Are you curious about the health benefits offered by your employer? Understanding your healthcare options can be overwhelming, but it's crucial for your well-being and financial planning. In this article, we'll explore common inquiries regarding employee health benefits and provide you with the information you need to make informed decisions. Stick around, as we'll dive deeper into navigating your benefits and ensuring you get the most out of them!

Employee Information

When assessing employee health benefits, factors such as coverage options, premium costs, co-pays, and deductibles must be scrutinized. Health insurance plans, such as Preferred Provider Organizations (PPOs) or Health Maintenance Organizations (HMOs), play a crucial role in determining accessible healthcare services. Specific benefits may include maternity leave, mental health services, or prescription drug coverage, all pivotal for overall employee wellbeing. Employers often provide additional perks, including wellness programs or gym memberships, enhancing the overall health focus at the workplace. Understanding the nuances of these benefits can lead to informed decisions and improved job satisfaction.

Inquiry Purpose

Numerous companies offer employee health benefits to enhance wellness and productivity, extending options such as medical insurance, dental plans, and mental health resources. Health benefits programs often cover various medical expenses, including hospitalization costs and preventative care measures, which can improve overall employee satisfaction. Organizations may also provide additional resources such as wellness programs or fitness memberships to encourage a healthier lifestyle. Understanding the specifics of these benefits can help employees make informed decisions regarding their healthcare needs. They should inquire about coverage details, eligibility requirements, and enrollment deadlines to maximize their health benefits.

Specific Health Benefits Details

Employees often seek specific health benefits information to understand coverage options and eligibility requirements. Health insurance plans, such as PPO (Preferred Provider Organization) or HMO (Health Maintenance Organization), vary significantly in terms of costs and in-network provider availability. Annual deductible amounts, typically ranging from $500 to $3,000, determine out-of-pocket expenses before coverage activation. Copayments for medical visits may range from $20 to $50, while prescription drug coverage can differ greatly, with tiers affecting the cost of medications. Additionally, mental health services, preventive care, and dental or vision coverage may not be universally included, making it crucial for employees to review the summary plan descriptions or contact the HR department for personalized guidance.

Preferred Communication Channel

Understanding preferred communication channels is essential for effective employee health benefits inquiries. Employees often favor email (over 75% of workforce), allowing for documentation and reference tracking. Phone calls, while personal, may restrict swift access to information due to call volume (averaging 50 calls per hour in HR departments). Digital platforms, such as secure web portals, increasingly resonate with tech-savvy employees, enabling easy navigation (with 80% of users under 45 reporting satisfaction). In contrast, face-to-face meetings, although beneficial for complex queries, are less conducive to efficient information dissemination due to scheduling conflicts (over 60% of employees prefer virtual solutions). Tailoring communication strategies to these preferences enhances engagement and satisfaction with health benefits programs.

Contact Information

Employee health benefits encompass essential coverage plans that provide employees with access to medical services, including preventive care, hospitalization, and prescription medications. Health plans, such as Preferred Provider Organizations (PPO) and Health Maintenance Organizations (HMO), vary significantly in terms of premiums, deductibles, and coverage options, affecting employees' financial responsibilities. The Affordable Care Act (ACA) mandates certain minimum standards for health insurance, ensuring essential health benefits are available to employees. Proper inquiry about these benefits should include essential contact information for human resources (HR) or benefits administrators, typically found in employee handbooks or company intranet. Accurate contact information ensures timely assistance regarding benefits questions or issues, fostering a supportive employee experience.

