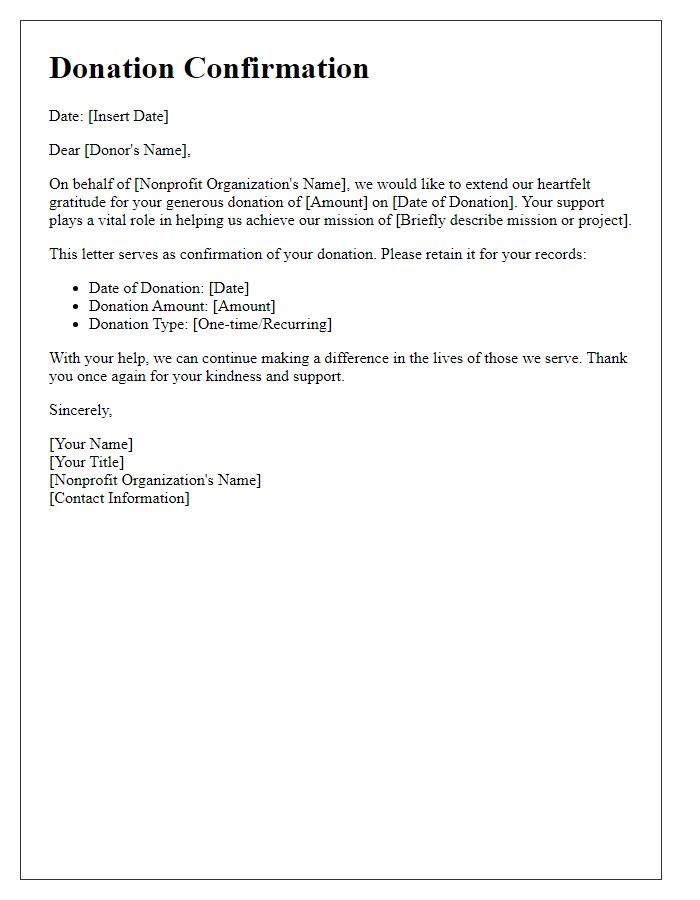

When it comes to supporting a cause close to your heart, having a well-structured letter for charity donation receipts can make all the difference. Not only does it convey gratitude, but it also ensures transparency and compliance for both the donor and the organization. This helpful template outlines the essential elements to include, making the process smoother and more organized. Curious to learn how to craft the perfect donation receipt letter? Let's dive in!

