Are you curious about how charity organizations maintain transparency and accountability? A financial audit is a crucial process that ensures all funds are managed correctly and used effectively to support their charitable missions. In this article, we'll dive into the essential components of a charity financial audit, highlighting its importance in building trust with donors and stakeholders. Join us as we explore the intricacies of this vital process and what it means for organizations and the communities they serve!

Organization Details

The charity financial audit process is instrumental in ensuring transparency and accountability for non-profit organizations. Organizations such as the American Red Cross (founded in 1881) or Oxfam (established in 1942) undergo rigorous audits to maintain trust with donors and stakeholders. Typically, an independent auditor will assess financial statements, which include balance sheets detailing assets, liabilities, and net assets, alongside income statements highlighting revenue streams such as donations, grants, and fundraising events. The auditor's findings contribute to the organization's annual report, which is often reviewed by the board of directors to inform strategic planning and donor relations, thus strengthening community support and mission effectiveness.

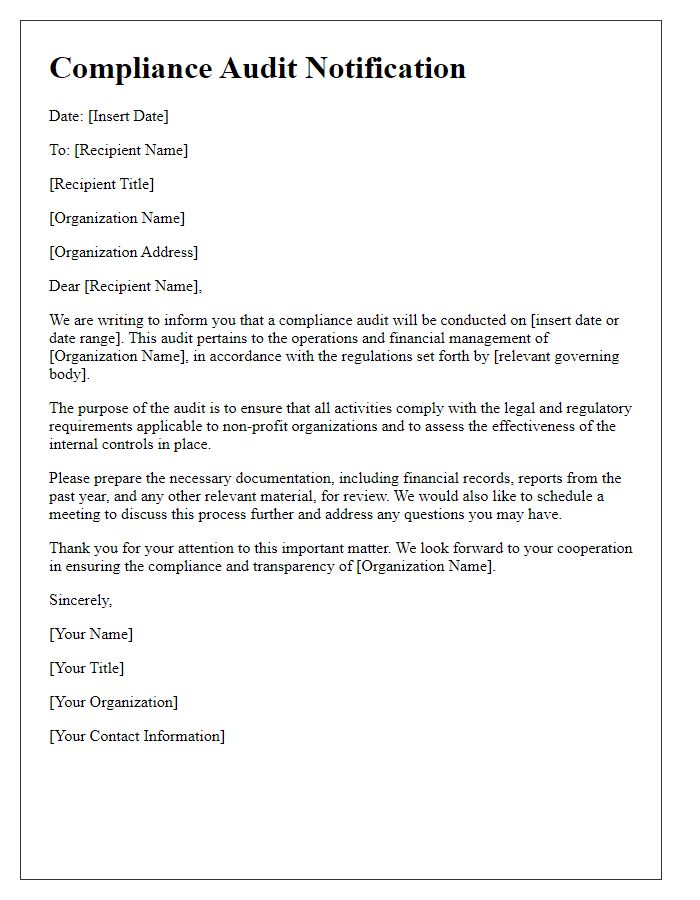

Objective of Audit

The objective of a charity financial audit is to ensure transparency, accountability, and compliance with financial regulations. This audit aims to provide an independent assessment of the charity's financial statements, including the balance sheet, income statement, and cash flow statement. By evaluating the accuracy of reported numbers, the audit can identify any discrepancies or misstatements, ensuring that funds are managed appropriately and used for their intended purposes, such as outreach programs, fundraising events, or community support initiatives. Furthermore, the audit enhances credibility with stakeholders, including donors, clients, and regulatory agencies, thereby fostering trust and encouraging future contributions to the nonprofit sector.

