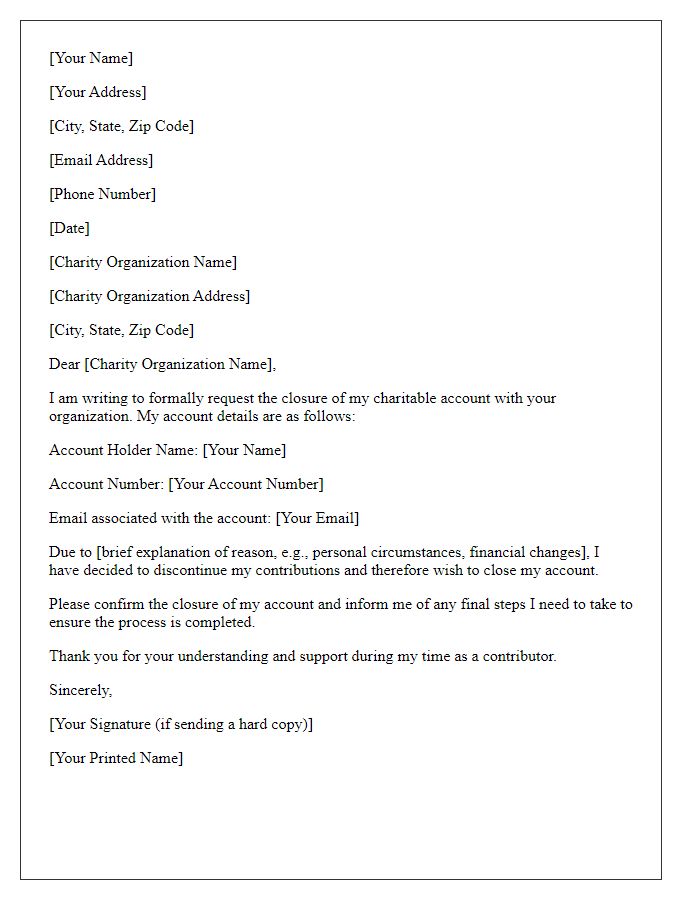

Are you looking to close a charity account and unsure how to go about it? It's important to ensure that all the necessary steps are followed to make the process smooth and compliant. In this article, we'll provide you with a simple letter template that clearly communicates your intent while also addressing any remaining obligations. Ready to find out how to craft the perfect closure letter? Read on!

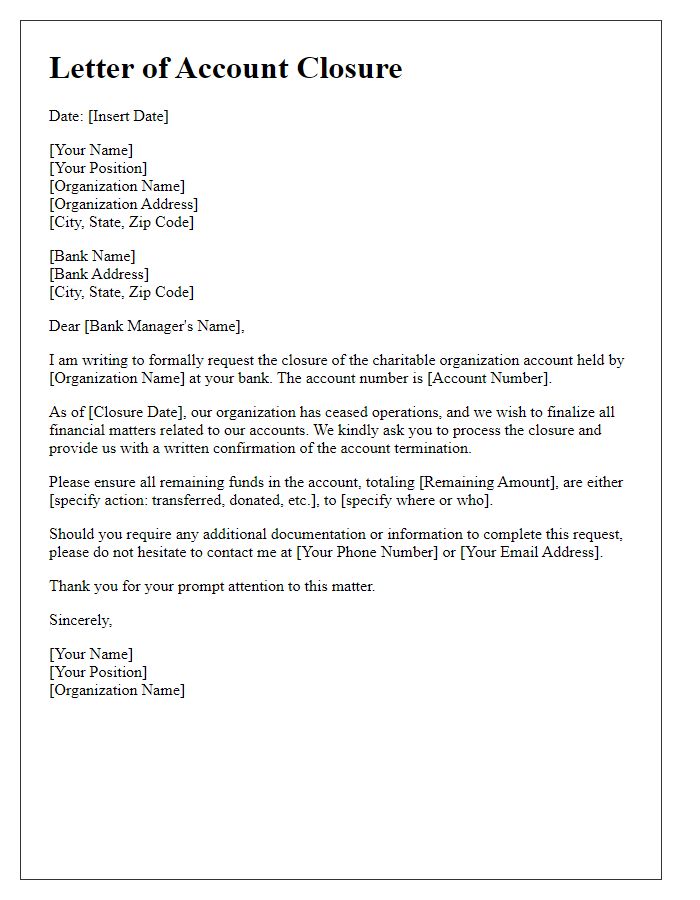

Account Details and Identification

The closure of a charity account, such as a Non-Profit Organization (NPO) account, involves several key elements. Essential information includes the account number, which identifies the specific bank account designated for charitable activities. Additionally, the charity's registered name serves as a crucial identifier, reflecting its legal status. Furthermore, documentation related to the charity, such as the certificate of incorporation and tax-exempt status (IRS 501(c)(3) in the USA), builds trust and legitimacy. Closure should ensure that all outstanding transactions are processed, and any remaining funds are appropriately disbursed to beneficiaries or redirected to another charitable entity in compliance with legal regulations.

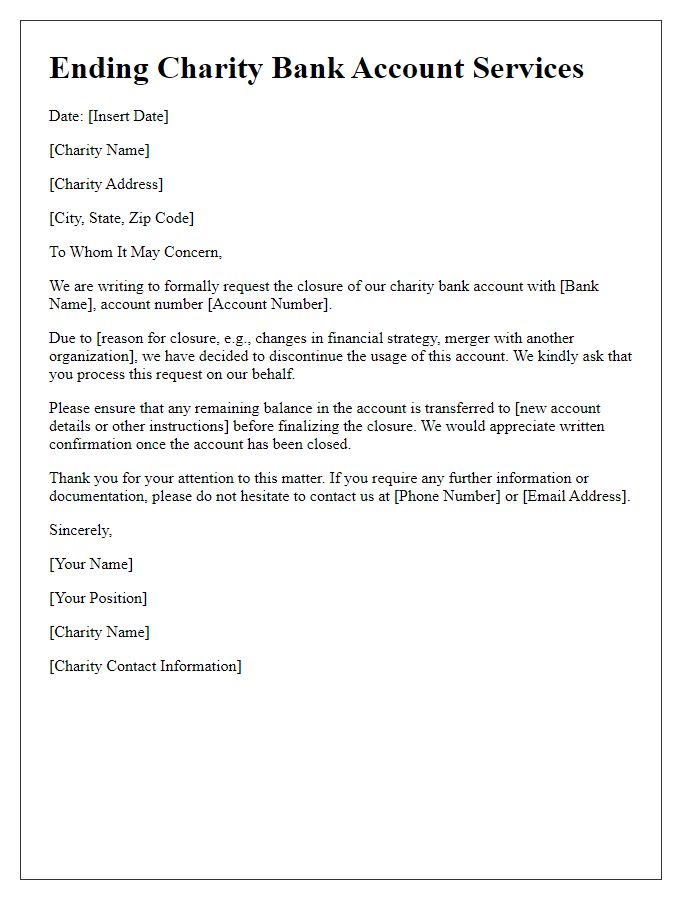

Reason for Closure

A charity account closure often stems from various reasons, such as insufficient funding, changes in organizational focus, or compliance with legal requirements. One primary reason for closure includes the termination of operations due to dwindling donations, which can hinder the ability to support the intended causes effectively. Another reason may involve shifts in mission or objectives, prompting the organization to reevaluate its financial management and prioritize its resources accordingly. Additionally, legal considerations, such as failure to comply with financial regulations or the need to consolidate efforts with another charity, can necessitate the closure of the account. Overall, the decision reflects a strategic approach to ensure that the charity's remaining assets are managed responsibly and directed towards beneficial initiatives.