Letter Template For Employee Health Benefits Inquiry Samples

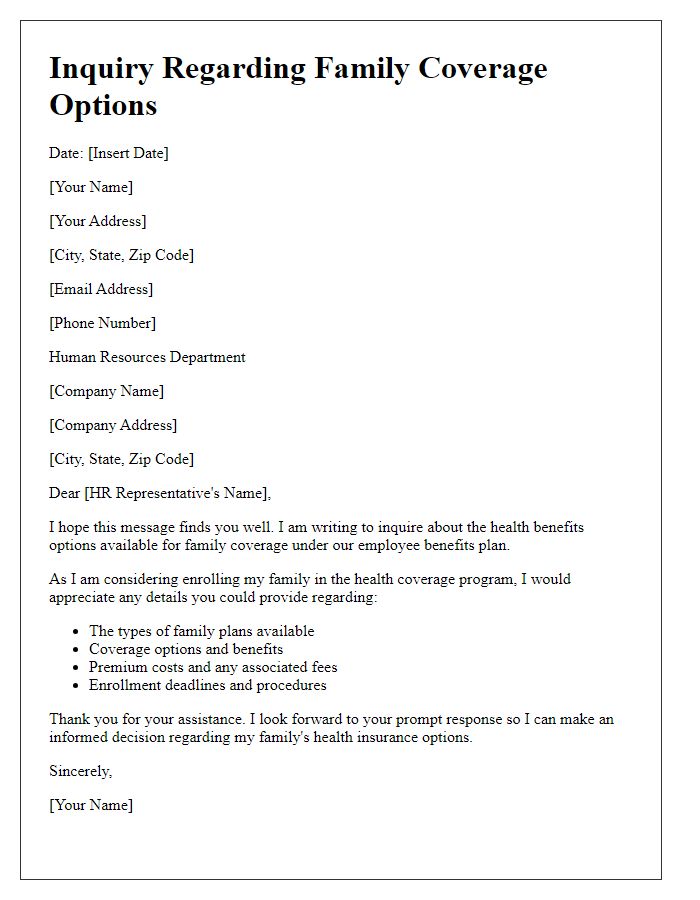

Letter template of employee health benefits inquiry for family coverage options

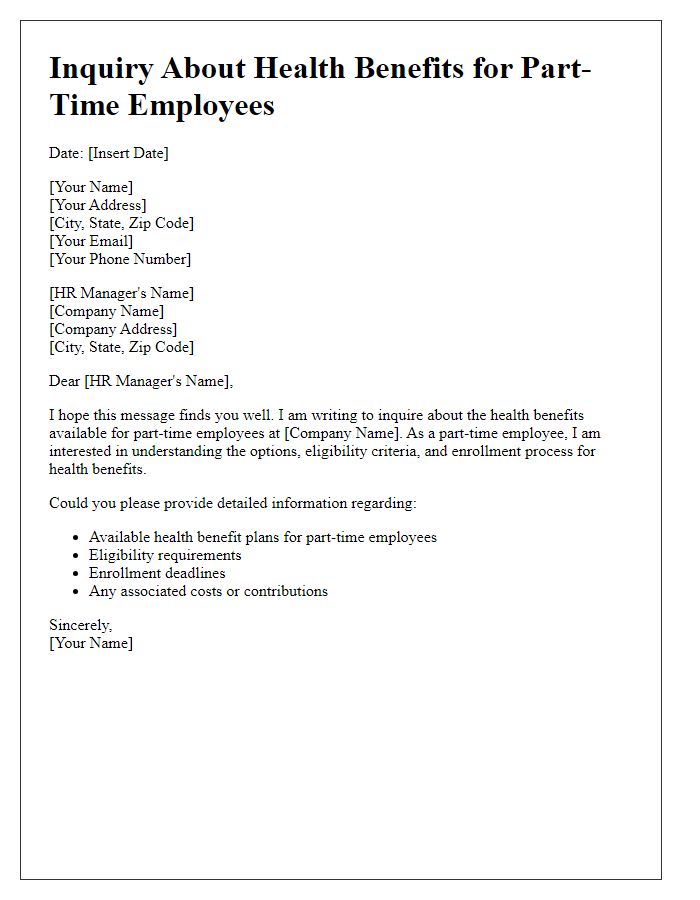

Letter template of employee health benefits inquiry for part-time employees

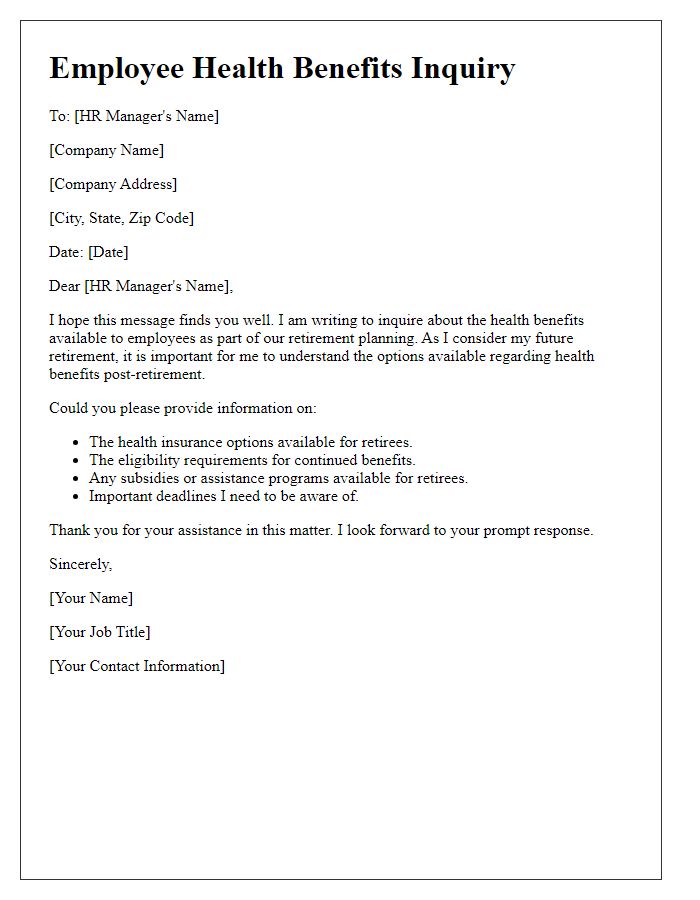

Letter template of employee health benefits inquiry for retirement planning

Letter template of employee health benefits inquiry for specific medical needs

Letter template of employee health benefits inquiry for wellness programs

Letter template of employee health benefits inquiry for dependent eligibility

Letter template of employee health benefits inquiry for coverage differences

Comments