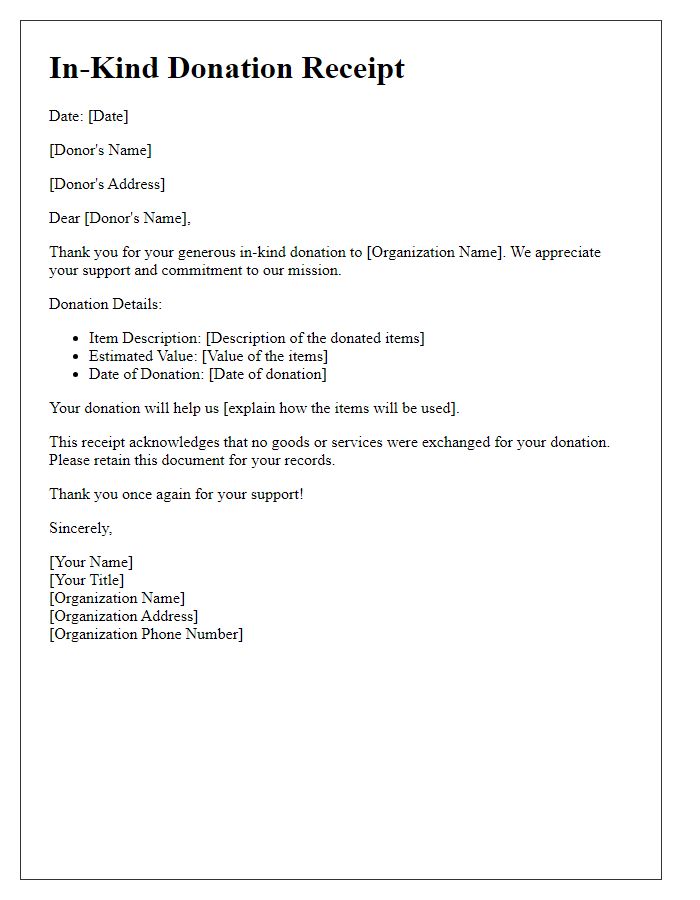

Donation Details

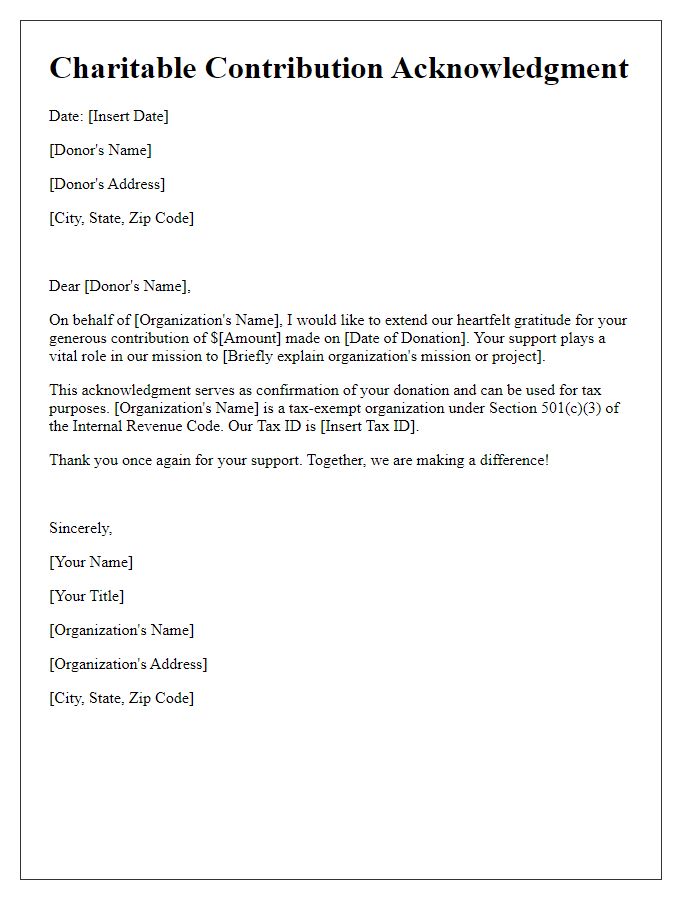

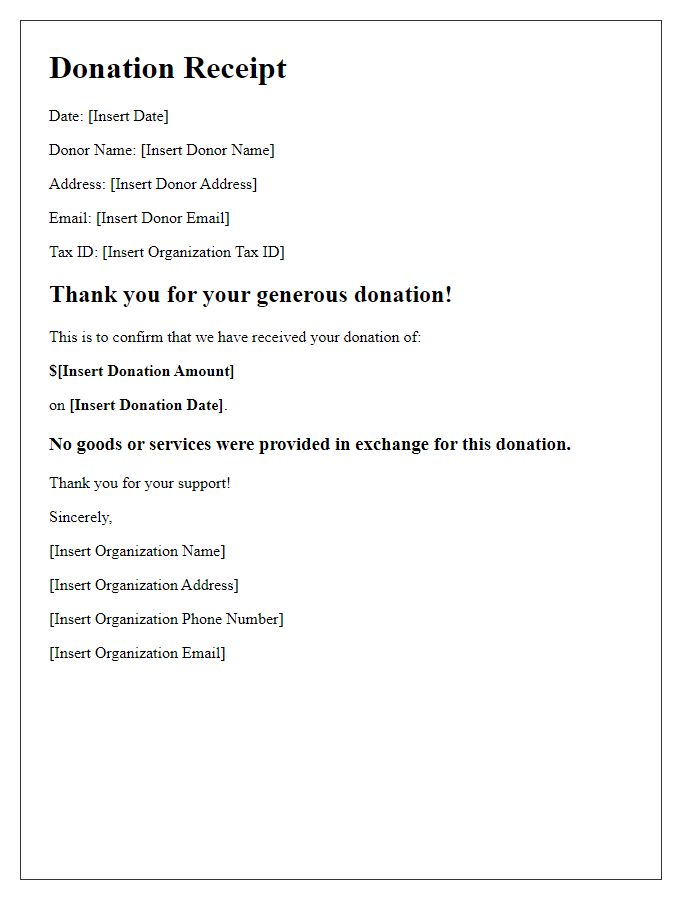

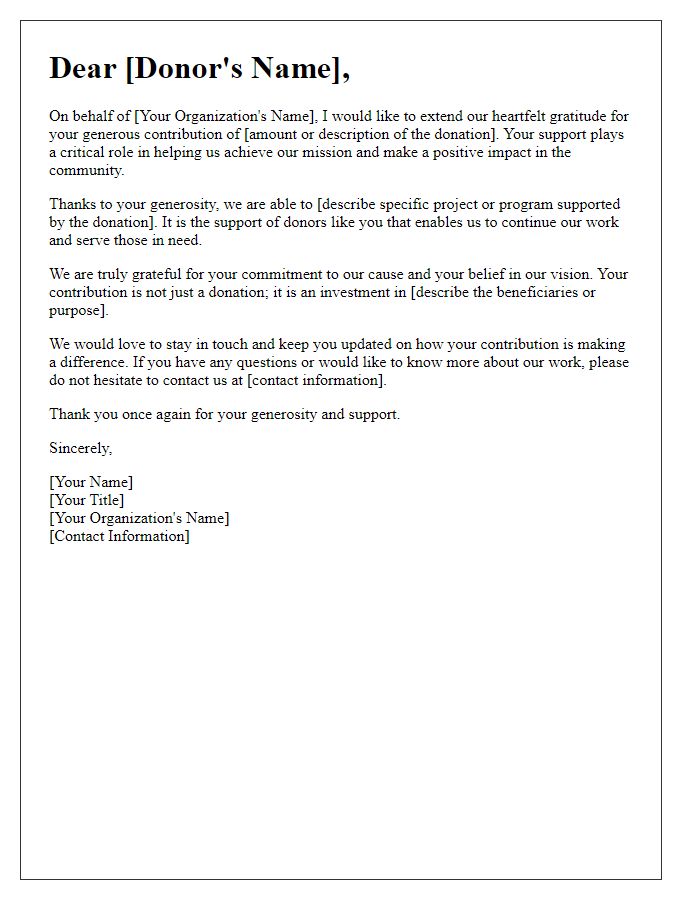

Charity organizations depend on donations to fund their crucial programs and initiatives, affecting various communities. Individual contributions, such as $100 from generous donors, provide vital resources for supporting initiatives like food distribution and educational scholarships. Events such as charity galas, held annually in major cities like New York and Los Angeles, can raise significant amounts, often reaching totals exceeding $50,000. Documenting donation details, including donor names, addresses, and specific amounts, is essential for transparency and accountability. Proper acknowledgment in the form of receipts, outlining both the donation date and purpose, fosters trust in the charitable organization while also providing donors with the necessary information for tax deductions.