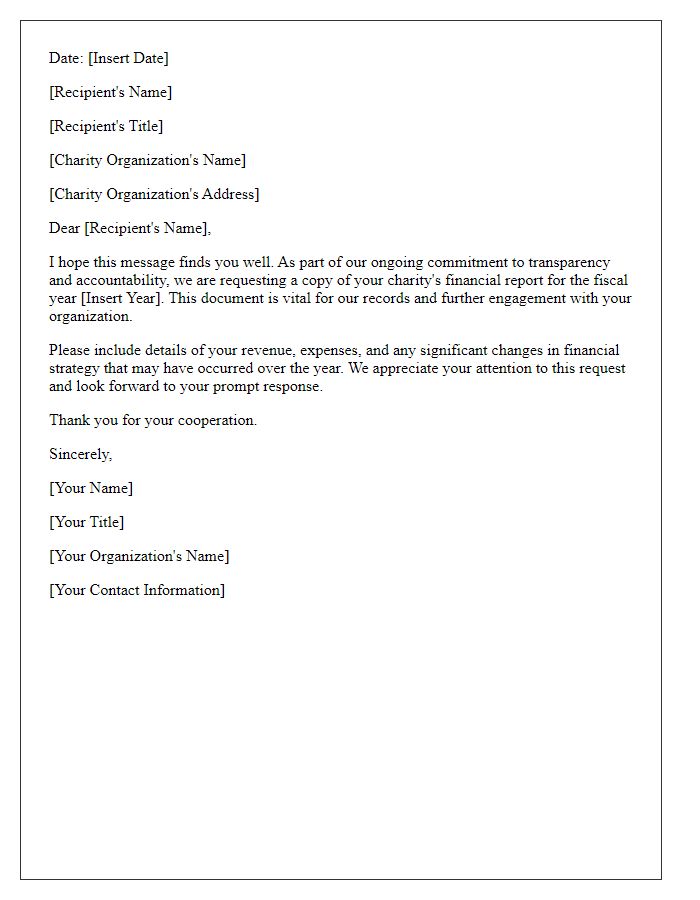

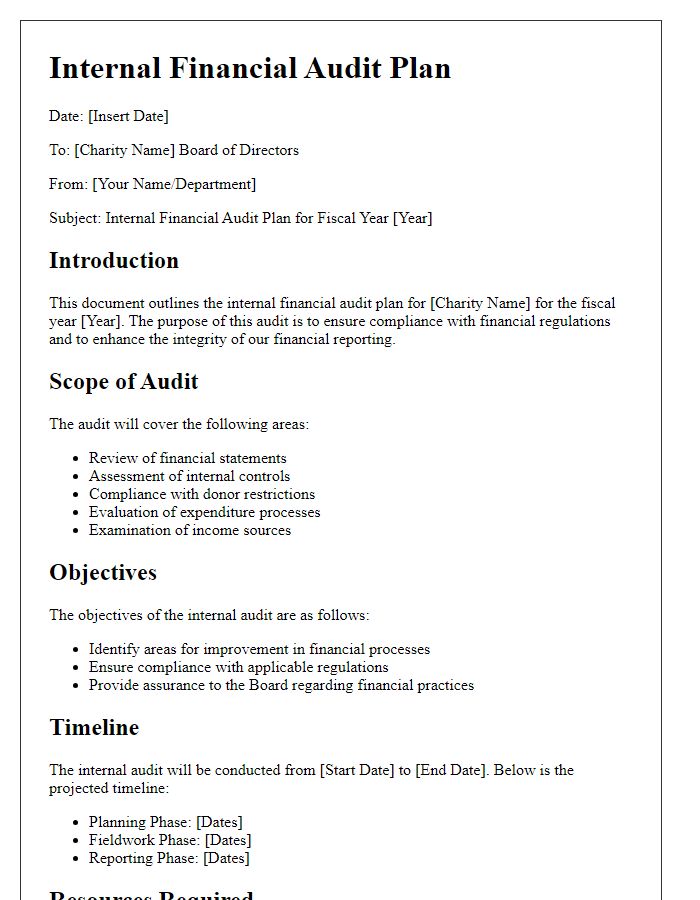

Scope of Work

The financial audit process is critical for charities, ensuring transparency and accountability in managing funds, typically ranging in millions of dollars annually. Auditors examine financial statements, including income and expenses, for specific fiscal years, commonly the previous calendar year. They analyze federal tax documents, such as IRS Form 990, to assess compliance with laws governing nonprofit organizations. Additionally, the auditors evaluate internal controls, ensuring that donations (often sourced from fundraising events or grants) are appropriately recorded and safeguarded. The scope also includes assessing the effectiveness of financial reporting systems, identifying discrepancies, and recommending improvements to enhance operational efficiency. Regular audits help rebuild trust with donors and stakeholders, contributing to the charity's long-term success and sustainability.

