When it comes to giving back, sometimes circumstances change and it becomes necessary to return funds given to a charity. It's important to approach this delicate situation with transparency and respect, ensuring that the charitable organization understands your reasons. In this article, we'll explore the best practices for crafting a respectful return letter, including what to include and how to convey your message effectively. Join us as we delve into this topic and help you navigate the process with ease!

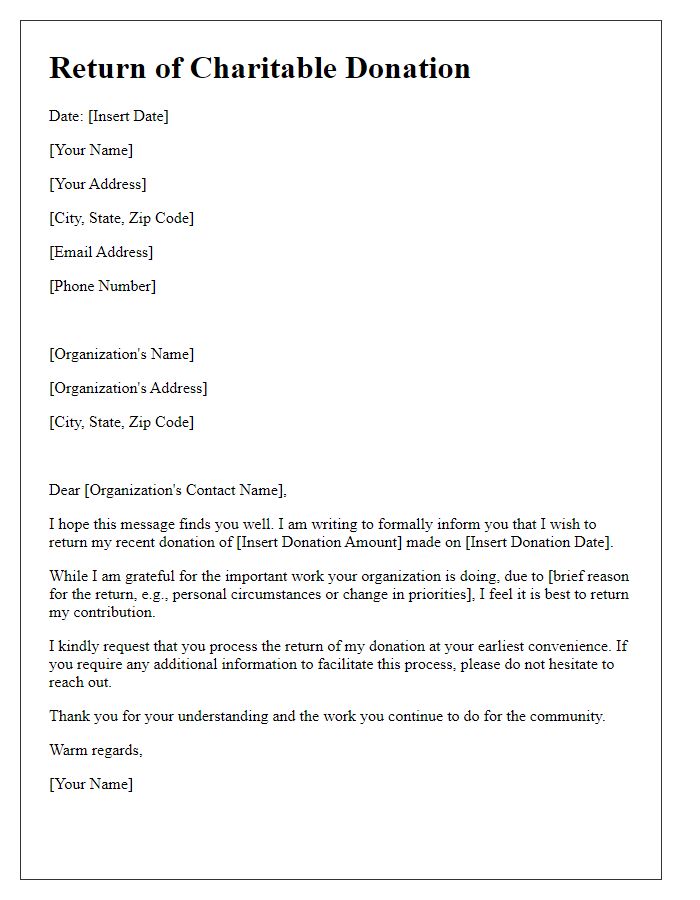

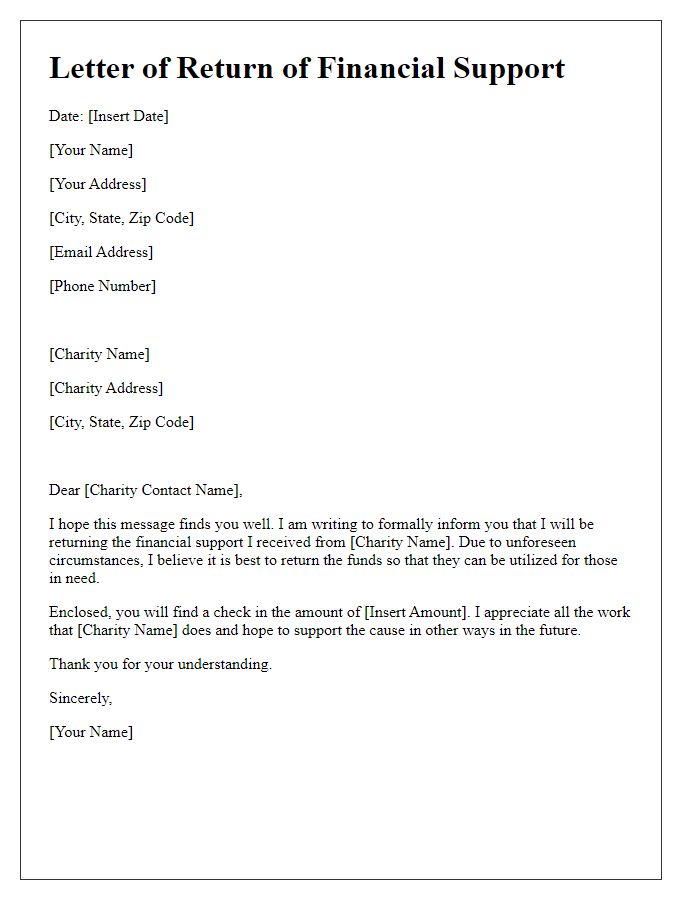

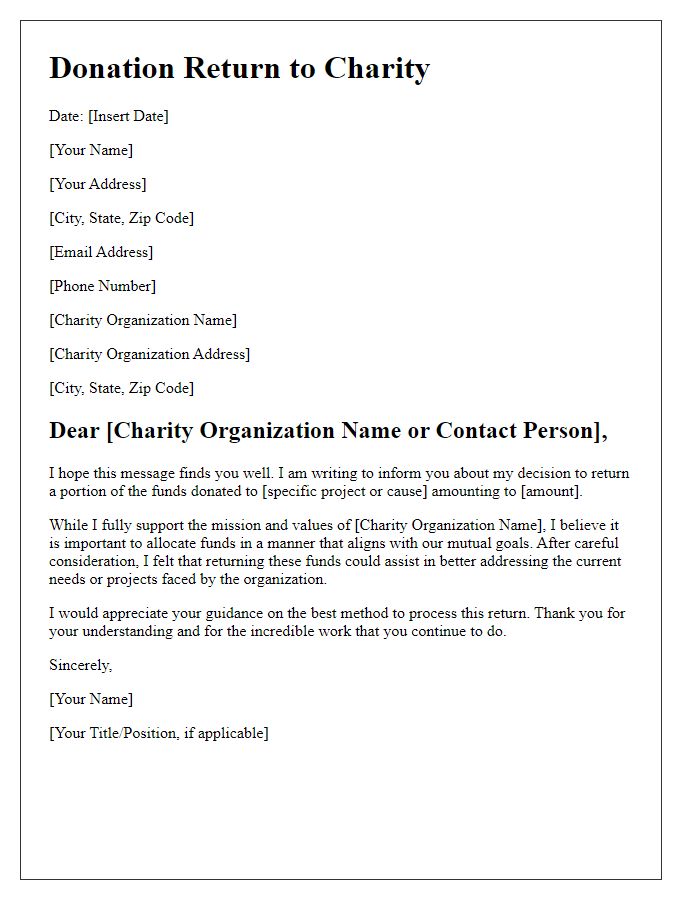

Acknowledgment and Gratitude

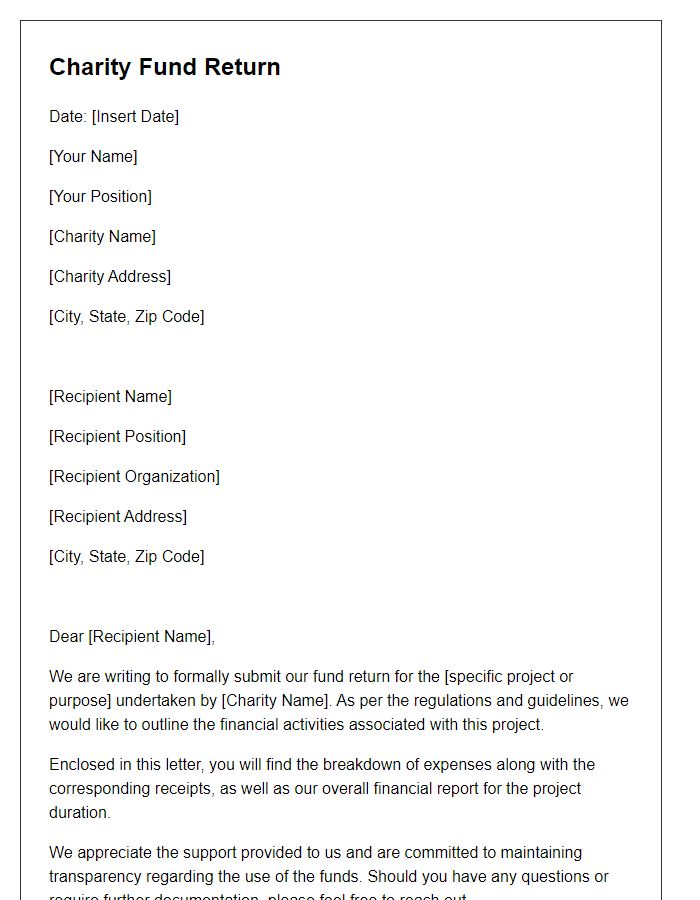

Charitable organizations often manage funds to support specific causes or projects, ensuring each dollar goes towards its intended purpose. Upon the return of donations, organizations must communicate effectively to maintain relationships, emphasizing gratitude and transparency in their acknowledgment. Returning funds can stem from various reasons including oversubscription or project completion. Maintaining clear communication helps reinforce trust and credibility, crucial elements for future fundraising efforts. This approach fosters ongoing support from donors, encouraging a sustained commitment to charitable endeavors, enhancing community engagement, and ensuring alignment with the charity's mission.