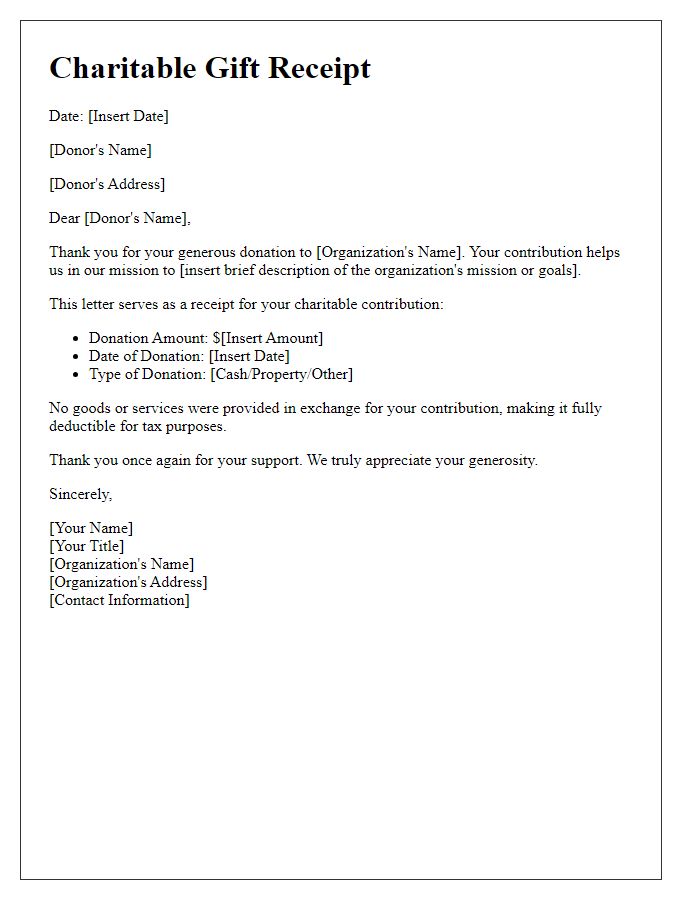

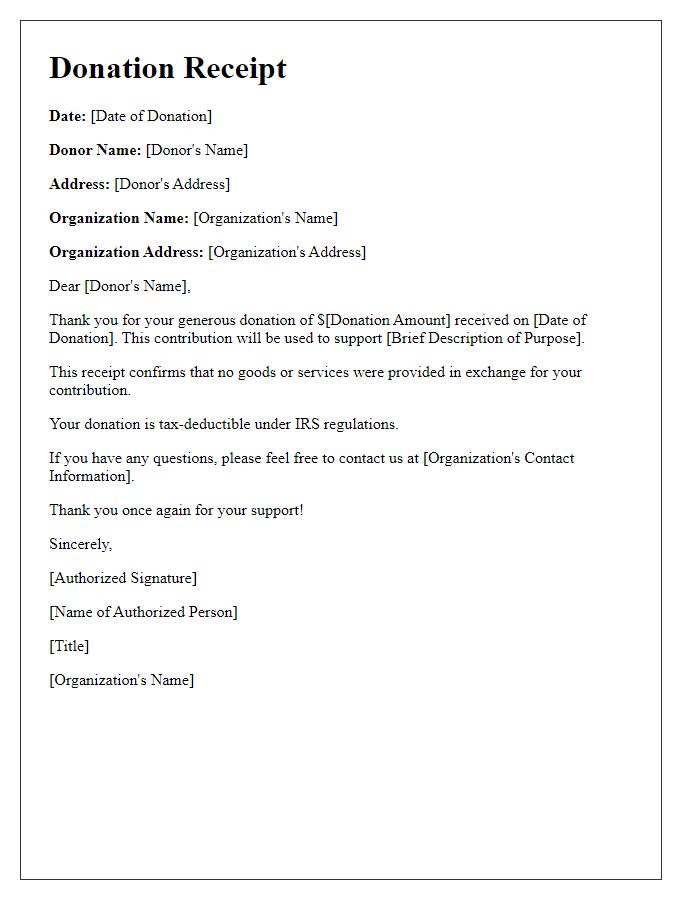

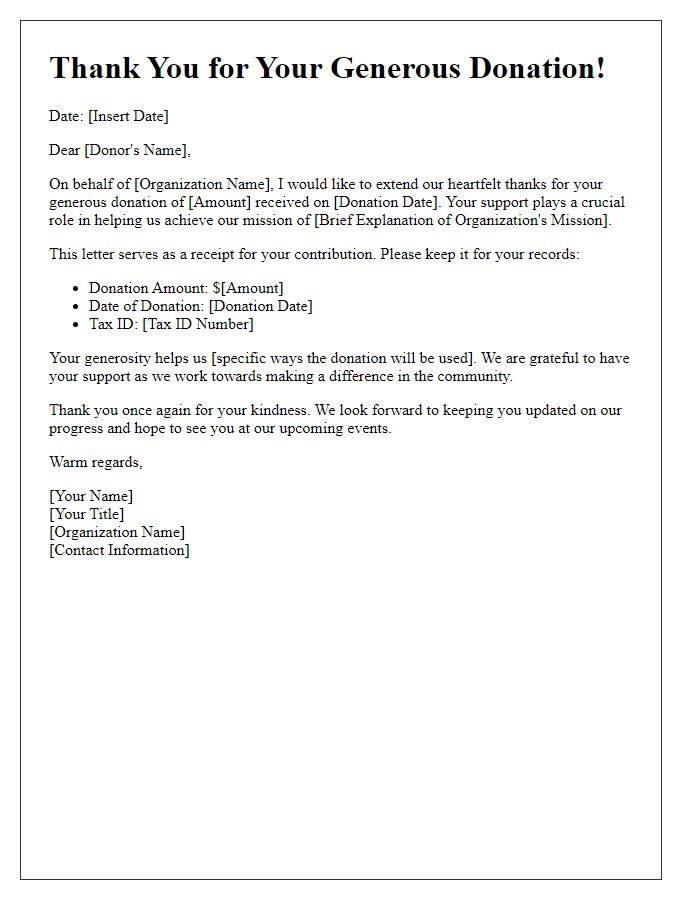

Tax Deduction Information

Charity donation receipts serve as essential documents for donors, providing crucial tax deduction information. These receipts typically include the organization's name, such as the American Red Cross or Habitat for Humanity, along with their tax identification number (EIN), which, in the United States, is a unique nine-digit number assigned by the IRS to identify nonprofits. The date of the donation, often ranging from January 1 to December 31 for annual contributions, must be clearly stated. The receipt should specify the donation amount, either as a monetary figure or a fair market value for goods donated, ensuring compliance with IRS guidelines for deductions. Additionally, statements confirming no goods or services were provided in exchange for the donation enhance the receipt's credibility, aligning with IRS requirements. Such documentation not only fosters transparency between the charity and the donor but also strengthens the donor's eligibility for tax deductions when filing annual income taxes.

Organization Information

Charity organizations, such as the American Red Cross or Habitat for Humanity, typically issue donation receipts that include essential details to acknowledge contributions. These receipts feature the organization's legal name, along with their tax identification number, often referred to as an Employer Identification Number (EIN), which can typically be a nine-digit number. The date of the donation is crucial, along with a description of the donated items (if applicable) or the monetary amount received. Additionally, a statement confirming that no goods or services were provided in exchange for the contribution, along with the signature of an authorized representative, adds authenticity and validity to the receipt. Including contact information, such as a physical address and website, allows donors to reach out with any inquiries regarding their contributions.

