Are you considering leaving a lasting impact through your estate? Charitable legacy gifts give you the unique opportunity to support causes you're passionate about while ensuring your legacy endures. This thoughtful act not only provides crucial funding for organizations but also inspires future generations to give back. If you want to learn more about how to make a meaningful contribution, keep reading!

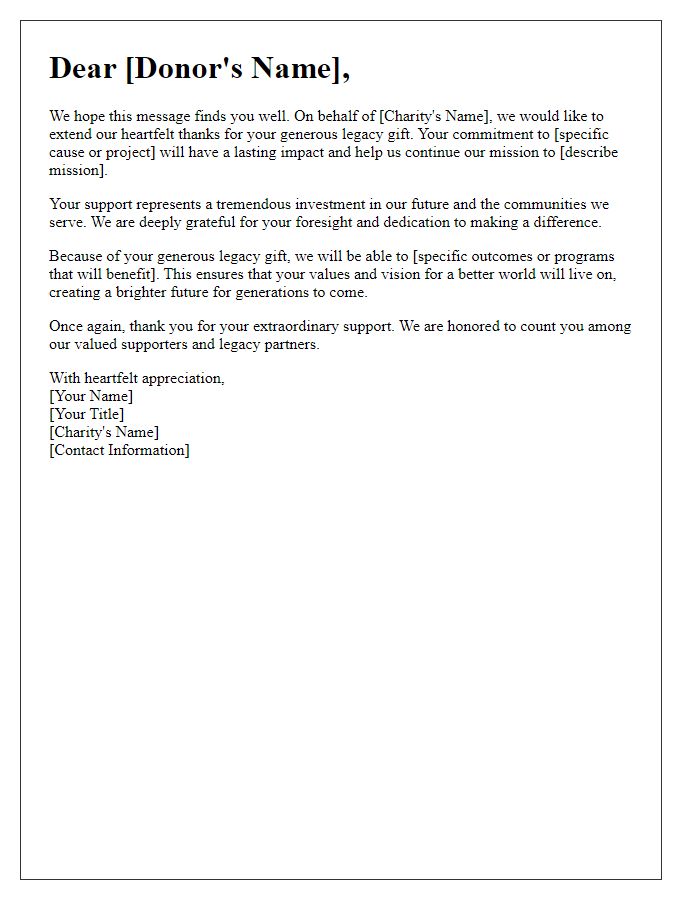

Opening Salutation

Legacy gifts, often referred to as planned or bequest donations, play a crucial role in sustaining non-profit organizations. These contributions, which can be made through wills or estate plans, provide long-term financial support necessary for continuing vital programs and services. They reflect a donor's enduring commitment to the mission of the charity, allowing for transformative impacts on future generations. Organizations frequently reach out to potential legacy donors during annual campaigns, emphasizing the importance and permanence of such gifts. Engaging storytelling about past beneficiaries enhances emotional connection, encouraging generosity.

Personal Story or Connection

Charity legacy gifts can profoundly impact communities and individuals, underscoring the importance of personal narratives in connecting with potential donors. Personal stories often highlight the journey of individuals or families affected by specific causes, such as childhood illness, hunger, or education disparities. For instance, a narrative featuring a young cancer survivor from Boston, Massachusetts, might illustrate the emotional and financial struggles faced by families during treatment. Effective storytelling evokes empathy, prompting support for organizations that provided crucial assistance. In the case of a nonprofit focusing on homelessness, sharing testimonies from individuals who transitioned from shelters to stable housing can create a relatable context. The culmination of these stories fosters a deeper connection, encouraging legacy gifts that ensure the sustained operation of charitable efforts long into the future.