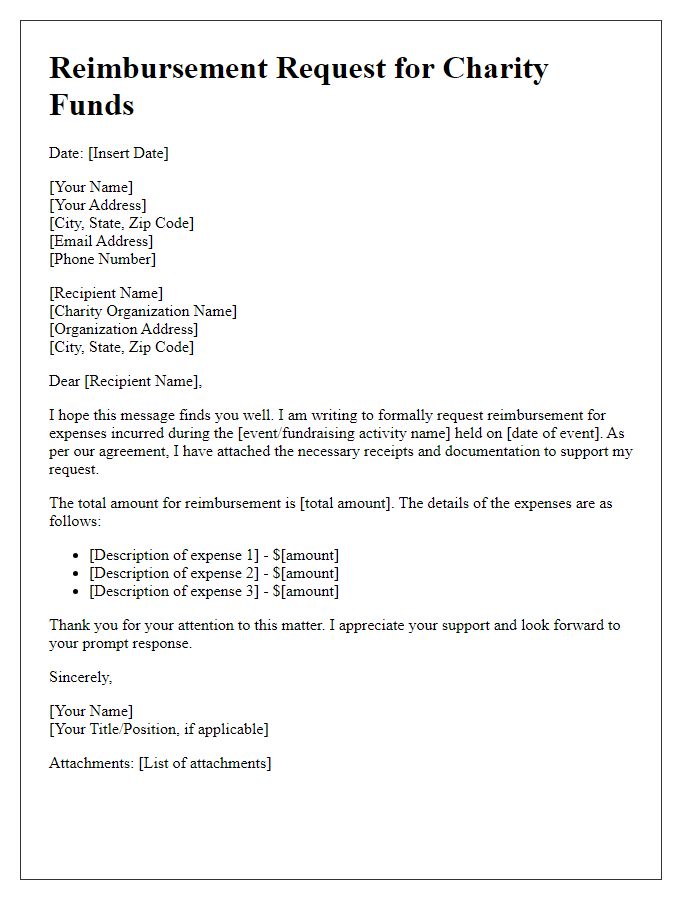

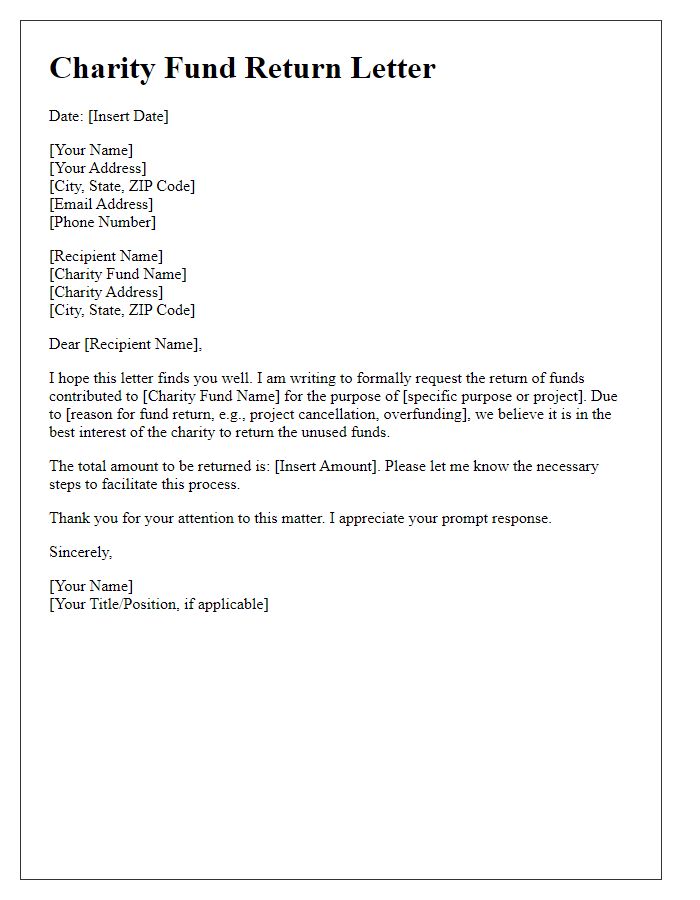

Reason for Fund Return

Returning charity funds can occur due to various reasons such as changes in project scope, exceeding funding requirements, or the inability to execute the planned activities effectively. In instances where objectives cannot be met at organizations like the American Red Cross, it is essential to communicate transparently with donors. Affected donations might be those collected during fundraising events such as the annual walk-a-thon, totaling $50,000. Ensuring those funds are redirected responsibly maintains donor trust and supports organizational integrity. Compliance with both legal and ethical standards enhances reputation while reinforcing commitment to rightful fund management. Clear documentation detailing the reason helps in maintaining accountability and fosters continued support from the community.