Timeline and Deadlines

The charity financial audit process requires meticulous planning and clear timelines to ensure compliance and transparency in financial management. Initial preparation, including gathering all financial documents such as bank statements, receipts, and ledgers, should commence no later than six months before the fiscal year-end. Engaging external auditors, ideally a certified public accountant (CPA) with experience in non-profit organizations, is essential; contracts should be finalized by eight weeks prior to the audit start date, typically set six weeks after fiscal year-end, in order to allow ample time for preliminary discussions and scope setting. The actual audit fieldwork should be completed within two weeks, followed by a review period where auditors prepare initial findings, usually within one week. Final reports, detailing financial status and recommendations, should be delivered within four weeks post-audit conclusion, allowing the charity's board sufficient time to address any issues before the annual general meeting. Furthermore, timely communication with stakeholders throughout this process is crucial to maintain trust and accountability, especially regarding key dates for financial reporting and board review meetings.

Contact Information

Charity financial audits are essential for ensuring transparency and accountability within non-profit organizations. The financial auditor, typically a licensed professional or an auditing firm, conducts thorough examinations of financial records against standards set by regulatory bodies such as the Financial Accounting Standards Board (FASB) or International Financial Reporting Standards (IFRS). Key information gathered during the audit includes income statements, balance sheets, and cash flow statements. The audit may also require contact details, like the organization's address, telephone number, and email, to facilitate communication. Furthermore, charity audits are usually conducted annually or biennially, ensuring compliance with the regulations established by entities like the IRS in the United States and similar organizations worldwide.

Letter Template For Charity Financial Audit Samples

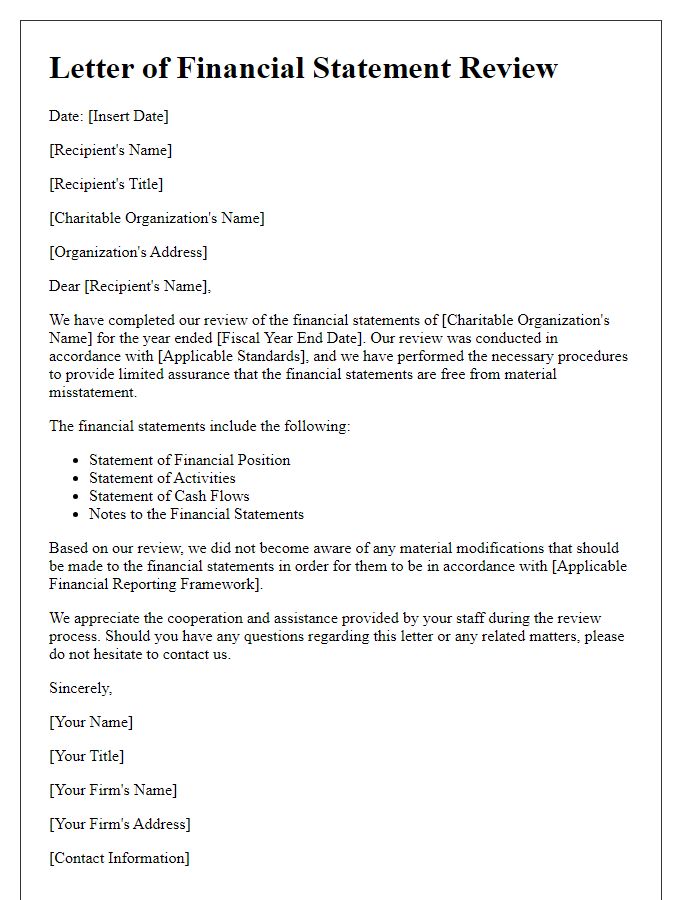

Letter template of financial statement review for charitable organization.

Comments