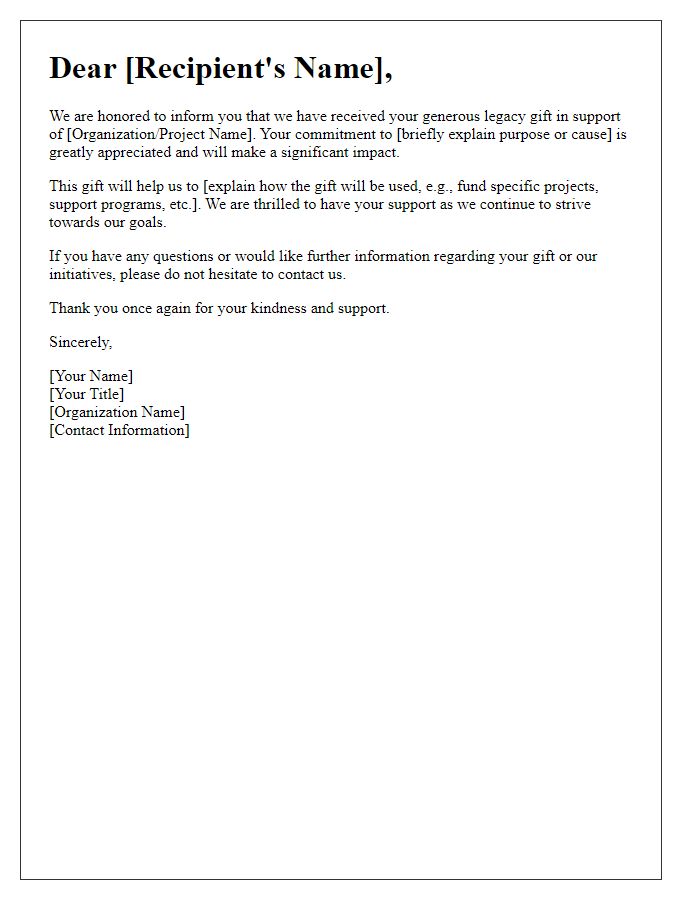

Description of Charity's Mission

The mission of Hope for Tomorrow Foundation focuses on alleviating poverty through education and sustainable development initiatives in underprivileged communities around the world. Established in 2010, the organization specifically targets regions in Sub-Saharan Africa, where over 300 million people live on less than $1.90 a day. Program efforts include the construction of schools, providing scholarships for over 5,000 children, and offering vocational training to empower adults with necessary skills for job markets. The foundation also emphasizes community health improvement projects, addressing issues such as malnutrition and disease prevention, benefiting more than 15,000 individuals annually. By cultivating self-sufficiency, Hope for Tomorrow aims to create lasting change that enables individuals and families to thrive and break the cycle of poverty.

Specific Legacy Gift Request

Legacy gifts, also known as bequests, represent a profound way to support charitable organizations such as hospitals, educational institutions, or environmental nonprofits after one's passing. Donors often specify the amount, such as $50,000, or a percentage of their estate, like 10%, to create lasting impact. These gifts can fund vital programs, community services, or scholarships, significantly enhancing the organization's mission. For instance, a legacy gift directed to a local animal shelter might improve facilities or provide veterinary care for abandoned animals. Planning a legacy gift involves considerations like estate taxes and the potential for personal tax deductions. Engaging with legacy gift planners or financial advisors can ensure that the intended difference is realized in alignment with personal values and charitable goals.

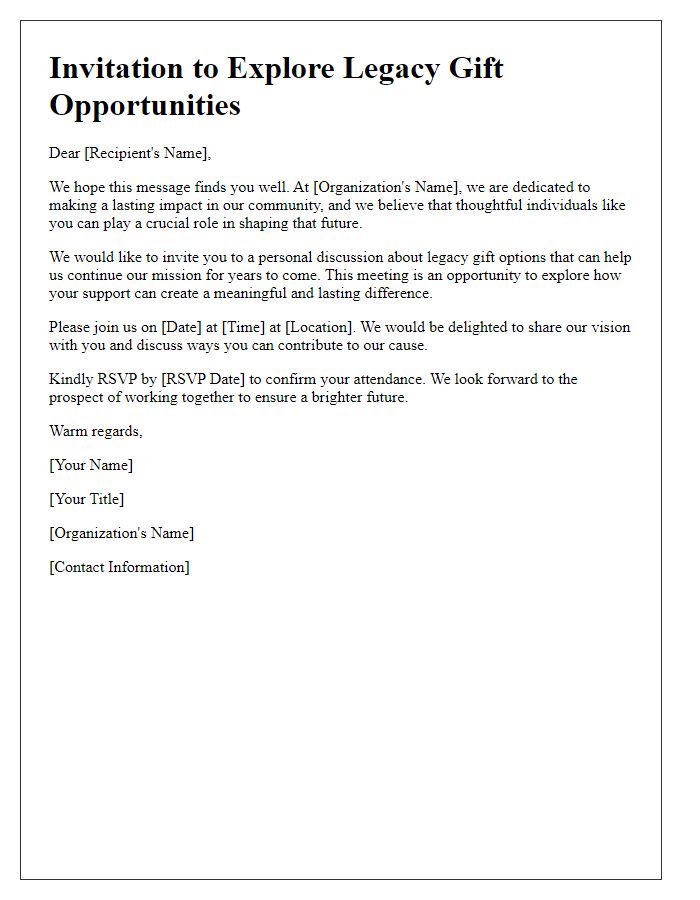

Contact Information for Further Discussion

Charity organizations often appreciate legacy gifts as a vital source of long-term funding for their missions. For individuals interested in exploring how to leave a lasting impact through estate planning, organizations provide dedicated contact information for further discussions. Engaging specialists, such as planned giving officers, can guide potential donors through the process, offering insights into various legacy options such as bequests, trusts, or endowments. These professionals, typically available via phone or email, can clarify tax benefits, answer questions about specific projects needing support, and help design personalized giving strategies that reflect individual values and charitable interests. Establishing a connection through these channels ensures that donors' wishes align with the charity's needs, promoting meaningful contributions to the community.

Comments