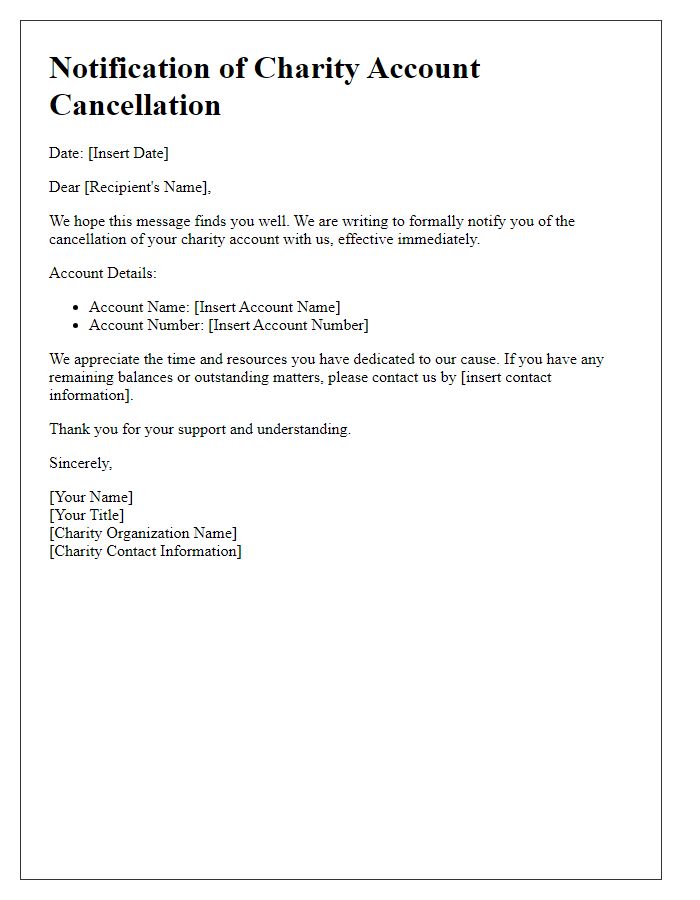

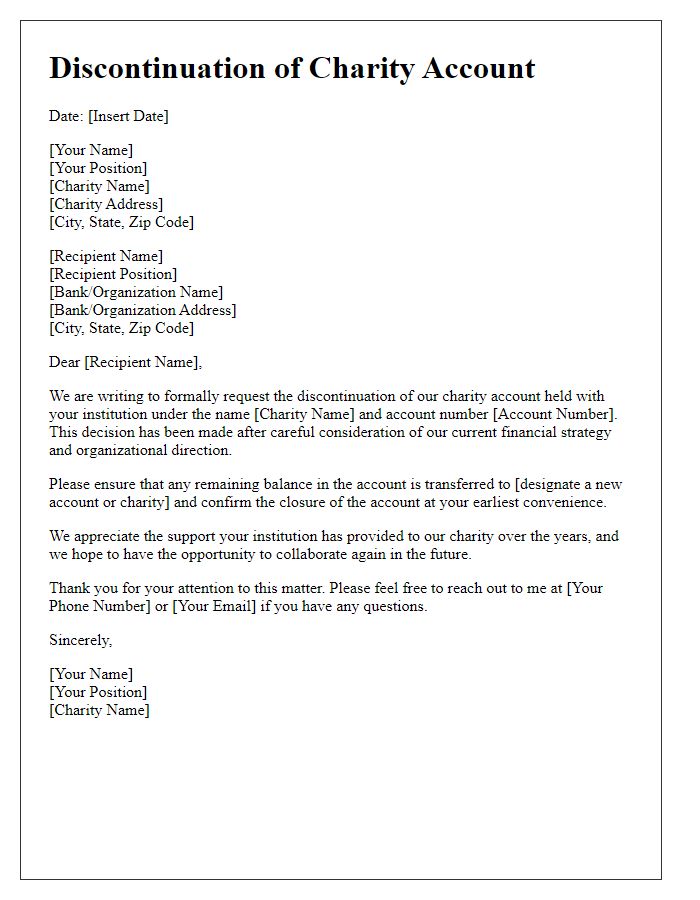

Confirmation of Final Transactions

When closing a charity account, it's essential to confirm the final transactions that have occurred within that account. Charitable organizations, such as non-profits registered under section 501(c)(3) in the United States, must ensure all financial activities are properly documented before account closure. This includes documenting all donations, grants received, and expenditures related to charitable events. Each transaction should reflect accurate dates and amounts, often involving bank statements from institutions like Wells Fargo or Bank of America. Confirmation of final transactions should also include acknowledgment of any remaining balance, as well as the reconciliation of any outstanding checks or pending payments to vendors or beneficiaries. Furthermore, ensuring compliance with local regulatory requirements is crucial, which may involve communicating with state charity officials or the IRS. Proper documentation serves not only as a record for the organization but also maintains transparency with stakeholders and donors.

Acknowledgment of Receipt of Funds

Charity organizations, upon closure, must ensure proper communication regarding financial activities. Acknowledgment of receipt of funds refers to the formal recognition of donations or contributions received prior to account closure. This documentation, particularly relevant for non-profit entities like registered charities, includes essential details such as the total amount received, the date of receipt, and the name of the donor. Transparency regarding financial matters fosters trust among stakeholders, including donors, beneficiaries, and regulatory bodies. Maintaining accurate records during this process is crucial for compliance and financial integrity, especially for future audits or assessments defined by local laws or guidelines governing charitable organizations.

