments