Are you considering closing your bank account but unsure where to start? Whether it's due to better banking options or financial adjustments, crafting a clear and concise letter is essential. In this article, we'll guide you through the steps of writing a professional bank account closure letter, ensuring that your request is processed smoothly and efficiently. So, grab a cup of coffee and read on to discover our handy template and tips!

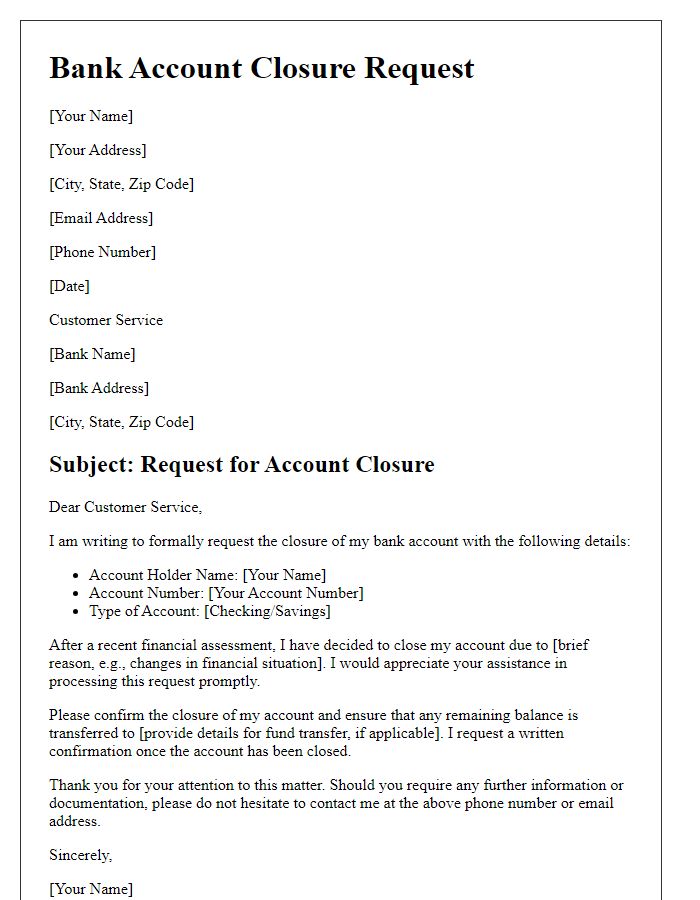

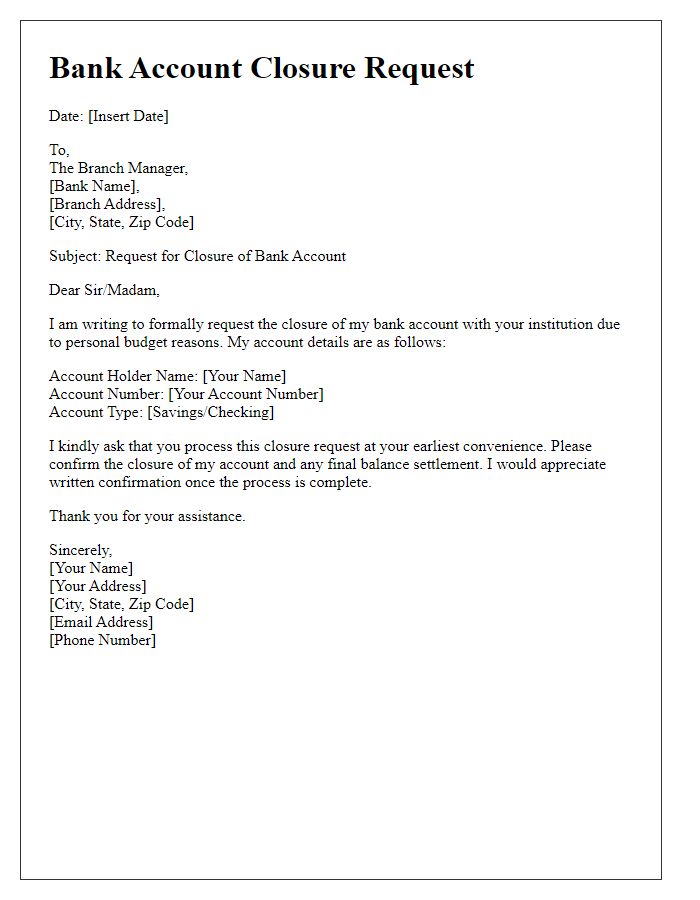

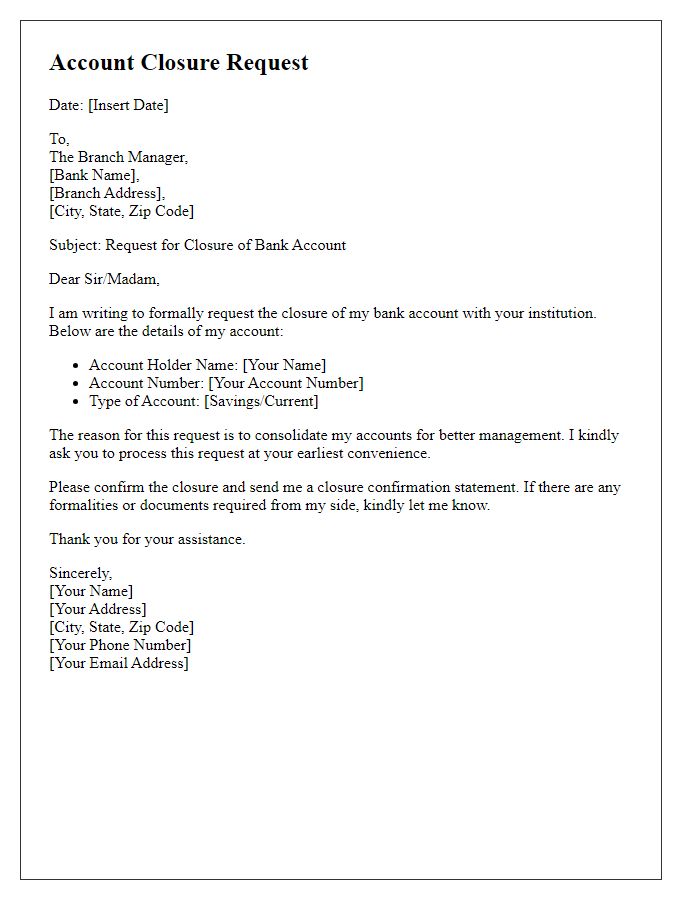

Account Holder's Information

Account closure procedures require careful attention to detail and adherence to specific bank policies. Account Holder's Information typically includes the full name of the account holder, the account number (usually a 10 to 12-digit identification number unique to the account), and the type of account (checking, savings, etc.). Important contact details such as the mailing address, email address, and phone number, facilitate communication with bank representatives. Additionally, providing identification documents, like a government-issued photo ID (passport or driver's license), ensures security during the closure process. A clear request for the remaining balance withdrawal method is essential, whether through a check or transfer. Finally, including the date of the request confirms the intent for timely processing within bank operational timelines.

Formal Request Statement

A formal request to close a bank account requires clarity and professionalism. The account holder should include essential details such as account number, type of account, and the reason for closure. For example, if the request targets a checking account at Bank of America, it's vital to provide account details like the account number (e.g., 123456789) and any related service deaths, including automatic payments. Including a specific closure date helps the bank process the request efficiently. It's also advisable to mention the preferred method for receiving any remaining balance, whether via a check mailed to the account holder's registered address or a transfer to another bank. Proper identification and a phone number for clarification can expedite the process and ensure successful account closure in compliance with banking regulations.

Account Details

Closing a bank account requires a careful process to ensure all financial transactions are completed and the account is officially closed. Account details such as account number, holder's name, and associated branch location (for example, Wells Fargo, Main Street Branch, New York City) must be clearly stated in the closure request. Financial institutions typically request a written notice, pointing out any outstanding checks or pending transactions that may need attention prior to closure. Additionally, notifying the bank of the preferred method for any remaining balance disbursement, whether by check or transfer, is crucial for a smooth transition. Completing this process ensures that all account-related activities, including direct deposits and automatic payments (like utility bills), are promptly canceled or redirected.