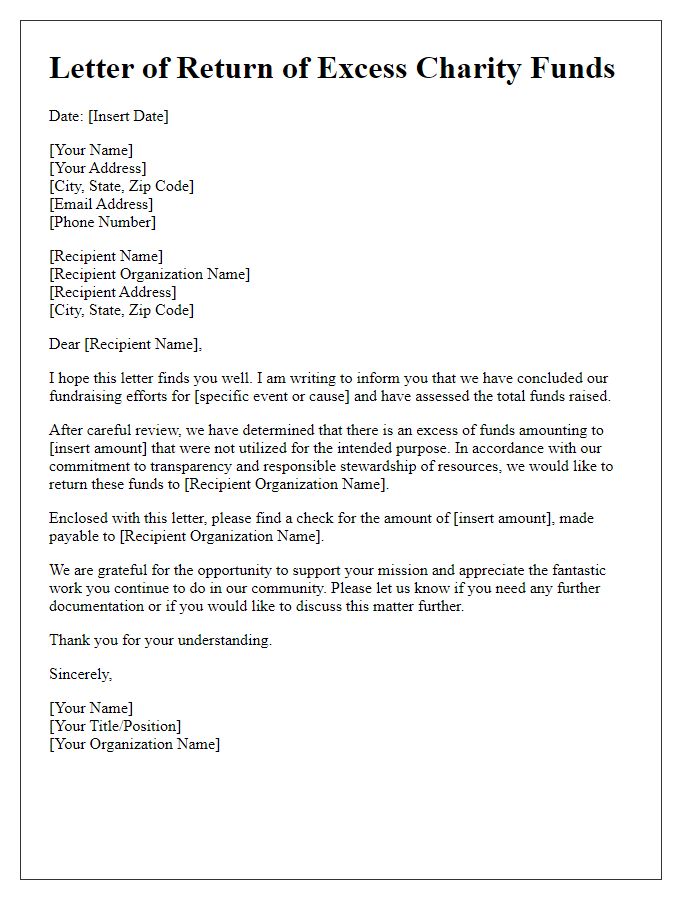

Details of the Fund

Returning excess charity funds can ensure responsible financial management of donations. Charitable organizations frequently receive contributions over their anticipated needs, necessitating a transparent process for returning surplus funds. For instance, a charity established in 2005 focused on alleviating hunger in New York garnered $50,000 in donations for a specific campaign. However, the campaign's expenses amounted to only $30,000, resulting in a $20,000 surplus. This excess funds should be communicated clearly to donors, detailing the allocation processes, the amount being returned, and ensuring donor trust in the organization's fiscal responsibility. Documentation should adhere to IRS guidelines and the charity's governance policies, ensuring compliance for transparency.

