Are you looking to make a meaningful contribution to a charitable cause while also maximizing your tax benefits? A well-crafted charity tax receipt can be the key to ensuring that your generous donations are recognized by tax authorities, making the process seamless for both you and the organization. In this article, we'll walk you through the essential elements of creating an effective letter template that meets all necessary requirements. So, let's dive in and discover how you can easily create your own charity tax receipt!

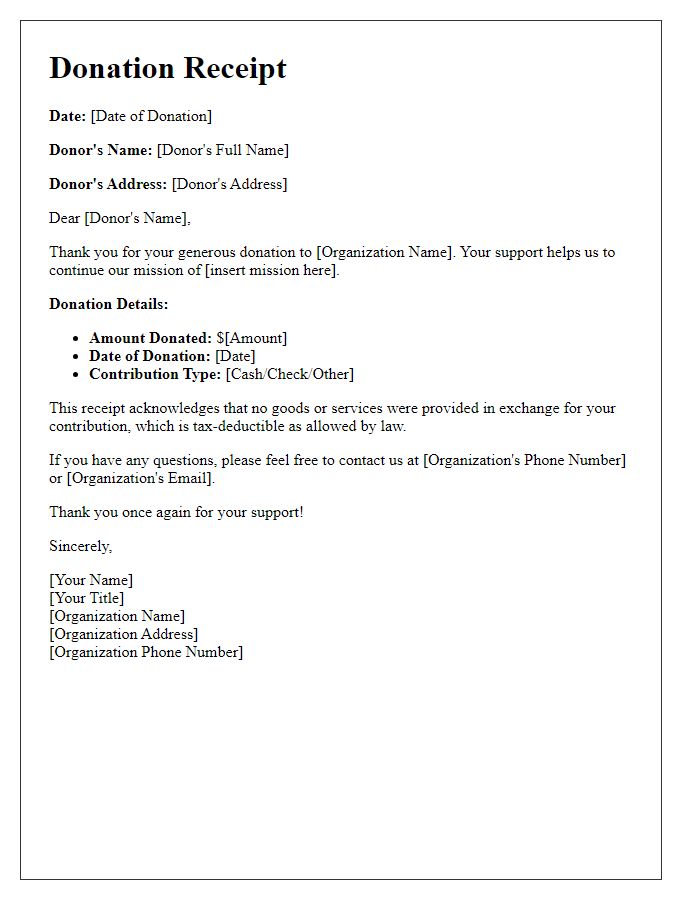

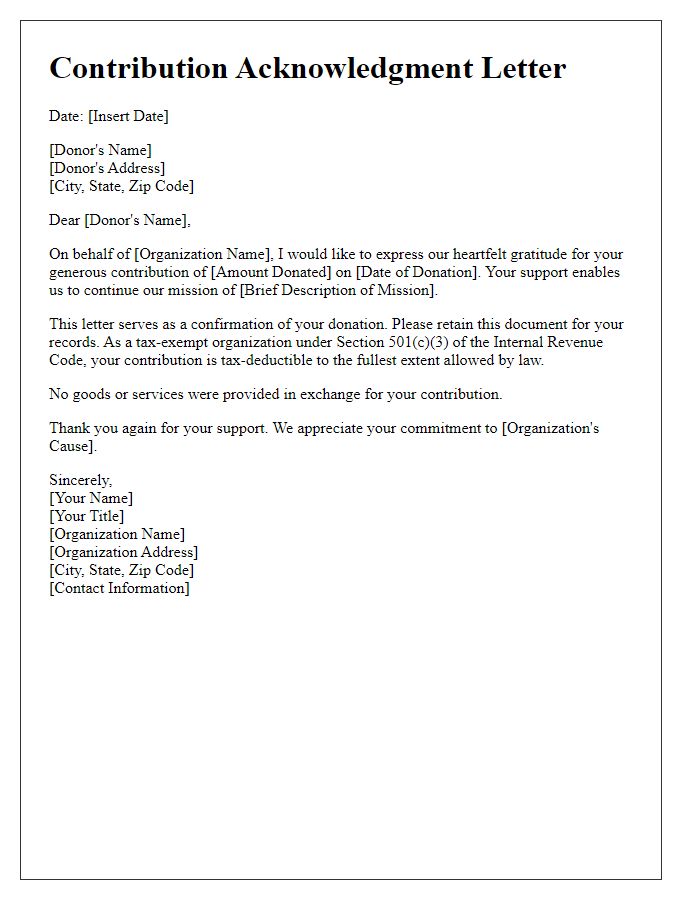

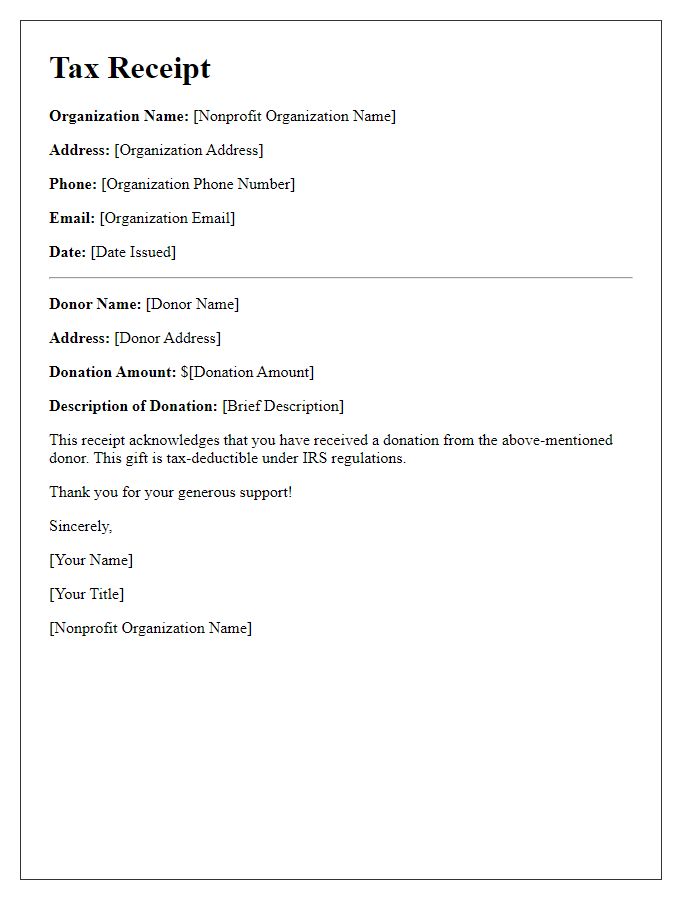

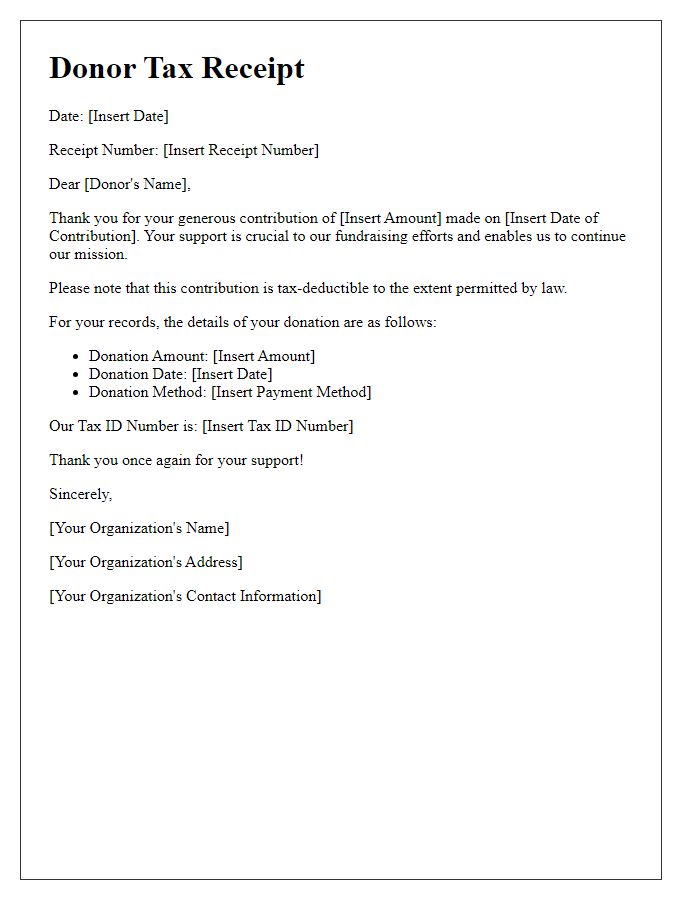

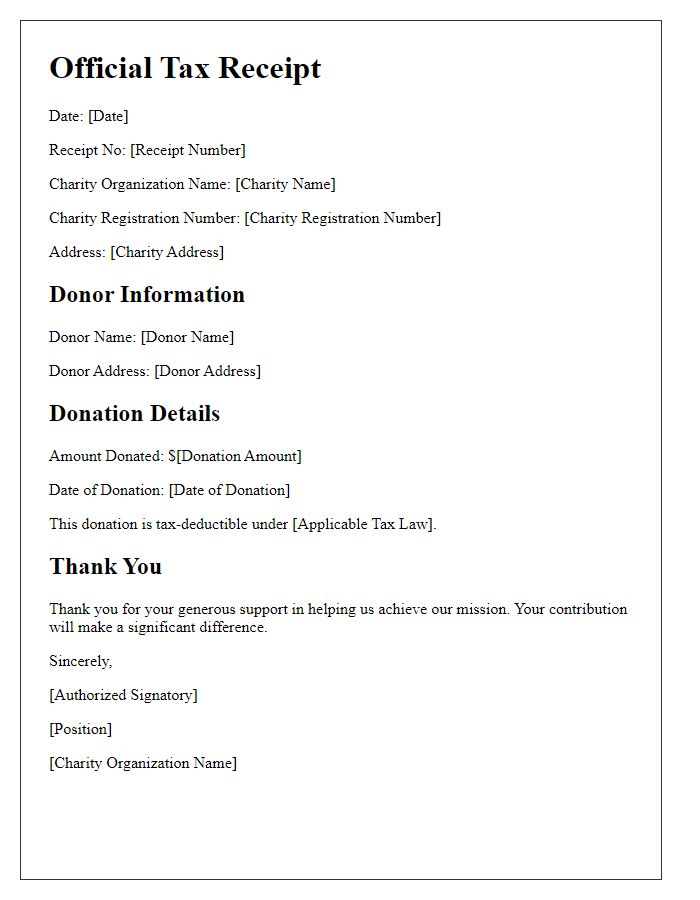

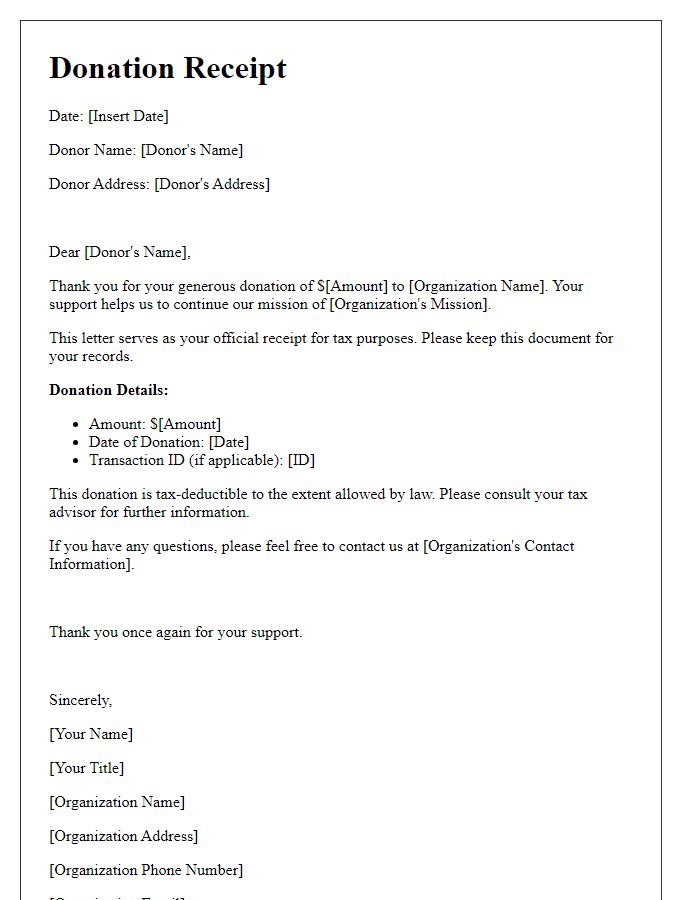

Donor Information

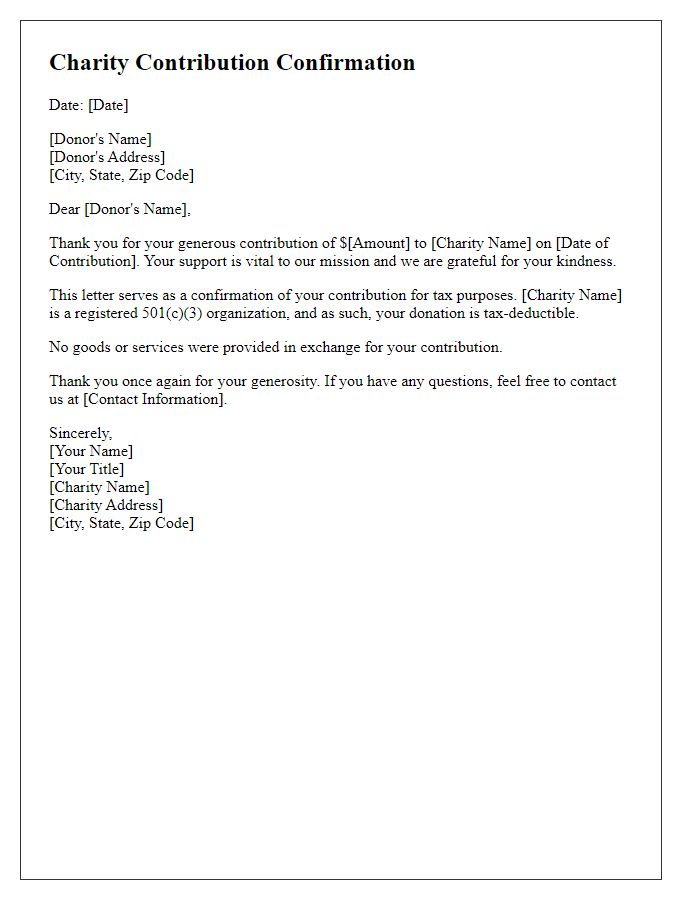