Closure Instructions

To close a bank account, customers need to follow specific steps outlined by their bank. First, it is essential to verify the account balance, ensuring it reaches zero or that enough funds are transferred to another account before initiating the closure process. Next, customers should contact the bank branch or call customer service to request the account closure, usually providing identification and any necessary account details. It is advisable to check for any outstanding transactions, such as pending payments or automatic deposits, as these could delay the closure process. Lastly, customers must request a written confirmation of the account closure for their records, ensuring all funds have been accounted for, and no further fees or charges will arise. Local regulations and specific bank policies may also affect the closure procedure.

Contact Information for Confirmation

To close a bank account effectively, it's essential to provide contact information to confirm the closure request. This includes full name, account number, and current phone number for direct communication with banking officials. In addition, including an email address can facilitate any electronic correspondence regarding the process. Providing a forwarding address is beneficial for receiving any final statements or documents related to the account closure. Confirming the contact details ensures that the bank can reach the account holder while processing the closure, preventing any potential misunderstandings or delayed communication regarding the completion of the request.

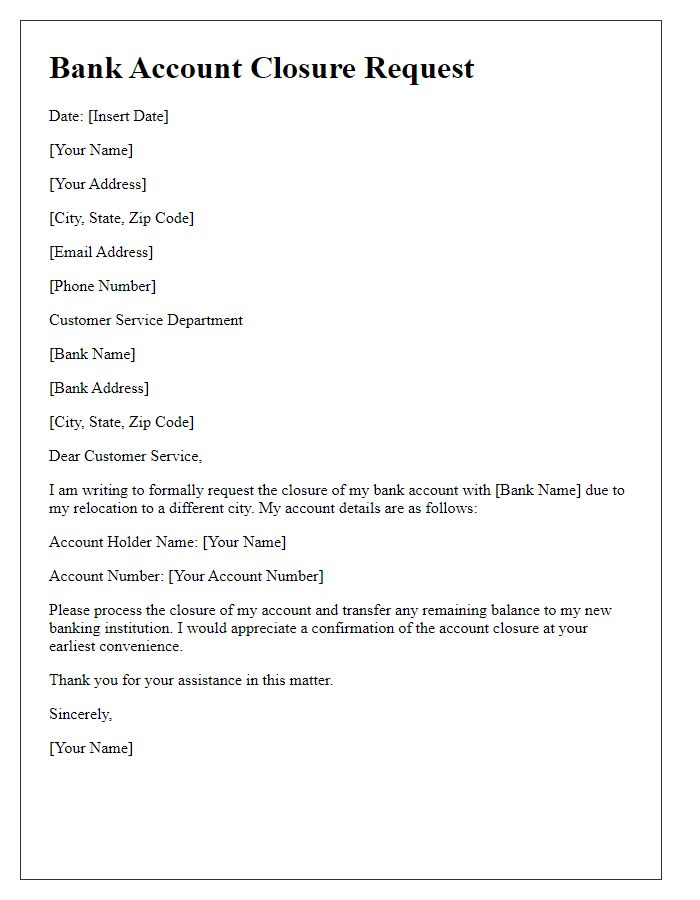

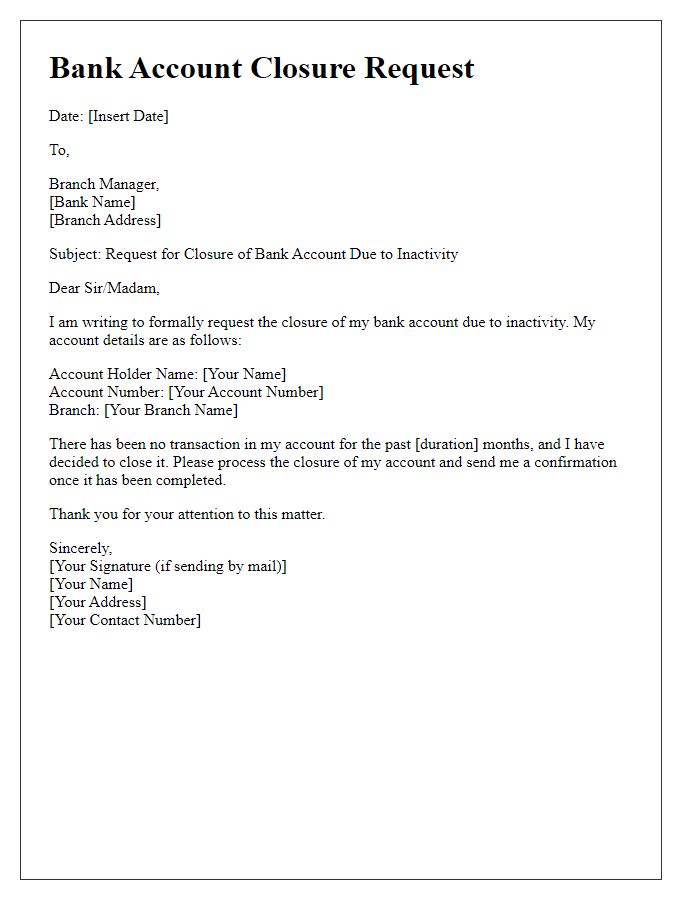

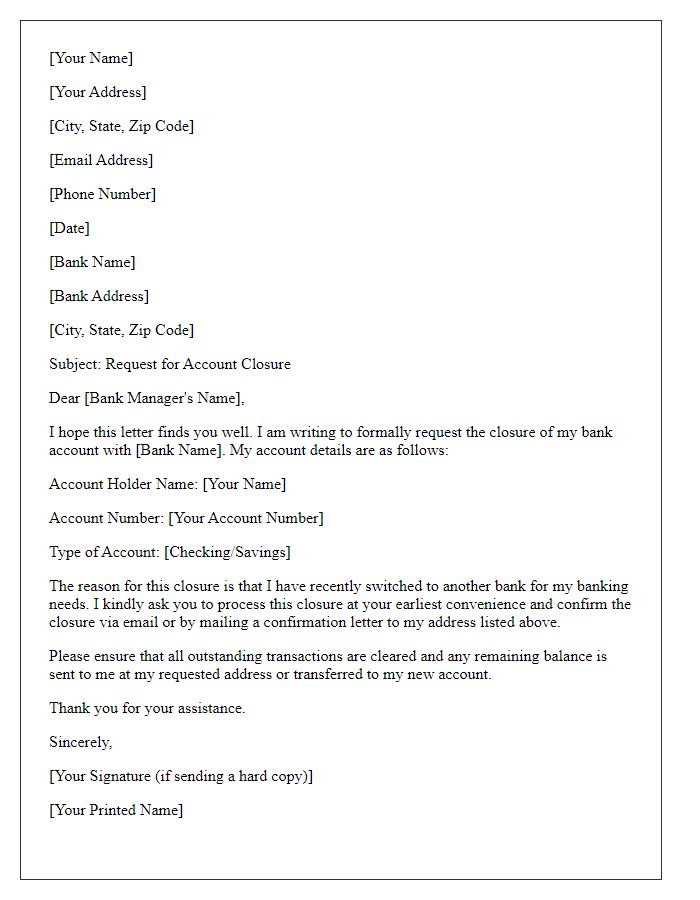

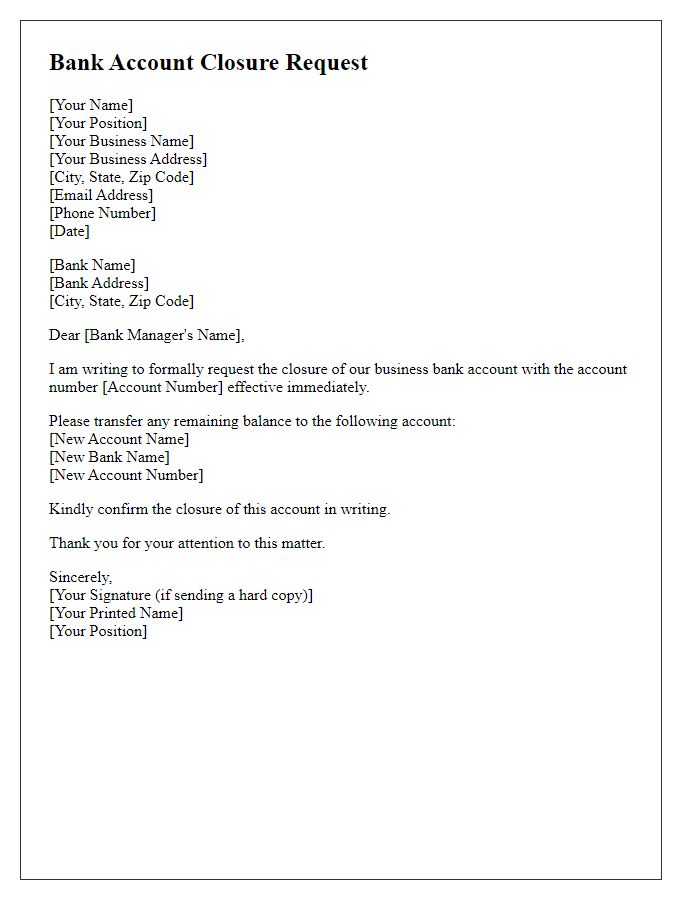

Letter Template For Bank Account Closure Samples

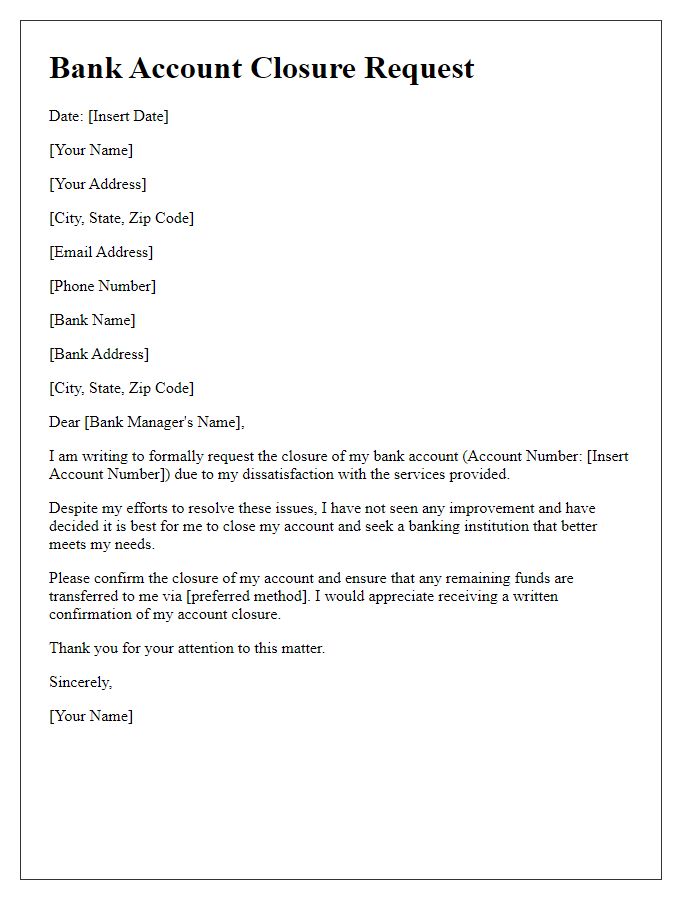

Letter template of bank account closure due to dissatisfaction with services.