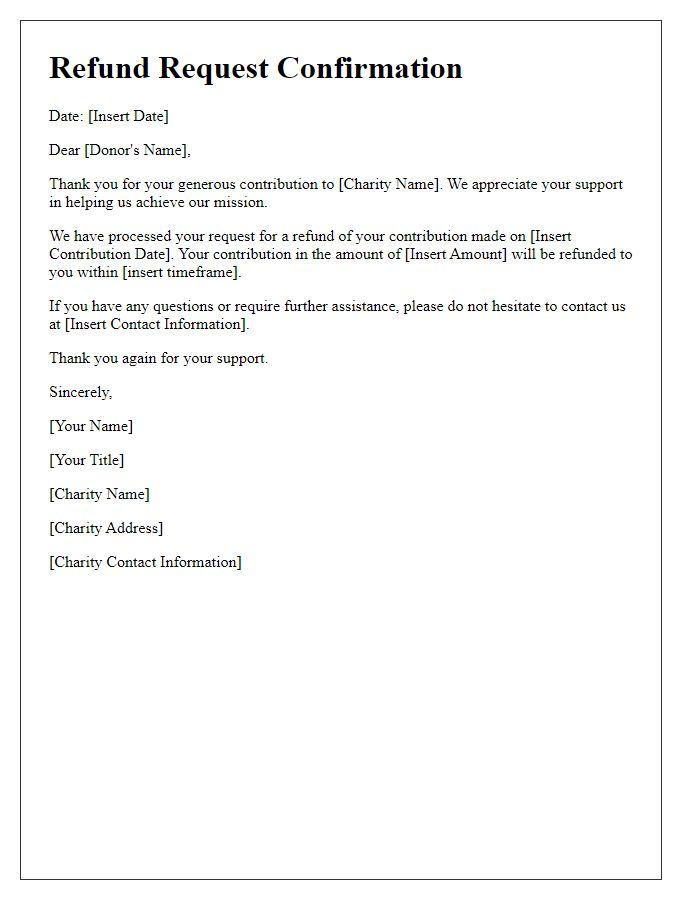

Contact Information for Queries

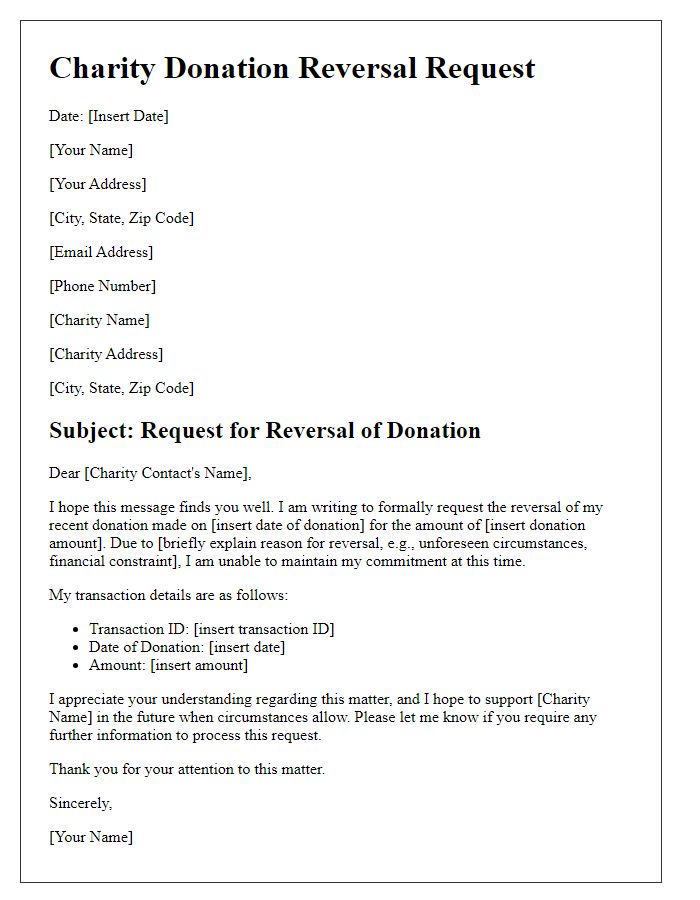

Returning charity funds involves a structured process to maintain transparency and uphold the integrity of the organization. Charitable organizations, such as the American Red Cross or UNICEF, often require donors to follow specific guidelines for refund requests. Interested parties should reach out to dedicated contact points established by these organizations, usually listed on their official websites. Common contact methods include email addresses, phone numbers, or online forms, which provide direct access to customer service teams. Timely responses typically depend on the volume of inquiries, with many organizations striving for replies within a week. Documentation, including donation receipts or transaction IDs, is often recommended to ensure efficient processing of refund requests.

Formal Closure and Signature