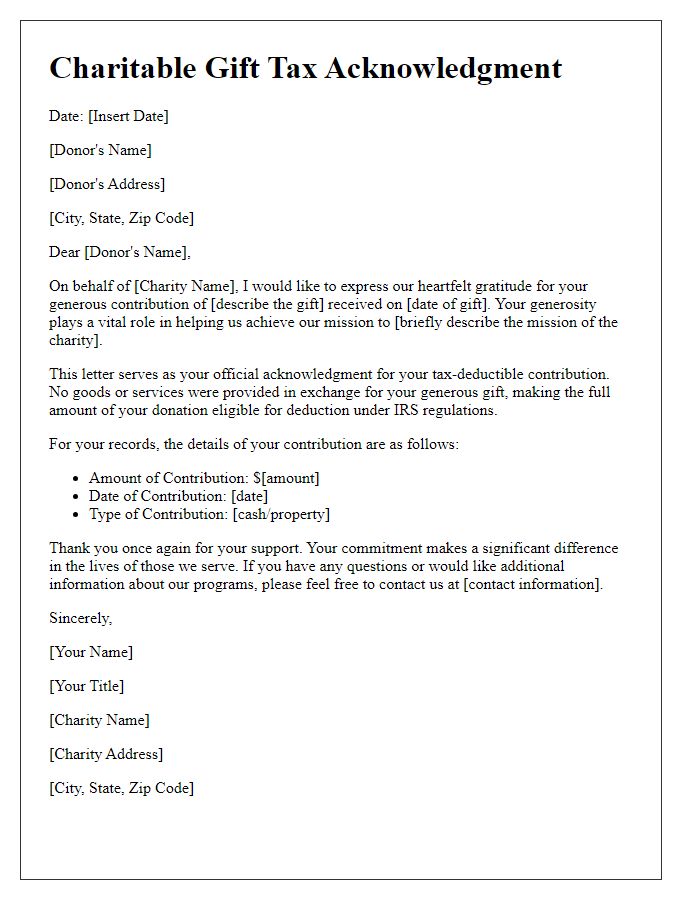

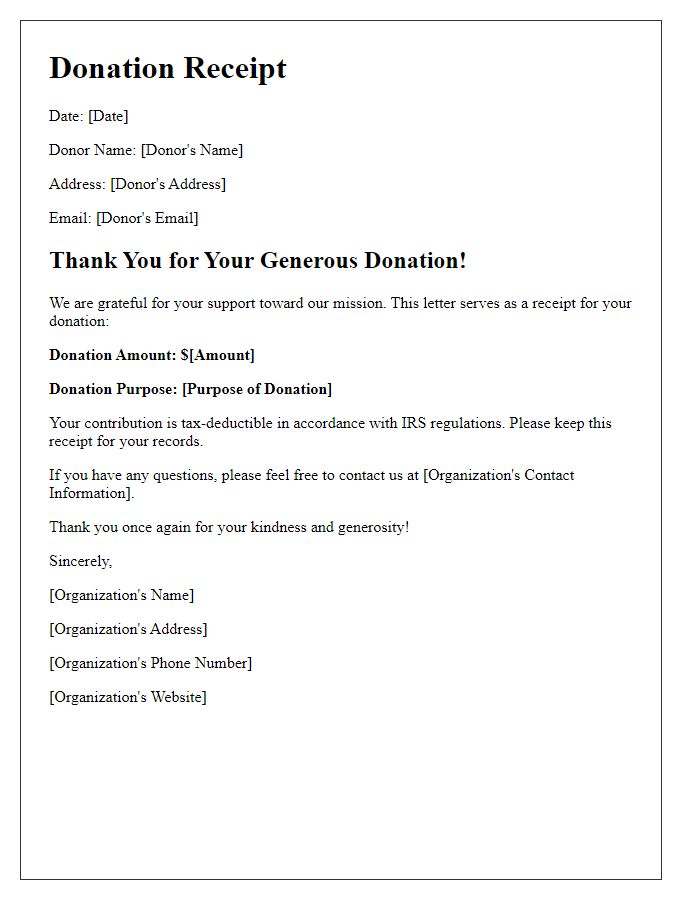

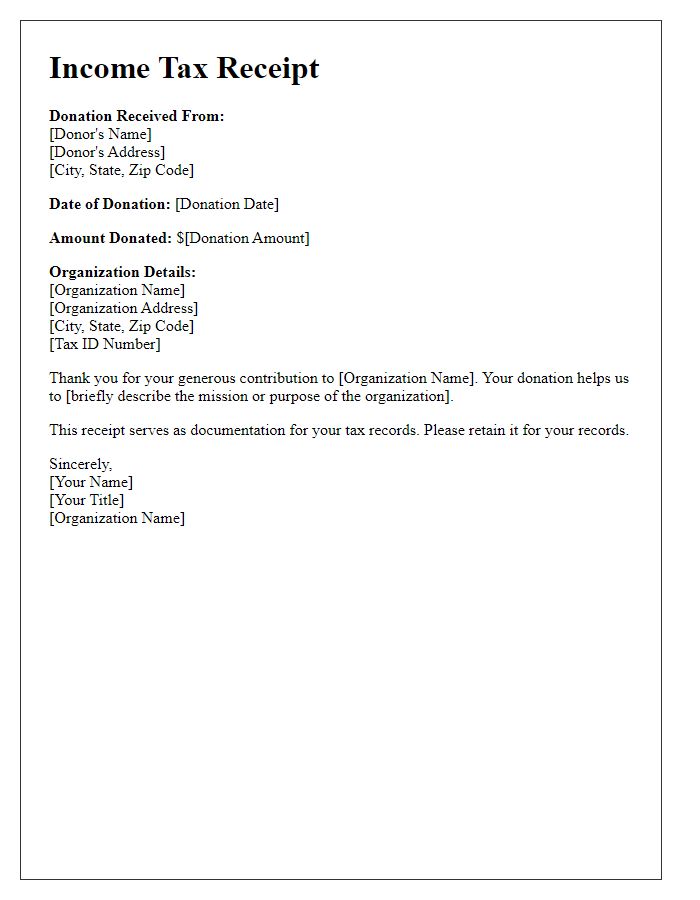

Charitable organizations are required to provide donors with tax receipts to acknowledge contributions made for charitable purposes. This receipt should include essential donor information such as the donor's full name, address, and the date of the donation. Additionally, it should indicate the amount donated (whether in cash or kind) and the registered charity number to comply with government regulations. Providing clarity in the receipt assures donors of tax deductibility for charitable donations, encouraging future contributions. Proper organization of this information enhances the transparency of the charity's financial dealings, fostering trust within the community.

Charity Information