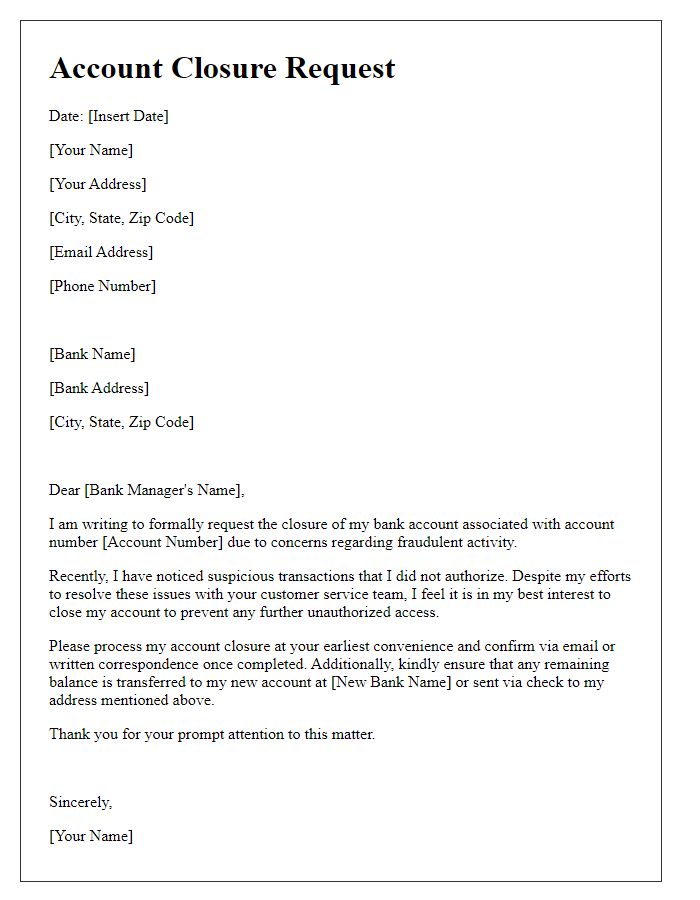

Letter template of bank account closure due to fraudulent activity concerns.

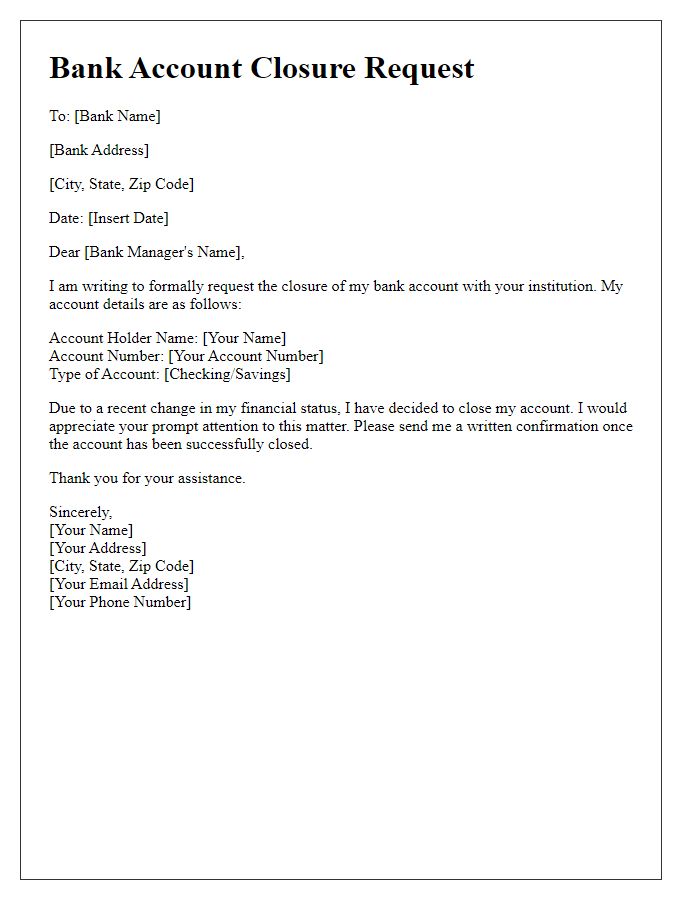

Letter template of bank account closure after a change in financial status.

Comments