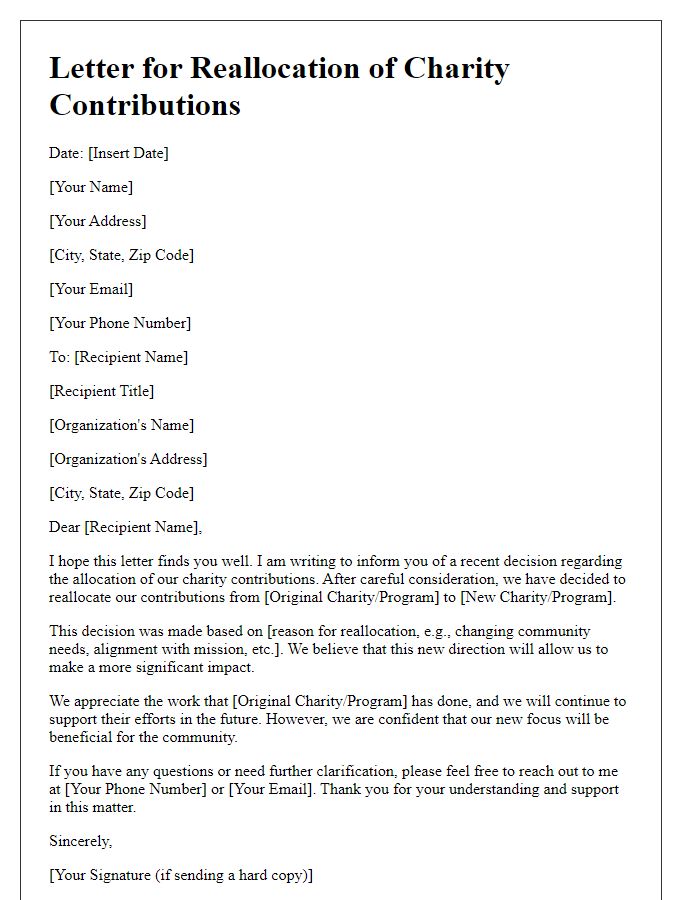

Returning charity funds involves formal procedures to ensure transparency and compliance with regulations. Charity organizations, like non-profits, often establish strict guidelines for handling excess funds or reallocating donations. A formal letter confirming the return of funds typically includes essential details such as the name of the charity organization, the amount of funds being returned, and the specific account information where the funds originated. The letter should also express gratitude to the donors, highlighting the impact of their contributions on the community or specific initiatives. Including the date and reference number of the initial donation provides clarity for both parties involved. Formal closure includes documentation of the return and a signature from an authorized representative, reinforcing the commitment to ethical practices in financial management.

Comments