Charity organizations, such as those recognized under the Internal Revenue Service (IRS) 501(c)(3) designation in the United States, are required to provide tax receipts for donations made by individuals or businesses. The receipt must include specific information, including the charity's official name, address, and Employer Identification Number (EIN) for identification purposes. The date of the donation is crucial, as it references the tax year in which the donor can claim their deduction. Additionally, the amount donated, whether it's a cash contribution or a non-cash item such as clothing or property, must be clearly stated. For non-cash donations, a brief description of the items donated is necessary to support valuation assessments by the donor. Finally, including a statement that no goods or services were provided in exchange for the donation ensures compliance with IRS regulations and enables donors to substantiate their charitable contributions during tax filings.

Donation Description

Charitable donations, such as monetary contributions or itemized gifts, hold significant value for organizations like local food banks or educational foundations. A typical monetary donation might include amounts ranging from $10 to $1,000, designated for specific programs like meal assistance or scholarship funds. Donated items, such as clothing or electronics, might include second-hand laptops or household goods with estimated values assessed based on resale prices. Accurate documentation of the donation description is crucial for tax purposes, providing necessary information to both the donor and the charity for financial auditing and compliance with tax regulations stipulated by the IRS in the United States. This confirmation aids donors in claiming deductions while ensuring transparency and accountability for the beneficiary organizations.

Date of Donation

Charitable organizations typically issue tax receipts to document donations made by individuals or corporations for tax deduction purposes. The date of donation is a crucial aspect included in these receipts, as it serves as proof of when the donation occurred. For example, on October 15, 2023, a donor may contribute $500 to a nonprofit organization focused on providing educational resources to underprivileged children. This date is significant for the IRS reporting requirements and may impact the donor's ability to claim the deduction in the appropriate tax year. It is essential for nonprofits to maintain accurate records of all donations, including dates, amounts, and donor information, to ensure compliance with tax regulations.

Tax-Exempt Status Statement

Charitable organizations, such as 501(c)(3) entities in the United States, are allowed to provide tax receipts to donors. These receipts serve as acknowledgment of donations and confirm the organization's tax-exempt status. The receipt typically includes details such as donation amount, date of contribution, donor's name, and a statement declaring that no goods or services were provided in exchange for the donation. Specific documentation aids in tax deductions for donors when filing with the Internal Revenue Service (IRS). Proper formatting ensures compliance with tax regulations, which may also specify the inclusion of the organization's Employer Identification Number (EIN) for identification purposes.

Comments