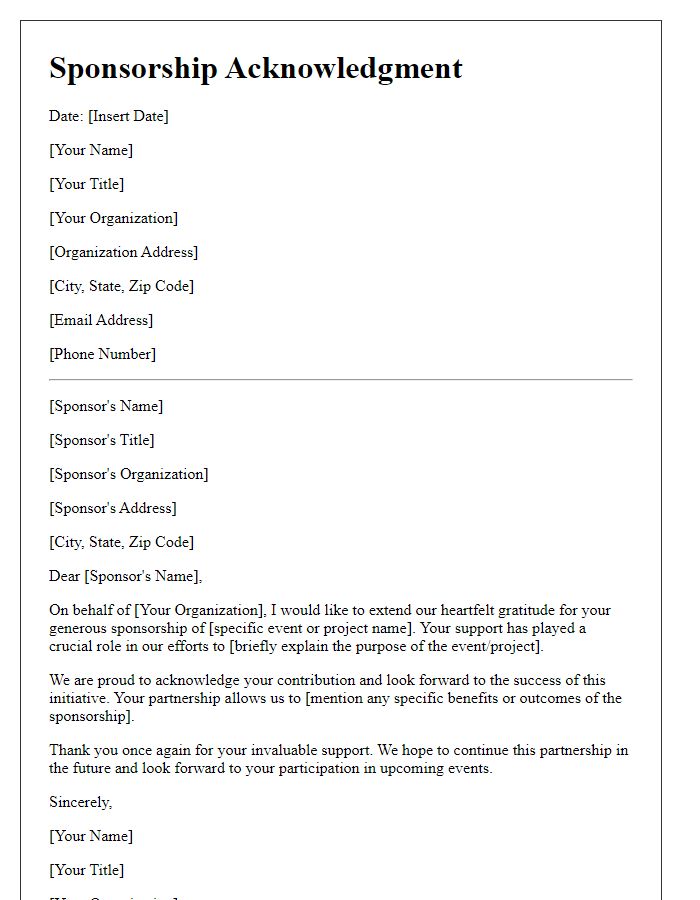

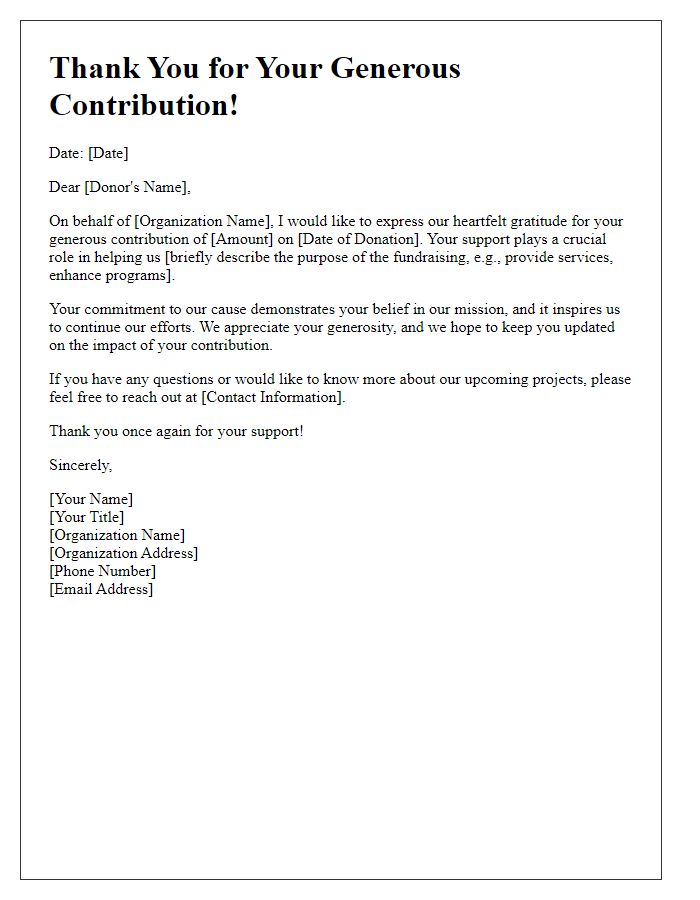

Appreciation Message

A charity donation receipt serves as a vital document indicating that a generous contributor has supported a non-profit organization. This receipt typically includes essential information such as the donor's name, donation amount (including any significant figures, like $100 or $1,000), date of donation (often including the month, day, year), and the charity's name (e.g., Smile Foundation). The appreciation message is a heartfelt acknowledgment, emphasizing the difference that contributions make in the community, particularly in various initiatives such as food drives, educational programs, or health services. Highlighting specific outcomes, such as providing 500 meals to families in need or funding scholarships for 20 students, can enhance the impact of gratitude expressed in the message. Thanking the donor not only fosters relationships but also encourages future support and engagement.

Compliance Statement

Charity organizations, such as 501(c)(3) nonprofit entities in the United States, must provide donors with official donation receipts following IRS guidelines to ensure tax-deductible contributions are claimed accurately. The receipt typically includes essential details such as the charity's name, address, and tax identification number (EIN), as well as the donor's name and address. Specifics of the donation should be itemized, including the date of the contribution, amount donated, and whether any goods or services were provided in exchange for the donation. For donations over $250, a compliance statement affirming the donor received no goods or services in return, or describing their value, is crucial for tax compliance, ensuring transparency and adherence to regulations governing charitable contributions.

Comments