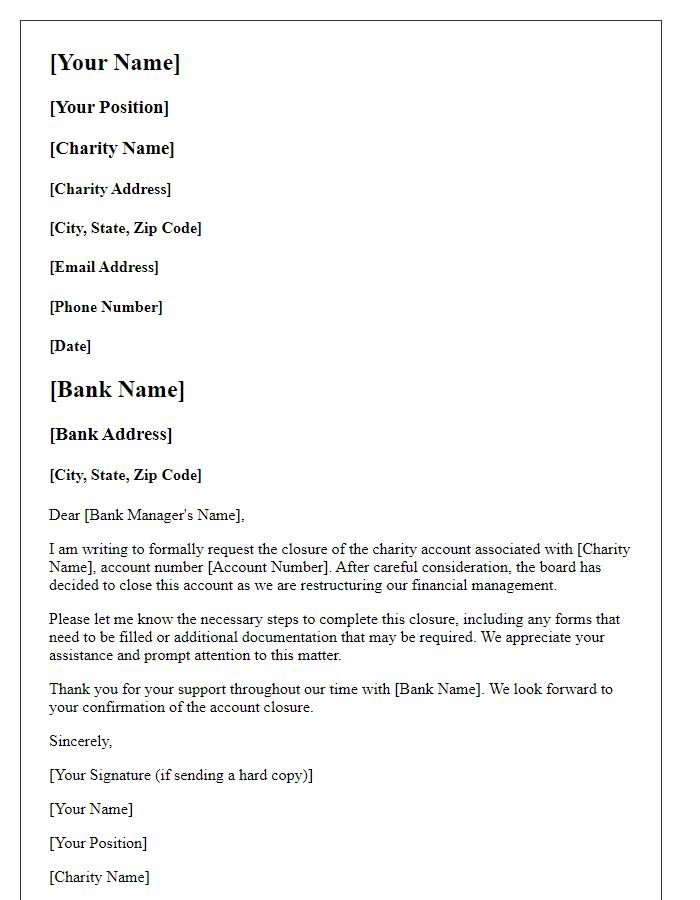

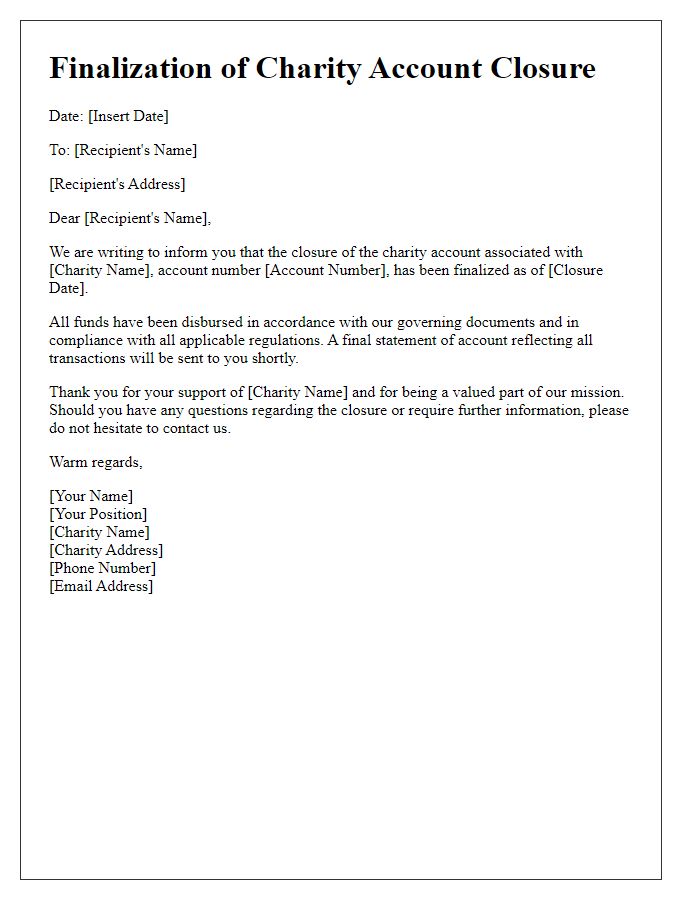

Contact Information for Further Inquiries

Closure of a charity account involves careful consideration of financial documentation and compliance with regulations. Nonprofit organizations, such as registered charities, often maintain accounts at banks or credit unions, like Wells Fargo or Bank of America. Required steps include settling outstanding transactions, notifying donors via newsletters or emails, and ensuring compliance with local regulations. Documentation such as the final financial report and organizational dissolution papers must be retained for auditing purposes. Also, informing stakeholders--including volunteers, partners, and service users--about the closure is crucial for transparency and maintaining trust. For additional inquiries, organizations typically offer contact details on their websites or final communication, emphasizing accessibility and support during the transition.

Comments